Living under an uncontrolled system with an unstable economy for more than 15 years has led me to think seriously about the financial future looking for security for my assets, looking for a system or a form of asset management that is not influenced by very volatile external factors. also protected from corrupt governments that can end a healthy economy quickly, the work of years can be destroyed in a short time by these negative factors that are isolated by the Kinesis platform

The blockchain technology is used by the Kinesis platform to generate a reliable and stable ecosystem, using the advantages of this technology in terms of security and data management in a decentralized way, by creating a monetary system backed by assets to generate a commercial world active in the monetary platform that is supported by a range of commercial products that adapt to the diverse needs that any user may have

Using the best technology, now you need the best support

Fiduciary money is, without a doubt, a very bad asset to safeguard value. Someone who had kept money as an asset in the period analyzed would have just 31% of what they had in 1978, at best, since there are economies so sick that everything would end in total loss of assets.

However, the fiduciary money is very liquid and its transaction costs to be used are the lowest in relation to any other asset in the world (even with the world laws in relation to the prevention of money laundering). This gives an advantage over precious metals such as gold and silver for the use of asset safeguards, so a balance must be sought on the use of these financial factors in order to achieve the maximum yields of both money and precious metals.

Gold and silver are definitely a good value guard. In the period of 38 years analyzed, shows that to safeguard value are good assets. Its use as a means of exchange probably implies transaction costs higher than 0.19%, compounded by an appreciation of inflation.

Gold during the time:

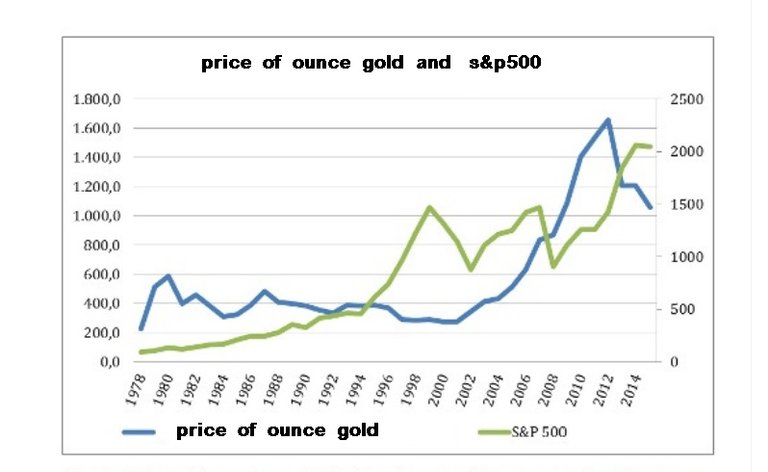

In the previous graph you can see the price of the ounce of gold denominated in current dollars and the value in percentage points of the S & P 500 compared. They are values at the end of the year for 38 years (1978-2015). It can be assumed that a prudent person, thinking that the money issued by governments without the support and limit that put the gold would end up losing all its value and, therefore, invested a good part of its portfolio in gold.

Benefits of 1: 1 currency support for gold and silver

If it is assumed that the dollar will lose value, and gold maintains its demand for other stable non-monetary uses and its offer is relatively stable, gold should rise in value. A prudent person could use the S & P 500 as a low-risk investment mechanism, thinking of obtaining a relatively low return compared to other investments, but at the same time of lower risk.

Gold and silver and their use on the Kinesis platform

These two precious metals are used as physical backups for the assets that enter the ecosystem by measuring 1: 1, giving the user direct ownership of the KAU and KAG currencies generated by protecting the assets from possible frauds or losses due to bad investments of those in charge of their shelter

A variety of assets and cryptocurrencies with their respective assigned titles are loaded onto the platform to develop a healthy and diverse ecosystem that generates a growing economy on the platform while these assets are physically and digitally safeguarded

the gold bullion market brings Kinesis to the blockchain

Using the security and stability of the precious metals and the easy handling of the FIAT currencies, the Kinesis platform generates a wide portfolio of financial products that give as a result a secure asset, which can be made liquid at any time and which allows Investors make small purchases whenever they want without having to acquire a fixed commitment

By associating a performance to currency or asset tokens, risk / return ratios can be forecasted and virtually all currency and investment asset markets can be targeted and infiltrated. As well, over time, we plan more coins and assets that will be added, eventually infiltrating more markets spread around the world. This form of currency has a necessary application in the real world in both trade and private transactions, together with capital of institutions and retail investors and savers.

Kinesis will attract capital from markets that are currently experiencing little or relatively low returns. These include:

- Cryptocurrency markets

- Gold and silver markets

- Fiat currency markets

- Markets of investment assets

Alliance that gives strength to the Kinesis market (ABX)

Founded in 2011, the Allocated Bullion Exchange (ABX) is an institutional exchange that offers global commerce services, price discovery and compensation of different regions in an online business environment through its market-leading commercial platform, MetalDesk. The exchange migrates the trade of physical precious metals to the electronic environment; break down barriers to entry to the wholesale market, connect the main liquidity centers of the world and fundamentally redefine the way in which the physical ingot is commercialized. At the core of ABX is the key objective of establishing a first exchange of physical assigned ingots in the world that is efficient, integrated and global.

Article source: https://abx.com/

Kinesis unites the technology of ABX and the blockchain to generate the perfect ecosystem that helps generate security of assets through precious metals, many countries are already using gold as a way of saving and safeguarding future assets, there is also a market for very broad exchange worldwide that should be more interconnected and this platform provides that possibility

Pension plans, long-term savings plans, funds, stocks ... there are many instruments that this market offers to citizens to save thinking about tomorrow and spend a quiet old age or generate a profitable business with ample power of exchange to world level

physical gold, an asset traditionally considered a refuge that Germans are now beginning to buy as a form of savings to complete the pension while in other parts of the world in crisis like Venezuela, its citizens are increasingly migrating to this market in search of protecting their assets of inflation and the chaotic economy of your country, gold is always worth while a currency can lose power of use in a very short time

I have lived the fall of a coin while I see the unalterable and strong gold

Why gold? Gold is a precious metal and a physical asset that has value in itself. That makes it a safe asset. That's why investors have traditionally used it as a safe haven when things went badly wrong in the markets. In addition, it is an extremely liquid asset, it can be sold at any time and recover the investment.

Maybe that's why ordinary Germans are starting to see it as a good saving system to complete the pension. We must also bear in mind that Germany is a country marked by war and inflation, in which citizens know perfectly well that a ticket can become tomorrow only a paper without any value, but it is not necessary to be at war, Venezuela has something similar, its currency has almost no value, the assets of Venezuelans have been hit hard, they have tried to protect it through foreign currency but this has generated an internal market parallel to the economy that has converted this currency and its calculation very volatile I have unstable

So to see gold as an exit is the option that in Venezuela has been born as well as in Germany, people who have seen economic problems end with patrimonies have learned to see gold as a savior of their assets, gold is worth all over the world, while a currency is a simple piece of paper that can be left without backing, gold is worth all over the planet

Case of use

Cruz in a 35 year old man who lives in a country hit by bad economy and politics, several internal laws take him to seek shelter of his most precious assets, quickly in 5 years he has seen each day as it is getting more uphill the to be able to invest and thus be able to advance in their finances, has been investing in cryptocurrencies to get out of the economic siege that exists in their country that is imposed by a foreign exchange control applied by the government

Cruz has carried out an investigation in his country and is witnessing how gold and its various forms of investment have worked for his friends and family so he wants to enter this market and thus protect his assets with a metal that is highly valued and that has had a constant growth for more than 30 years, a friend who also deals with the problem speaks of Kinesis

On the cross platform you will find just what you need, to be able to manage cryptocurrencies, invest it in 1: 1 backups in roro and silver, you can start investing in a stable global market, you can generate new sources of income and also create your own plan of retirement through future savings in a secure manner with growth of its assets and physical and digital support through this platform

Cruz can now free himself of the fence that is generated in his country and places his assets on a platform that provides security

video for Kinesis

Kinesis entry made by @aerossone for the @originalworks writing contest sponsored by

for more information about the contest between here

kinesis2018

Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.Congratulations! This post has been upvoted from the communal account, @minnowsupport, by aerossone from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

Sponsored Writing Contest!

This post has been submitted for the @OriginalWorks You can also follow @contestbot to be notified of future contests!