I read a very interesting thought provoking article the other day so I'm sharing it with the steemit community

Cashing out of Bitcoin

Three days ago the Bitcoin network split in two.

This happened after a more than three year long, intense struggle between different factions. Or, it’s really more the case of one faction that has tried to hold the network ransom for their own purposes and the opposition to that, rather than two sides struggling for the best way of evolving the network.

There are now two versions of the same currency. One is Bitcoin Cash (BCC), the currency that branched away and the other is the “old” Bitcoin (BTC). That is not entirely true though. BTC also changed at the time of the network split. The main changes are the adoption of segwit and promises of further diversion from the original rules of the game.

Misery loves company. No, scratch that. Some mountains love company

A very short time have passed since the split. There are massive unknowns, but patterns started emerging well before the split event. It’s probably not too early to start drawing some conclusions. But, buyer beware. It’s difficult to make predictions, especially about the future. With that said, what are the viabilities for each branch to persist and prosper?

The first indication that we got for the viability of a new coin was, apart from the many voices screaming for change, the BCC futures on ViaBTC. The surprisingly high valuation indicated not only an interest in the new hypothetical BCC branch but also that the collective estimate of the value of that new branch was much higher than the censoring part of the Bitcoin community wanted you to believe. The flood gates had opened ever so slightly.

The second indication was at the moment of the actual split. Mining power were prepared to mine at a loss to make a new branch come to life. It’s a very costly process to bring the difficulty down, even with the emergency difficulty adjustment that is built into BCC.

As of current writing, 60 blocks have been mined on the BCC branch. Several interesting patterns have emerged already. As you could guess, miners have adjusted their mining pattern to not mine at a loss, to make best use of the emergency difficulty adjustment. They are however still mining at a hypothetical loss and did so even more before the adjustment happened. This means that their belief in the BCC branch goes beyond the short term economical incentives. Another interesting observation is that despite no blocks appearing for over 18 hours after the first day, prices on exchanges not only persisted but actually increased. They peaked on about 1/4th of the value of the BTC branch. This happened under very uncertain conditions. At that time no one knew if BCC would even reach the first emergency difficulty adjustment.

For a currency that is less than 24 hours old to reach a valuation of over 10 billion dollars is not only an amazing feat. It is also an extremely strong indicator that the common non censored view of investors is that value lies elsewhere than in a restricted network with forced features that imposes systemic risks. Furthermore, one of those systemic risks just manifested. It happened in the form of a network split.

Advantages and disadvantages on each side

The first, very glaring disadvantage that BTC holds is that an alternative exists. The market has raised its voice. An alternative that has existed for three days is valued at a substantial chunk of a currency that has been around since 2009. That is not a very comforting thought if your allegiance lies with the old network.

You’re not getting that one back together again

Apart from that, there are three practical disadvantages that BTC holds. The first and most obvious is the artificial restriction of the block size. Slow, expensive and unreliable versus fast, reliable and cheap? You choose. The second are other technological choices made by the central network influencers. Two examples are segwit and something called replace-by-fee (RBF). The way that segwit is implemented imposes great systemic risks. RBF is created as an answer to the problem with a congested network, at the cost of subverting the reliability for receivers of transactions. Both these choices severely decreases network value. The third disadvantage is the network influencers themselves. Over time, they have proven themselves beyond reasonable doubt to hold hidden agendas. Not everyone, but as their grip of the network have tightened, outliers have been forced to leave. A prominent example of these influencers are Blockstream and their executive arm, the development team in Core. Others are the sub-reddit /r/bitcoin, the forum bitcointalk.org, a range of exchanges and to a lesser extent some mining groups.

A bonus disadvantage that BTC holds is the symmetrical difficulty adjustment algorithm. We will get to what that means soon.

The main advantage that BTC holds is its currently dominant role and at least as of now, a substantially higher valuation.

The advantages of BCC are more or less a mirror of the disadvantages of BTC. There is no (practical) block size limit. Subversive technology that have been created to benefit a single party have not been inserted into the common codebase. The influencers of BTC have no influence over BCC, but there is also not an equally obvious central team for BCC. The origins of BCC is somewhat muddied, but some of it can be traced back to a Bitcoin Unlimited proposal, BUIP055. Some of the ideas in that proposal, about setting a fixed date at which a forced split was to occur, were picked up by an implementation named Bitcoin-ABC. Other implementations soon followed. This means that no single group can dictate which direction the new BCC branch will go.

Some disadvantages of BCC are the lower value, a very short history and unproven changes that could turn out to be problematic. This is for example the emergency difficulty adjustment algorithm. On the other hand, that specific change could very well prove itself to be an advantage in some circumstances, and actually already has.

Dumping for fun and profit

There are a lot of public declarations happening on Twitter and other places where some are keen to take a stance. The most prominent ones are very certain that as soon as they get the chance, all their BCC will swiftly be converted to BTC. That’s the rational thing to do, if you believe in your vision. Right?

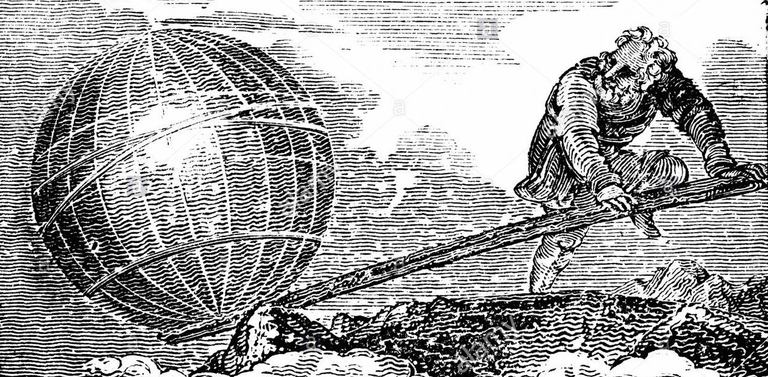

Give me a lever long enough, a fulcrum on which to place it and something to dump on the lever and I shall move the world

The common understanding is that a flood of BCC will arrive at exchanges over the coming weeks. This is due to that blocks on the BCC branch are coming slow until the difficulty has adjusted accordingly. Reality currently moves at snail pace.

But surely, when these coins finally arrive there will be a torrent of cheap BCC, destroying the opposition? Well. There might be, and might be not. The market has just spoken against those planning to dump. A branch peaking at a value of 1/4th of the current system appeared out of nowhere in less than 24 hours. This means a lot. Are you prepared to drop your holdings on what might in the end turn out to be the new main chain? And if you are, at what valuation? Currently you are just gaining somewhere around ten percent, with the risk of being left outside, forever.

Apart from this, futures contracts existed well ahead of the split event. Why would the dumpers only live in the real world, with tangible assets, and the holders in the world of speculation, where you trade with strange hypothetical constructs?

What is to say that the dump hasn’t already happened?

Communicating vessels and miners

What will happen now? It is of course impossible to say, but what has already happened points to very dramatic changes in the coming months. The unfolding of events could also happen much faster than anyone expects.

We can see from the split that BCC didn’t take value away from BTC, but instead created new value in its own network. In the friendly scenario, both these branches will continue to co-exist in their respective networks. That is probably not going to happen.

Fighting the laws of physics might turn out to be a futile endeavour

What may not be obvious to everyone is that both networks compete for the same mining power. The respective branches are communicating vessels. In an ideal world mining power aligns perfectly with the value of the respective coin. And it does. It’s just that the value of a currency isn’t a static thing. It includes much more than just the so called market cap. Among the many things that are factored into the value is future potential, the technology in the network and the main influencers of the system. For these three factors BTC is at a severe disadvantage. It’s exactly those that made the BCC branch come to life.

Not with a whimper, but with a bang

The value of BCC has been at its lowest somewhere around 1/12th of BTC and at its highest 1/4th. The lowest value was also noted for the BCC futures contract. So even the non-existing new branch, with the risk of not ever manifesting, was valued at a high price. This could indicate that the open market judges the value of an unrestricted coin higher than a restricted one. It maybe just needs some time to let the insight sink in and the uncertainty play out.

Once the difficulty has settled on the correct level to match current pricing, interesting things will start to happen.

Shift the balance ever so slightly and bad things will happen

Initially there might be fear of switching over from BTC to BCC. You know what you have, right? This stalemate could persist as long as the two branches are working as intended. But BTC has experienced severe congestion the last year due to the artificial restrictions imposed on the network. Alternatives for sending value have been experimented with, seeping value over into other currencies. Now a seamless option exist. Can’t send your bitcoins on the normal chain? Just send them on the alternative that actually works. When the next congestion happens, value should flow into the natural option that already is the third biggest cryptocurrency on the market. On which you already have the same coins as in the old system.

Forced change isn’t the only way that value transfer can happen. Speculators will gravitate towards the option that holds promise of the highest future value. You be the judge of the pros and cons of each.

If the shifting of value starts happening, it will probably be unstoppable. A self-fulfilling cycle could start drawing mining power over to the BCC branch. First out of logical profit seeking. Eventually out of fear.

If the value of BCC surpassed BTC, you’d think that the mining power would shift accordingly, just adapting to the new world. That is not how it works. As previously mentioned, the difficulty adjustment rules of BTC is symmetrical. This means that you need to expend the same amount of resources to bring difficulty down as you did to bring it up. This has until now been considered a virtue, preventing malicious miner behaviour. The main problem with the symmetrical difficulty is that if BTC would ever loose a substantial amount of mining power, a vicious circle would start. It would even happen well before BCC became the dominating currency. Let’s assume that BCC takes away 30 percent of the mining power due to the better value proposition. Congestion would appear on the BTC branch and this could cause miners and investors to panic. They might assume that this time it very well could be permanent. A mass exodus to the safe option would happen almost instantly.

Blocks on the BTC branch would not be coming slightly slower. It would come to a grinding halt. The branch would be dead within days or even hours.

When worlds collide

You’d think that events would play out safely, the new branch proving its worth over time. This may not be the case. The shift could come very quickly. Disruption doesn’t happen gradually and three days ago we saw that statement proven. The chance of change happening violently is probably bigger than a slow transition.

Searching for disruption on the internet truly gives you the dumbest of images

A shift could happen in a few months or shorter. One key date is middle of November, when the BTC network has promised to increase the block size limit to 2MB. If this does not happen, BTC will have proven itself to be restricted by external forces. Such an event could make investors finally lose faith and switch to an alternative. A lot of other influencing factors could trigger a shift well before that time. It just needs investor confidence. Or the loss of it.

Can a potential shift be prevented? Maybe. BCC is right now unproven and holds great unknowns. On the other hand, the BTC branch has proven its unreliability in fulfilling on its promises. Can you maybe take the problematic parts out of BTC and adapt it to align with the improvements done for BCC? No. The influencers of BTC have their own agenda, and for them adaption means loosing completely. For all it seems, things now must run its natural course to the end.

If you in the coming days or months plan to shift your alignment one way or the other, choose wisely.

In the game of forks you either win or die.

Copyright to John Stuart Millibit.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@john.s.millibit/cashing-out-of-bitcoin-72ffe6226ab4

thanks for this post, including mentioning some of the technical details. a listing of the backers of each coin would have been nice too. maybe a follow up post? I was under the impression that the majority of the miners were behind, the then upcoming, bcc. i was too busy/lazy to look into it deeply. I sold my btc for alt coins right before the fork and am watching and waiting to see what happens with these two, but predicting would be better. :) hmm, i wonder if btc would take all the alt coins value down with it if bcc takes over quickly? or would the exchanges just automatically use the top currency (by some metric) as the reserve/pegged asset/whatever it's called?