1

1

- Reliable information on currencies besides the major coins in the space (BTC, XRP, ETH) and a handful of others is hard to come across

The most popular sources for research on most alt-coins were reddit, youtube channels and a variety of internet forums. There are no 10K filings for cryptocurrencies. There is no earnings call. Getting good information on coins takes time and requires focused research.

- More user friendly methods of investing would be incredibly valuable

“ETF” was one of the most common words that I heard during the event. A bitcoin ETF, an ETF that tracks the value of “small cap” coins or really any type of product that allows investors to offload the risk of holding private keys would be a huge plus for the crypto investment landscape. Diversification is expensive. Maintaining a robust portfolio of crypto assets requires massive amounts of time to register on multiple exchanges, wait for money transfers, find a way to securely store coins, and track the value of the portfolio.

- Regulatory threats are bigger than most people believe them to be

There was very little discussion on the potential for government intervention. Although US regulatory agencies have been relatively quiet over the past 6 months, more actions from regulators should be expected. Smart regulation that reduces the amount of money laundering and criminal activity being facilitated by cryptocurrencies can and should happen. Big dips can be expected when this occurs.

“It is definitely going up… But it could go to zero” was a common phrase.

No one has a comprehensive view of the space

Every person I spoke to had an opinion on a few coins (mostly the same ones). Just like no one can be expected to analyze each stock in the S&P 500, no one had deep knowledge on more than a handful of coins. Currently there are 1300 different coins listed on coinmarketcap.com.

- There was limited discussion on block sizes, proof of work vs proof of stake, mining, or even blockchain apps.

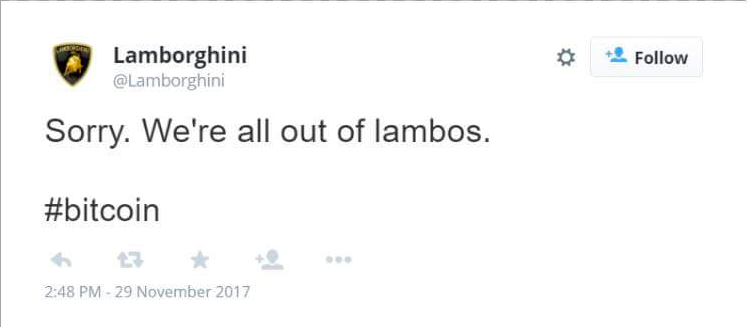

All conversation centered on generating huge investment returns. #lambos

7.

7.

- Cryptocurrency could be killing productivity for a lot of 9–5ers

No one I met actually worked in the cryptocurrency space as a profession. Nevertheless, everyone was up to date on current news and the price of the coins they followed. IT administrators could ruin a lot of fun by blocking coinmarketcap.com.

- Brand is huge

I found myself asking “How is Ethereum classic (ETC) different from Ethereum (ETH)?. Why would I buy ETC if I can buy regular ETH ?” While most veterans found this to be a stupid question, brand will be a big factor in determining where the next waves of speculative investment flow.

- Roger Ver’s freak out was hysterical and highlights the importance of brand

No one at the Meetup called it Bitcoin Cash. It is and forever will be Bcash after this video.

Congratulations @cahilla119! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!