The year 2018 already entered its final stretch, so it is tradition that in this month of December people take the opportunity to take stock of the year that ends and try to predict the main events of the beginning.

This practice is not an exception in the cryptocurrency sector, so it is usual for different personalities and business spokespersons, both inside and outside the ecosystem, to emit their predictions, mostly related to the price and future of cryptocurrencies.

This year the attention is placed, above all, on the price of bitcoin, in view of the significant fall of the crypto market in the month of November.

After waiting for almost the entire course of 2018 for prices to return to the levels reached at the end of 2017, (when the BTC reached a peak of almost USD 20,000), let's see what some analysts predict for next year.

FAVORABLE FEW EXPECTATIONS

In the group of the most pessimistic is the security company Kaspersky Lab, which a few days ago released its predictions for 2019, presenting an unfavorable scenario for the ecosystem.

According to the firm, it is likely that the price of cryptoactives will remain at low levels and that the use of cryptocurrencies as a means of payment will decrease, in addition to believing that expectations on the advantages of blockchain technology will decrease.

The company establishes a direct relationship between the price of cryptocurrencies and the interest of the public. Based on this, it ensures that the audience interested in cryptocurrencies is limited, and "once that limit is reached, the price will not go up any more".

In this same line of ideas, Arthur Hayes, CEO of BitMEX, said that the bear market that has characterized 2018 has caused him to change his hope that the BTC will reach USD 50,000 this year. Therefore, last July he said that the cryptocurrency had not seen the worst, when bitcoin briefly passed below USD 6,000 at the end of June. At that time he predicted that the cryptocurrency would reach levels between USD 5,000 and USD 3,000 this year.

In its most recent statements, it affirms that the bear market will be dominant throughout 2019, a trend that would even last until the first months of 2020. Hayes made reference to one of the analyzes carried out by BitMEX Research on the historical performance of bitcoin , where it is estimated that the current bearish period began on March 12 and possibly lasts a minimum of 200 more days.

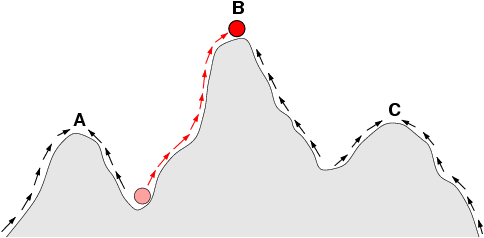

ANALYZE VALLEYS AND PEAKS

An approach similar to that of Hayes exposes the founder of Morgan Creek Capital Management, Anthony Pompliano, one of those who predicted that bitcoin would reach USD 50,000 by the end of 2018, although he later admitted that his prediction was wrong.

Based on the valleys and peaks of bitcoin throughout the history of their prices, Pompliano said, in one of the bulletins published on his blog last August, that bitcoin could fall first to USD 3,000, before seeing a positive trend in the market, something that in his opinion could happen in the third quarter of 2019.

Pompliano explains that bear markets tend to last longer, recalling that the first bear market lasted 160 days (in 2011) and the second 400 days (2013-2014). Consequently, it calculates that the current bearish market, if it follows the historical trend, can last 650 days.

With similar arguments, exchange market analyst Willy Woo explains that the BTC is in a valley and will hit bottom in the coming months. To make its prediction, Woo uses the NVT indicator (market value of BTC among the daily trading volume in USD), created by him in 2017, and the average price of that cryptoactive in the last 200 days, or moving average.

POSTURES THAT EXPECT SIGNIFICANT INCREASES

In May 2018, Fundstrat analyst Thomas H. Lee predicted that bitcoin would reach USD 36,000 by the end of 2019, based on the likely growth of mining infrastructure.

At that time, the Wall Street expert explained that his thesis on the price of bitcoin had a risk, related to the trajectory of the hash index (measurement of the processing power of the bitcoin network), which could change the support capacity for the prices. Even so, it considered that the growth of this index could support a value of USD 36,000, with a range that would go from USD 20,000 to USD 64,000 until the end of 2019.

Even though the market remained on a downward trend in the months following this statement, Lee maintained its forecast in July 2018, calculating that by the end of the year the price would be around USD 9,000 and even USD 25,000.

A similar position was maintained last October by Mike Novogratz, a former Goldman Sachs partner and hedge fund manager who founded the cryptocurrency bank Galaxy Digital, who said he expects another rally to take place in the second quarter of 2019.

A similar position was maintained last October by Mike Novogratz, a former Goldman Sachs partner and hedge fund manager who founded the cryptocurrency bank Galaxy Digital, who said he expects another bitcoin rally to take place in the second quarter of 2019. break the barrier of USD 10,000.

However, he thinks that this time the rise would be driven by institutional investors and not by the members of the community. The main reason for this situation is that there will be a generalized case of FOMO (fear of missing out or fear of being left out of technological advances) at the level of the institutions.

In the short term, the expectations of the entrepreneur were not optimistic, for the date of these statements (before the fall of prices last November), as he assured that the cryptoactive would not reach again USD 9,000 in 2018.

THE MOST OPTIMISTS

The CEO of the Brave New Coin research firm, Fran Strajnar, expects the price of bitcoin to reach USD 200,000 by January 1, 2020 at the latest.

In an interview published last May he made his calculations, taking into account that adoption rates have been constant, in a process that, his judgment, grows at a rate strongly related to price.

This same optimism was shown by John McAfee, founder of the company of the same name, after his famous bet last year, which said that bitcoin would be quoted at one million dollars in 2020. Although he has not indicated a certain price for 2019, the entrepreneur calculated that on December 31, 2019 the BTC could be around USD 170,000, to be on track to reach the 1 million dollar mark a year later.

INTERMEDIATE POSTURES

At an intermediate point between optimism and pessimism is another group of analysts, such as Todd Gordon, founder of TradingAnalysis.com, who in various media had been saying, shortly before the current decline, to be waiting for a fall in bitcoin that would take you to $ 4,000. Although it also predicts that a later rebound will return to $ 10,000 at the beginning of 2019.

More moderate expectations have been pointed out by the Professor of Monetary and Financial Economics at the Complutense University of Madrid, Pedro Durá, who considers it difficult to predict the evolution of bitcoin next year.

In general, the foregoing predictions show a kind of polarity in the analysis of market behavior, which makes some very optimistic and others very pessimistic.

As a result, it is difficult to know what to really expect in terms of the price of cryptocurrencies for next year. Therefore, placing themselves among the extreme positions there are those who do not even dare to make a forecast, as Professor Durá did.

However, there is a point in which most analysts agree, which is that cryptocurrencies and blockchain technology are already part of a reality and their influence in the world of finance, economy and technology are increasingly evident , a sign that they came to stay, regardless of the rise or fall of bitcoin.

FOLLOW ME IN: @desocrates

bitcoin will kill all the physical money and has huge community to make this happen

Of course, that is not in doubt. But something really must happen that really happens!

and altcoins will be affected much more, well anyway I also grab this buying and selling contest while its not too late buying altcoins. If I won more btc then I will leave crypto. lol check this out its a big game for us https://www.kucoin.com/#/rank/IOG