OVERVIEW

What is DUO Network?

DUO Network is a decentralized platform enabling issuance, trading, and settlement of tokenized digital derivatives. The platform aims to reduce risks and barriers in traditional derivative transactions, through collateralized smart contracts and distributed price feeds, thereby creating a transparent and autonomous derivative marketplace.

DUO Network provides its own derivative token-issuing protocol. The issued tokens are named Collateralized Autonomous Tokens, or CATs in short. CATs contain a number of innovative features which are not natively supported by existing decentralized exchanges, because most DEXs are cash exchanges built to support ERC20 tokens. Building a new DEX not only allows us to provide the right trading infrastructure for CATs, but also helps to define a brand new set of standards for tokenized derivative

FEATURES

Read this excellent blog post to understand more about DUO Network and its products

Collateralized Autonomous Token

Collateralized Autonomous Token defines a set of standards for the issuance, redemption and settlement of crypto derivatives. More specifically, CATs possess below key features:

- Collateralized - CAT’s value is backed by digital assets held in its custodian smart contract. Splittable - A custodian may create two or more payoff classes of CATs, each representing a partial claim of the underlying collateral. The split can be based on seniority, levels of risk or other option payoff structures.

- Fungible - CATs are two-way convertible with corresponding collaterals. They can be created from depositing collaterals into the custodian smart contract, or redeemed back into collaterals anytime using its lifecycle. The mechanism enforces the net asset value (NAV) parity between CATs and their underlying collaterals, and allows market to self-correct any price dislocations.

- Autonomous - Streamlined issuance and settlement procedures mean reduced adminstrative costs and lower entry barriers. Distributed price oracles help to create a fair and objective reflection of the underlying asset value and safeguard against price manipulations. The result is high degrees of transparency and market autonomy.

- Tokenized - All CATs are ERC-20 compatible. By allowing storage and trading across most existing wallets and exchanges, we make it possible for derivative positions to be freely transferred and not bound to any centralized venue. We believe cross-platform trading of tokenized derivatives holds the key to an efficient market by improving decentralized liquidity and price discovery

DUO’s DEX

- Designed and optimized for derivative trading

- Support all CAT functionalities and lifecycle events

- Based on 0x Protocol

- DUO Network will closely follow ongoing technologies such as Plasma, Proof of Stake and Polkadot, and we will adopt such technologies when they are fully functional and secure.

More info check out DUO Network Ecosystem Whitepaper

MVP

They have their DEX on BETA right nliow which can be accessed here

It is the first 0x based, decentralized marketplace for trading a new class of tokenized derivative instruments — Collateralized Autonomous Token, or CAT for short, including products such as tranche tokens, options, and structured products. https://kovan-dex.duo.network/

https://kovan-dex.duo.network/

Video on how to use the DEX can be found HERE

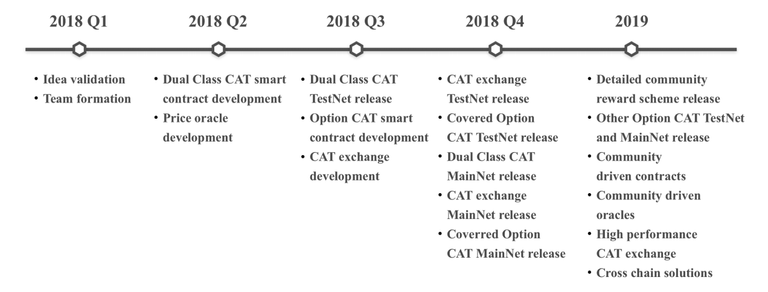

ROADMAP

Roadmap is self-explanatory.

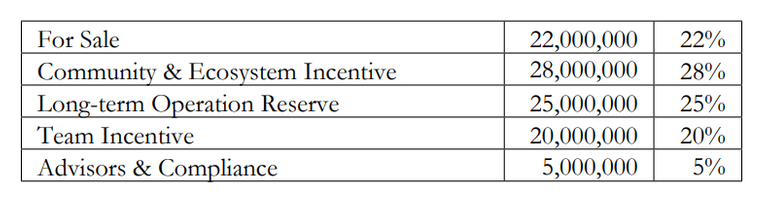

TOKEN METRICS / DISTRIBUTION

Ticker: DUO

Total Supply: 100,000,000

Token Price: $0.15 Presale, $0.30 Private Sale

% of Tokens sold: 22% - 22,000,000

Hardcap: $5,100,000

Country: SINGAPORE

Unsold Tokens: BURNT

Initial Circulation Supply: 10,360,000 ~ $1.55m

The hard cap of $5.1m is pretty low and $3.6m has already been raised in private sale leaving just $1.5m for the upcoming presale on Bitmax Exchange. 22% of tokens are being sold to investors, 28% kept for "community incentive, 26% for "long-term reserve", 20% for "team incentive" and 5% for advisors . Honestly not the best metrics ive seen nor the worst Just a little bit worried about team keeping 20% to themselves with another 25% in reserve basically meaning they kept almost half of the entire token supply to themselves.

Vesting

Private Sale - Locked for 11months (3%,3%,3%,14% and 10% each for the next 8months)

Presale - Unlocked

Team Incentive - 2-year vesting with first 25% release 6-month after listing

Advisers & Compliance: - 2-year vesting with first 25% release 6-month after listing

Community & Ecosystem - 2-year gradual release

Operation Reserve - long-term reserve, 100% lock-up for the 12-month, gradual release when Phase-2 development concludes

TOKEN USESCASES

The DUO Network Token is an ERC-20 token with limited supply. The design of DUO Network requires a token which value is implicitly linked to the growth and adoption of the Network. DUO Network Token functions as a medium of exchange among network participants, smart contracts, and the DUO community as a whole.

Price Oracle Node

Network participants can stake their DUO Tokens to become a node in our Price Oracle. Penalties andrewards are distributed in DUO Tokens based on difference between each node’s price feed and theaccepted price.

DUO Protocol Node

Network participants can also stake their DUO Tokens to become a super node and be able to propose new custodian specifications.

Governance

We aim to create a community-based governance model. Any DUO Token holders can vote proportionally on protocol decisions and development based on DUO Token balance.

Conversion Fee

All custodian contracts in DUO Network charge a small percent of fees on CAT conversions. Users can choose to pay fees in ETH or DUO. Early stage payments in DUO will be discounted to encourage token adoption. Conversion proceeds in ETH will be primarily used to maintain the daily operation of the Network, such as pricing feeds, oracles, gas fuels, and personnel expenses. Excess proceeds serve as operation and community reserves for the Network.

Price Service Fee

External users can use our Price Oracle as a pricing service, charged in form of DUO Token.

Community Rewards

The Network provides its participants with an incentive scheme similar to mining on blockchains. Instead of recording transactions on blockchain, the Network recognizes conversion arbitraging, which helps stabilizing the token prices, as the mining operation. In addition to arbitrage profits, the Network rewards participating users with DUO Tokens. The detailed reward scheme will be released at a later stage.

PARTNERS & INVESTORS

More info on DUO Network Partners and Investors can be found HERE

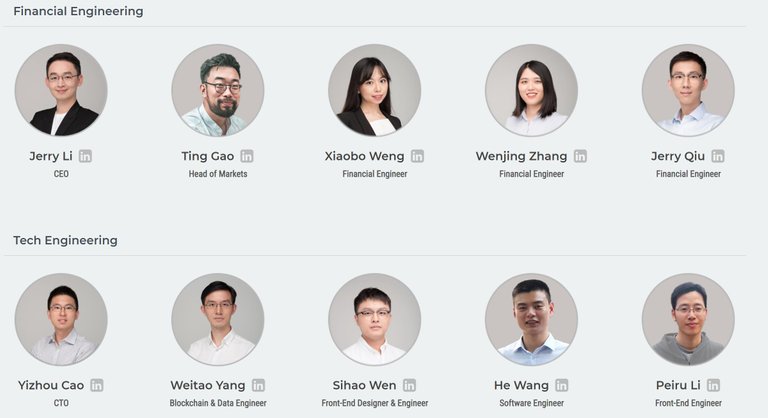

TEAM

Ting Gao – Head of Marketing at DUO Network. Ting worked as an options trader at Citigroup for 6 years where he ran a global options portfolio with focus on EM Asia interest rates & FX.

Yizhou Cao - CTO of DUO Network. Yizhou worked at Nomura Securities for forex proprietary trading and was an Assistant Vice President at Credit Suisse for fixed income technology.

Jerry Li - Ceo of DUO Network. Worked at Citigroup and SS&C on hedge fund valuation, where he built the regional quantitative team, and advised multiple billion-dollar hedge funds in valuation policy and derivatives strategies. Before joining Citigroup, Jerry was a sales & trading analyst at UBS Investment Bank.

Weitao Yang - Blockchain Engineer at DUO Network. Former Business and Data Analyst at Deloitte Consulting.

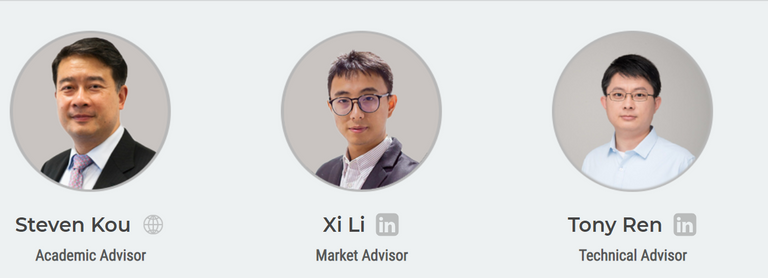

MAIN ADVISORS

Steven Kou – Academic Advisor to DUO Network. Questrom Professor in Management at Boston University.

Xi Li – Marketing Advisor to DUO Network. Managing Director at LD Capital. Former Senior Software Engineer at VISA.

Tony Ren – Technical Advisor to DUO Network. CTO at Longhash. Former network engineer at Huawei Singapore.

FINAL THOUGHTS

DUO Network will have presale for Bitmax.io Exchange users and this is pretty good for potential investors as the current trend in 2019 is these so called "IEOS" that give instant profit to those that get in. So this presale should be profitable for those that can actually get into it.

The hardcap of $5.1m is low and with the majority of that already raised, they should have enough money "hopefully" to finish the project and deliver on the promises made to their supporters.

Private sale allocation is vested for quite a long time which is a good thing to presale investors as this will stuff tokens being dumped from private sale participants but also a bad thing for private sale investors who will lack liquidity for months after listing. Then again if you're investing in private sale, it should be cause you support the project long term and not looking for a quick flip.

The core members come from leading global banks such as Citi, Credit Suisse, HSBC; with long-term academic collaboration with NUS, Boston University and ETH Zurich. They are definitely capable of delivering on the road-map set forth.

There's another existing company with the same name https://www.duonetwork.com.br. Hope there wont be a potential future legal issue with the.

All in all i like DUO Network and will try to invest in the presale.

DUO NetworkSOCIAL LINKS

WEBSITE

TELEGRAM

TWITTER

MEDIUM

Disclaimer

This analysis is based on information that is currently publicly available in the White Paper, Website and Team . The above information is not financial investment advice. Please do your own research before making investment decisions. This information is for educational purposes only. I will personally be investing in DUO IEO.

Follow DiddycarterICO for more crypto content

Spreadsheet: https://bit.ly/2JcUIws

Telegram Channel: https://t.me/diddycarterico

Discord: https://discord.gg/jTzYpJc

Twitter: https://twitter.com/diddycarterico

LinkedIn: https://www.linkedin.com/in/diddy-carter-35894869