OVERVIEW

REDi is developing a decentralized renewable energy data marketplace, where renewable energy industry participants can actively buy and sell the data that is produced by the renewable energy industry.

In addition to the marketplace, various services that make use of such data will be available to stakeholders, such as power generation optimization and service matching. The data described in REDi’s whitepaper includes, but is not limited to, electricity generation data, power plant construction data, legal registration documents, and weather data relative to specific power plants.

Per REDi’s whitepaper, the integrated data will be able improve productivity as well as efficiency in the renewable energy market. REDi suggests a new data-based solution to the growing renewable energy industry, this differentiating itself from already existing clean energy blockchain projects such as Power Ledger or ElectrifyAsia, which are instead focussed on P2P energy trade, financing, smart grid and Carbon emission trading.

SOME CURRENT PROBLEMS

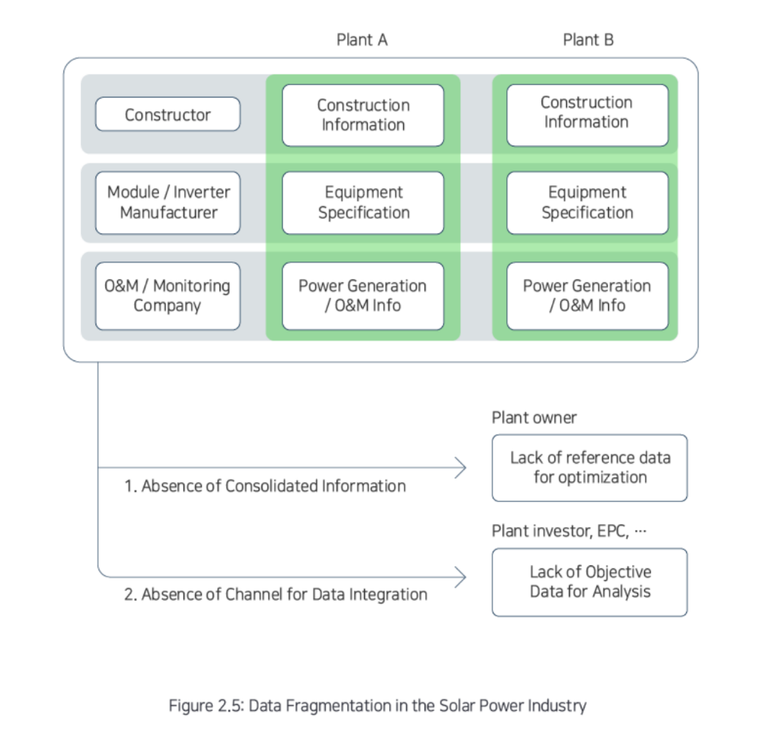

● Lack of data aimed at energy producers: Having access to standardised and verified information is vital for good decision making. At present, the solar power industry lacks a platform to incentivize plant owners to share data with other stakeholders.

● Untraceable power plant history: At present the solar power industry also lacks accessible archives containing information about the life cycle and current value of existing power plants. The resulting lack of transparency has dissuaded many stakeholders, such as insurance companies, from entering the industry.

Valuation

PROPOSED SOLUTION: THE REDi INFRANET

● The REDi Infranet is a decentralized platform which will provide stakeholders with energy data. Such data will be vetted by industry experts and leaders (data verifiers).

● Stakeholders who provide data receive incentives, in the form of tokens, through the REDi infranet.

● Data verifiers will also receive incentives to validate the data and ensure its reliability.

● All the data will be securely stored on the blockchain, safe from any manipulation and ready to be accessed.

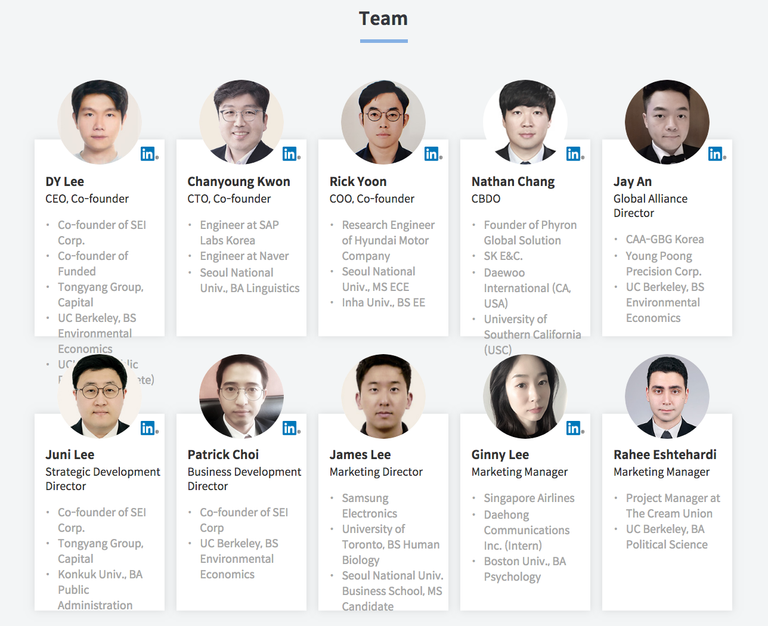

TEAM HIGHLIGHTS

Dong Young Lee – Worked at Samsung for 5 months, is also the founder and CEO of Smart Energy Island

Chanyoung Kwon – Worked at SAP Software Solutions for 5 years and 9 months as Senior Engineer

Ilo Yoon – Worked at Hyundai for 6 years and 1 month

Nathan W. Chang – Worked at Daewoo for 2 years and 6 months as Renewable Energy Specialist (Solar)

JaeHwan Seol – Worked at Hyundai for 3 years and 11 months as Research Engineer

ADVISORS

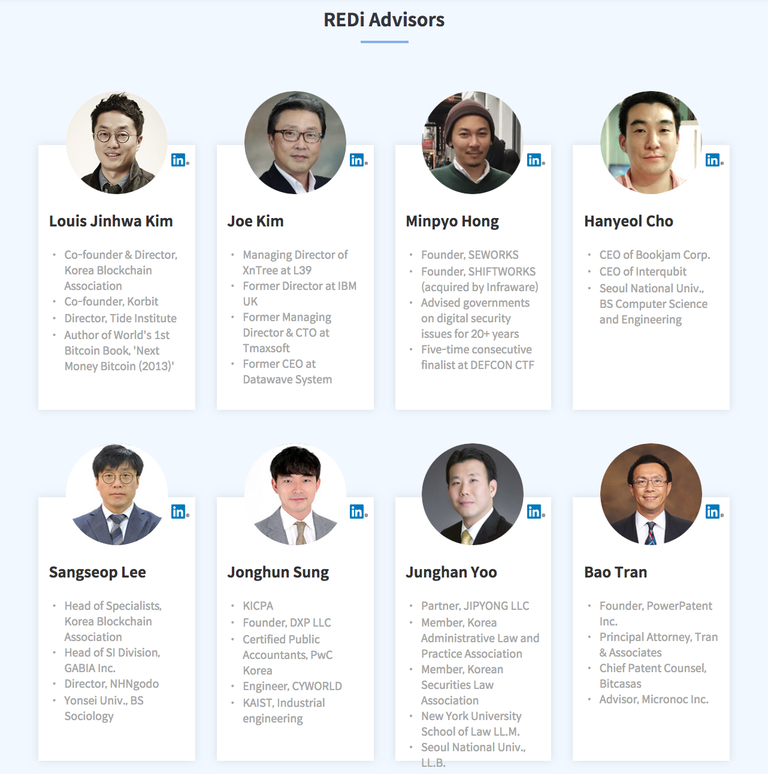

Louis Jinhwa Kim – Cofounder and Director of the Korea Blockchain Association

Joe Kim – Former Director of Enterprise System and Director of Technology and Strategy at IBM

Sangseop Lee – Head of Specialists at Korea Blockchain Association

Jong-Hun Sung – Former CPA at PwC

BACKERS AND PARTNERS

REDi seems to have a good set of partners. Notably Hyundai, most likely because of the ties that some team members have with the company, in addition to a few companies that operate in the renewable energy industry, namely Keps (Korea Engineering & Power Services), SEI (Smart Energy Island), Phyron, Everon, Envis, Cyclogic and PowerVault.

Finally we find among the partners two solid blockchain-based companies (IoTex and Moin) as well as a tech start-up accelerator (Xn Tree) and a VC specialised in blockchain projects (Block Crafters Capital).

COMPETITORS

At present there seem to be no competitors who operate in the same niche as REDi. Other blockchain-based renewable energy projects such as PowerLedger, Electrify.Asia or Restart Energy start from different premises and even cater to a different clientele.

REDi has the unique ambition of linking photovoltaic power plant owners through a platform that facilitates the exchange of trustworthy, verified data, vital for good decision making and successful management.

Moreover, REDi’s prospective customers are not limited to PV power plant owners, but also include financing companies, O&M companies, newcomers and investors who could provide service to the power plants.

MVP

The actual REDi Infranet MVP will be released, according to the roadmap, only in Q3 2019. With the alpha a year away, and no public GitHub, the REDi team does not have a lot to show its investors at present. A dedicated REDi wallet, however, will be released very soon (Q3 2018) and it will be the first tangible technical development. I look forward to that and will suspend judgement until then.

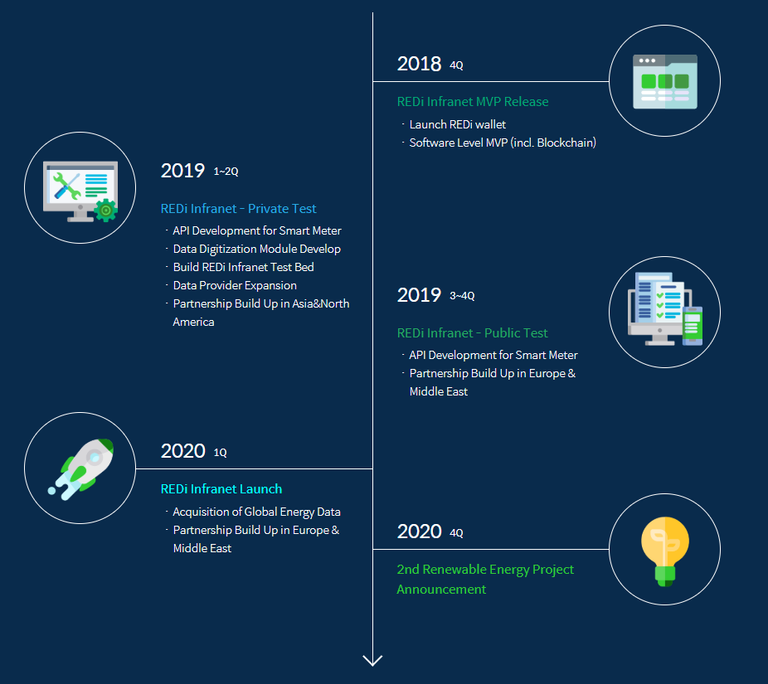

ROADMAP

REDi has recently updates its roadmap, and at present the team is busy with forming new partnerships. While the working alpha of the REDi Infranet MVP will be ready only in Q3 2019, followed by a beta in Q4 of the same year. The long wait is due to the fact that the Infranet needs to receive streaming data from smart metering devices, which will have to be installed in solar power plants. However, an initial development of the software will be ready much sooner, in Q4 2018, and will be published on the REDi website as the MVP. After the alpha and beta versions, the roadmap indicates that the REDi Infranet will be fully operational (for the South Korean market) in Q1 2020, and will become global in Q2 2020.

Below are the main milestones that REDi will accomplish according to the roadmap:

End of October 2018: Github update with the REDi Infranet software code

December 2018: Software MVP published on the website

Q2 2019: Solar Power Plant construction for REDi Infranet testbed

Q3 2019: Installing smart metering and sending data to Infranet (Alpha version) *

Q4 2019: Installing smart metering and sending data to Infranet (Beta version) **

- Alpha : receiving data from testbed solar power plant

** Beta : receiving data from other solar power plants

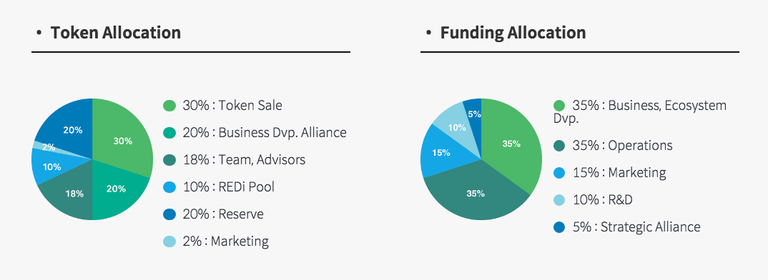

TOKEN METRICS & USE CASES

Ticker: REDi

Type: ERC-20

Token Supply: 2,000,000,000 REDi

% of Tokens sold: 30%

Hardcap: 30,000 ETH

Crowdsale: TBA

Token Price: 1 ETH = 20,000 REDi

USE CASES

The demand for tokens includes:

● Rewards for the provision of data. After registering to the REDi Infranet, data providers will be able to upload and store (following a verification process) data onto the platform. Each data provider will then be rewarded with an amount of tokens equivalent to the value of the data that has been contributed.

● Rewards for the validation of data. Data verifiers will also receive tokens for any validation performed on the data sent by the data providers.

● Utilization of data. Data users will need tokens in order to pay for accessing data on the REDi platform.

FINAL THOUGHTS

● Data is one of the most valuable assets at present, and the clean energy industry has been in constant expansion over the past few years. Therefore, I believe that REDi's idea of monetizing renewable energy data is quite good.

● However, the long roadmap is not promising and I believe REDi should wait until the release of the alpha before starting to raise funds (this could happen, at least in theory, since the date of the crowd sale is – for now – TBA).

● I am neutral on this project in the short term, but if properly developed REDi could become a very interesting blockchain start-up in the medium and long term, since it is a rather ambitious idea with very little competition out there.

REDi SOCIAL LINKS

Disclaimer

The above information is not financial investment advice. Please do your own research before making investment decisions. This information is for educational purposes only.

Follow DiddycarterICO for more crypto content

Spreadsheet: https://bit.ly/2JcUIws

Telegram Channel: https://t.me/diddycarterico

Discord: https://discord.gg/jTzYpJc

Twitter: https://twitter.com/diddycarterico

LinkedIn: https://www.linkedin.com/in/diddy-carter-35894869