The trading of futures markets allows traders to negotiate prices without high risk when trading and earn some profit from the entire underlying value of the instrument they are buying. However, the transaction fees remain very high, which reduces the profit margin and the it becomes less attractive so the real net profit is quite low compared to the nominal one.

There have been cases in trading history that have caused the lost of traders funds, this is a consequence of the platforms being centralized entities that even have control of the private access keys of all their customers. This reality has been reflected in the conventional stock exchange and now in the cryptocurrencies exchanges.

The problem with futures markets is that the only way to obtain an acceptable return is by acquiring large volumes, given that with small operations the profit margins are so derisory that they generate doubts about the viability of buying them.

What are the future exchanges, and how do they work?

The future Exchange is simply a promise/contract to buy something, on a specific date at a specific price in the future.

According to Investopedia: “A futures contract is a legal agreement to buy or sell a particular product or asset at a predetermined price at a specific time in the future. Futures contracts are standardized by quality and quantity to facilitate trading in a futures market.”

DIGITEX THE FUTURE EXCHANGE THAT DOESN'T CHARGE FEES ON ITS CUSTOMERS. HOW IS IT POSSIBLE?

DIGITEX will be a self-sustaining and growing economy that will attract more users thanks to its game changer trading structure. The advantage of DIGITEX is that it DOES NOT CHARGE FEES! This will allow DIITEX to pick the attention of the entire current future market customers who always struggle to gain profits from current schemes that cut their profits by charging high fees.

The current stock exchanges charge some tariffs associated with the negotiation of futures contracts that leave very reduced profit margins to the operator or dealer. Wiith DIGITEX, a standard operation can reach up to 400% of performance compared to BitMEX. BitMEX's fees makes unfeasible such profit margins.

DIGITEX CONCEPTPayment for transactions will be made through the issuance and sale of DIGITEX cryptocurrency. Instead of charging a fee for each transaction, holders of DGTX token will decide how many new DGTX will be issued to cover operating expenses.

DIGITEX Profit Scheme

DGTX THE DIGITEX TOKEN

DGTX is the element that will make operations commission free possible, all profits or losses will be expressed in DGTX. Since each customer must have DGTX, this ensures the permanent demand for DGTX, its issuance will be minimized to keep inflation as low as possible while maintaining a healthy liquidity to ensure the capability to handle trading volumes.

DGTX token will be compatible with ERC-223 Ethereum Blockchain protocol It is a native currency in which all benefits, losses, margin requirements and account balances are denominated in. DGTX can cover platform costs by creating new tokens instead of charging fees to costumers. The small inflation rate to create additional tokens will be offseted by the demand that is created by traders who must own DGTX tokens to participate in the future markets.

The only way traders can participate in these new future markets is by buying DGTX tokens to cover their margin requirements to open trades.

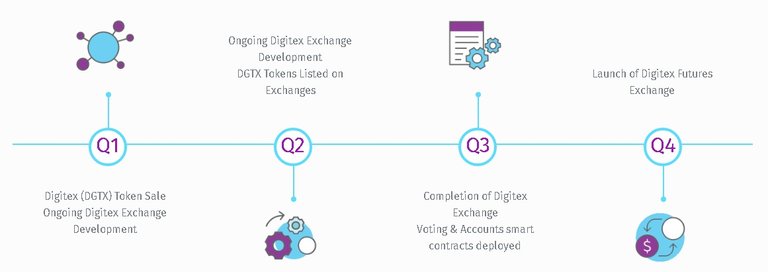

There will not be a new issuance of DGTX tokens for the 2 years following the launch of the Digitex Futures Exchange, since its operating costs will be covered by the revenues of the DGTX ICO.

On the early months of 2021, the Digitex Futures Exchange will start creating new DGTX tokens to cover the costs of operating the Digitex Futures exchange. These costs will include software development, servers, staff, premises, marketing, support and all other associated costs. Based on the projected costs and the current price of DGTX, traders will vote on how many new tokens to create to cover those projected costs. The vote will be done through Decentralized Governance by Blockchain — 1 DGTX = 1 vote.”

The new DGTX tokens will be created through a fully audited contract. Buyers will send ETH to the smart contract address and will automatically receive the correct amount of DGTX tokens in return, with a minimum and maximum financing limit. A separate and fully audited smart contract will maintain the accumulated total of the token emission so that the total offer of DGTX tokens is always publicly verifiable.

Key elements of the DGTX token:

• DGTX is the protocol token that is the native currency of Digitex Futures.

• The value of each Digitex futures market is 1 DGTX token.

• "The margin requirements in each Digitex futures market are paid in DGTX tokens because the profits and losses are denominated in DGTX tokens."

• Account balances in Digitex Futures Exchange are defined by an independent smart contract and are denominated in DGTX tokens.

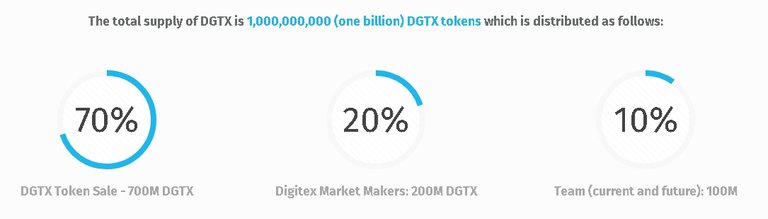

• The DGTX Initial Currency Offer (ICO) has 1,000,000,000 DGTX.

• There is no creation of new DGTX tokens during the first 2 years after the launch of the Digitex Futures Exchange.

• The token issuance generates inflation, but by subsidizing fee-free futures markets more traders will be attracted, and they will have to buy DGTX tokens to participate. Therefore a high demand is expected to counter inflationary price pressure.

• DGTX is an ERC-223 token based on Ethereum that will be able to freely market Bitcoin, Ether and many other cryptocurrencies in the Digitex platform through integration with decentralized token exchange protocols and with a trust-less system like swap.tech, 0xproject.com and bancor.com.

• Traders can eliminate the DGTX price risk of their exchanges with the DGTX Peg System.

The owner of the DGTX tokens has the ability to participate in the purchase and sale of liquid futures contracts on the Bitcoin-Ethereum -Litecoin price against the USD without incurring commissions. If the same merchant buys and sells similar futures contracts in any other stock exchange, he will incur commission costs. The saving of the commission costs is a commercial strategy of high volume and low profit margin which makes it more profitable.

DGTX Token Supply and Distribution

During the initial sale, 1000 MM of DGTX Tokens will be placed and distributed as follows:

• 650MM DGTX (65%) Retail to Token DGTX

Start on January 15, 2018. Buyers will exchange ETH for DGTX tokens at an equivalent price of USD $ 0.01 per DGTX token, resulting in a maximum cap of $ 6.5M that can be raised.

• 200MM DGTX (20%) Digitex Market Makers

The commercial bots of DIGITEX have algorithms programmed to balance themselves. A large commercial bank of 20% of all the tokens in circulation, helps to create liquid futures markets that have adjusted supply and supply margins, even in volatile conditions, which is a natural behavior of crypcurrencies.

• 100MM DGTX (10%) Digitex team and advisors (current and future)

These tokens will be assigned 1 year after the first token issue for income generation in January 2021, which guarantees that the team has incentives to create a stable and lasting business model.

• 50MM DGTX (5%) References

• 100% of that is in a 3 year award calendar.

• After the initial auction, only 90% of the total supply will be in circulation.

Profile of the DIGITEX traders:

• 2% of the traders are whales that buy $ 150,000 USD in DGTX.

• 10% of merchants are mid-size who buy $ 15,000 USD of DGTX tokens over a 2-year period.

• 88% of the traders are small traders who buy a total of $ 1,500 USD in DGTX.

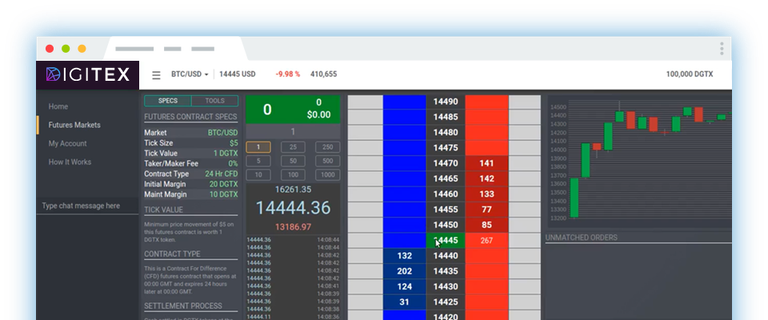

DIGITEX FUTURES EXCHANGE

• Zero trade commissions

The exchange covers your costs by generating new tokens from your own native currency.

• Decentralized Accounts

“All account balances are maintained through a decentralized and independent intelligent contract in the chain of blocks of Ethereum”.

• Decentralized government

Decentralized governance by Digitex operators where they determine through Blockchain how many new DGTX tokens should be issued and when.

Futures of Bitcoin, Ethereum and Litecoin

Digitex works with 3 futures markets: BTC/USD, ETH/USD and LTC/USD. Each futures contract allows prices to be displayed in a one-click ladder-style trading interface, even in volatile market conditions. The tick values of futures contracts are denominated in DGTX tokens, which means that all gains and losses are settled in DGTX tokens.

Complete privacy

Operators in Digitex can operate without the need to send identification documents. As an offshore exchange that only accepts DGTX tokens, Digitex is not subject to KYC/AML standards that expose the identity of the customers and put them at risk of identity theft by making the exchange a target for hackers. The best way to protect the personal data of our users is not to collect that data.

WHAT MAKES DIGITEX A GAME CHANGER?

• NO CHARGES: “Operators can apply low-profit and low-risk strategies, and still be profitable without trade fees reducing their profits.”

• Decentralized business model: “Instead of a company acting in benefit of its centralized interests, a business model based on decentralized voting guarantees that Digitex Futures Exchange will always be executed at the cost and for the benefit of its users.”

• FREE TRADERS OF PROFIT CUTOFF BY HIGH TRADING FEES

• GIVE THE TRADERS AN OPORTUNITY TO GAIN MORE FREEDOM WHEN EARNING PROFITS FROM A NEW FUTURES MARKET.

DO YOU WANT GET THE DGTX TOKENS?

JOIN DIGITEX HERE DIGITEX Early Access

Digitex offers early access to the community to participate and win tokens with Digitex Early Access.

Leverage and margin Management

Leverage and margin Management

Concept of Digitex Future Exchange Suite

Concept of Digitex Future Exchange Suite Digitex Future Exchange Suite

Digitex Future Exchange Suite Digitex Forward Trends

Digitex Forward Trends

This post has been submitted for the OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!