Disclaimer

The following information is not financial investment advice. Please do your own research before making investment decisions.

Current Problem recognized by BOLT team:

Digital services are not accessible or affordable for emerging market populations.

These people face the following issues:

- Unbanked

- creditless

- flat fees are awful for small fish (ever try withdrawing a small amount of crypto from Binance? Ouch.)

- huge commission fees paid to telcos by traditional payment rail systems which are also not scalable to a global level (often needs individual/local integrations) and furthermore they are inflexible in their model

Shifting to the Blockchain

So, why does BOLT need to go on the Blockchain?

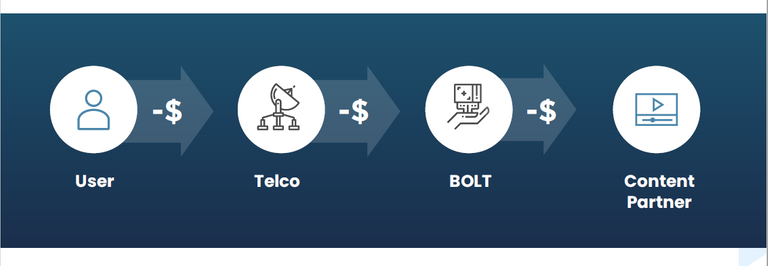

- Liquidity - traditional system creates a 120-day payment delay from point of when a customer pays to the point it reaches the content provider (user->telco->BOLT->content partner). So this creates a huge liquidity business delay, which the micropayment system BOLT wants to implement would cut through since they could cut out the traditional payment gateways and instantly compensate the content partner. Remember, blockchain is about verifying transaction. You don't need a payment gateway to process a transaction and verify it, etc if you can put it on an immutable ledger and prove the funds were paid. This allows the content provider to get paid much quicker, allowing them to build and use those funds. In short, they will love it.

- Efficiency - As shown above, it's simply more efficient. Furthermore, BOLT claims they are losing 30-40% of revenue to the traditional payment gateways. That's insane. There's your value.

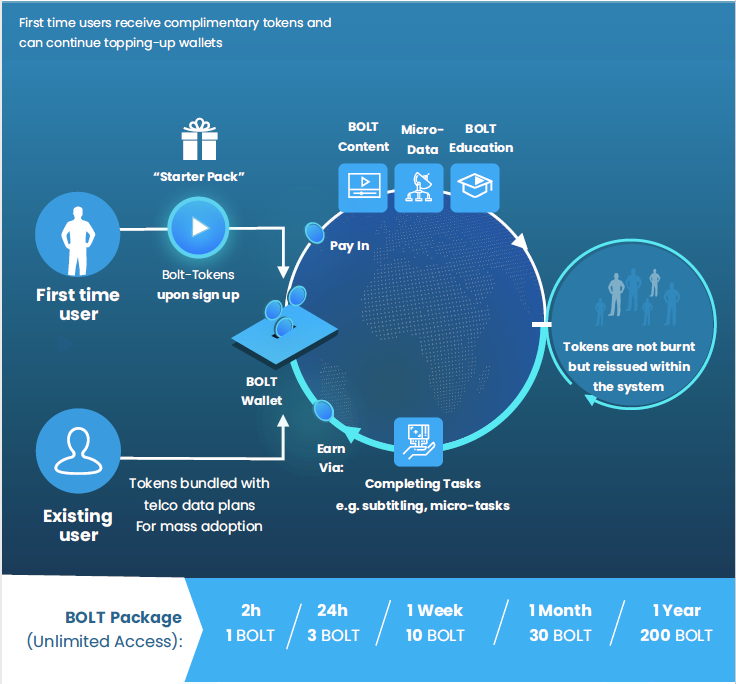

- Giving back to the user & incentivizing token adoption - BOLT wants to provide discounts (50% in first year, halved every year) and bonus subscriptions to those that choose to pay with BOLT tokens instead of fiat, though they will still allow the traditional fiat gateway payments, as well. They are going to take a piece of the revenue they are taking back from fiat gateways and giving it back to their users. Isn't this what we want?

- Borderless payments/Global Scaling - The great thing about blockchain and cryptocurrency is it transcends borders. The BOLT utility token will allow users, unbanked or banked, worldwide to access content without having to try to go through a local fiat gateway and pay in their traditional currency.

- User Data - this model can keep BOLT advertiser-free and leave your user data protected and not sold to advertisers, which is what Facebook, Youtube, and the like have been doing. They have been raking money in hand-over-fist selling your data. That shouldn't be ok. Of note, the BOLT platform will allow sponsors/brand advertisers to use BOLT tokens to access advertising on the platform. I am curious to see how they will still protect user data or whether we can opt-in or out of this part of the economy.

Token Economy

BOLT doesn't just want to provide content. They want to open up the platform to allow users to share and review content.

Ways to earn tokens:

- Publish your own content and get rewarded from viewers

- Help out by voting on content - engagement

- community-based content moderation - interested to see what this looks like

- translate content

- community tasks - vote on these to affect level of token rewards for each task

This is yet another counter-argument to those stating content is free on youtube. I can make a side-income on the BOLT platform and potentially fund my own consumption of media on the platform and never have to spend a dime. I am interested to see how moderated or unmoderated this will be. That will speak to the level of decentralization. If content can't be "decentivized" as we are seeing happen en masse at youtube due to Youtube's reliance on advertisers, then there is even more competitive value in the BOLT project. I believe this is the case here.

Here's a visualization at their proposed ecosystem:

Value Proposition

I remember when I first got a decent smartphone with a half-decent data plan. I used up my monthly dataplan streaming videos on the bus within a week.

Youtube and Netflix streaming on mobile for HD video can be 3 GB/hour vs Bolt's proprietary tech that compresses the files to much smaller file sizes resulting in a much more reasonable 250 MB/hour. That's a massive difference in mobile data consumption (12x less data usage).

They provide access to their HD video and livestreaming content through microtransaction formats, allowing users to pay on a basis of 24 hours, 1 week, or monthly (10 cents for 24 hours; $1 for 1 month) through already existing telco data and airtime bundling. If I'm understanding this correctly, Bolt is covering the data costs with the user's microtransactions. That's your value, right there. Not everyone has access or affordability for a good data bundle to mobile stream youtube content, for example, especially not HD streams.

20% of the token profitability will be used every year to repurchase BOLT tokens and burn them till 400 million total are gone,which follows a similar burn model to Binance's BNB token. Yes, there's an ongoing token burn. That's a 40% supply burn total. Remember Switcheo value proposition in token burning? Hmmmmm, maybe this has something do with Christel being an advisor to Switcheo! I am seeing a connection! Anyways, this will increase value of your BOLT tokens over time as the BOLT token supply is capped 1 Billion max.

Lastly, I'll note that BOLT has a working product on android and iOS (I do want to see alot more development towards the platform, which I think we are sure to see), 3 million existing users, and can use their funds to further develop the application and make it much smoother.

Team

I'm a pretty big fan of this team overall. I think they need a bit more blockchain dev experience, but I don't think that will be too hard to find with their funding and existing connections in crypto. Keep in mind that they have assistance from and connections to Zilliqa and Switcheo. Here are some members that stood out to me:

- Jamal Hassam, CEO - Strong Has held management positions at different TV media companies; previous CEO of SPH Mediaworks Ltd

- Christel Quek, CCO - All-star ; Advisor to Zilliqa & Switcheo projects; former Head of Content for Twitter; former Social Business lead for Samsung Asia; awards from The Guardian and Business Insider publications

- Julian Jackson, Chief Content Officer - All-star ; former Managing director of branded content for Zenith (7.7k employees on linkedin); former CEO of B4 Capital, Asia; former Chief Content Officer of Total Sports Asia

- Lynn Morales, Digital Operations/marketing - related work at Twitter, Aesop, Brandwatch; needs to update her linkedin to reflect position at BOLT

- Ivan Liew, Corporate Affairs - Strong ; 17+ years in oil and gas industry in different positions - I'd be interested to learn more; I think he got linkedin just for BOLT (since crypto is so obsessed with linkedin) as his profile is bare bones. Previous University lecturer, so fairly smart!

- Jean Poireau, Partnerships - Strong ; business dev experience at French Embassy in Malaysia (French Ministry of Economy); also experienced in business startups

Graham Duncan, Finance - All-star ; former Director of Corporate Finance at Mazars LLP (16.5K employees on linkedin); needs to update linkedin to reflect BOLT position

Partnerships/Advisors

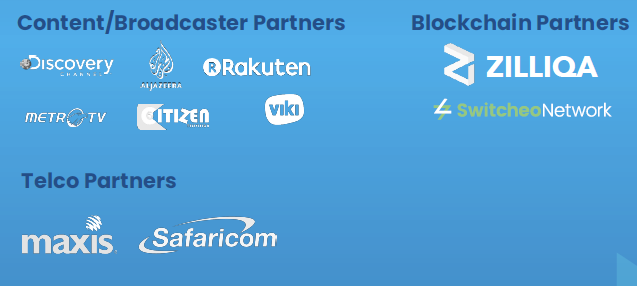

The BOLT team already has partnerships via licensing agreements from Discovery Channel, Al Jazeera, Viki Rakuten, Bloomberg, Reuters, and others. Once again, they also have partnerships with telcos for data bundling. What's truly interesting about this is that BOLT wants to pay their content partners in BOLT tokens and let them sell them on exchanges. This whole ecosystem is what adoption and organic value growth looks like.

- Zilliqa - Already a very successful blockchain in terms of marketcap ($1 Billion), BOLT will be the first dapp launched on the Blockchain, which boasts an already achievable throughput of 2,488 TPS. This relatively high TPS, which is likely to scale further in the future, will allow for much quicker transaction confirmations than a blockchain like Bitcoin or Ethereum would allow. Zilliqa is a very highly regarded blockchain project and I've honestly only seen positivity with regards to their project.

- Switcheo - The first and only NEO DEX and both their CEO and COO are advising the BOLT project. The future is bright for Switcheo, but I won't delve into that here. Suffice to say that I use their platform regularly to trade NEO & NEP-5 tokens. The BOLT token is initially going to be a NEP-5 token until the Zilliqa mainnet is launched and ready. The Switcheo dynamic call function will allow for immediate listing on the switcheo exchange. What's cool about the switcheo exchange is that it's decentralized, so anyone with a NEO wallet they own the private keys to can access and trade their BOLT there without it ever going to a centralized holder (e.g. binance, kucoin).

Diving deeper into the Switcheo partnership, it appears the Switcheo cofounders are going to be working on developing a smooth integration of BOLT tokens by linking directly to Switcheo. One click functionality. Very cool.

They also have several other investors and advisors to support, including Steven Pang (early investor of Quantstamp, Zilliqa, Canya, Loki).

Token Distribution - This is what I'm hearing and may be subject to change

- 1 Billion Supply

- 40% Private Contribution Round

- 20% BOLT team - 36 month vesting with a release schedule of 33.33% every year on a quarterly basis- remember their hardcap is low (12 million), so they are not getting as much out the gate as another project that would be raising more as their token % at ICO price would be worth less than another project. They also reduced their token allocation from 30% to 20% and increased the length of lockup by a year. That's alot of faith in their project, compared to some other projects that won't be named here :)

- I am currently uncertain whether advisor tokens will be paid from here or not

- 20% Strategic & content partners - I would like to know whether this includes the institutional investors and what their lockups are

- 15% BOLT Research (separate entity) to spearhead R&D of BOLT platform, marketing/community engagement/support. Vesting schedule is exact same as team's tokens

- 5% Rewards for BOLT network community contributors - my only question is what happens when this 5% runs out, or will the ecosystem be self-sustaining by then

ICO Fund Usage:

- 60% - R&D; implementation of network

- 20% - operating expenses

- 10% - legal/consulting

- 10% - reserves

I don't have any concerns with this fund usage breakdown, especially at their low cap.

Conclusion: Excited

I think this project could do really well and it is really cool. I think the more well-to-do crypto people often forget about the unbanked, but it's a massive use case for blockchain and cryptocurrency technologies.

With proper token supply management (lockups and vesting) and proper exchange listings through their connections, this project could do very well, despite it being a dapp.

BOLT project website: http://bolt-token.global/

BOLT telegram: https://t.me/BoltGlobal

BOLT twitter: https://twitter.com/Bolt_Global

If you enjoyed this review or other content I've created, feel free to join the groups below, follow me on twitter, and/or upvote and comment on this article:

Telegram group

Telegram Announcement channel

ICO spreadsheet

Twitter