On new years eve before midnight EST, I tried to buy bitcoin at coinbase for just under 3700-in which to eventually buy steem. Nothing that significant. My first time in over a year of buying crypto, but my plans were thwarted when they tried to verify my somewhat new card but the transactions for verification never appeared on my online bank transactions. I still don't see it there as of this writing. I rarely make my way over to the bank, and I am not making a special trip.

I was expecting a substantial January effect. The collapse last year made cryptos prime for hodlers to sell for a tax loss to offset capital gains. December tends to be bearish for bad performers. So there are some opportunities for buying before new years, with the expectation that investors will return in January. While Bitcoin did appear to have reached well above 3900 on january first after a few hours. This delay suggests that foreigner investors weren't taking advantage of US tax codes. That gain has quickly fizzled to slightly over $3800 this morning. Perhaps it is due wall street fearing for apple's future as china sales are down and even cryptos were affected by market psychology. I don't anything in the news search for bitcoin in the last 24 hours that could fuel any FUD as to bitcoin. Some of the news is quite positive, or perhaps more accurately stated speculative opinion and more opinion and some private keys activism against exchanges. Another site predicts a stagnation, or rather stable 2019. So what is stable? 0 percent growth. If so, why not buy bonds?

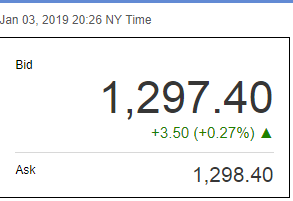

Nothing I see in the last 24 hours that would have affected the price. If people are fearing a recession as what had happened to wall street, it seems counterintuitive for things that could behave as hedges against inflation to decrease in value. As expected, but to no great degree, Gold is up.

source:kitco

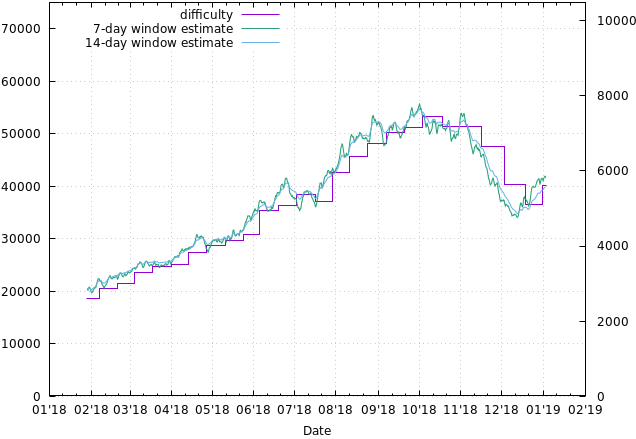

But perhaps, outside of the poorer areas of the world where there isn't a choice, crypto isn't yet recognized as a hedge against inflation and will follow the whims of wall street. Perhaps, at worst, Bitcoin will collapse. But from a chart, mining hashes have been readily increasing since about the time of the new miners.

source:eobot

Unless Electricity if free, even the new mining hardware will look like it will not be profitable for years using the estimates from asicminingvalue. Even the asicminer pro, referencing this news.bitcoin.com, appears to cost over $11k. So even the case where electricity is free, a $15/day profit (with no electricity costs) at current market value would take years to pay for itself and would be made obsolete when new hardware is released. I don't see the argument for buying them; Even if you are one of the people projecting bitcoin to go to 15k+, it would make more sense to just buy the coins. I have great difficulty believing, other than for testing purposes, that people would be buying new hardware. Maybe after the liquidation of the old miner's mining hardware, new users are simply turning on the old machines where the hash rates are purchased at a discount at the detriment of greater energy consumption.

The increase of hash rates is the only bullish thing I see right now, but suppose that is just a false positive. Perhaps it is due to the new glut of cheap equipment flooding the market. Perhaps the price decrease is a false negative. Perhaps something more sinister is going on in the bitcoin mining world; what if the bulk of the mining is being done by the Chinese government-just print off more money to build the hardware and sell the hardware to foolish westerners thinking they can compete against a farm the Chinese could make essentially for free. But that is unfounded speculation, especially with prior reports earlier this year that china has cracked down on mining. Governments hate competition, so perhaps it isn't far fetched to argue they might have a monopoly of bitcoin mining in the country. But I digress.

It appears one big seller may have been behind the decline. Although in every sale there is a buyer, it doesn't look to many people tried to fill in the vacuum created by the whale.

source:coinmarketcap

I think if the us economy faces recession and inflation this year that there is a chance for a rally in crypto, but that would require the market collectively seeing crypto as a hedge against inflation. Without it being seen as a hedge, and the us approaches recession it could be painful to hold. I expected more sellers to return at create a noteworthy rally. I am not seeing one that was noteworthy. About the only positive I see is the increasing in hash rate. My gut instinct is still somewhat fomo [fear of missing out] and I suppose that is because of history and the miners, and the regret of being a poor college student and not buying crypto back then. But I think the crypto market, especially for bitcoin, could be quite bearish for a while based upon these last few days. The fomo in me would like to put a little more in crypto, but how much lower can bitcoin go before we may end up playing a little chopin Piano Sonata No 2 in b flat minor for it.

Chopin...I miss full metal alchemist (2003) and the good ole days of anime. FMA used Etude no. 3 in E major

I think there is still a lot of capital on the sidelines waiting for the right sign to come back into the market. Whether it be clarity regarding regulation or a new ETF product being approved, one change and the trend can easily reverse. If you consider the amount of capital held in stablecoins alone, the potential for a bounce is real. However, the problem remains that price is still tied to speculation and not the underlying value as adoption in the use of cryptocurrencies is still behind.

Posted using Partiko iOS

This post was shared in the Curation Collective Discord community

community witness. Please consider using one of your witness votes on us here for curators, and upvoted and resteemed by the @c-squared community account after manual review.@c-squared runs a

Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.Congratulations! This post has been upvoted from the communal account, @minnowsupport, by firstamendment from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.