Cryptocurrency Explained

The first cryptocurrency was Bitcoin, invented in 2009 by a pseudonymous developer named Satoshi Nakamoto. The market doesn’t know the true identity of Satoshi Nakamoto, but the groundwork laid by the invention of Bitcoin paved the way for other digital currencies and led to the growing acceptance of cryptocurrencies as both an investment opportunity and as a medium of exchange, a way to securely transfer money from one currency owner to another digitally and without the use of traditional banks or financial institutions.

Cryptocurrencies are designed to function as money, an alternative to the fiat currencies of the world, many of which are in various stages of erosion through inflation or are at risk of government seizure. Greece, a country with a 45% income tax rate, seizes over 900 bank accounts per day.

The island nation of Cyprus, a budding financial center, suffered the consequences of Greek debt defaults, forcing Cyprus’ government to seize depositor’s funds to remain solvent.

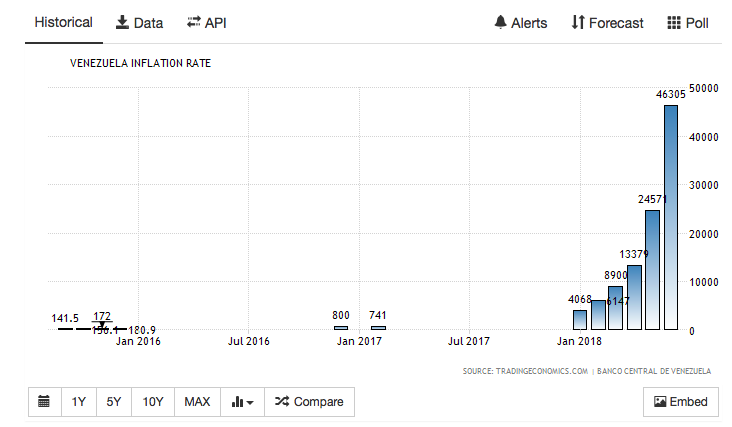

Venezuela’s inflation rate is currently over 46,000%, which creates a financial crisis that threatens the survival of families in the country.

Venezuela inflation rate

Source: Tradingeconomics.com

Cryptocurrency Advantages

Cryptocurrencies offer several advantages when compared with traditional banking, money transfers, and fiat currencies.

Privacy

Many cryptocurrencies are designed with privacy in mind and obscure the identity of the sender and receiver of cryptocurrency funds. Only cash provides similar anonymity.

Decentralization

Cryptocurrency owners use a wallet to access their currency and receive or send funds from a specific wallet address that uses a secret key for access. Some also use an exchange to store currency, although the practice brings additional risk. The record of the currency exists on the blockchain with a copy stored on every full node, a computer that keeps a ledger locally and syncs with other computers online.

Your money isn’t in a single bank, or even several. The decentralized nature of cryptocurrency ledgers makes cryptocurrencies less vulnerable to seizure or localized risks, like fires or hardware failures. The data isn’t just stored off-site, it’s copied worldwide to all full nodes.

Scarcity

Bitcoin has a fixed supply. Over 17 million Bitcoin are in existence. However, only 21 million Bitcoin will ever exist. It’s built into the code for the currency. The fixed supply gives Bitcoin and other cryptocurrencies similar characteristics to gold, silver, or other precious metals that have historically been used as money. Unlike U.S. Dollars, British Pounds or any other fiat currency, after the full supply is in circulation, the supply will never grow, devaluing the currency’s buying power.

Smart Contracts

Some cryptocurrencies have a unique feature that can’t be duplicated with fiat currencies. Ethereum is among the best examples with its robust support for “smart contracts”, essentially programs that live on the blockchain and can be used to manage transactions as well as many other uses, some of which we may not have yet imagined. At a base level, these contracts can be used to replace arbiters or escrow services. The smart contract can manage the details of a transaction, only releasing payment when predefined conditions are met.

Cost of Transfers

The cost associated with cryptocurrency transfers can be a pro or a con, depending on the type of currency, the type of transfer, and the speed of the transfer. Bitcoin, for example, can become prohibitively expensive if you need fast clearance for a transaction. Costs are less problematic for less time-sensitive transactions. Other types of cryptocurrencies, such as Ripple, are fast an inexpensive to transfer, leading to increased adoption of Ripple-based transactions and related technology by financial institutions.

Cryptocurrency Disadvantages

Cryptocurrencies come with a list of considerations that can help investors make safer investments. It’s fair to say that there is no safe cryptocurrency at this early stage, but with careful planning, you can assemble portfolio that limits your risk while still providing you the opportunity to exit the trade if needed.

Market Adoption

Awareness for Cryptocurrencies is growing, but most of the focus has been on Bitcoin. Relatively few retailers accept cryptocurrencies for payment, but there are a few. Overstock.com announced in 2017 that they would accept cryptocurrencies as payment. Payments will be limited to Bitcoin, Ethereum, Litecoin, Dash, and Monero, giving the other 1,500+ cryptocurrencies the cold shoulder.

Pizzaforcoins.com accepts over 50 cryptocurrencies, allowing cryptocurrency owners to buy pizza from local establishments and have it delivered. Market adoption of cryptocurrencies for payment has been slow and options continue to be limited but the cryptocurrency market can change quickly.

Obsolescence

As many as 1,000 cryptocurrencies have failed already, with more currencies sure to follow. The most common type of failure is at the Initial Coin Offering (ICO) or shortly thereafter, with many coins finding a crowded market for coins with similar characteristics to existing offerings, causing skepticism among investors. In some other cases, the ICO itself was just a cash grab, with the founders running off with investor funds. Currently, ICOs are unregulated.

Abandoned Cryptocurrency Projects

Most of the investment money for cryptocurrencies is focused on a relatively small group of coins. Without investor interest, projects can get abandoned, leaving investors with essentially worthless digital coins.

Regulation Risk

As it pertains to cryptocurrencies, regulation risk has two sides. In the U.S., cryptocurrencies are not regulated at a federal level, leaving states the option to introduce rules and regulations regarding cryptocurrencies or the blockchain technology that serves as the backbone for cryptocurrencies. On the other hand, some investors and finance experts have expressed concern over future regulation for cryptocurrencies, which could cause a drop in demand or eliminate demand altogether.

Liquidity Risk

Investors and lesser-known cryptocurrencies may find fewer buyers, creating challenges when looking to exit a position.

Volatility Risk

Few investment classes can rival cryptocurrencies when it comes to price volatility. Prices can rise or fall dramatically in a single day, making or breaking fortunes.

Third-party Risk

Mt. Gox, a Bitcoin exchange based in Japan, and the leading exchange worldwide in 2014 was hacked, leading to a loss of nearly half a billion dollars in Bitcoin. In total, an estimated 850,000 Bitcoins belonging to investors went missing, ultimately forcing the exchange into bankruptcy.

Secure Keys

Cryptocurrencies are often kept in a digital wallet, which is secured by a long code or a long series of words. Unlike your bank account or investment account, there is no recovery process available if you lose your password. Without your password, your cryptocurrency wallet and its contents are no longer accessible.

What to Look for in a Cryptocurrency

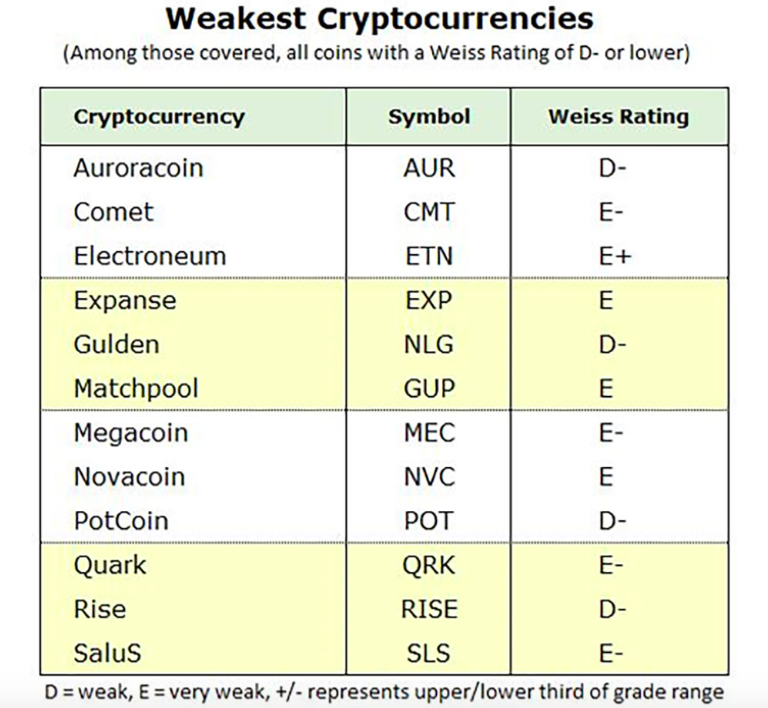

Weiss Ratings, a leading independent rating agency for financial institutions, recently introduced ratings for cryptocurrencies, identifying Bitcoin, Ripple, EOS, NEO, and Steem as its five top-rated cryptocurrencies. Weiss also spotlights a dozen cryptocurrencies it identifies as being the weakest.

Weakest cryptocurrencies

Source: Weisscryptocurrencyratings.com

Adoption Rate

Cryptocurrencies are highly speculative investments in the biggest gains are sometimes found among newly introduced coins or coins whose technology has found the market, as was the case with Ripple. More cautious investors may choose to look at adoption rate, focusing portfolio investment on cryptocurrencies that are currently used in real-world transactions.

Market Cap

In many ways, the market cap for a given cryptocurrency goes hand-in-hand with liquidity. Fledgling cryptocurrencies may not ever find the market, preventing investors from exiting the position profitably.

Promising New Technology

Ethereum and Ripple both owe their stratospheric gains in 2017 to the innovative technology built into their respective platforms, differentiating both cryptocurrencies from the crowded market of often similar offerings.

Security or Anonymity Features

Technology such as smart contracts, found in Ethereum and several other cryptocurrencies make transactions more secure by enabling a set of rules for each transaction. Some cryptocurrencies, like Monero, place a strong focus on anonymity, obscuring the identity of the sender and receiver of funds.

Industry Utility

Ethereum and Ripple are again good examples of cryptocurrencies with utility beyond a simple medium of exchange. Ripple, in particular, attributes its rise in popularity and a price appreciation of 36,000% in 2017 to acceptance within the financial industry as a tool to transfer money around the world inexpensively and faster than by traditional methods.

Red Flags for Cryptocurrencies

When choosing a cryptocurrency for investment purposes with the hope that it may someday become a tool for monetary trade, there are some things to look out for and some evidence that sometimes it’s more prudent to wait until a market is established for a cryptocurrency.

Redundant Technology

Many cryptocurrencies are built on open-source code, making it relatively easy to clone an existing cryptocurrency, possibly making only minor changes to the code or the cryptocurrency’s features. In these cases, the new currency may not offer enough unique benefits to justify investment or suggest that the currency will be widely adopted.

Limited Market Interest

The cryptocurrency market has its well-known heroes, but it also has its share of duds, well-intentioned cryptocurrencies that never get off the ground or poorly-supported or niche currencies that are better described as a hobby than as a currency. Staying with currencies that have shown signs of continuing market interest is a safer bet.

Low Market Cap

Much as market cap helps us to instantly distinguish between a Dow Jones stock and a penny stock, a higher market cap points to a more vibrant market and greater liquidity. Thinly traded cryptocurrencies or those with a low market cap could be a trap that’s difficult to escape if you need to make an exit.

Limited Exchange Support

Similar to the concerns regarding market cap, a cryptocurrency with little support on exchanges can make it difficult to trade, often requiring several steps and conversions to make a single trade. Cryptocurrencies with wider support on popular exchanges make it easier to build or exit a position.

How We Chose the Best Cryptocurrencies

The most daring investors can purchase new cryptocurrencies at the initial coin offering or shortly thereafter, following the example set by many of today’s Bitcoin millionaires. However, there may never be a “next Bitcoin”, and the estimated 1,000 cryptocurrencies that have vanished into the digital ether point to risks for early investors. We took into consideration:

More established cryptocurrencies with a larger market cap

Promising technology

Those that are traded on a number of exchanges (providing enhanced liquidity)

Historic performance and recent trends

Volatility

Best Cryptocurrencies

- Bitcoin (BTC)

The granddaddy of all cryptocurrencies, Bitcoin was first and is the most well-known cryptocurrency on the market. It also benefits from the largest market cap and is among the most highly traded cryptocurrency, assuring liquidity in the short-term. Bitcoin is the king when it comes to retail adoption, leading all other cryptocurrencies in terms of acceptance as a payment medium. Down significantly from its all-time high of over $20,000 per Bitcoin, BTC may have plenty of room for growth despite an increasingly crowded field of competitors.

- Ethereum (ETH)

As the currency and platform that made “smart contracts” part of the cryptocurrency market’s vocabulary, Ethereum has seen massive gains since its introduction in 2015. Currently trailing only Bitcoin in regard to market capitalization, Ethereum has become one of the most widely discussed cryptocurrency projects in the world.

A consortium of some of the biggest names in the business, including Microsoft, Intel, Chase, and J.P. Morgan are building business-ready versions of the software that drives Ethereum. With momentum and market enthusiasm behind the Ethereum project, there’s no reason to think Ethereum has run its course and investors should consider Ethereum as part of a cryptocurrency portfolio.

- Ripple (XRP)

Ripple diverges from much of its cryptocurrency competitors in a number of ways. Ripple is an invention of Ripple Labs, and the Ripple token is being used in high-speed and low-cost money transfers worldwide. Ripple Labs has announced a number of partnerships with leading money transfer services, with more financial market partnerships expected in the future. Unlike many cryptocurrencies that trade on hopes and dreams, Ripple is being used in the real world today, showing signs of future adoption within the financial market community.

Ripple rise in value over 36,000% in 2017, but similar gains may not be likely going forward.

- EOS (EOS)

Another cryptocurrency with smart contracts like Ethereum, and which is gaining in popularity is EOS. EOS is credited with being the first blockchain operating system, offering decentralized applications that live on the blockchain and parallel processing, enabling faster transaction speeds and better scalability than some competitors. Transactions on the EOS network are free. Many competitors, including Ethereum, have a transaction fee for transferring coins or tokens from one wallet address to another.

EOS concluded its year-long ICO in May of this year, raising a total of $4 billion. The longer-duration ICO was done in an attempt to create an orderly market for EOS without the dramatic run-up and sudden crash common to cryptocurrencies when launched. YTD performance for EOS is flat, with less volatility than has been seen with some competitors. Enthusiasm for the project remains high, and EOS is one of the most actively traded cryptocurrencies on exchanges.

- Bitcoin Cash (BCH)

Bitcoin Cash, a fork of the original Bitcoin project, is one to watch, as it’s the fourth largest cryptocurrency by market cap. If forced to level criticism against Bitcoin in its current form, slow transaction speeds are among its primary challenges. Bitcoin cash was developed using modified code from the Bitcoin project that allowed larger block sizes, promoting faster transaction times and better scalability. Although not yet as widely accepted or as widely known as Bitcoin, Bitcoin Cash is still a promising alternative to Bitcoin with an enthusiastic market following.

- Litecoin (LTC)

Now accepted as a payment method at Overstock.com, Litecoin may also have a bright future. Long-term investors in LTC have been rewarded with up to 20x returns, although a spike in late December 2017 sent the price of LTC to over $350. Litecoin now trades at around $84 USD, and although showing signs of consolidation remains actively traded and is consistently one of the top 10 cryptocurrencies when measured by market cap. Litecoin boasts a faster transaction time than Bitcoin, largely attributed to its use of a different type of algorithm to add transactions to the blockchain. Increased transaction speed also enhances scalability.

Final Thoughts on Best Cryptocurrencies

Cryptocurrencies are still in their formative years. If you’re new to cryptocurrencies, you may be better served by investing only risk capital and by building a portfolio of widely traded cryptocurrencies. Initial coin offerings can be tempting, particularly with the parabolic rises common to ICOs. Almost as common is a precipitous fall following the ICO. More established currencies help to prevent some of the volatility and provide better liquidity than found with newly minted cryptocurrencies.

It’s important to learn where a cryptocurrency can be traded and how big the market is for that cryptocurrency. Many early investors have found themselves without a viable way to exit the position. If cryptocurrencies are here to stay, some very good opportunities are likely to exist among the most commonly traded currencies, while also minimizing risk due to abandoned projects or lack of liquidity.

Posted using Partiko Android

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.benzinga.com/investing/best-cryptocurrency/