In first part we know About history of money, medium of exchange. In this part I specially discuss about cryptocurrency.

Revolutionary medium exchange will be explained part by part.

Now a days cryptocurrencies have become a global phenomenon known to most people. Still now this, money concept is not understood by most people, banks, governments and many businesses. Still this concept in early stage, some says its as like as 1992 Internet.

In 2017, we'll have a hard time discovering a major bank, a major accounting firm, a dominant software company or a government that did not research cryptocurrencies, publish a paper about it or start a so-called blockchain-project.

But beyond the noises and the press emits the overwhelming majority of men and women - bankers, sales staff, scientists, and developers - have a very limited knowledge about cryptocurrencies. They are often neglect to even understand the basic concepts.

What is cryptocurrency and how this digital innovation can change history of money?

Few people know, but cryptocurrencies emerged as a part product of another new technology. The unfamiliar inventor of Bitcoin, is the first and still most important cryptocurrency, never designed to invent a foreign currency.

In his announcement of Bitcoin in late 08, Satoshi said he developed "A Peer-to-Peer Electronic Funds System. "

His goal was going to create something; where many people failed to create before digital cash.

Announcing the first release of Bitcoin, a brand new electronic cash system that uses a peer-to-peer network in order to avoid double-spending. It's completely decentralized with no machine or central authority. - Satoshi Nakamoto, 09 January 2009, announcing Bitcoin on SourceForge.

The most important part of Satoshi's invention was that, this individual found a method to build a decentralized digital money system. In the nineties, there are many individual and team attempts to create digital money, nevertheless they all are failed.

... after more than a decade of failed Trusted Third Party structured systems (Digicash, etc), they find it as a lost cause. I hope they can associated with difference, that this is the very first time I know of that we're trying a non-trust based system. - Satoshi Nakamoto within an Email to Dustin Trammell

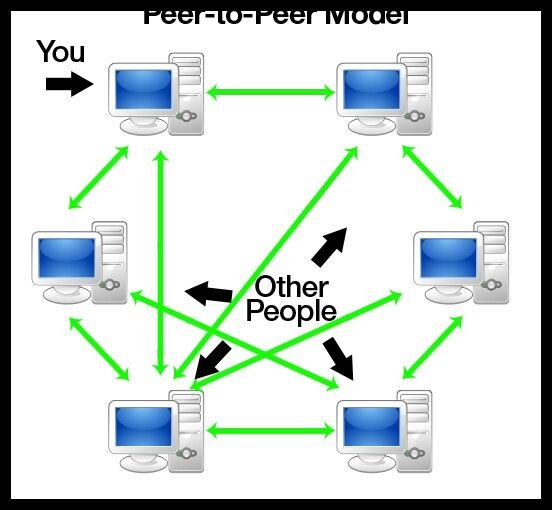

After seeing all the central attempts fail, Satoshi tried to build a digital cash system without a central entity. Such as a Peer-to-Peer network for peer to peer.

This decision became the birth of cryptocurrency. They are the lacking piece Satoshi found to understand digital cash. The reason why is somewhat technological and complex, but if you get it, you will know more about cryptocurrencies than most people do. So, let's try to make it reasonably easy.

To realize digital cash you desire a payment network with accounts, balances, and purchase. That's easy to understand. One significant problem every payment network must solve is to prevent the so-called double spending: in order to avoid that one entity usually spends a simlar amount two times. Usually, this is carried out by a central server who keeps record about the balances.

In a decentralized network, you don't have this server. Which means you need every single entity of the network to do this job. Each expert in the network needs to have a list with all transactions for checking so that future deals are valid or an attempt to double spend.

But how one can keep a consensus about this records?

If the peers of the network disagree about only 1 sole, minor balance, everything is broken. They need a total consensus. Usually, you take, again, a central expert to declare the accurate state of balances. But hard part is to achieve consensus without a central authority.

Nobody did know until Satoshi emerged away of nowhere. In reality, nobody believed it was even possible.

Inventor of Blockchain turned out it was. His prime innovation was to achieve consensus without a central authority. Cryptocurrencies are a part of this solution - the part that made the solution stimulating, fascinating and helped it to roll over the world.

Cryptocurrencies simplified.

If we take away all the noises around cryptocurrencies and reduce it to a straightforward classification, we found that it just limited records in a database where no person can change those without complting specific conditions. This is exactly the best way to determine a currency.

Take those money on your Bank account: where entries in a databases that can simply be transformed under specific conditions? One can even take physical coins and notes: Exactly what they else than limited entries in a general public physical database that can simply be changed if you match the condition than you physically own the coins and notes? Funds is all about a verified entry in some kind of database of accounts, balances, and orders.

In part three I will give more about cryptocurrency. If you like my post please Upvote me. And help to serve you more and more.

Source :- Some sort of help taken from "Blockgeeks"

lil tip - center your images ;)

thanks bro.

@akazad