Welcome to a succinct rundown of how to use BitMEX to make the most profits in the upcoming Bull market. Thanks to the possibility of BitMEX's leveraged shorting, one can use BitMEX to also make money in a bear market! Keep reading to find out how :]

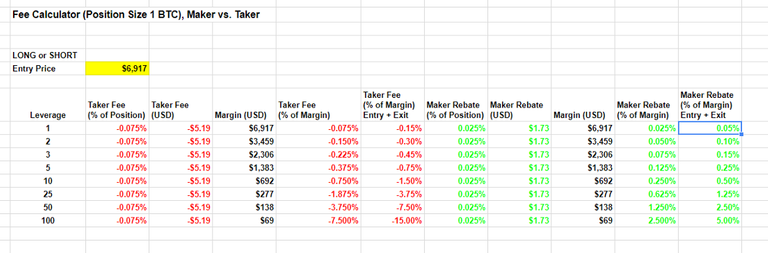

(BitMEX fees are much higher than on conventional exchanges because the fee applies to the entire leveraged position, not just your margin. For market trades, fees are 0.075% of your position for both entry & exit. So total fees on a $1,000 trade with 100x leverage are $150 [100 x $1,000 x 0.00075 x 2]. Fees are 15% in that case.)

👉Save 10% off BitMEX fees with this coupon👈

BitMEX Calculators: Profit/Loss, Margin, Liquidation & Bankruptcy Prices, Fees

Intro: Using BitMEX in Falling Crypto markets

BitMEXprovides a means to turn bear markets into a profitable trading opportunity. Anyone who fails to learn how to use BitMEX is limiting their opportunities in crypto trading: They are denying themselves the ability to trade Short and profit from declining prices.

The global crypto market reached its peak on 8 January 2018 of $828 billion, and then fell by 70% to $243 billion on 1 April 2018. Those who HODL’d lost 70% (Nearly everyone.) Those who sold for USD or EUR in January did well — they preserved their portfolio value measured in USD. Those who sold their portfolios for USD and shorted the crypto market at or near its peak made an additional fortune to the one they made in the run-up to 8 January.

Buy 1 Bitcoin with 0.1 Bitcoin Initial Margin: Example of 10x Leverage

Let’s start with an example of a Long as it is easier to understand. You can buy 1 Bitcoin ($11,670 at time of screenshot) with 0.1 BTC ($1,167) by buying a 10x leveraged position at BitMEX. You pay only 10% Initial Margin. You can also short the Bitcoin price (profit from a fall in its price) by Selling the Contract. The most you can lose is your Margin.

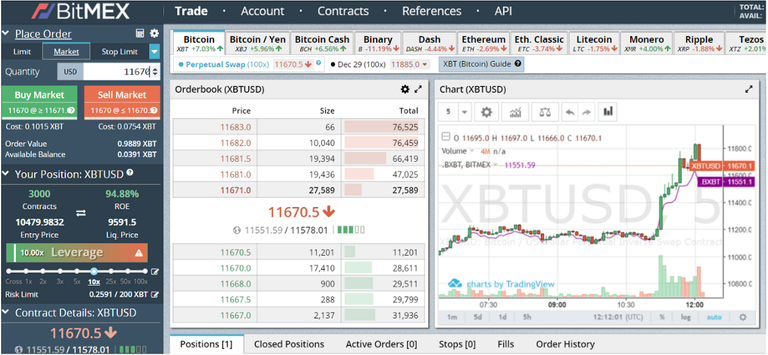

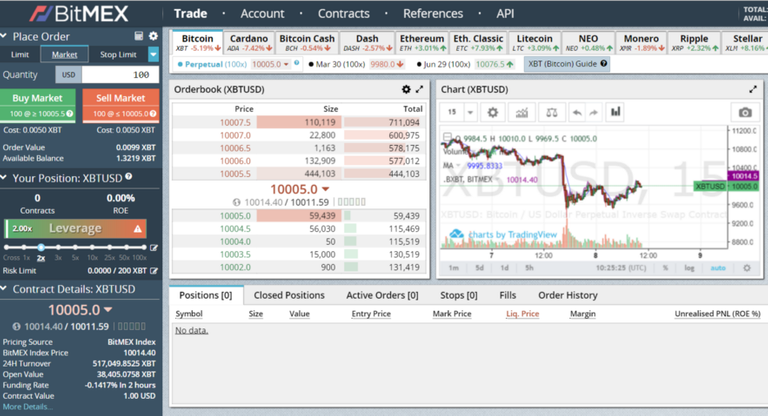

Set-up to buy 1 Bitcoin ($11,670) with 0.1 BTC ($1,167) Margin i.e. 10x Leverage Long

(Ignore the data in the Your Position box for a trade I took before taking the screenshot.)

This is the set-up for 10x Leveraged Long. You can increase your leverage as you gain competence. E.g. Use 100x leverage to buy 1 Bitcoin at $11,670 with 0.01 BTC, or $116. 100x leverage is gambling, likely to make a lot of money or get wiped out in minutes. But it can be profitable if used strategically during wild bull or bear runs in the XBTUSD market.

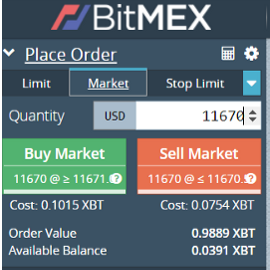

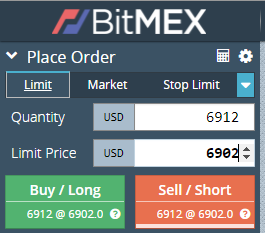

The Place Order Box (top-left box)

Quantity: The quantity of the trade is $11,670. This is your position. But the money you place at risk is less than this, depending on what leverage you choose.

Cost: The cost is 0.1015 BTC i.e. $1,184.

Initial Cost = (1/Leverage x Position) + (2 x Taker Fee)

= (1/10) x 11,670 + 11,670 x 0.0015

= $1,184.50

This is the maximum you can lose. You lose the entire amount should the price fall by 10% from $11,670 to $10,500. If the price was to crash to $5,000 your loss is still limited to $1,167 which is the value of your Initial Margin.

Order Value: The value of your position is 1 BTC i.e. $11,670. (0.9889 BTC to be exact.) Fees are calculated on this amount.

Available Balance: This is how much you have available for trading. Cost must be lower than Available Balance to execute the trade.

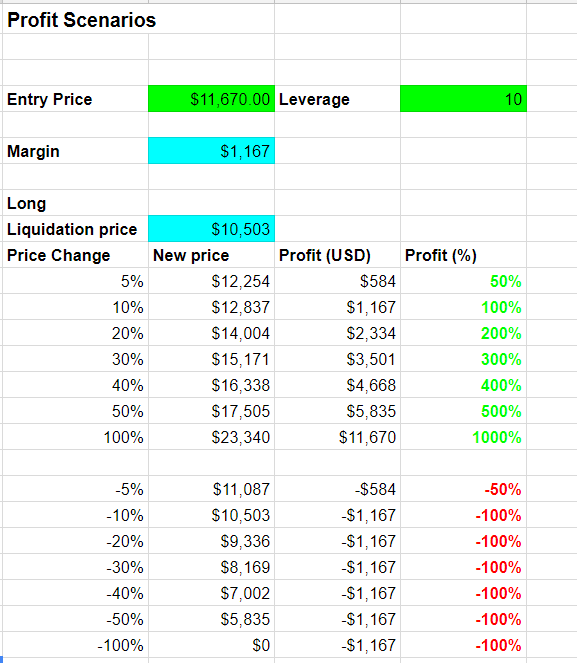

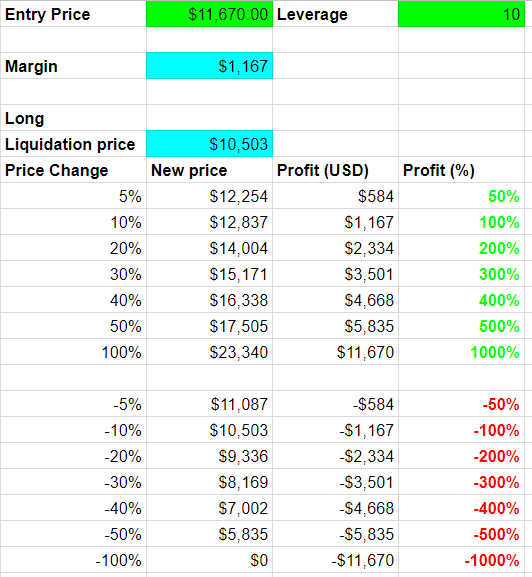

Profit & Loss Scenarios with 10x Leverage Long

Note that your profit can exceed 100%, indeed it is unlimited, but your loss is limited to 100% (i.e. $1,167) , however much the Bitcoin price falls.

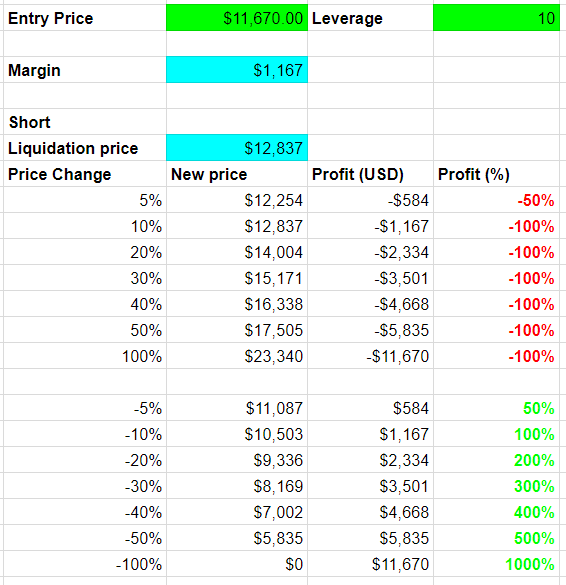

Profit & Loss Scenarios with 10x Leverage Short

Again, as with the Long, your profit can exceed 100% by orders of magnitude. (Profit is unlimited with Longs, but there is a theortical maximum limit with Shorts which is the profit when the price has fallen by 100%, as the price cannot fall further and become negative.) Your loss is limited to 100%, however much the market rises.

This asymmetry (unlimited profit, limited losses) is the beauty of the BitMEX Limited Risk contract, which is a BitMEX innovation. Trading Futures Contracts on the CME or CBOT, for example, there is no such limited risk facility. With standard futures contracts the Exchange will Margin Call the client for Maintenance Margin to supplement his Initial Margin when the price approaches the Bankruptcy Price, and you can lose a lot more than your Initial Margin. So you would get a Profit/Loss Scenario like this for a Long:

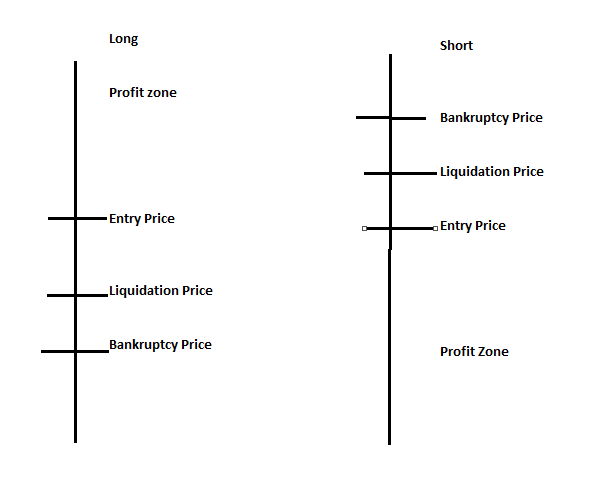

The mechanics of the BitMEX solution are that BitMEX sets a so-called Liquidation Price a fraction above the Bankruptcy Price (in the case of Longs) or a fraction below the Bankruptcy Price (Shorts).

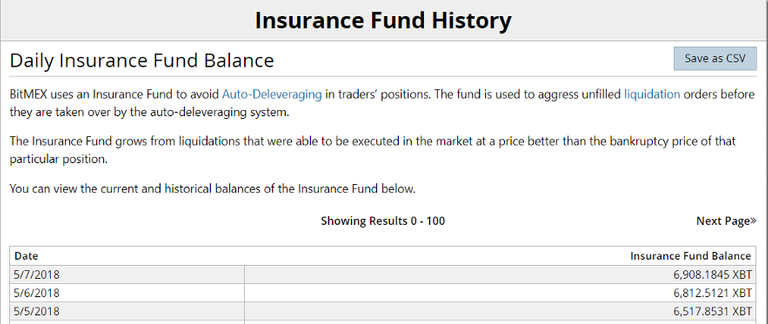

When the market moves adversely against your position and approaches the Bankruptcy Price, and breaches the Liquidation Price, the Liquidation Engine takes over your position and liquidates it automatically at market. It add any tiny profit made by the Exchange to the Insurance Fund, or deducts any loss made from the Fund.

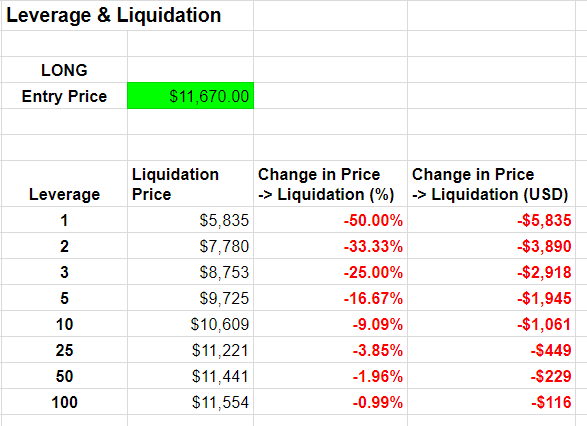

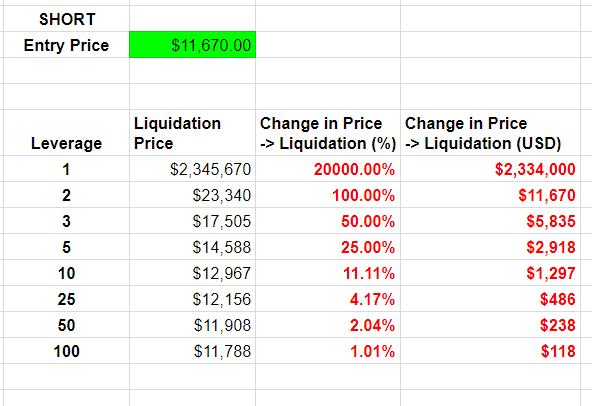

Selecting Your Leverage

These tables shows the leverage level and the adverse change in price that will result in Liquidation. The greater the leverage the smaller the adverse change in price that will cause a Liquidation.

Long: Liquidation price < Entry Price

Short: Liquidation price > Entry Price

The above tables show that Shorting is safer than going Long, in that a larger percentage change (and USD change) is required to cause Liquidation when you go Short than when you go Long, for a given level of Leverage.

The above tables also show that even with the minimum 1x Leverage there is a small but real risk of Liquidation when Long. But there is no risk of Liquidation when 1x Short.

Use Maximum 25x Leverage

The BitMEX Exchange offers Long and Short leveraged trades of up to 100x Leverage. Never use more than 25x because the difference between the Liquidation and Bankruptcy Prices at high leverage stacks the statistical odds against a winning trade. Don’t worry about it at low leverage.

Example: you buy a $9,255 100x leveraged XBTUSD position with 1% margin, i.e. your stake is $93 of Initial Margin. Your Bankruptcy Price (Entry Price less 1% Margin) is $9,163 but your Liquidation price set by BitMEX is $9,240. The price just has to fall $15 (0.16%) from your Entry to trigger your Liquidation and 100% Loss. That is a trade for suckers. Trading with 100% leverage on a repeated basis (Long or Short) will inevitably result in losses. The BitMEX Insurance Fund wins. Its current holding is 9,700 BTC, or ~$70 million. That money came from salami-slicing the testicles of 100x bulls via the Liquidation Engine.

Selecting Market vs. Limit: Use Limit Trades!

To use Market or Limit is one of your most important decisions.

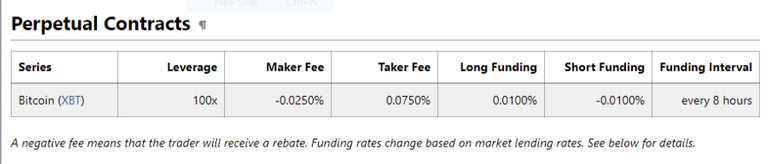

It is not widely known that BitMEX charges extremely high fees to takers (those who use Market tab in the screenshot) but actually pays market-makers to trade (those who use the Limit tab). A marker-maker is defined as someone who places a Limit order and does not take the market price to open or close a trade. For all Bitcoin contracts:

- Taker fee — 0.075% of total position

- Maker fee — 0.025% of total position Rebate!

BitMEX fees for market trades are 0.075% of your total leveraged position (not just your margin) for both entry & exit.

Example:

Calculate total fees on a $1,000 trade with 100x leverage. i.e you pay $1,000 Margin to open a $100,000 position.

Total Fees = 100 [leverage] x $1,000 [Margin] x 0.00075 [Rate for Market order] x 2 [Entry + Exit] = $150

Fees are 15% of your $1,000 trade in the example. Why pay 15% for market trading when BitMEX pays you 5% for trading with Limit Orders? (An additional benefit of Limit trading is that your trading is likely to be less frequent and more disciplined and profitable.)

Note that fees for market orders have a massive effect on the costs of trading at high leverage, less so at low leverage. Use Limit orders!

🙌Save 10% off BitMEX fees with this coupon🙌

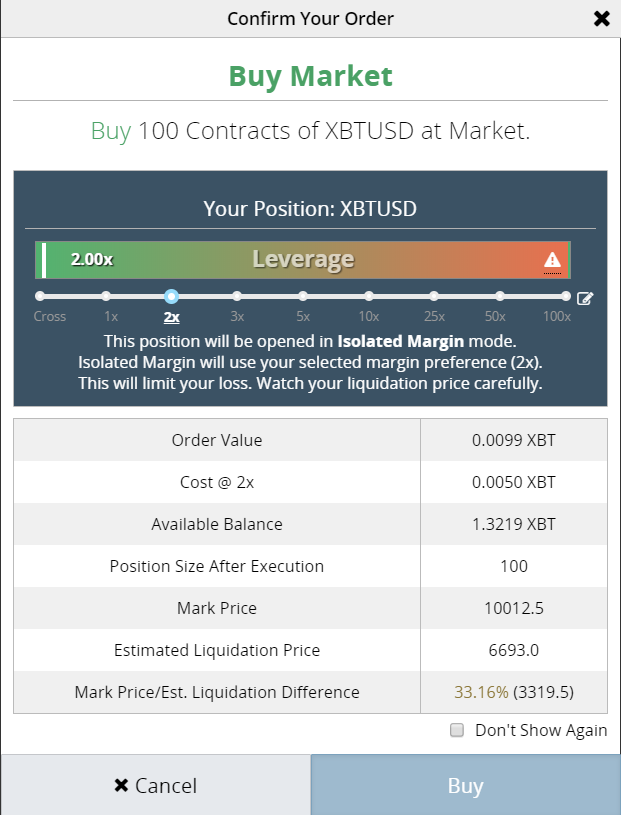

Your First Trade: Long BTC with $50 and 2x Leverage

Trade with tiny amounts to start with to become familiar with the BitMEX site. Then you can increase your leverage as you gain competence. E.g. you might open a safe position of $100 at 2x Leverage which means your Cost is $50. This $50 trade is illustrated:

👆A $50 Trade at BitMEX👆

The most you can lose is the Cost: 0.005 BTC = $50. You lose that if the market price falls 33% to the Liquidation price of $6,693.

When you press Buy Market, this confirmation screen pops up. Your order is not placed until you confirm Buy in this screen.

Risk Management

I recommend these practices in making your first few trades, to be on the safe side:

Deposit a small amount into your BitMEX account so that even if you screw up you know the most you can lose. Maybe 0.05 BTC?

Concentrate on one market and become familiar with it. I suggest the XBTUSD Perpetual Swap which is the most heavily traded. Starting out, ignore all other markets including the Bitcoin Futures, the Bitcoin Upside and Downside Profit Contracts, and the Altcoin Futures.

Set the leverage at 2x, 3x or a maximum 5x using the Leverage Slider Bar. Don’t set too high a leverage or you might get liquidated quickly and get stressed. n.b. Do not select Cross on the Leverage Slider Bar. This exposes your whole equity balance and is risky.

Setting up your first trade, the field to pay particular attention to is Cost. This shows the maximum that you can lose. The cost must be less than the Available Balance.

Watch the Market : BitmexRekt Explained

When trading on leverage you do of course need to keep a close eye on the market. Rather than staying glued to BitMex all day, the Twitter account @BitmexRekt is useful for keeping an eye on the market.

Take this Tweet as an example:

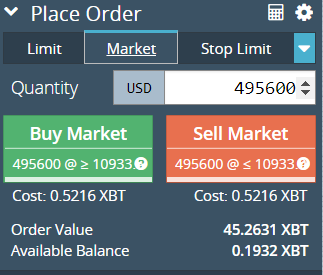

Liquidated long on XBTUSD: Sell 495,600 @ 10866.5 💯💯💯💯🔥⚡ ~ WICKED SICK ~ I'm shocked, shocked to find that gambling is going on in here!

This Tweet indicates the XBTUSD market has experienced a sudden drop. (If the Tweet says ‘Liquidated Short on XBTUSD: Buy …’ then the market has risen quickly.)

When a Long position is liquidated it means the price has fallen and breached the Liquidation Price. The BitMEX Liquidation Engine then takes over the position and closes it by Selling 495,600 contracts at the market price.

1 XBTUSD contract = 1 USD on BitMEX. (Warning: Other Futures contracts on BitMEX have different contract sizes. E.g. the contract size of the ETH Futures Contract is 1 ETH, or about $800 at time of writing.) So the trader who got liquidated for 495,600 Contracts lost a position of $495,600. He does not, however, lose $495,600. The amount of his losses depends on the leverage he was using. The greater the leverage, the smaller the loss. With the maximum 100x leverage the loss is 0.5212 Bitcoin, about $5,700 or 1.15% of the $495,600 position.

That’s it. Best of luck!

Here is a video tutorial by the CEO of BitMEX on trading Bitcoin with leverage.

This is my honest review for BitMEX: https://www.wissen.fun/en/bitmex-review-and-tutorial-100x-btc-trading/

✅ @galiphilecrypto, I gave you an upvote on your post!If you are interested in claiming free Byteballs ($10+), just for having a Steem account, please visit this post for instructions: https://steemit.com/steem/@berniesanders/claim-your-free-byteballs-today-usd10-in-free-coins-just-for-having-a-steem-account

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://hackernoon.com/a-quick-starter-guide-to-using-leveraged-trading-at-bitmex-5383de4cb320

Congratulations @galiphilecrypto! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Congratulations @galiphilecrypto! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!