It is a known fact that the crypto market has engrossed its worth in asset value over the past nine years. While there are over 200 cryptocurrencies in existence today, and several emerging into the light, the top cryptos have their worth in billions of USD, with the inevitable fragmentation of these tokens and exchanges.

However, there have been several shortcomings in the past few years across these exchanges, disturbing and discouraging new individuals with blossoming interests in cryptocurrency and blockchain technology as well as individuals with established foothold in the ever expanding digital reality such as crypto investors and traders.

Some of the problems and challenges found include trade execution, compliance, position and risk management, reporting functionality, etc. This has hindered development in several ways.

TRADE EXECUTION

Fragmentation of assets exchanges and relatively low volumes has lead to liquidity and slippage.*Source: Whitepaper, page 4

The most predominant exchanges today started off as smaller ventures, until the boom of market values and business evolution, pushing them to the forefront. This growth being a great turn of events in the state and in the hearts of these exchanges, has however been met by a slow paced growth in evolution of customer, investor or institutional traders' wants, requirements and necessities. These exchanges have evolved in their market value and business expanse, but have not fully met customers' satisfaction, investor’s requirements and protection, and traders or customers’ friendliness.

High volume of trading causes friction in these exchange and often results in a suspension of operation or freeze of the exchange for some periods of time, resulting in the denial of access of traders into such exchanges, in some cases for days and this could lead to significant loss for investors.

Due to the fact that most exchanges started off as small business ventures, with the ever expanding growth with failure to keep up with needs of traders and investors, there is often a regrettable high latency. The time at which trade is made and the execution of such trade across a portfolio of assets is often inconveniently and undesirably slow, thereby hampering the investors’ foresight into making good deals and decisions and earning more profit.

The institutional traders are not left out, as they venture into cryptocurrency business with challenging and minimal interest, have their investment strategies, skills and plans ruined by such degree of latency, leading to a significant loss in terms of money and time, discouraging them from the dynamic world of cryptocurrency trading.

This slow paced growth of exchanges in terms of customers’ services has however resulted in little to no customer friendliness for traders passionately interested in the business market of cryptocurrency trading, thus leading to frustration and disinterest and often disqualification or disrecommendation of such exchange to prospective traders or investors by those experiencing such challenges.

Investors naturally would seek to rebalance their portfolio of assets in order to meet a target asset allocation. Rebalancing is the process of adjusting the weights of a portfolio of assets so as to achieve alignment. It involves periodical trading to maintain target asset allocation of investors. By rebalancing consistently, the investors can mitigate exposure to risk pertinent to their target asset allocation. This is a huge challenge for investors who have their portfolio of assets across several distinct exchanges, and the consequence could be very dire to the investor, such as having an asset mix that is incoherent with the tolerance level. Due to fragmentation of exchanges, this becomes even more difficult as there is no platform that can concurrently handle these processes or provide tools for handling these processes for several exchanges (which is where Caspian comes in place).

POSITION AND RISK MANAGEMENT

Risk management is an imperative requirement for anything that has a value, especially an asset. In the case of digital assets, it is twice as important, as digital assets are prone to risks of insecurities such as hacking, scamming, phishing for exchange private keys and passwords, etc. It is of utmost importance that investors and traders are enabled with the ability to manage risks (either by mitigation, acceptance, rejection or sharing) that are inherent on trade transactions that could swipe the investors fund or exchanges that could go wrong. Risk tolerance must be established to prevent significant loss. This is however not provided by exchanges as fully required by investors as in traditional markets.

Also, fragmentation of exchanges could lead to insufficient liquidity on some fragments to give up a given position.*Source: Whitepaper, page 5

Hence, the need for position management systems of all exchanges across platforms, which is unavailable, the best the investor can do is simultaneously monitor all platforms which can be terribly tedious.

COMPLIANCE

Fragmentation of exchanges has also created a problem of compliance in exchanges across several platforms, investors are often left hanging in difficulties and in proffering sole and individual solutions. This may involve tracking trade records or monitoring ledgers or trying to predict or determine current or future pricing, etc. As humans are prone to error, this often is a huge setback as errors could contaminate such records making them less valid. Investors are subsumed with the responsibility of keeping records however means possible or available. Institutional entities are tasked with the responsibility of keeping thorough and detailed track of activities by means of which may not be readily available for each kind of record keeping (as it involves keeping details such as traders, limits and triggers of such limits).*Source: Whitepaper, page 6

Thus these entities are forced to spend funds in building systems to monitor and keep activity records and logs and this may be costly to the institutional entities. There is also a need to monitor and keep track of positions across all platforms of exchanges very accurately and very up to date. This can only be achieved by concurrently monitoring of each platform which is a great way to let in fatigue.

These problems and difficulties can be very frustrating.

CASPIAN

Caspian, a joint venture between Tora Trading Services Limited (and its affiliates, “Tora”) a global leading cloud based front-to-back tech to buy side institutions, and Kenetic Systems Limited (together with its affiliates, “Kenetic”) a leading blockhain and cryptocurrency investment*Source: Whitepaper, page 2, has developed solutions to tackle and eliminate these problems.

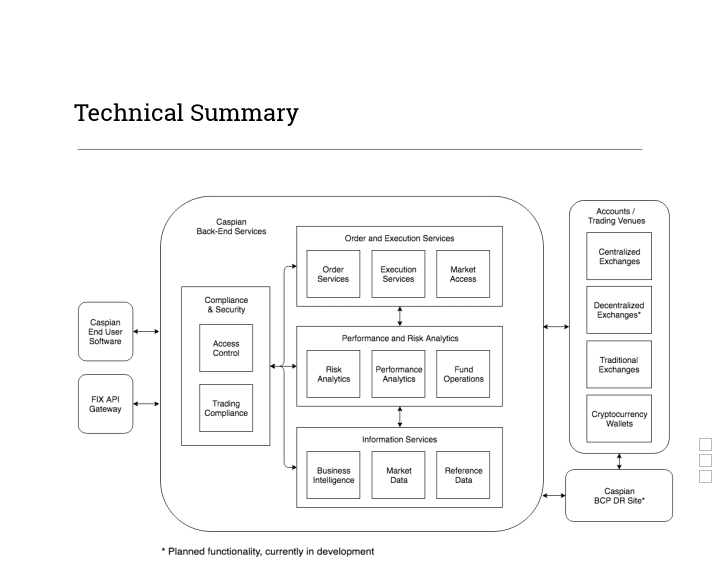

Caspian seeks to solve these problems by offering professional high-grade trade execution, (Order and Execution Management Systems), Risk Management Systems (RMS) and Positional Management Systems (PMS) and compliance features with limits and alerts to tackle compliance problems. With Caspian, one can monitor, compare, analyze and determine which exchange to invest in by having a palatable, secured comfortable and efficient track keeping of trades across platforms of exchanges all in one single platform with a friendly user interface, eliminating errors of omissions and ensuring greater management of assets.

Caspian provides auto-reconciliation tools for reconciliation of positions against each individual exchange. With this tool, reconciliation across exchanges match precisely. The heart of Caspian is providing quality services that can be classed into three, these are: professional grade execution,positional management and reporting capabilities. The investor is equipped with access to major digital assets exchanges, a powerful user interface, ability to view prices and manage orders.

Accompanied with the vast and diversified rules, functions and capabilities of Caspian, is its ability to enable users define their own rules for managing orders, equipped by Caspian algorithm suits. A user can make any rule he/she desires to boost profit, thus Caspian abstracts the difficulty of compliance and provides a new paradigm for viewing and working with cryptocurrencies. This can impact society in a positive way by bringing or attracting new pools of investment in cryptocurrency. However, it doesn't end there.

Caspian also provides Order and Execution Management Systems, seamlessly without having to monitor the portfolio of assets across platforms of exchanges, cutting down latency and slippage by a great deal. One need not worry about record transactions or omitted transactions as the Risk Management System tracks every piece of data continuously, enabling the investors to track positions and view past data at any point in time, this simulates record keeping in a traditional market with the user being able to keep records of transactions effortlessly.

The ability to set limits and alerts will tackle the issue of compliance as the investor doesn't have to monitor and keep track of positions across all platforms of exchanges concurrently on a nearly up to minute basis. With limits, the investor knows precisely when a rule configured by him/her is being or about to be broken or need to be overridden. And with the ability to configure alerts to the preference of the user (either as pop-ups or to be delivered as emails) and also the conditions that trigger such alerts, the stress of having to constantly and simultaneously monitor portfolios across several platforms is eliminated and this improves customers' investment, boost interests and giving investors better chances and morale to invest.

Caspian would enhance cryptocurrency adoption by individuals and institutions as it eliminates compliance issues. Institutions would no longer be bothered with the fatigue of keeping records and audits that are prone to error or building systems to do these, saving institutions from unnecessary spending of funds, thus creating an opportunity for a more robust investment. Funds would no longer be spent on compliance issues but invested directly into the cryptocurrency market.

Security issues and fear of loss are eliminated by a great deal opening up cryptocurrency to new individuals. This would make cryptocurrency easily adopted by individuals as it becomes more customer friendly to new individuals, traders and investors.

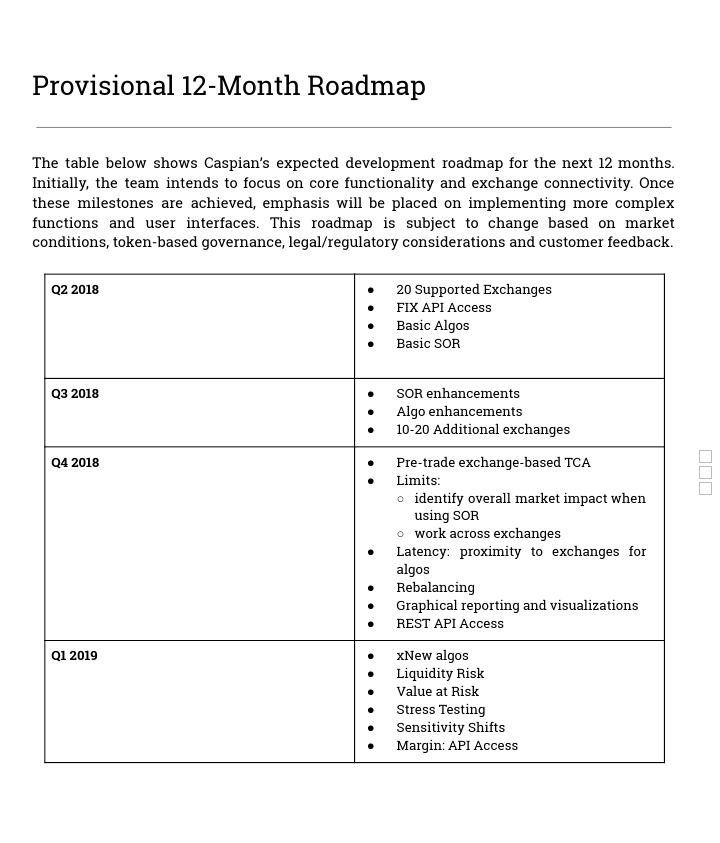

CASPIAN's ROADMAP

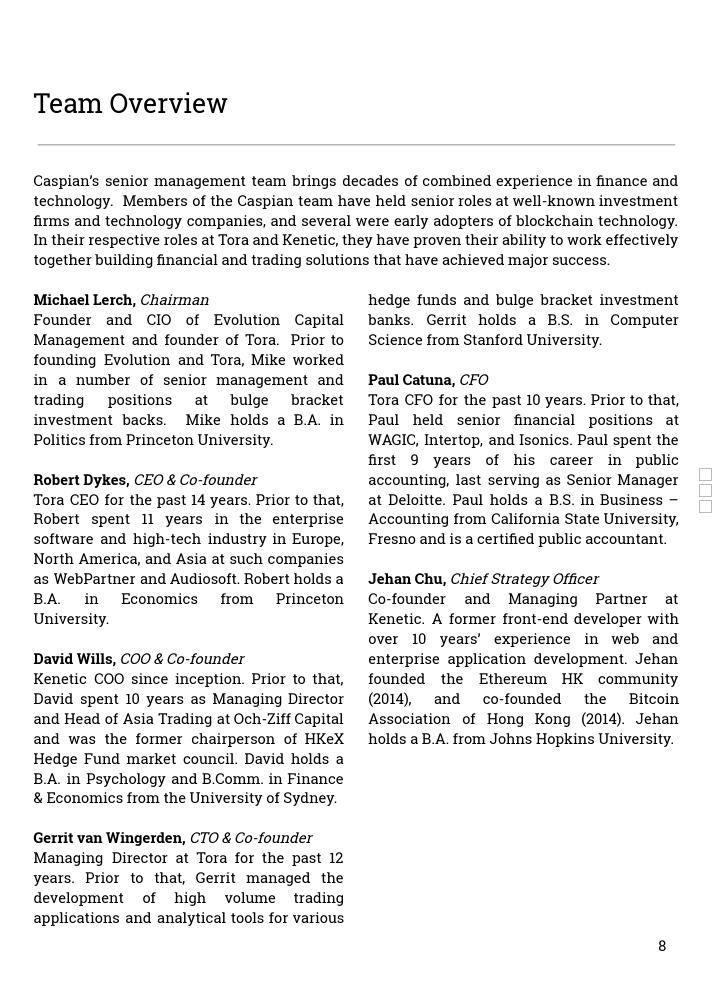

Caspian's Team Overview

Caspian is a new way to get better and smarter in this cryptocurrency era. It is the smart choice and the right decision to make. With solutions provided by Caspian discussed above, Caspian would not only create a wave of change in this new age, but would also spark a revolution in the world of cryptocurrency. Indeed, it is the new revolution.

Here is my video entry

For more information and resources, check these out:

Caspian Website

Caspian WhitePaper

Caspian Steemit

Caspian YouTube

Caspian Telegram

To participate in this contest, visit the link below:

https://steemit.com/crypto/@originalworks/910-steem-sponsored-writing-contest-caspian

caspian2018

Congratulations @goz! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPSponsored Writing Contest!

This post has been submitted for the @OriginalWorks You can also follow @contestbot to be notified of future contests!

Congratulations @goz! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @goz! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @goz! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOP