Technically I made ~$200 today and I was going to title this “I didn’t make as much today….” But then ETH tanked.. :/

So how can I lose money, but still consider myself a better trader? I have to thank @exxodus for pointing me towards the right words to google. Those being ‘position-sizing’. I had already been thinking about how my strategy might change as my trading account grew larger. I just wasn’t sure what form that would take or how to develop or evolve my strategy when the time came.

These words are golden. “position sizing”. I found a few articles that put into perspective how idiotic my trading has been during my first week. Also, it highlights why it is so very stressful for me.

The articles I found here, here and here clearly outline that the proper amount of your entire trade balance to risk on any given trade is .05-5% with 1% or 2% being the preferred risk level for professional traders.

To put that into perspective, I have been risking 25%-50% of my trade account with every trade! Oops! Now, this doesn’t mean you only put 1% of your trade account into a trade, but you have to do some calculations to determine how many coins at what price you will buy and (most importantly) What your stop-loss is.

If you don’t know, a stop-loss is the point at which you say, “I was wrong.” And you take a loss on the trade. There is no way to do this automatically in Binance while you have an active sell order, so I set up alerts and if it starts to get close to my stop-loss, I cancel my sell order and get prepared to sell at my determined acceptable loss. So far, I have pretty much been doing this randomly with no rhyme or reason other than gut feeling.

I am SO happy that I came across this article today! It very clearly outlines the formula used to responsibly choose how many shares (or coins) to buy at your chosen entry level. Up until this point, I had just been choosing an entry and then buying as many coins as 25%-50% of my balance would allow me to buy. I decided to start entering positions based on this formula from now on.

I made a spreadsheet using the formula outline in the above article and now I have a real tool that I can use to mitigate my risks and make more intelligent decisions. It took me most of the day to get used to using it and to make sure I had all the right numbers put in before making a trade, but once I got it figured out I really saw the benefit of using this approach! I know I said don’t take advice from me, but listen to me now. If you are going to trade, whether it is short, mid or long term – read that article. Make yourself understand and figure out how to apply it. Ask someone, if you can’t figure it out. I say this as someone who was not using it for a week and made a nice chunk of change. That was beyond stupid, what I did. YOU SHOULD NOT TRADE UNLESS YOU UNDERSTAND THIS! I see that now.

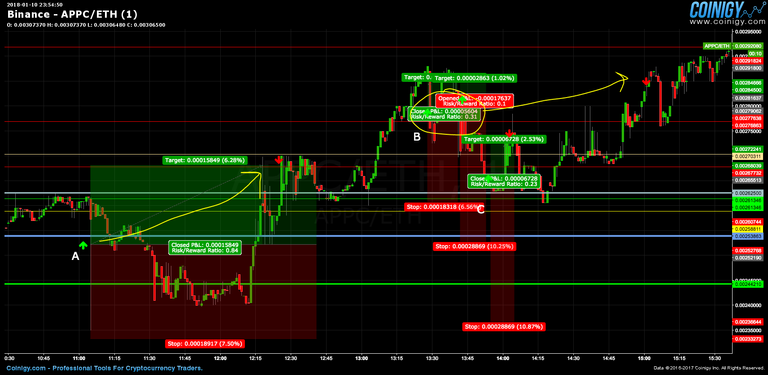

So how did it help? Check out the below graph of APPC.

These are not the only trades I made today, but they are the only ones I will talk about because they prove this point so well.

At A, I bought in on a little dip below what I feel is a very strong support level for this coin. It ended up taking a big dive. Yesterday I would have had a heart-attack! But today, I was calm. I knew that I could let it fall as far as the bottom of that red section and only lose 1% of my account balance. This made it really easy to wait out the battle, and you see I ended up with a nice trade off the top. The best part is I wasn’t freaking out and there was no stress. Only a slight disappointment that I might miss the trade, but I knew the financial loss would be minimal.

We see it again at B. I probably shouldn’t have bought this dip because it was knocking up against a pretty tough resistance level. I’m not sure what I was thinking, actually. In fact, I bought twice! Grr. But you see, I had factored in substantial “padding” in terms of the level I was willing to get out. The formula mentioned above, allows you to choose your level of “padding” on the trade and still only lose whatever % of your balance you are ok with risking. In my case, it is 1%. Because I knew I could let the coin fall all the way to the bottom of that red section, I was able to calmly assess the situation. I even bought again at the bottom and made a quick profit while waiting!

Again, you see I managed to get a small profit on both trades. That NEVER would have happened yesterday! So, I didn’t make the best decisions today, but this system helped me make the best out of the mess I got myself in. I am also much more willing to go for a 5-15% profit now instead of grabbing the first 2.5% I see. As I get used to it and figure out how to better incorporate this into my trading style, I know I will see great benefits. I anticipate that I will opt for 2-5% risk once I get going. But I’m going to stick with 1% for now.

The main reason I lost money today was that while I was trading ETH took a tank. Just like @exxodus said it would. At least on binance, it’s catching a substantial rebound at the $1220 level and is currently at $1300, but if @exxodus is to believed, it has another drop to go. Essentially I’m stuck in Ether until it gets back up to ~$1350. This is the risk I worry most about when trading coins. Since I have to move everything through Ether, I always run this risk of no matter how good I trade, ETH could eat it all before I can pull back out. What’s a boy to do?

Also, Binance sucked ass today. It was very unresponsive, constantly freezing up and requiring refreshes and re-logins. I also noticed that coinigy was lagging severly behind realtime today. I hope this does not become commonplace.

Don't trade like an idiot! Learn about position sizing before you make another trade!

Today's balance calculated off of ETH value as of time of posting. :(

| Balance | Today's Profit | Today's % | Average Daily % | Daily % needed to reach 1M |

|---|---|---|---|---|

| 6470.70 | $-42.27 | -0.65% | 2.03% | 1.43% |

keep up the good work!! We all definitely always have a lot to learn. I never stop.