Raiblocks has been one of the new surprises to end off 2017. Raiblocks rose from obscurity to one of the top 20 cryptocurrencies (by market cap) in a single month! Raiblocks is often compared to IOTA (covered in our previous article) as it also features a DAG (Directed Acyclic Graph) as opposed to the traditional blockchain.

This analysis is done following strict criteria and is the result of hours of research as well as an interview with 3 of the Raiblocks developers, including the team lead: Colin LeMahieu. Your constructive input and comments are more than welcome.

Please upvote, share or donate (details at the bottom of article).

Follow us on Twitter @icoPntsAnalysis

In a nutshell

Pros and Cons (opinionated)

Note that some points are both in pros and cons

Pros

- Fee free

- Instant transactions

- No miners (which removes the conflict of interests between users and miners).

- No ICO: more interested in creating a robust system for value exchange than raising money.

- Goal oriented around value exchange, sending and receiving payments, and nothing else. Their mantra - “Do one thing and do it well”.

- Seeks to be “what Bitcoin is meant to be”. A pure, easy-to-use digital currency.

- Raiblocks went on live net in October 2015 (over 2 years ago!)

- Listed on a few obscure exchanges but added to new exchanges every week (Jan 2018): big potential for leaps in value once it becomes tradable on well-known exchanges.

- The tech is fairly new as there are very few other players in DAG tech at the moment. This could potentially mean there is unseen room for improvement.

- The main focus has been on tech. There is a potential for an increase in value once marketing commences.

- None of the team is currently famous in the blockchain field, although it could be the medium for new household crypto names to emerge (like Vitalik Buterin did via Ethereum).

- No mobile wallet: market value will increase once released in January 2018.

- No hardware wallet: market value will increase once released.

- Legal status to be be released in Q1 2018: market value will be positively affected.

Cons

- Listed only on obscure exchanges which makes it risky to trade.

- New tech, maturity has yet to be fully tested, making it risky.

- The team not well known in the blockchain field and there are no well known advisors, which can be seen as risky.

- Very little marketing: market value probably affected.

- No mobile wallet: market value probably affected.

- Aims to be a “currency” which has a lot of competition.

- No hardware wallet: riskier to store securely, and market value probably affected

- Unreleased legal status: can be seen as an obscure project.

- Representation in the voting process is only based on the goodwill of each coin holders to let their wallet connected to the net.

Final words (opinionated)

- What investment rating do you give (rate from 1 to 5)?

- 4/5 - This is what Bitcoin is supposed to be: a fee-free, fast value exchange with no conflict of interest between miners and users.

- What investment risk do you give (rate from 1 to 5)?

- 4/5 - The tech works and the team is great. This token is probably undervalued.

- What’s your gut feeling about this project (describe but be short)?

- This project is probably one of the best projects in value exchange crypto available.

- Raiblocks has been fast rising from beyond 100th place in market cap (currently 17th place on Jan 2nd 2018). There is a good chance this token will be in the top 5 market cap by the middle of 2018.

The nitty gritty

Basics

- what is the official website?

- where can I take part in the ICO?

- There was no ICO

- what is the ticker?

- XRB

- if already listed, can you link to coinmarketcap or other page showing its chart?

- if already listed, what exchanges trade it?

- Mercatox

- Bitgrail

- BitFlip

- Kucoin (added early Jan 2018)

- Note: none is very famous

- what is the goal of project (try to be as short as possible)?

- "Do one thing and do it well”

- Extremely fast & zero fees payments

- No smart contracts, no IoT, no big promises of changing the world.

- what is the best way to describe the project (try to be as short as possible)?

- Zero fees

- Instant transactions

- No miners

- Using block-lattice DAG (different to Tangle DAG)

- Delegated Proof of Stake (dPoS)

- "[...] individual blockchains for each account, eliminating access issues and inefficiencies of a global data-structure"

- Very minimal (almost negligible) proof of work (PoW) is required for confirming transactions. This allows the system to run smoothly on most outdated hardware or mobile devices.

Other reviews/analysis

- IOTA vs RaiBlocks

- https://hackernoon.com/iota-vs-raiblocks-413679bb4c3e

- This article digs into every aspect on both projects from the team, roadmap, tech, vision and nuts and bolts of the implementation. The conclusion of the article being “We don’t really know whether one will “win” or whether both will thrive in their own ways. They both have many, very exciting features, products, and improvements yet to be released.”

- ~9/10 - Raiblocks is focusing on solving one problem and they seem to be doing a very good job of just that.

- How RaiBlocks Provides Unlimited Transaction Throughput

- https://steemit.com/raiblocks/@raiblocks/how-raiblocks-provides-unlimited-transaction-throughput

- This is a very tech-heavy article that goes into the model of the DAG and compares it to bitcoin and IOTA, with RaiBlocks sticking out as the winner in the conclusion as while IOTA provides the same functionality, RaiBlocks has proven cryptography and is fully deployed whereas IOTA has experimental cryptography and has a coordinator in place during deployment so is essentially not entirely deployed.

- ~9/10 - Raiblocks looks to be the best form of currency exchange available.

- We could actually not find any proper critical articles on RaiBlocks so far. Feel free to comment and add a source if you know any.

Company/organisation

- What is the company/organisation behind the project?

- RaiBlocks team

- In which country is this company/organisation based (country of jurisdiction)?

- RaiBlocks is a legal entity since November 2017 but will only announce it in Q1 2018

- Developers are located in Los Angeles, Austin, and other parts of the United States. The creator, Colin LeMahieu is based in Austin.

- What is the experience of the company/organisation behind the project (if it's not its first project)?

- This is their first project

- Does the project has any partnership with other companies/organisations?

- This information will be announced Q1 2018

Team

- Does the team have a history of successful projects?

- No

- What is the experience of the team members (is any famous in the DLT field, if yes what did they do)?

- Not any member of the team has any previous experience in the crypto ecosystem.

- What is the experience of the advisors (is any famous in the DLT field)?

- No

- How many people are in the team?

- 10+ (more people will be announced Q1 2018)

- What is the approximate proportion between tech people and business people?

- There is an overlap in a few areas as the team is still small.

- Technology and development ~ 5

- Community managers ~ 5

- Business people ~ 2

Project

- When did this project start?

- 2014

- Is the project actually made of several projects (if yes, how many and which are they?)?

- No, it’s a single project.

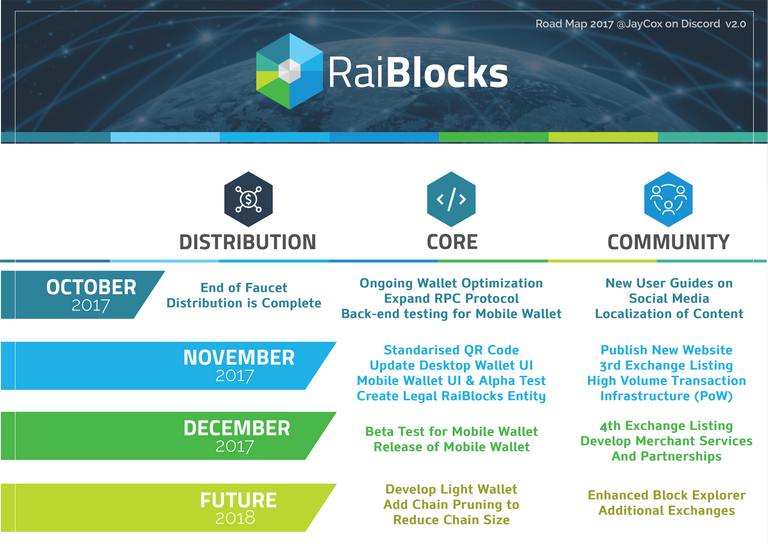

- What were the achieved milestones?

- Dec 2014

- “The original RaiBlocks paper and first beta implementation were published in December, 2014, making it one of the first Directed Acyclic Graph (DAG) based cryptocurrencies”

- Oct 2017

- Faucet distribution is complete.

- Nov 2017

- Standardised QR Code

- Updated Desktop Wallet UI

- Mobile wallet UI & Alpha test

- Create Legal RaiBlocks entity

- Dec 2017

- Test and release of mobile wallet

- Dec 2014

- What is the state of the project (already have working product)?

- The system is up and running.

- What is the roadmap for the future?

- 2018

- Mobile wallet for iOS and Android -

- more exchanges listing added every week (Jan 2018), on Binance for instance https://support.binance.com/hc/en-us/articles/115003705851-The-Fifth-Session-of-Community-Coin-per-Month-

- Merchant services

- Partnerships

- Develop light wallet

- Add chain pruning to reduce chain size

- Enhanced block explorer

- 2018

- Is the project already profitable?

- This is not a for-profit venture

- Does the project already have clients (if yes, who?)?

- Will be announced Q1 2018

Market

- What is the market size (roughly)?

- Raiblocks tries to solve all the limitations/issues bitcoin has & adds the “no miner” feature on top: it aims to become “the new bitcoin”.

- In attempting to become the “gold standard” of value exchange in crypto could lead it to be number 1 in market cap.

- Simply put: it could become a large percentage of the total crypto market cap, which is currently around 600 billion USD right now (Jan 2018).

- If Raiblocks gets managed to get close to this goal (reaching top 5 in crypto market cap), it’ll reach over 100 billion USD market cap sometime in 2018.

- What are some of biggest the competitors?

- Ripple

- Ticker: XRP

- Market cap in the top 3 (early Jan 2018)

- Fast transactions: 1,700 transactions per second on Testnet

- Low fees

- Has miners

- IOTA

- Ticker: IOTA

- Market cap in the top 5 (early Jan 2018)

- Over 1000 tps on the latest stresstest

- Zero fees

- No miners

- DAG tech

- Read our deep analysis about IOTA

- Read our deep analysis about IOTA

- ByteBall Bytes

- Ticker: GBYTE

- Market cap around 55th place (early Jan 2018)

- DAG tech

- Hashgraph

- Ticker: Not traded

- Market Cap: Not traded

- DAG tech

- Ripple

- How much demand is there for the project, short & long term?

- Zero fees, instant transactions & no mining is a dream crypto-currency.

- Raiblocks solves the problems that traditional blockchain has with long transaction times, high fees, and mining issues (environmental damage, politics and more).

- There is a desperation for VISA-like throughput (around 2,000 transactions per sec)

- Does/did the project get discussed in the relevant communities more than usual before launch?

- It did get discussed, but not more than usual

Token use

- Is there an off-chain solution to solve the same problem?

- Fiat currency is an off-chain solution to value exchange, Raiblocks is trying to improve on that (essentially: by having no fees)

- Why what they offer is better than what we currently have on the market?

- Zero-fees, fast transactions, no miners

- Do token holders get any dividend?

- No

- Do token holders get access to any extra functionality (that non token holders don't have access to)?

- Proof-of-stake vote

- Is there any built-in governance, project decision-making?

- Yes, by owning more XRB entitles you to a larger portion of votes.

Storage

- Any hardware wallet supporting this crypto (Ledger, Trezor, Keepkey)?

- No

- Trezor: communication is opened

- Any regulated exchange listing this crypto?

- No, only unregulated exchanges list Raiblocks as of January 2018.

- Any web wallet?

- https://raiwallet.com - lets you own your private keys

- Any desktop wallet?

- Yes: available on Windows, Mac & Linux

- “Light desktop wallet” will be released in Jan 2018: not requiring a download of the global ledger

- Any mobile wallet?

- Will be released in Jan 2018: not requiring a download of the global ledger

- iOS wallet: currently in development

- Android wallet: currently in development

- Any paper wallet?

- Write your seed down

Pre-ICO funding

- How was the project funded until the ICO? (there was no ICO)

- Spare time of founders and developers

ICO

- Did the project do an ICO? If not, why not?

- RaiBlocks had an interesting distribution method. It did not have an ICO at all, but instead distributed XRB via a captcha-based faucet distribution system that ran for roughly two years, ending in October 2017.

- This evenly distributed the tokens as it relies on time spent solving captchas for tokens. Being PoS-based RaiBlocks requires that no entity controls more than half of all XRB to avoid 51% attack.

- How many tokens get generated?

- RaiBlocks is not mined and has reached its maximum supply of 133,248,290 XRB.

- What was the approximate price for each token?

- There was no way to “buy” tokens.

- The only way to get tokens was by solving captchas.

Online presence

- How many people are on their Facebook group (in total, for the english speaking ones, there can be several groups)?

- Community Facebook page

- https://www.facebook.com/RaiblocksOfficial

- 6.7K subscribers

- How many followers do they have on Twitter?

- Raiblocks

- @raiblocks

- 25.6K followers

- How many subscribers do they have on Reddit?

- RaiBlocks

- https://www.reddit.com/r/RaiBlocks

- 18K readers

- How many followers do they have on Medium?

- Colin LeMahieu

- https://medium.com/@clemahieu

- 239 followers

- How many people are on their Telegram group?

- Raiblocks (English Chat)

- https://t.me/raiblocks

- 6K members

- How many people are on their Discordapp channel?

- http://chat.raiblocks.net

- 4K members

- Is there a strong and well maintained social media presence?

- As the team is still mostly product focused, there is not a strong social media presence. It may change in the next few months as it makes its way up the coin ranking.

Noise

- Much media coverage?

- As until very recently, it was still a fairly obscure project until very recently (below 100th coin market cap), it has not made it to the mainstream media just yet.

- Much buzz on social medias?

- Raiblocks is starting to crop up in discussions on social medias due to its growth since December 2017.

- Any recognisable partners such as governments, companies, institutions, influencers?

- No

- Any recognisable backers/investors such as governments, companies, institutions, influencers?

- Not publicly available yet

Overall marketing

- Is branding taken seriously?

- Not yet

- Is this project more marketed than usual (given the type of project, market cap & what competitors are doing)?

- No, the project is probably less marketed than usual actuall

- Is there a clear and well defined marketing plan?

- No

- Is there much help available to get new users up to speed (wiki, articles, youtube...)?

- There is help available, but not so much since the project is still rather unknown

- Have marketing bounties been established to incentivise the advertising of the project?

- No

Code quality & transparency

- Is the code publicly available (i.e. on github)?

- Was the code audited by 3rd party companies/organisations? if yes, was the audit published publicly?

- No. Due to the code being publically available, no 3rd party audits have been explicitly carried out.

- Is there any history of hacking?

- No

- Is there any history of big bugs?

- No

- Is there any strategy in place to avoid hacks or similar issues?

- No. There is no explicit strategy that is available for the public to see apart from a bug bounty.

- Has a bug bounty been established to incentivise the discovery of exploits and bugs?

- Yes, there is a RaiBlocks Bug Bounty https://goo.gl/forms/NX67WDwtoyjLLxg52

- Is the company/organisation regularly reporting progress on the social media streams (Facebook, Twitter, Reddit, Medium, Telegram, Slack)?

- The company keeps their social media streams up to date with the current status of the system, reporting on bugs, fixes, updates and plans for the future.

Tech

- How clear is the white paper?

- The white paper is clear and concise, delving into the need for a system like RaiBlocks, the components and system overview, possible attack vectors, and resource usage.

https://raiblocks.net/media/RaiBlocks_Whitepaper__English.pdf

- The white paper is clear and concise, delving into the need for a system like RaiBlocks, the components and system overview, possible attack vectors, and resource usage.

- Is the white paper surprisingly short or long (i.e. 3 pages)?

- The white paper is fairly short at 8 pages

- In the white paper, has the concept been fully thought through and described?

- Due to the nature of Raiblocks, “Do one thing and do it well”, the concept is fairly simple and is clearly described in a short white paper.

- Is the white paper clear on the technical implementation?

- The technical implementation is clear, with a focus on tech over mathematics.

- What type of DLT is this (blockchain, DAG, else?)?

- Block-lattice DAG

- Is there any privacy/anonymity feature (i.e. ring signature, zk-SNARKs, or else)?

- No, it’s a public ledger

- What is the consensus used (PoW, PoS, else?)?

- Delegated Proof of Stake

- What is the cryptographic algorithm (maturity & strength (quantum proof?) of hash)?

- Signing algorithm - ED25519

- Hashing algorithm - Blake2

- https://github.com/clemahieu/raiblocks/wiki/Design-features

- Is there a live network/project?

- Project is live and functional.

- Moved from testnet to live net in October 2015 (over 2 years ago!).

- Is the live version in alpha or beta?

- No

- Any special note?

- Block-lattice structure

- Each account has its own blockchain (account-chain), equivalent to the account's transaction/balance history.

Legal

- Has there been appropriate consideration of legal matters?

- Yes. Raiblocks will announce their legal status in Q1 2018.

- Has the company provided an analysis of legal issues presented?

- No

- Does the project have a identifiable legal representation?

- This will be announced Q1 2018

Authors and contributors

- Follow us on Twitter @icoPntsAnalysis

- Written by

- Adrien Berthou - founder of ICO Points Analysis

- Herman Martinus - Shoegazer | Beach bum | Tech professional | ICO Points Analysis writer

- Special thanks to guests contributors

- Colin LeMahieu - Developer Lead at RaiBlocks - interviewed for this article

- 2 other developers at RaiBlocks who also were interviewed for this article

- Maxime Berthou - PhD in Physics - Freelance developer

- Jonathan Dizdarevic - Blockchain developer & startup founder

Please

- Share this post

- Vote up

- Comment if there is anything incorrect or missing to the article

- Donate

- BTC: you're funny

- IOTA: ZPIXGFSROQRVZXHMQOSTCBRJODELQEUKMIYVARCABAQLFXTUMHBXESWIAWQRJO9RXTWPPADSQCTWMFQJYFNNBJJYKX

- ETH: 0x5C3c3C12ba509Bb277D0997A91AdCF9EFf7b439E

- ERC20 tokens: 0x5C3c3C12ba509Bb277D0997A91AdCF9EFf7b439E

- PIVX: DEyCTTsK89LSDVxHGzi8iHdWs4EBiZVAuZ

- NEO: AaFdvPJ6zACF7eiFHfbUAXqn7wbkipdwnd

- BCH: 357p1BEgz3p67VhXz3HtSF4iMp7nxAVN71

- DASH: XjxB8CaEBQizhpjQgHRfSxvtsjjXivb7Sw

- LTC: LRKEHbMUmtyAeumKcQR7bJn9ndjuphVXAY

- QTUM: 0xc6cc90e81c6e431675fc9655d7035da08d23d24e

- STORJ: 0x7cb93df618c196c892fc646159549ebd281c800f

- XLM: +RgwjTD4RuaSUYXOXANTyQ==

Sources

- https://raiblocks.net

- https://github.com/clemahieu/raiblocks/wiki/Design-features - design features

- https://reddit.com/r/RaiBlocks/comments/752o5k/raiblocks_wikipedia_page - Raiblocks’ wikipedia page

- https://goo.gl/forms/NX67WDwtoyjLLxg52 - RaiBlocks Bug Bounty

- ~~~ embed:RaiBlocks/comments/7chzel/light_walletmobile_wallet_discussion/ - new light wallet & new iOS/Android wallets reddit metadata:fFJhaUJsb2Nrc3xodHRwczovL3d3dy5yZWRkaXQuY29tL3IvUmFpQmxvY2tzL2NvbW1lbnRzLzdjaHplbC9saWdodF93YWxsZXRtb2JpbGVfd2FsbGV0X2Rpc2N1c3Npb24vIC0gbmV3IGxpZ2h0IHdhbGxldCAmIG5ldyBpT1MvQW5kcm9pZCB3YWxsZXRzfA== ~~~

- https://steemit.com/raiblocks/@raiblocks/how-raiblocks-provides-unlimited-transaction-throughput

- https://hackernoon.com/iota-vs-raiblocks-413679bb4c3e

Looks like a great coin ... but would love to see it on Bittrex or Binance before I get into it!

If you like the project, why would you wait for it to list on Binanace? It is already scheduled to go on there, and it will probably be more expensive to get in after it is listed.

Great work on this post! Will you write about Byteball aswell?

Maybe yes. But there is no plan for it just yet.

We have an about the most famous non-blockchain DAG project though: https://steemit.com/crypto/@ipa-news/iota-analysis-in-details

Very detailed analysis. Thank you for sharing!

Thanks for the analysis, makes decisions easier :)

I would donate some Bytes, but Byteball address is missing in your donation address list. Let me know in case you got one!

Excellent article, thank you for sharing! Your due diligence makes mine easier :)

I would like to note about the bug that prevented transactions involving large amount of XRB to hang, but according to their Twitter they were able to resolve it so other than the possible temporary FUD it may have created, like wasn't that "big".

I guess "big" is a relative term. The bug did mean the transaction did hang for a bit, and this issue has been resolved. I hate to compare XRB to BTC, but that "hang" was less time than ~200,000 current BTC transactions ;)

No sybil attack protection. No spam protection. PoW is a fee in time and cost. But it's not scaling thus not enough to prevent sybil attacks meaning it's completely open. Its distribution used captcha method that was attacked as, once again, it doesn't offer sybil protection given ai and captch farms cost almost nothing. It uses delegation of stake instead of approval voting dpos have switched to because 1 account 1 vote is worst possible design method for representatives. it has same exact scaling issues as iota and blockchains by having to keep up with entire state of chain.

Bitcoin is important because it's secure. Steem tries to be secure by providing incentives and making it expensive and difficult to attack. RaiBlocks doesn't even pay its security nodes anything unlike miners or witnesses in steem meaning they have no reason to be honest at all. It's literally just badly copied old version of dpos with no incentives and a dag on top adding issues where they didn't have to be.

also, devs controlling most producing nodes is not a surprise. https://www.bitcoinbeginner.com/blog/raiblocks-needs-proof-of-stake/ but expected since there's no reward for doing all that work.

You make some fair points. As far as Sybil attacks go, an entity could create hundreds of RaiBlocks nodes on a single machine; however, since the voting system is weighted based on account balance, adding extra nodes in to the network will not gain an attacker extra votes. Therefore there is no advantage to be gained via a Sybil attack. As for spam protection, in the article you'll notice that it mentions there is a minimal PoW in order to prevent this. Moving on, when I spoke to the devs, I asked them about the incentives for running a full node. Considering they're evangelists they believe that people will set up their own nodes to strengthen an open system, which has been happening. Exchanges also have to set up their own full nodes. I believe that these are very minor flaws that are currently being dealt with as it becomes more adopted by the community at large.

https://github.com/clemahieu/raiblocks/wiki/Attacks

Yes!

Bitcoin introduces the world to crypto and then something else takes it over eventually because BTC is too limited. Will that thing be XRB? Time will tell, but the potential is there for sure.

Thanks for another great analysis!

There is an interesting reddit comment from the creator of raiexchange, explaining the actual situation of adding xrb to more exchanges:

Hey,

great and profound analysis indeed!

Ps I hope it's ok to refer to another site! Just my 2 cents :) : as far as I understand, this user addressed an issue re: scalability (and provided a possible solution): https://bitcointalk.org/index.php?topic=2649842.new#new

The Facebook link that is posted in this article is a scam site and is in no way related to Raiblocks or their team. You should edit that so people don't end up thinking they can "mine for Raiblocks" as the so called "official" site with 7k followers directs. hah

Really like they have their founder out of Austin, actually.

The addition on Binance should help a lot with visibility.

We also did a rangey piece on it (and Raiden Network before that)...

https://steemit.com/cryptocurrency/@harpooninvestor/raiblocks-master-crypto-series-because-everyone-deserve-their-own-blockchain