How's that for ironic?

One of the largest banks in the world, and one that was previously known for being one of the more scrupulous banks around, got nailed big time for something they did a few years ago.

Back in 2016 it was revealed that Wells Fargo staff was fraudulently creating accounts for customers without their consent or knowledge.

They were also purchasing life insurance and many other products on the behalf of their clients, again without their consent.

Basically, they were stealing in a major way from all the people that had entrusted them with their hard earned money and personal information.

Again, this was from the bank that had mostly kept its nose clean during the mortgage backed securities and subprime mortgage catastrophe back in 2007/2008.

However, what employees of the company took part in less than a decade later was downright appalling.

Employees attributed their behavior to unrealistically impossible sales metrics the company had mandated for its staff to meet, the staff felt they had to do this other wise they would be fired.

The CEO of Wells Fargo was forced to step down when what they were doing came to light and the bank got a serious black mark on its previously mostly untarnished name.

Recently a settlement was reached for the wrong doing revealed back in 2016...

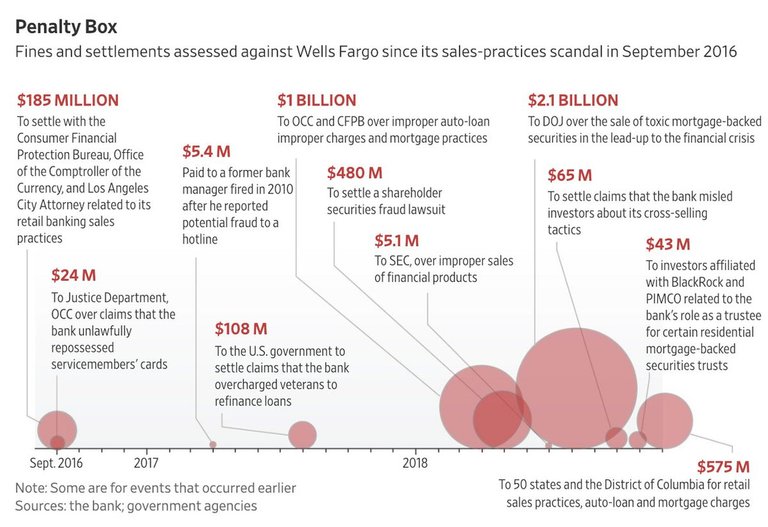

A breakdown can be seen here:

(Source: https://twitter.com/ritholtz)

The total amount Wells Fargo has paid is now close to $2 billion.

That may sound like a lot but keep in mind Wells Fargo had roughly $88 billion in revenue last year alone.

The irony?

Just a few months ago, back in mid-2018, Wells Fargo banned its clients from purchasing cryptocurrency with a credit card.

The reasoning?

Bitcoin and cryptocurrency were considered too risky of an investment for clients to be able to purchase them using a credit card.

That is fine if that is how they feel as cryptocurrencies are some of the more volatile assets out there...

However, I guess the more interesting thing is that Wells Fargo felt the need to keep clients from purchasing crypto while at the same time scamming them.

'Don't spend your money on crypto so we can scam it from you with our people!'

Something like that...

How's that for irony?!

Stay informed my friends.

Follow me: @jrcornel

Did anybody go to prison? Thanks mike

The CEO resigned, but I don't think any prison sentences.

That sounds about right, one rule for us and another rule for them. Thanks for your reply cheers mike

Wipe WellsFargo off the planet! 👎👎😩👎👎

But but... the banks are too big too fail. We must protect them.

fucking hustlers...

Criminals.

It is proof we can trust them and crypto is the way to go.

Posted using Partiko Android

Yep, that has been known since 2008.

Business as usual, amirite? The best part is doing the math. For 2 billion dollars you could hire 10,000 programmers for 2 years at 100K salary... or 1000 programmers for 20 years.

Imagine the kind of crypto you could build with 2 billion dollars and the right organization. We honestly aren't very far from this happening naturally as we shake off the year long bearish nightmare and move forward into the collapsing economy that blockchain is designed to fix.

Yep. Which also means the ones with all the money will likely start to build their own, which may be better than anything that exists currently. Bitcoin's decentralization is the only think keep it going right now in my opinion. If Facebook or some other massive company with billions of users launched their own and gifted some to every user at launch, it would already have a leg up on bitcoin in terms of decentralization, at least in a POS system.

The scam with banks continue today as they continue to earn absurd amounts of money on the money we deposit with them. Even worst, what happens when those investments they make fail, they get bailed out fo being too big to fail! Have any been reduced to small enough to fail? Don’t think so.

Posted using Partiko iOS

And I am sure most collude on some level with the interest rates they give clients. They give clients .2% interest, yet they can earn 5% on loans with that money...

Yep, you nailed it.

Criminals.

Congratulations @jrcornel! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

"Bitcoin is too risky for its clients" Translation: Bitcoin is a threat to my business/businesses.

Bitcoin represents a fundamental paradigm change. Banks are not going down without a fight.

Wow!!

88 B. Just revenue for lending money and holding money.

That’s what we know on the surface.

Thanks for informing us.

Keep on postin

Posted using Partiko iOS

True, that is what is on the books. I am sure there is some off the books.

I read this article and could do nothing but laugh.

Posted using Partiko iOS

Pretty ironic right?!

Yeah those damn bastards scammed people for 15 years that’s nutty.

Posted using Partiko iOS

Wells Fargo is organized crime.

Si