Market Report: 2 May 2019 — Subscribe to our newsletter.

Join us on telegram

OUR TWO SATOSHIS

The daily view from our desk

We all remember the sensational headlines concerning cocaine levels in the River Thames, well the situation is worse than we thought, as the drug can now be found in river-dwelling shrimp! I wonder if there’s any correlation between that and the sudden urge for British donkeys to remain indoors. In further unconnected news, Pete Doherty has recently been hospitalised following a hedgehog injury.

WHATSOPR

TOP CRYPTOASSETS BARELY MOVED OVER THE PAST 24 HOURS, SO LET’S ZOOM OUT TO THE FUTURE

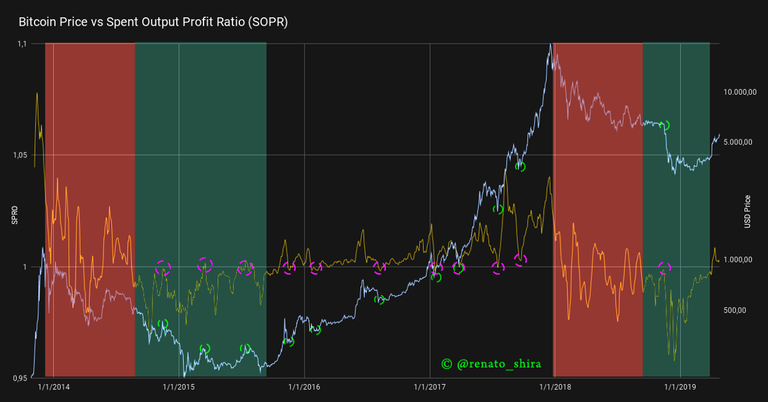

Last week, Renato Shirakashi, an entrepreneur from São Paulo, announced yet another new cool blockchain metric: the Spent Output Profit Ratio, or SPOR. The indicator — which claims to help predict UTXO-based cryptoasset’s local tops and bottoms — was revised by Cryptopoiesis, who just called our attention to it. And it’s gaining traction! As the recent pump was “meh”, let’s dive into it now.

In brief, the ratio measures the “price sold / price paid” of transacted bitcoins. Note that purple circles within the green shaded areas coincide when the ratio failed to get below the value of 1 during the last bull market or above the unit during the past two bear markets. Meaning that bull markets find local bottoms once profit taking reaches an equilibrium. And bear markets reach a local top once the majority finds their breakeven spot to cut their losses. Check it below:

MESSENGEVRV

“I KNOW THAT WE DON’T EXACTLY HAVE THE STRONGEST REPUTATION ON PRIVACY RIGHT NOW, TO PUT IT LIGHTLY” — MARK “LOL” ZUCKERBERG

Willy Woo just found it too and argues it’s similar — but interestingly different — from the Market-Value-to-Realized-Value ratio, or MVRV: which we shared last October, when it was introduced by David Puell and Murad Mahmudov. Because SOPR concerns “the net position of investors who exited” and MVRV the “net position of the market, including those who haven’t exited”, as Woo puts it.

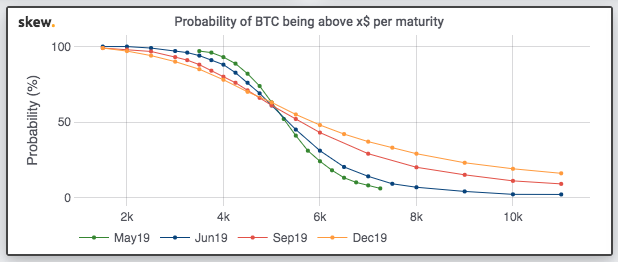

Lastly, there’s another piece of analysis we must share today. And that’s the April edition of Skew’s Crypto Derivatives Review — a must-read! In brief, ether has had a disappointing performance last month — even if its future contracts curve is more bullish than bitcoin’s. With this in mind, consider taking a look at Panda’s fragile outlook for BNB here that can provide guidance for other alts. To conclude, check the probabilities derived from the latest options prices below:

WHAT YOU CAN’T MISS TODAY

DON’T LEAVE FOR THE WEEKEND WHAT YOU SHOULD READ TODAY

▪ Andreessen Horowitz’s partner Ali Yahya interviewed Ben Fisch, a PhD student, on “building decentralised storage systems”. When Filecoin moon?

▪ Bloomberg’s Joe Weisenthal explains why bitcoin is trading at a premium on Bitfinex and even compares it to Mt. Gox. But is the current case analogous?

▪ That’s it for today, don’t forget to check the articles from Renato and Skew.

QUOTE OF THE DAY

MONERO AND ZCASH, NOT BLOCKCHAIN?

“The future is private”

- By Mark Zuckerberg

You got a free upvote from @reversed-bidbot! Follow me to earn steem by interacting with my promoted posts.