Overwhelmed with myriad investment options?

Know what crypto you like, but don't know how much to put in each one?

Want to protect principal without missing growth opportunities?

Here, I will outline a basic strategy that gives me confidence in my portfolio.

We have at our disposal the best prediction market for crypto, and it's free. This is the market itself.

This is why I recommend, as a baseline, distributing your investment according to the market capacities. This takes into account the collective wisdom of every crypto investor. Furthermore, it is equivalent to investing in the crypto market as a whole.

What does this mean, exactly? Assume Bitcoin ($72B) and Ethereum ($28B) are the only crypto I'm interested in, and I have $100 to invest. Then I should put $28 into Ethereum and $72 into Bitcoin, because those amounts reflect the market shares.

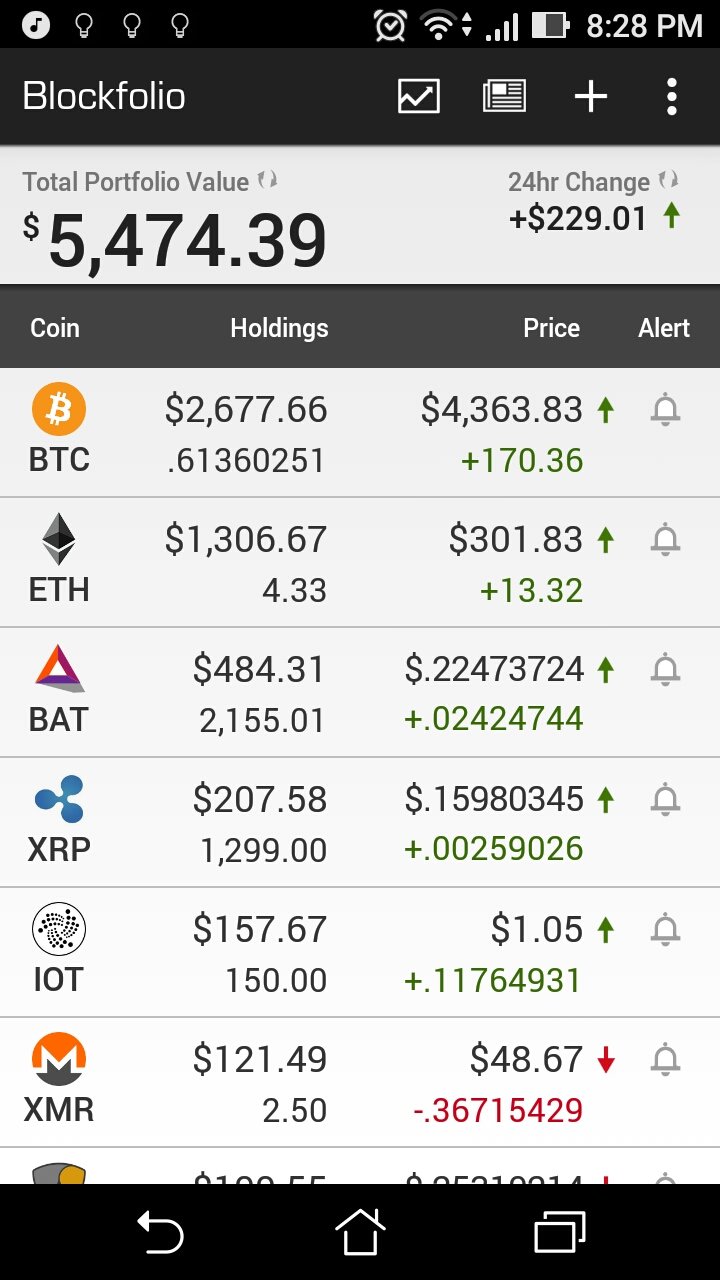

You can extrapolate this example to include as much of the market as you want. You don't have to include the whole market. Nor must you maintain strict parity -- as you can see above, I have a disproportionately high investment in BAT, and a disproportionately low investment in others.

We all know that crypto is the future, so the market as a whole will grow. Hence, you can't go wrong investing with the market as a whole.

Good game plan.