The image above was made with stable diffusion using the prompt 'a futuristic robot trading crypto.'

A few years back, I spent an immense amount of time trying to make a bot that traded better than I could trade manually. I spent countless hours attempting to predict prices with LSTM and other kinds of neural networks, but my results were always mixed at best. This year, I picked the project up again. After throwing all of my old assumptions out the window and starting from scratch, I finally devised an algo with real potential.

Wrangling Data

To start, I needed data. Historical trade data has always been hard to come by unless you want to pay Coinmarketcap's insane api prices, but I managed to find a year's worth of OHLCV data on CHEX and EOS here. A tiny script turned scraped data into a couple of clean csv files. Then I used mpl finance to plot the CHEX and EOS candlesticks like this.

import pandas as pd

import mplfinance as mpf

import matplotlib.pyplot as plt

from matplotlib.lines import Line2D # For custom legend elements

# File paths

chex_filepath = "C:/datasources/chex.csv"

eos_filepath = "C:/datasources/eos.csv"

# Step 1: Read data

chex_df = pd.read_csv(chex_filepath, delimiter='|', parse_dates=["Date"])

eos_df = pd.read_csv(eos_filepath, delimiter='|', parse_dates=["Date"])

# Step 2: Prepare candlestick data (no normalization)

chex_candlestick = chex_df[["Date", "Open", "High", "Low", "Close"]].set_index("Date").sort_index()

eos_candlestick = eos_df[["Date", "Open", "High", "Low", "Close"]].set_index("Date").sort_index()

# Step 3: Plot the original price data

fig, ax = plt.subplots(figsize=(30, 16)) # Enlarged chart size

# Define custom colors for each dataset

chex_colors = mpf.make_marketcolors(up='blue', down='lightblue', wick='blue', edge='blue', ohlc='blue')

eos_colors = mpf.make_marketcolors(up='orange', down='lightcoral', wick='orange', edge='orange', ohlc='orange')

chex_style = mpf.make_mpf_style(marketcolors=chex_colors, base_mpf_style='yahoo')

eos_style = mpf.make_mpf_style(marketcolors=eos_colors, base_mpf_style='yahoo')

# Plot Chex candlesticks

mpf.plot(

chex_candlestick,

type="candle",

ax=ax,

style=chex_style,

warn_too_much_data=5000, # Suppress warnings for large data

)

# Overlay EOS candlesticks

mpf.plot(

eos_candlestick,

type="candle",

ax=ax,

style=eos_style,

warn_too_much_data=5000, # Suppress warnings for large data

)

# Add a title

ax.set_title("Chex vs EOS in USD", fontsize=20)

# Add a legend

legend_elements = [

Line2D([0], [0], color='blue', lw=2, label='CHEX'),

Line2D([0], [0], color='orange', lw=2, label='EOS'),

]

ax.legend(handles=legend_elements, loc='upper left', fontsize=14)

plt.tight_layout()

plt.show()

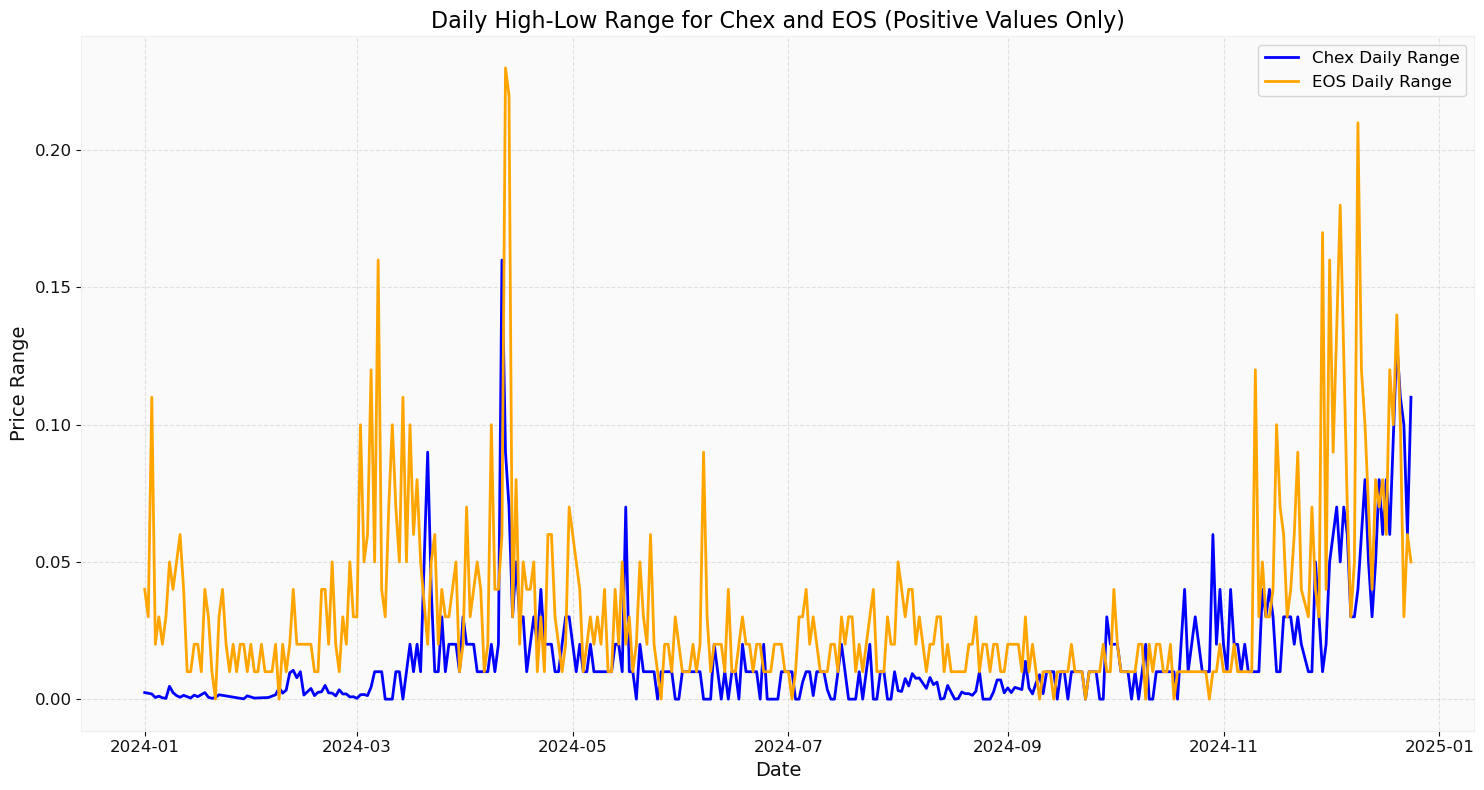

From there I calculated the price range being traded every day and plotted the result.

chex_df["Daily_Range"] = (chex_df["High"] - chex_df["Low"]).abs()

eos_df["Daily_Range"] = (eos_df["High"] - eos_df["Low"]).abs()

# Step 3: Merge data on Date for comparison

merged_ranges = pd.merge(chex_df[["Date", "Daily_Range"]], eos_df[["Date", "Daily_Range"]], on="Date", suffixes=("_Chex", "_EOS"))

# Step 4: Plot the daily range for both coins

plt.figure(figsize=(15, 8))

plt.plot(merged_ranges["Date"], merged_ranges["Daily_Range_Chex"], label="Chex Daily Range", color="blue", linewidth=2)

plt.plot(merged_ranges["Date"], merged_ranges["Daily_Range_EOS"], label="EOS Daily Range", color="orange", linewidth=2)

plt.title("Daily High-Low Range for Chex and EOS (Positive Values Only)", fontsize=16)

plt.xlabel("Date", fontsize=14)

plt.ylabel("Price Range", fontsize=14)

plt.xticks(fontsize=12)

plt.yticks(fontsize=12)

plt.legend(fontsize=12)

plt.grid(True, linestyle="--", alpha=0.6)

plt.tight_layout()

plt.show()

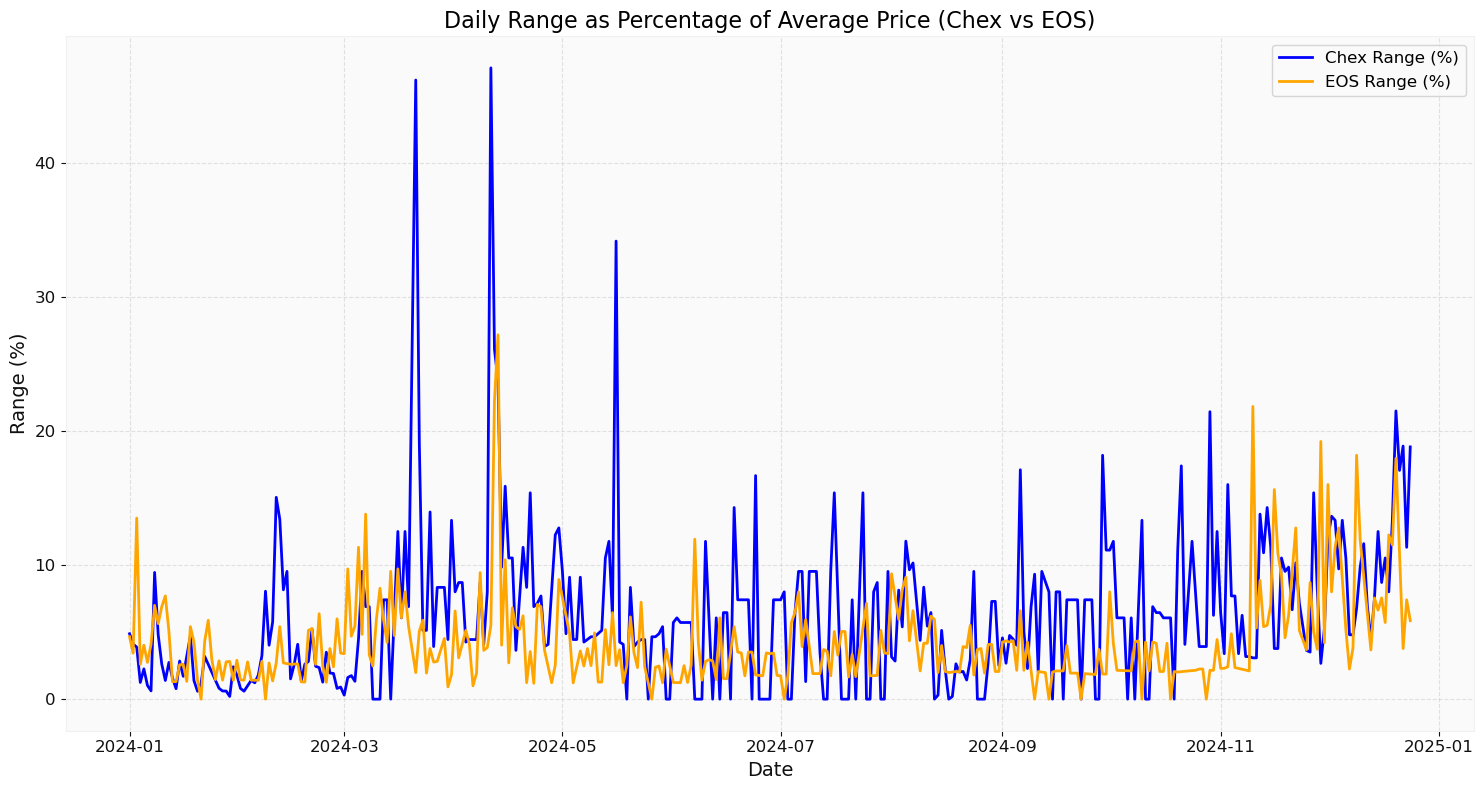

Next I plotted this daily range as a percentage of average price to get a better sense of the tokens' relative volatility.

chex_df["Daily_Average"] = (chex_df["High"] + chex_df["Low"]) / 2

chex_df["Range_Percentage"] = ((chex_df["High"] - chex_df["Low"]) / chex_df["Daily_Average"]) * 100

eos_df["Daily_Average"] = (eos_df["High"] + eos_df["Low"]) / 2

eos_df["Range_Percentage"] = ((eos_df["High"] - eos_df["Low"]) / eos_df["Daily_Average"]) * 100

# Step 3: Merge data on Date for comparison

merged_ranges = pd.merge(

chex_df[["Date", "Range_Percentage"]],

eos_df[["Date", "Range_Percentage"]],

on="Date",

suffixes=("_Chex", "_EOS")

)

# Step 4: Plot the range as a percentage of average price

plt.figure(figsize=(15, 8))

plt.plot(

merged_ranges["Date"],

merged_ranges["Range_Percentage_Chex"],

label="Chex Range (%)",

color="blue",

linewidth=2

)

plt.plot(

merged_ranges["Date"],

merged_ranges["Range_Percentage_EOS"],

label="EOS Range (%)",

color="orange",

linewidth=2

)

plt.title("Daily Range as Percentage of Average Price (Chex vs EOS)", fontsize=16)

plt.xlabel("Date", fontsize=14)

plt.ylabel("Range (%)", fontsize=14)

plt.xticks(fontsize=12)

plt.yticks(fontsize=12)

plt.legend(fontsize=12)

plt.grid(True, linestyle="--", alpha=0.6)

plt.tight_layout()

plt.show()

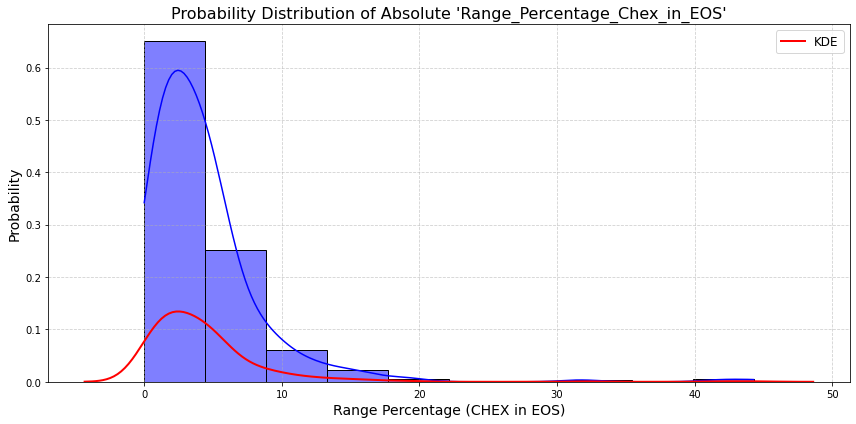

Probability

With the data firmly wrangled, I calculated the probabilities of volatility levels appearing. These results were very promising.

adj_df = adj_df.dropna(subset=["Range_Percentage_Chex_in_EOS"])

# Calculate absolute positive values for 'Range_Percentage_Chex_in_EOS'

adj_df["Range_Percentage_Chex_in_EOS"] = adj_df["Range_Percentage_Chex_in_EOS"].abs()

# Plot histogram with KDE overlay

plt.figure(figsize=(12, 6))

sns.histplot(

adj_df["Range_Percentage_Chex_in_EOS"],

bins=10, # Number of bins

kde=True, # Add KDE

stat="probability", # Normalize to probabilities

color="blue", # Histogram color

)

# Add labels and title

plt.title("Probability Distribution of Absolute 'Range_Percentage_Chex_in_EOS'", fontsize=16)

plt.xlabel("Range Percentage (CHEX in EOS)", fontsize=14)

plt.ylabel("Probability", fontsize=14)

plt.grid(True, linestyle="--", alpha=0.6)

# Optional: Adjust KDE line appearance separately

sns.kdeplot(

adj_df["Range_Percentage_Chex_in_EOS"],

color="red",

linewidth=2,

label="KDE",

)

plt.legend(fontsize=12)

plt.tight_layout()

plt.show()

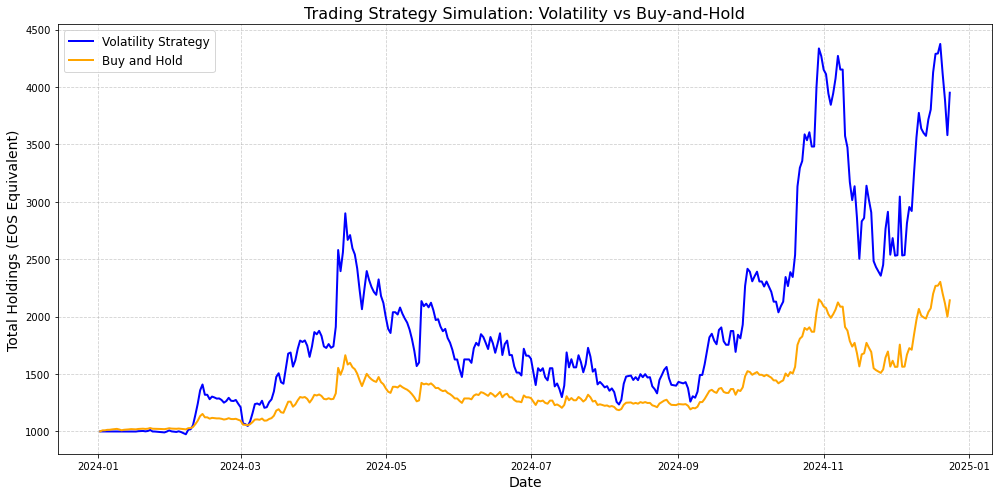

Simulation

With this info, I devised a trading strategy, then created a simulation with gpt's help to test this strategy. The underlying idea was that prices can't be predicted but volatility can, so an algo that anticipates big price swings could theoretically harvest more than an algo that just does simple market making or range trading. The initial algo I developed was a total failure.

After simulating the loss of my entire roll many times, I eventually just did a computationtionally intensive grid search of the entire parameter space to identify the right parameters for this algo on this pair. And suddenly, bam! A very promising algo emerged. Note that the sim begins with a bankroll of 1000 EOS.

# Initial setup

initial_eos = 1000

volatility_threshold_low = # x% spread

volatility_threshold_high = # x% spread

buy_spread = # Adjusted buy spread

sell_spread = # Adjusted sell spread

fee_rate = 0.01 # 1% trading fee

order_size_fraction = # Use x% of available funds for each order

# Prepare historical data

data = food.copy() # Use your DataFrame with necessary columns

data = data.sort_values("Date").reset_index(drop=True)

# Initialize variables for volatility strategy

eos_balance_volatility = initial_eos

chex_balance_volatility = 0

bankroll_volatility = []

# Initialize variables for buy-and-hold strategy

eos_balance_buyhold = initial_eos - 100 # Spend 100 EOS on CHEX

chex_balance_buyhold = 100 / data.loc[0, "Open_Chex_in_EOS"] # Buy CHEX at day 1 open price

bankroll_buyhold = []

# Simulate trading

for i in range(1, len(data)):

# Get previous day's close price

prev_close = data.loc[i - 1, "Close_Chex_in_EOS"]

# Determine spreads based on volatility

spread = volatility_threshold_high / 100 if data.loc[i, "Range_Percentage_Chex_in_EOS"] >= 10 else volatility_threshold_low / 100

# Calculate buy and sell prices with asymmetric spreads

buy_price = prev_close * (1 - buy_spread)

sell_price = prev_close * (1 + sell_spread)

# Get today's open, high, low, close prices

today_high = data.loc[i, "High_Chex_in_EOS"]

today_low = data.loc[i, "Low_Chex_in_EOS"]

today_close = data.loc[i, "Close_Chex_in_EOS"]

# Adjust order size based on available funds

eos_order_size = eos_balance_volatility * order_size_fraction

chex_order_size = chex_balance_volatility * order_size_fraction

# Execute trades

# Sell CHEX if today's high >= sell_price

if today_high >= sell_price and chex_balance_volatility > 0:

sell_amount = chex_order_size

eos_balance_volatility += sell_amount * sell_price * (1 - fee_rate)

chex_balance_volatility -= sell_amount

# Buy CHEX if today's low <= buy_price

if today_low <= buy_price and eos_balance_volatility > 0:

buy_amount = eos_order_size / buy_price

eos_balance_volatility -= buy_amount * buy_price * (1 + fee_rate)

chex_balance_volatility += buy_amount

# Calculate total bankroll for volatility strategy

total_bankroll_volatility = eos_balance_volatility + chex_balance_volatility * today_close

bankroll_volatility.append(total_bankroll_volatility)

# Buy-and-hold strategy

total_bankroll_buyhold = eos_balance_buyhold + chex_balance_buyhold * today_close

bankroll_buyhold.append(total_bankroll_buyhold)

# Final buy-and-hold adjustment

# Sell CHEX for EOS on the last day

eos_balance_buyhold += chex_balance_buyhold * data.loc[len(data) - 1, "Close_Chex_in_EOS"] * (1 - fee_rate)

chex_balance_buyhold = 0

final_bankroll_buyhold = eos_balance_buyhold

# Plot results

plt.figure(figsize=(14, 7))

plt.plot(data["Date"][1:], bankroll_volatility, label="Volatility Strategy", color="blue", linewidth=2)

plt.plot(data["Date"][1:], bankroll_buyhold, label="Buy and Hold", color="orange", linewidth=2)

plt.title("Trading Strategy Simulation: Volatility vs Buy-and-Hold", fontsize=16)

plt.xlabel("Date", fontsize=14)

plt.ylabel("Total Holdings (EOS Equivalent)", fontsize=14)

plt.grid(True, linestyle="--", alpha=0.6)

plt.legend(fontsize=12)

plt.tight_layout()

plt.show()

# Print final bankrolls

print(f"Final Volatility Strategy Bankroll: {bankroll_volatility[-1]:.2f} EOS")

print(f"Final Buy-and-Hold Strategy Bankroll: {final_bankroll_buyhold:.2f} EOS")

Final Volatility Strategy Bankroll: 3949.95 EOS

Final Buy-and-Hold Strategy Bankroll: 2129.53 EOS

Next Steps

My next steps include waiting for Newdex to provide me with an api key, generalizing my method into a scale-free approach to automated trading on any high-volatility pair, and manually trading using this strategy to see how it performs in the unpredictable real world. If you're making trading bots and you want to compare notes, hit me up.

Read Free Mind Gazette on Substack

Read my novels:

- Small Gods of Time Travel is available as a web book on IPFS and as a 41 piece Tezos NFT collection on Objkt.

- The Paradise Anomaly is available in print via Blurb and for Kindle on Amazon.

- Psychic Avalanche is available in print via Blurb and for Kindle on Amazon.

- One Man Embassy is available in print via Blurb and for Kindle on Amazon.

- Flying Saucer Shenanigans is available in print via Blurb and for Kindle on Amazon.

- Rainbow Lullaby is available in print via Blurb and for Kindle on Amazon.

- The Ostermann Method is available in print via Blurb and for Kindle on Amazon.

- Blue Dragon Mississippi is available in print via Blurb and for Kindle on Amazon.

See my NFTs:

- Small Gods of Time Travel is a 41 piece Tezos NFT collection on Objkt that goes with my book by the same name.

- History and the Machine is a 20 piece Tezos NFT collection on Objkt based on my series of oil paintings of interesting people from history.

- Artifacts of Mind Control is a 15 piece Tezos NFT collection on Objkt based on declassified CIA documents from the MKULTRA program.