What is Caspian?

An institutional grade crypto trading platform for sophisticated traders, This creates a barrier to entry for individuals and institutions who could otherwise partake in this growing economy.

Caspian is a full stack of financial tools that integrates with major exchanges in order to offer users a single place to interact with the entire crypto-space.

Caspian targets the following three functions:

- Execution.

- Position & Risk Management.

- Compliance & Reporting.

Interview — Who created Caspian?

Meet Robert Dykes (CEO of Caspian) and Daniel Weinberg (CEO of Kenetic) who share why they created Caspian and what problems Caspian is solving that many sophisticated crypto traders face.

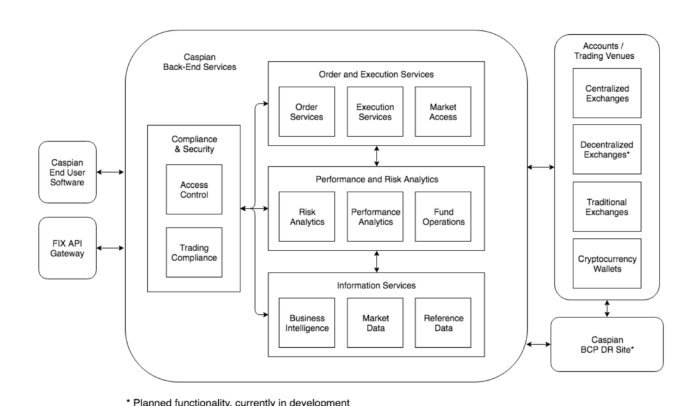

Technical Summary

Caspian Order and Execution Management System!

Caspian gives users access to the entire breadth of financial tools available on each individual exchange. Users can use the Caspian platform to access all the available exchanges and their respective functions through one platform.

Building a Crypto Trading System for Institutional Investors

We are reaching a crucial point in the history of crypto development. While the general public may be focusing on the headlines about the ups and downs of cryptocurrency markets, the important thing is that the world is watching.

That includes institutional investors, who are increasingly interested in the benefits that crypto could offer their portfolios — to a degree that might have been unthinkable even six months ago. These investors, who have $130 trillion of assets under management worldwide, could have a huge impact on the crypto market, whose market cap remains under $300 billion.

However, many of these investors are still waiting to be convinced to take the leap into crypto. One thing that is still giving many institutional investors pause is the fact that trade management systems in the crypto world simply do not offer the sophistication they are used to in conventional trading. They’ve become accustomed to the support of reliable automated tools, and the prospect of working without those can be a serious roadblock.

As it stands now, cryptocurrency traders are often reduced to using spreadsheets and ad-hoc solutions that offer far less than they need in terms of optimizing trade execution, risk management and audit and compliance.

Solving pain points

Our mission at Caspian is to build a solution to this problem by offering a full-stack crypto trading and risk management platform developed for institutional investors. There are several real pain points that institutional investors face, and in building Caspian, we have focused on relieving these.

Crypto exchange fragmentation

One of the biggest issues for institutional investors is the fragmented nature of the market, requiring them to operate on several exchanges. Often, this forces them to come up with customized ways to deal with the limitations of each exchange — a time-consuming and frustrating exercise. Not only that, but this can lead to liquidity and slippage problems, as even small trades can consume liquidity and cause prices to slip.

Portfolio management

Another huge pain point for institutional investors is portfolio management. Investors face major difficulties in tracking their real time and historical P&L (profits & loss). Our PMS (Portfolio Management System) allows users to see real-time and historical P&L over any time interval, as well as perform real-time monitoring of positions across exchanges and wallets.

Risk management

Then there is the issue of risk. Often, crypto-exchanges lack many of the security features offered by trading platforms in traditional markets — including experienced customer support and risk management capabilities.

Our Risk Management System (RMS) offers fully reconciled positions as well as accurate pricing and valuations, so there is only one view of the portfolio across the firm. It allows users to run simulation-based scenarios that generate risk metrics in seconds, allowing faster and more effective decisions.

Caspian demo

.png)

traders can view all balances across all exchanges from one place!

Caspian OEMS demo

Reporting and compliance

Reporting and compliance also present difficulties for institutional investors. They are required to keep extensive records for both internal and regulatory stakeholders, but these outputs are not available on most crypto exchanges. With the multiplicity of exchanges, the challenge only increases.

Caspian Use- Case

caters to a wide range of users. Unknowingly, many crypto-holders are traders and their own personal fund managers.

Two weeks later, her bank rolls out cryptocurrency investments, increasing their clients exposure to a variety of investments, as well as attracting new clients who are interested in fund managers who specialize in cryptocurrencies!

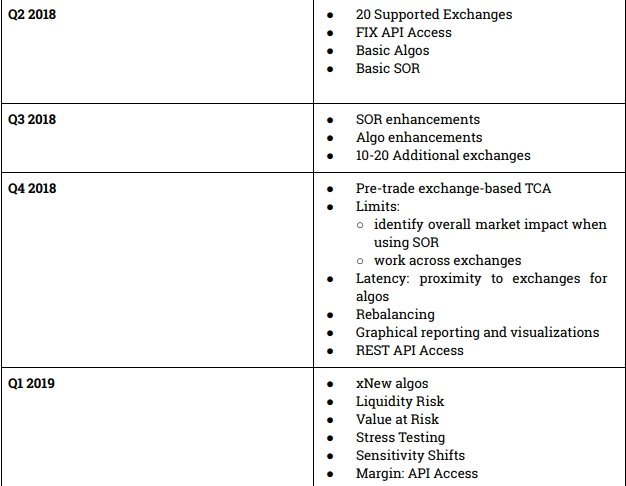

Month Roadmap

Here is this video where it gives you all the functions you need to manage your encrypted fund..!

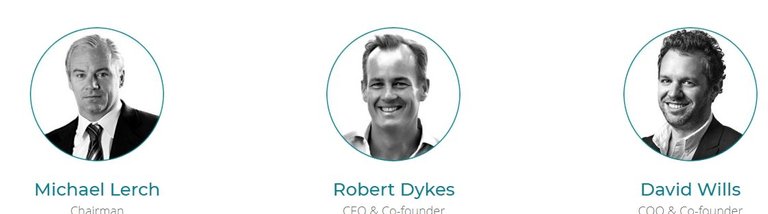

Team

The contest @Originalworks, Sponsored by CASPIAN..!

caspian2018

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/swlh/building-a-crypto-trading-system-for-institutional-investors-4c2b14e7a3db

Sponsored Writing Contest!

This post has been submitted for the @OriginalWorks You can also follow @contestbot to be notified of future contests!