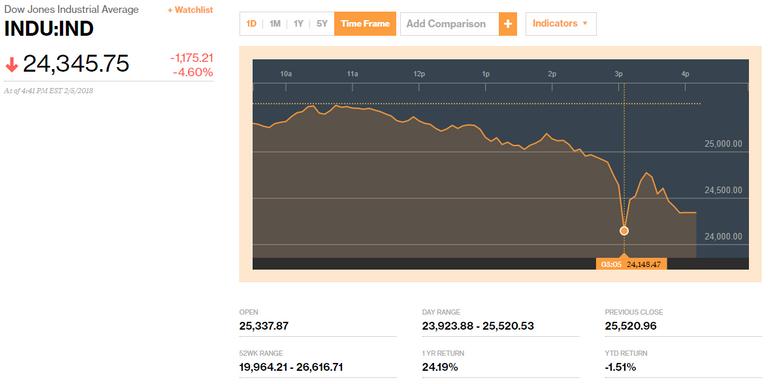

The Dow Jones fell more than 1,100 points on Monday, February 5 to the lowest point since 2011, while Bitcoin (BTC) also dipped below $ 7,000 for the first time since November.

The drop in the market occurred around 2:40 pm EST, with turnover reported at nearly double the 30-day average, according to Bloomberg.

Dow Jones

Although CNBC reported that no "specific news" caused the market to fall, unfounded fear about rising interest rates could have been a factor, although government bonds were actually lower today.

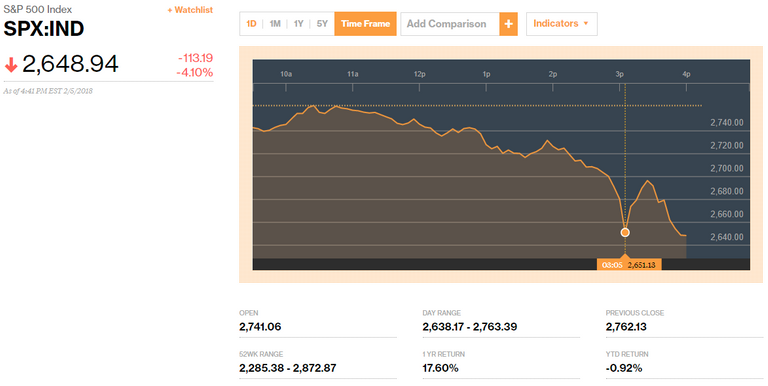

The S & P 500 Index also fell 4.1%, losing January profits.

S & P 500

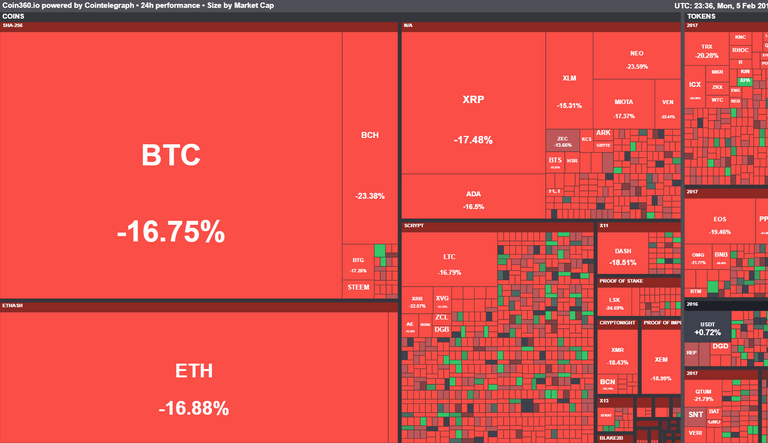

The crypto market experienced a similar sharp decline, with 98 of the top 100 currencies listed on the CoinMarketCap in red at the time of this publication.

The decline of the market crypto could be attributed to China's ban on foreign currency exchange houses and ICO websites reported earlier in the day.

Just after 3:00 p.m., at about the same time as the traditional market experienced its dip, the full market capitalization of the crypto-coins reached $ 310 billion, according to CoinMarketCap data. Total market capitalization was about $ 330 billion at the time of this publication.

Crypto-currency markets have been declining since the $ 20,000 maximum of the BTC in December 2017, but major defenders like John McAfee had retained confidence in Bitcoin and altcoins.

During the most drastic dip in both traditional and crypto-currency markets, McAfee tweeted a chart from the late January of Bitcoin, writing that "Bitcoin does this every year at this point".

Author: CointelegraphTags: #crypto #stocks #investment #wallstreet #bitcoin