Ever since the creation of Bitcoin and the cryptocurrency reaching an all time high of around $19,000 the cryptocurrency market has been booming. With more and more exciting new ventures wanting to create their own cryptocurrencies, we are living in exciting times.

However, there remains a big problem with financing these innovative new businesses. Traditionally, access to funding is often centralized and inaccessible. In 2017, entrepreneurs have tried to overcome this issue by raising funds through Initial Coin Offerings (ICOs).

A company known as Corl aims to tackle this problem head on, with the combination of three concepts: Crowdfunding, revenue sharing and the blockchain. Through owning equity in the Corl company, companies who are not able to benefit by means of traditional finance, will be provided with revenue-sharing investments (for example royalties).

Companies owning equity in Corl, will receive capital upfront in exchange for a percentage of future monthly revenue until a specific repayment amount is achieved. This innovative financial structure maximizes revenue for both Corl and the company involved. Corl recognizes that true productive growth is really achieved when the needs interests of both the entrepreneurs and investors are met.

What Is Corl?

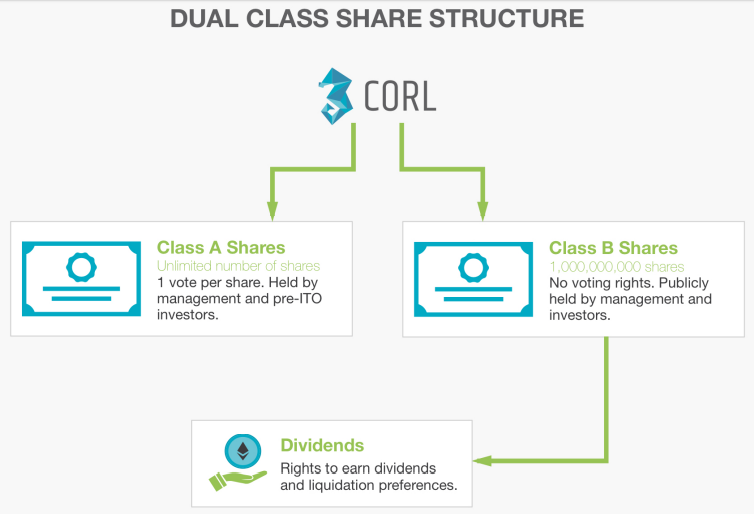

Corl is a federally-registered company in Canada, that strictly follows nation securities laws and is regulated by the IFRS. The image below represents the share structure of Corl.

As illustrated in the image above, the Corl token, known as CRL, is the legal equivalent of a Class B share. This makes Corl the first company in the world to offer 100% of its equity ownership in the form of a digital token cryptocurrency! Token holders will also receive dividends.

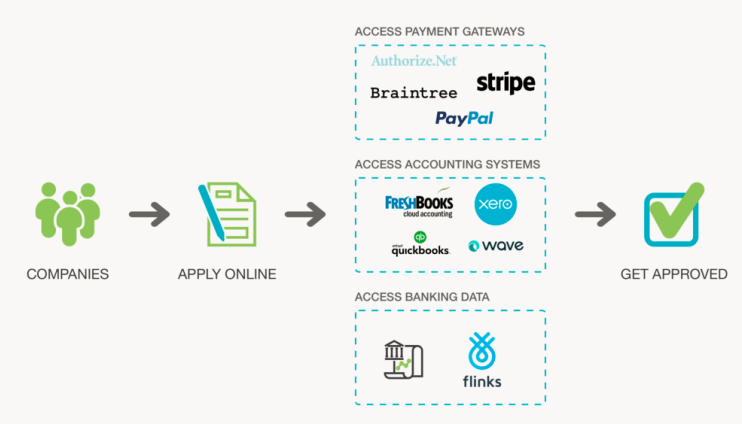

Companies wishing to apply for funding can do so on the Corl business platform, via an easy to complete application process, that should take no longer than 10 minutes to complete. Companies authorize Corl access to their payment gateways, accounting systems and banking data, which enhances the user experience and gives Corl accurate information.

The image below demonstrates the simplicity of the application process for companies.

Once the application process is finished, pre-approved applicants will be subjected to a qualitative risk assessment. This will include an analysis on the founders , the structure of the company, the business plan and vision, their target market and their product. Combining this assessment with the quantitative risk assessment will determine if a company is approved for funding. At present, the time taken from initial application too funding is up to 2 weeks. This is projected to reduce as time goes on, as automation is implemented.

Revenue Generation And Profit Distribution

A diversified portfolio provides the financial backing of Corl, made up of revenue-sharing investments in start up companies already generating substantial revenues. Revenue is generated through the following streams:

- Revenue Repayments

- Origination Fees

- Equity Warrants

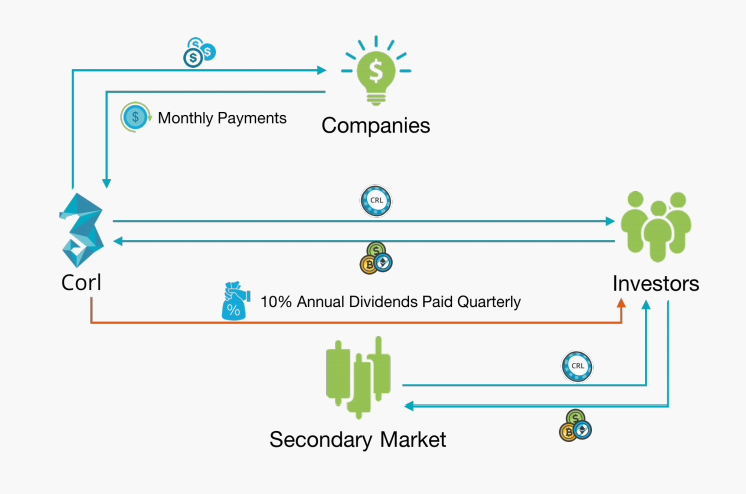

These sources of revenue will determine both the quarterly dividends and the token price of Corl.

Investors in Corl will be rewarded with ten percent of the quarterly net profits of these early growth companies. This dividend rate is fixed, meaning investors holding larger quantities of tokens will receive more tokens when dividends are paid. If there is a net loss during a quarterly period, no dividends will be paid out.

The following image shows how the profit distribution and dividend system works.

The remaining ninety percent of quarterly net profits will be invested back into Corl, for portfolio growth and expansion of operations.

How can I invest in Corl?

You can invest in Corl via the investor platform. The registration process is very simple for an investor, beginning with submitting personal information, an Ethereum address and the necessary documentation to confirm your identity.

The registration process will ensure that all members are compliant with law requirements including Anti-Money Laundering (AML), Know Your Customer (KYC) and Counter Terrorist Financing (CTF).

For more information on the Corl token sale, check out their website here: https://corl.io

For a more in-depth look at the Corl platform you can see their Whitepaper here: https://corl.io/whitepaper

Here is a link to my Bitcointalk forum profile: https://bitcointalk.org/index.php?action=profile;u=1559399

Thank you for reading my article, if you have any questions or comments please write them below.