Being concerned about our national debt, weakening dollar and overall economy. Our government and mainstream media keep saying how everything is contained and looking so great. However, I can feel there is something wrong and I’m concerned about our children’s future. So I went throug a few articles, what and how could our national debt cause dollar collapse and eventually economic collapse.

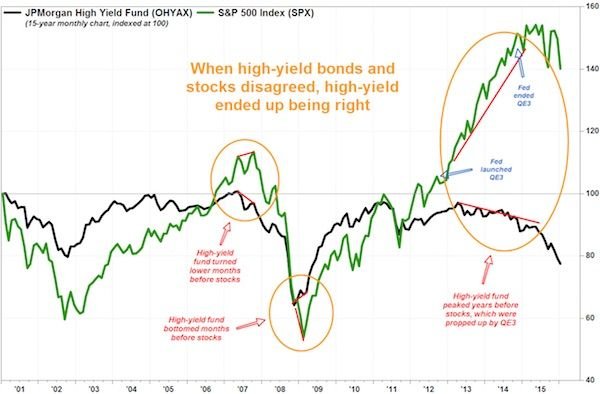

One of the thing concerning me at this time “Very well said by Gregory Mannarino the Robin Hood of Wall Street” is a major divergence between what the S&P 500 is doing, and high yield bonds over the last 10 years.

“This divergence really got started in 2012, and the red line denotes where we are today. What this chart is demonstrating is the difference in performance between stocks and high yield debt however, we are reaching extremes-meaning one of three things will happen. (Possibly a combination of the three).

- Stock market valuations will come down

- Junk bonds will rally.

- Some combination of the above 2 will happen.”

If the U.S. economy collapses, you would not have access to credit.

Banks would close. Demand would outstrip supply of food, gas and other necessities. If the collapse affected local governments and utilities, then water and electricity would no longer be available. As people panic, they would revert to survival and self-defense modes.

If the US dollar loses its status as the world’s reserve currency, it will likely be the tipping point at which the US government becomes sufficiently desperate to implement official restrictions on the movement of people and their money, as well as nationalization of retirement savings.

It’s probably not going to happen tomorrow, but it’s clear the direction the bankrupt governments of the US and most of the West are headed.

Historically, when a nation’s debt exceeds its ability to repay even the interest, it can be assumed that the currency will collapse. Typically, governments exacerbate the situation by printing large amounts of currency notes in an effort to inflate the problem away, or at least postpone it.

This is happening now!

The greater the level of debt, the more dramatic the inflation must be to counter it. The more dramatic the inflation, the greater the danger that hyperinflation will take place. No government has ever been able to control it. If it occurs, it does so quickly and always ends with a crash.

The inflation is actually starting to pick up!

First, the Euro Crash

It’s safe to say that the EU, the US, and quite a few other jurisdictions are nearing currency crashes, and in all likelihood, the euro will go before the dollar. So, unless the EU has already prearranged a new euro, the US dollar might well be chosen as an immediate solution to the problem, as the US dollar is presently recognised and traded throughout Europe. Therefore, a relatively painless transfer could be made.

Then, the Dollar Crash

However, the dollar, which is presently praised as being a sound currency, is really only sound in relation to the euro (and some other lesser currencies). Once its less stable brother, the euro, collapses, the dollar will be exposed.

As the US dollar is a fiat currency and is on the ropes, the US (and any other country that is using the dollar as its primary currency when the time comes) will experience a currency emergency at the street level that will be unprecedented.

The big question that is generally not being discussed is: The day after the crash (and thereafter), what will be the currency that is used to buy a bag of groceries, a tank of petrol, a meal at a restaurant? Certainly, the need will be immediate and will be on a national level in each impacted country, affecting everyone.

And Then…

The US will be prepared ahead of time with a new, electronic currency. This will serve three purposes:

It will allow the US government to blame paper currencies for the crash, in order to distract the public from recognising that the government itself is the culprit.

It will allow the US government to create a currency system that disallows the holding of tradable currency by the population—that is, a debit card would be created by banks through which all transactions must pass, assuring that all transactions are processed by (and thereby subject to the control of) a bank.

It will allow the US government to have knowledge of every penny earned and spent by any individual or organization, allowing for direct-debit income taxation.

Finally cryptocurency to take over?

This article was written eight months ago by Gregory Mannarino

“In order for any currency which includes a cryptocurrency to be a real threat to the US dollar, it would need to be a potential reserve currency. What this means is this cryptocurrency would need to be widely held by central banks from all over the world as to pay off international debt obligations. It would also mean that assets such as commodities, including crude oil would need to be priced in that particular cryptocurrency and not dollar-denominated.

In order for A cryptocurrency to ever become a reserve currency, there would need to be a revolution on a global scale, a war if you will against the worlds central banks, (something I personally wish would actually happen).

World central banks power exists in their ability to force their product, debt units, also known as the Fiat currency, upon the masses, and this is not something that world central banks would take lately. Wars have been fought to support the US dollar, and bring it to a reserve status. In fact the entire Vietnam war was fought for two reasons and two reasons only, and neither of them had to do with the spread of communism.

The Vietnam war was fought to 1. Establish a Fiat monetary system, and 2. To establish the petro dollar system therefore vaulting the US dollar to World reserve status. Therefore you can rest assured that world central banks would resist any new reserve currency with and by any means necessary.

The real threats to a government with regard to the use of a cryptocurrency is the governments ability to collect taxes on transactions, and law enforcements ability to fight crime transacted in a said cryptocurrency.

As for a cryptocurrency making it to a reserve status which could actually threaten the United States dollar, I think is a long shot or impossible at best, at least during our lifetimes.

Could I be wrong on this?

Sure, I'm just giving you my best thoughts on this topic however I would love to hear from you so please feel free to comment and resteem this article.

By Gregory Mannarino”

A Return to Precious Metals as Currency?

A further possibility is taking place in Mexico today. Mexico is remonetising silver. Thus, Mexico will create a legal way for its citizens to protect themselves against devaluation of the peso, whilst creating an internal protection against currency crashes in other countries.

If the Mexican government remains consistent in its plan, it will do more than simply help stabilise Mexico economically; it will serve as an example to other countries that when the Goliaths of the euro and US dollar fall, there is a very sound alternative.

Further, the more countries that follow this policy, the more silver (and for that matter, gold) would become an international currency. It would matter little to a petrol station owner in Canada, Australia, or Chile whether his till was filled with coins marked, “Mexico,” or whether they said “Iceland,” “New Zealand,” or “South Africa.” After all, an ounce of silver is an ounce of silver, no matter what the issuing country is.

Unfortunately there’s little any individual can practically do to change the trajectory of this trend in motion. The best you can and should do is to stay informed so that you can protect yourself in the best way possible, and even profit from the situation.

I think everyone should own some physical gold. Gold is the ultimate form of wealth insurance. It’s preserved wealth through every kind of crisis imaginable. It will preserve wealth during the next crisis, too.

But if you want to be truly “crisis-proof” there's more to do…

Most people have no idea what really happens when an economy collapses, let alone how to prepare…

How will you protect your savings and yourself in the event of an economic crisis?

End

Has there ever been a currency that lived longer than about 70 years?

My grandma experienced 4 different currencies living in eastern Germany. Since 2001 its the Euro, but how will that last next to conservative, anti-european political trends in many neighbour countries?

Currencies, mostly those influenced by many economically different countries chance fast.

So in the longer term, holding Euros is almost as speculative as trading certain assets in the stock market lol

Physical things like gold are pretty safe in the longer term, many people will get it anyway in upcoming financial crises.

But knowing how the market works and managing your investments adapted to economic circumstamces is the best way in my eyes to keep money and wealth safe for the future.

Well said, thank you!

I personally think that its gonna be a mess if the popular fiat currencies die.To be honest cryptocurrencies are something I would rely more on because I think people are going to lose trust in anything else but a "imaginary" currency that can't be touched and in the same time has no connection with the government.

I hope things like that don't happen because only those who are prepared the most are going to be living good while the rest might starve.

Thank you for contributing to the Steemit Community.Keep up the great work and I'm looking forward to your next posts.