We now all know that the Dot-com bubble was just that, which resulted in major losses and lots of IT companies going bust. It was a classic case of a bubble where prices soured and while it happened not a lot of people were asking themselves how it was possible. The next major phase of all bubbles is that they burst. In the beginning, people don't even see the declines, then they ignore it and when 70% is lost they are depressed and stop investing for a few years, losing their chance to get in cheap...

So as the Crypto enthusiast as I am, I was wondering in what ways the current crypto market (2018) is to be compared with a classical bubble and in which ways it compares with a very well-known bubble like the mentioned Dot-com bubble.

So to make this comparison, I started with selecting a graph that would closely represent the Dot-com bubble. It was obvious to me that I should use the NASDAQ index, it pretty much was and still is holding the world's most important tech companies. Below you can see this chart

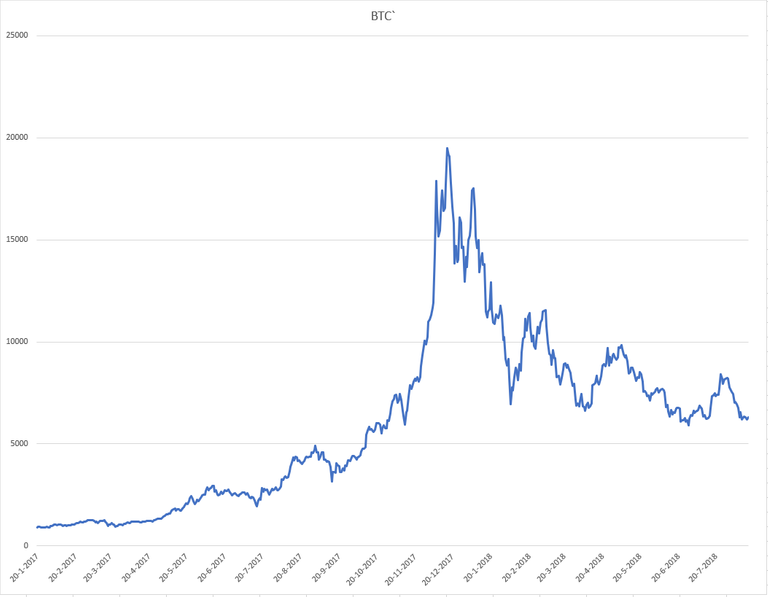

So all I had to do now, was to compare this chart with Crypto's flagship, Bitcoin. Below you can see Bitcoin's chart

Do you already see the similarities?

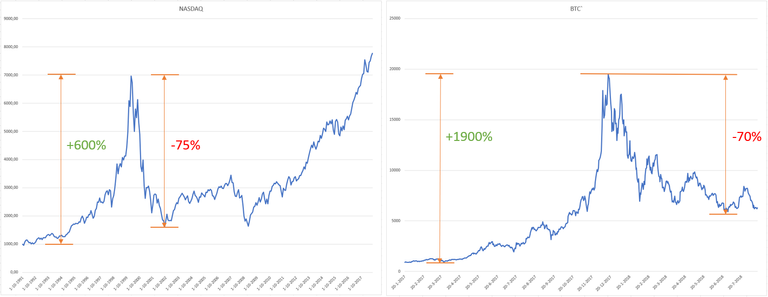

Let's put both charts side by side and mark the comparable parts:

________________NASDAQ_______________________ BTC____________

First Impressions

- The speed of climb and fall of both charts look very familiar. Prices increase exponentially but they fall even faster

- NASDAQ takes a much longer time to reach its top and to fall back. Bitcoin does it about 10 times faster.

- NASDAQ's percentage increase is 1/3th of that of Bitcoin's (+600% vs +1900%)

- They both fall with about 70%

- NASDAQ needs about 15 years to recover to its top

Some wild conclusions and thoughts

We don't know for sure yet if Bitcoin is at its bottom. Even more so, seeing that Bitcoin's moves are much faster and much bigger, It would not be strange for Bitcoin to fall more than NASDAQ did. Bitcoin's increase was more than 3 times of that of the NASDAQ. so why would it not fall more also (like 80 or 90%). Doing so would bring Bitcoin's bottom between 2.000 and 4.000 Dollars.

If this is to be Bitcoin's bottom, looking at the speed in which it moves relative to the NASDAQ (10 times faster), it should recover above 20.000 Dollars in less than 1,5 years.

So what are your impressions and conclusions?

"Financial Liberty comes from decentralization"

Golden @ https://twitter.com/Goldenized1

Congratulations @moneyyou! You received a personal award!

Click here to view your Board

Congratulations @moneyyou! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!