The XRP token has been experiencing issues lately in being listed on major exchanges despite it being the third largest token by market cap.

Coinbase and Gemini have both passed on the opportunity. Gemini was offered "... a $1 million cash payment ... to list XRP" and Coinbase (GDAX) was offered "... $100 million worth of XRP to start letting users trade the asset". Neither exchange clearly explained their decision; however, Coinbase did refer "Bloomberg to the exchange’s listing framework."

In reviewing the listing framework, it does not take long to see some potential issues with Coinbase listing XRP.

Under section 1.1, we see an issue:

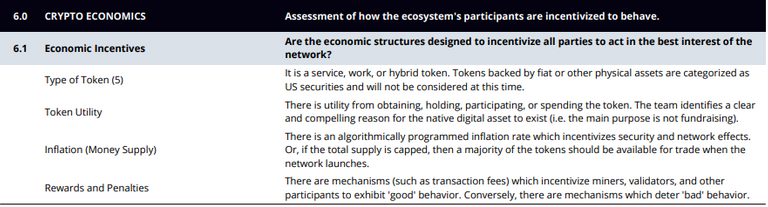

"Open financial system is defined as being available to everyone and not controlled by a single entity." The token is controlled by Ripple Labs which also owns "about 61 percent — or $16 billion worth — of XRP" out of the "... 100 billion XRP in existence". As we read on, we can see another issue in 6.1 under "Type of Token (5)".

XRP may be a utility token as its purpose is "To protect the XRP Ledger from being disrupted by spam and denial-of-service attacks" This is done by having "each transaction ... destroy a small amount of XRP" known as drops.

I believe that this utility aspect is what is preventing the token the most from becoming listed. As a result, Ripple's head of strategy is suggesting the view that: "We absolutely are not a security. We don't meet the standards for what a security is based on the history of court law,".