2 days ago, the cryptocurrency market witnessed a flash crash across virtually the entire market. Bitcoin, Ethereum and other leading cryptocurrencies dropped several percent in a few moments. Even some stablecoins peg faltered a little at the peak (these were very subtle movements but one could see the nervousness that prevailed at the time). What was the trigger for this flash crash and how the prices of cryptocurrencies may evolve in the future. I will try to outline this in today's post.

According to the CoinMarketCap website, just before the crash the total market capitalisation was $1,099 trillion. A few moments later it was down 5%. It may not have been a cataclysmic event however the price wall downwards certainly impressed some.

HIVE was not the cryptocurrency that withstood these declines. Here, the price drop was around 9% bringing the price of this cryptocurrency below 30 cents for the first time since the end of June this year.

What could have been the reasons for this flash crash? At the time, it was reported that Elon Musk had sold some of the Bitcoin he held as part of SpaceX. Surely such news would have been the catalyst for some pretty strong price movements. Particularly because for some time now Elon has been associated with the world of cryptocurrencies and the already very popular DOGE cryptocurrency. Others may look for the reason in the fact that Evergrande, a very large Chinese developer has filed Chapter 15 bankruptcy protection. An additional reason, however, rather the least crucial at this particular time, is the market's belief that the Federal Reserve wants to keep interest rates at higher levels for an extended period of time. This is probably some explanation if we think along the lines that Bitcoin is nevertheless a highly speculative asset and high interest rates are unlikely to attract investors to aggressively buy cryptocurrencies. However, it is not without reason that opinions have arisen that Bitcoin is an creation of low (virtually zero) interest rates. Furthermore, there will be a separate post on my blog about this topic.

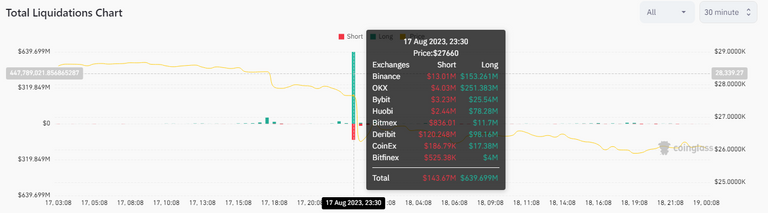

Before going into my personal opinion of the crash and a summary, I would still like to mention the scale of liquidation that occurred during the crash. Referring to the Coinglass website, at the time of the crash, positions of almost $800 billion were liquidated.

What was it really like? Did Elon actually cause the market crash? At this point it seems a thesis worth approving. However, in my opinion, it was just the spark that ignited the haystack left in the middle of the field. For quite a long time, the market had been moving in a fairly narrow consolidation in the $29,000 to $31,500 range. In addition, liquidity in this market had gradually declined. These were no longer the volumes we saw two years ago or even a year ago. These two aspects combined together - very low volatility for Bitcoin and waning liquidity is the perfect explosive mix for a price change whenever there would be some event hitting the cryptocurrency market directly or indirectly. Problems with some exchange, a renewed lack of confidence in some stablecoin or a hacking attack on some project that has a large market share. These are examples that would cause a small panic in the market. However, with these two previously mentioned conditions, the price changes became more dynamic by which it drove the price down so sharply in a few moments.

The opinion that Bitcoin is unattractive due to the level of interest rates seems reasonable but in the long term (it is unlikely that one decision within 5min would cause the market to fall by 10-15%). It is likely that such an opinion that is grounded in macroeconomic factors is more or less true at certain times but it is a factor as I wrote, long term and hard to translate into any price models.

And what about future cryptocurrency prices? Well, of one thing I am sure. For sure the chart will go further to the right. I'm not a fan of price forecasts so I certainly won't write you the exact price every cent right now. What I would like to point out, however, is that over the next few days or weeks the price of the major cryptocurrencies may stabilise at current levels due to the continued relative fear in the markets. However, in the longer term, the price may return to earlier levels where further narrow consolidation may occur again with low liquidity (i.e. again an explosive mix is ready). The second option is a further wave of fear, perhaps fake news and another cryptocurrency sell-off. This option, however, is less likely for me. But what time will show - we shall see. This paragraph is just my subjective opinion of the current market sentiment (don't take this as a forecast, I advise you well).

If this article has interested you in any way, please leave an upvote or comment, thank you.

Thank you and until the next time, Nervi.