What's the difference between EOS and ETHEREUM?

Go on coinmarketcap.com and you'll see a couple things:

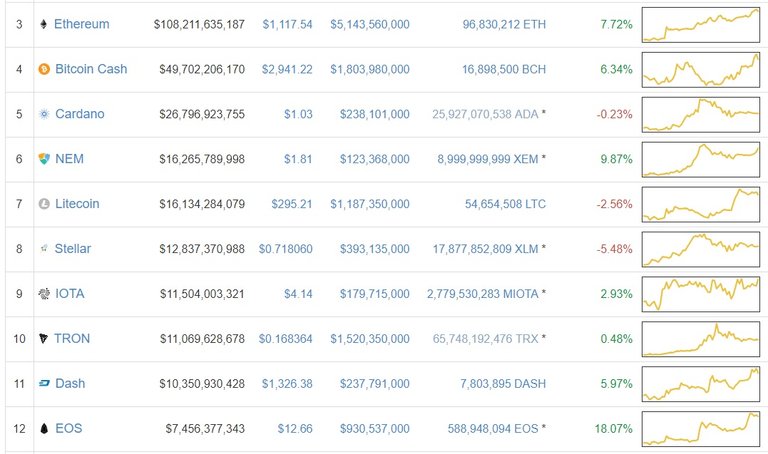

First is that Ethereum is in 3rd, has a HUGE market cap of 108 billion, and is clustered up with Bitcoin Cash, the original Bitcoin, and some other big projects like Ripple (XRP) and Cardano (ADA). All of them have a market cap of at least 20 billion dollars.

Second is that if you scroll down to 12th place, you find EOS with "only" 7 billion dollars.

What's the difference in programming for it?

EOS uses the C++ programming language, which is harder to learn BUT has the advantage of being able to do more than Solidity and being easier to audit so you know how it'll run once the dAPP is launched.

ETHEREUM uses the Solidity programming language, which is similar to javascript and easier to get into for the millions of people who know a bit of web development, but also easier to make programming mistakes on, which could cost users money.

Once launched, a dAPP is hard to patch so there are major advantages to a programming language that is

What's the difference in blockchain structure?

EOS uses dPOS (delegated proof of stake) which is slightly more centralized and arguably less secure than Proof of Work BUT has the advantage of being able to process many more transactions per second.

ETHEREUM uses POW (Proof of Work) which is super, super secure but can only process up to about 10 transactions per second.

- Ethereum plans to use sharding in the future, which is an advanced way to break up the blockchain and enable more transactions by burdening processors with less demands. This is still under development however.

- Ethereum might switch to PoS in the future.

Which Coin Can Make Me More Money?!?

Ah. The billion satoshi question! ;)

- If Ethereum fails to surpass Bitcoin's marketcap as per historical norms, then it could only double in marketcap and roughly per-coin value before running up against bitcoin whereas...

- Eos has a marketcap of only 7 billion dollars, which is less than a tenth of Ethereum, so if it really takes off then it could go up TWENTY TIMES in value!

This of course assumes that Bitcoin's market cap stays stagnant, Ethereum doesn't surpass bitcoin, and EOS takes off

Other scenarios include bitcoin rising and pulling the entire market up along with it, in which case EOS and Ethereum will both go up in value, the "Flippening" finally going down where Ethereum's market cap surpasses that of Bitcoin and leaving EOS users in the dust, and the very unlikely (I think basically impossible) scenario of EOS going up roughly 35x in value to overshoot Bitcoin.

So which is better?!?

That depends entirely on how much you want security against attackers vs security in programming, how fast of a network you'll need to run your dAPP, whether you think Ethereum will roll out sharding in a reasonable time and whether you think EOS is going to deliver on its promises and select good delegates as well as whether you're in it to invest in the possible growth in future monetary value or the usefulness of it as a network!

Ivan on Tech goes very deep into this in a video of his, so I'll drop a link to his video below:

Hopefully this answered your questions, and if you have questions drop me a comment below. If I made a mistake somewhere or you have info I didn't include, do let me know down below because I'm always looking to learn more about what I'm invested in!

Cheers!

-CryptoTrucker

You mentioned that C++ can "do more than Solidity", but solidity is a Turing complete language, so you can literally write any possible program with it. That said, being able to write any kind of program isn't the only measure of the utility of a language, and C++ certainly has a number of advantages over Solidity, like portability, speed, function libraries, community...

Also, DPOS "is slightly more centralized and arguably less secure than Proof of Work" is a pretty big claim. At the very least, both of these points are arguable. @Dan has addressed both of these points at length in his blogs as have many others. Some POW may be more decentralized in theory than current DPOS systems, but you only have to look at mining pools, The Pareto principle, and lack of leverage against back actors to understand that DPOS is, in practice, more decentralized.

But don't take my word for it, like with everything, put the time in.

@cryptokens all good points, I generally was referring to C++'s longer history, more established community and easier access to libraries, guides, etc. My question is: aside from being designed for ease of access to web developers, does Solidity have any major advantages over C++?

*As far as DPOS vs POW, I guess I'm being a bit of a purist. But you're right in that mining pools do regularly sway the boat like whales, especially in Bitcoin! I should read up on Dan's posts, they sound interesting. Especially the leverage against bad actors part, I generally am worried that in DPOS a rich investor could just buy up tons of tokens, get delegated, and guide the network in a way that benefits him just like mining pools do in POW.

Holy crap! You're right though in that at least POS has the advantage of speed, transactions per second. Yeah, dude you're making me think here, I like that! Imma upvote you on this because I think that you've changed my mind about POW vs DPOS, I never really considered it from that perspective before! Any links to these articles of Dan's?

Now what does the pareto principal principal hafta do with crypto? I generally refer to the pareto principal when it comes to language learning, or the infamous application of fuel economy standards and their effect on the price of automobiles.

Thanks for the reply Cryptokens, you're making me think with this! I like this :)

No problem, thank you for getting involved. Pareto principal in language is the same 80/20, usually in reference to word/grammar frequency and use. The insight being, you spend 80% of your time with 20% of the language. Its basically the same in Economic systems, but results in 20% of the agents having 80% of the wealth, and this is recursive, so within that top 20%, the top 20% have 80% of that wealth. This is kind of how capitalist (and other) systems work. You can notice this trend and our long standing response to it with things like anti-monopoly laws. POW and POS systems also have this issue. DPOS does as well, but there it should be limited to the accumulation of wealth, and somewhat isolated from the infrastructure/governance of the system. In POW and POS the miners/mining pools or stake-holding validators/producers and the 80/20 effect are so intertwined that pareto drags you towards monopolization, thus the 3 mining pools that control 50+% of Bitcoin hash rate, 2 pools in Ethereum, as of today.

So dPOS splits the baby by having the possibility of delegates who are not necessarily monetary stakeholders? What's a good article so I can read more about delegated proof of stake... ?

Is it like how steem has socially staked Witnesses that are voted for as well as people who hold large amounts of vested monetary steam power, they're not the same but both groups help secure the network and resolve conflicts in the blockchain?