It was refreshing to see that an analyst at a bank actually thinks that cryptocurrencies could be worth a lot more than they are today instead of the usual doom and gloom, "pyramid scheme", "ponzi", "bubble", warnings that we've been accustomed to. $10 trillion would represent an approximate 12-13x increase in current valuations from today and while i sort of agree with his conclusion, i don't agree on how we get to that point.

People aren't going to sell one third of their gold

The tl;dr of the article was that people would take a third of the approximately $30 trillion in assets held in gold and other offshore funds and invest in digital currencies which serve as a store of value. I just don't see people selling one-third of their gold to park it in cryptocurrencies instead. Can you imagine grandma or your parents, old-world money, selling one-third of their gold? They tend to prefer hard assets like property, gold and silver.

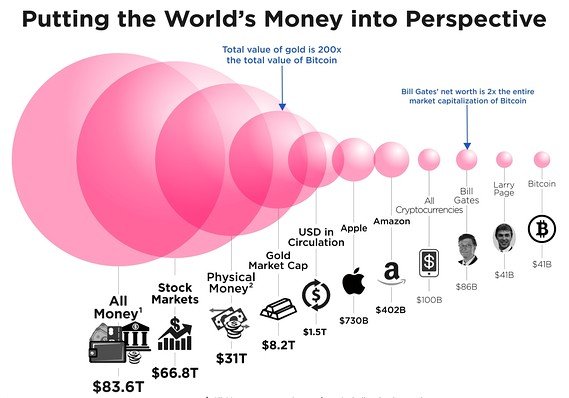

The infograph above from howmuch.net is slightly dated but i haven't seen an updated one so do forgive me. Things haven't changed all that much apart from the bitcoin valuation though. According to the chart, there's about $84 trillion worth of money and assets out there in the world. How much of your own net worth are you willing to put in crypto?

Let's say you have $100 k net worth right now, would you be comfortable putting 5% of your net worth in cryptocurrencies? That would be about $5k. Personally, i think for most people right now, 5 - 10% represents a sort of upper threshold mental barrier as to how much they are willing to invest. Purely anecdotal based on conversations with friends and family.

As cryptocurrencies mature, i think we'll see more people willing to put up to 10% of their worth in cryptos and 10% of 80T gives us 8T... close to the $10 trillion number by the RBC analyst. I've simplified the calculations - money is inflationary and it is likely that the total value of money/assets will be more than $80 T in 15 years.

Are we in a bubble?

When talking about crypto with friends and family, it is almost impossible to avoid those who claim that it is just a massive bubble that is going to end badly. These comments have been around even when bitcoin was worth $1 but they're becoming harder to brush aside when you see articles like this, pointing out that the Ripple founder is now worth more than the Google founders.

My argument has always been that all prices are in a bubble- whether it is the price of a house in Vancouver, the price of an ounce of gold, or even the price of a burger, all prices are controlled by supply and demand. If there's a lot of demand and supply is scarce, we'll see prices go up. If there's a lot of supply and no demand, then prices will crater unless the suppliers are willing to HODL.

If you have read the classic book, Manias, Panics, and Crashes: A History of Financial Crises, you'll notice that almost every crisis begins with buyers not showing up one day. They don't show up because they're already fully invested and prices have risen too far, too fast.

That's the one danger i see with crypto today. A lot of terrible projects getting funded means there are a lot of bag carriers. These bag carriers are then unable to invest in good crypto projects since their funds are tied up. When everyone is left holding bags at the end, a sudden drop in price will have everyone rushing for the exit. Say no to shitcoins.

When the NASDAQ crashed back in '00-'01, it had a market cap of around 5 Trillion. A lot of money has been printed between now and then but it would be interesting to see how cryptocurrencies react as it approaches that old psychological threshold. Till then, i think it will be clear skies ahead.

Title image: pexels

Interesting and useful information! I don't know much about investing and cryptocurrency, but if it can make me rich, I would have to study it.... Thanks so much for sharing! ;)

p.s. While typing this comment, I am standing.... So, I'll have a slender shape....., right? ;D

Hahaha definitely... extra 50 calories burnt every hour. I'm standing and typing this too :)

Oh! That's really great! I'll try to do it very often.... ;))

Great news the Bankers are starting to accept that they can't win.

Decentralization is here to stay, cryptocurrecies will kill fiat over the next 10-20 years, mobile crypto wallets will be the norm, nobank accounts, one third of Kenyans have a mobile hone wallet already.

Keeping the crafty bankers from centralizing some coins and pumping the price and then ordinary people losing their money when the coins are dumped will be a challenge.

bankers coin ripple is centralized owned by the bankers and someone (banks) bought 900,000 ripple dec you can see the transaction on the blockchain at youtube

Nick

Certified Bitcoin Professional

Yeah the banks getting involved in crypto has me a little worried. I recall reading recently a book that mentioned how the banks getting into commodities, both physical and paper, resulted in the huge price swings in the mid to late 00s.

Had real world consequences when the price of wheat doubles / triples for those who cannot afford it.

Yes agree!

Smart money moves much faster than any news, predictions, or statistics. All those are lagging behind. So we see so much money already being poured into cryptos. This is sign number one, that blockchain and cryptocurrencies are here to stay.

Trillions will be cool, but who knows what is going to happen? And that makes it exciting.

Definitely, @onetree. If 6 years ago someone told me 1 bitcoin would be worth $20,000 some day, i'd think they were crazy! :)

Knowing that recently almost all official banks analytics were wrong.... is this the number? Or can that be much higher than 10 Trillions?

Yeah it could be much higher. I think 10-12% of total value of all assets and money makes sense so depending on how that has increased, we could see crypto worth much more as well.

Good analysis. I am rather new to the cryptocurrency world, and I am looking to learn all I can so I found your article informative. I agree with what you had to say about bubbles. Some of the value increases may be due purely to speculation, but these currencies are designed to serve a purpose, so even if some bubbles burst I think there would still be some real value left in many of them. And we could still be in the early stages of this whole process.

Indeed, just as with the dot-com bubble, there were good companies like Amazon, Cisco and there were terrible companies like pets.com. In the end, 16 years after that bubble crashed, we're higher than we were back then. :)

Good point, the quality companies endured the bubble bursting. Also, the housing market has climbed back from what I understand. As long as there are products of substance, they will endure a speculative market correction, and cryptocurrencies definitely have usefulness. The cryptocurrency blockchain system is likely the future of money from what I can see.

What if I told you today steem may worth $20,000 in the next 6 years, would you beleive or think I am crazy and day dreaming.

Haha i can see steem going into the 100s but 1000s might be a bit of a stretch. Stranger things have happened though. Gotta HODL :)

Seem like the banking world is finally upping their game. It's good that they are finally seeing the real value of the crypto market. Also 10 trillion is a massive number, makes you.wonder how high the price of Bitcoin would be in 15 years. Now imagine the price steem 15 years later. Thanks for the interesting article

Have a nice day.

Thanks for reading, @riovanes. I think good coins like Steem/SBD are going to be higher than they are today... hopefully without a lot of turbulence along the way.

Interesting question on valuing steem. On one hand, a rising tide lifts all boats and that should lift steem prices higher. On the other hand, i think steem is terribly undervalued. That tron and bitconnect are/were valued higher are just some examples.

I truly hope cryptocurrencies continue their advance. I think the crypto market in 2018 will make the crypto market in 2017 look as boring as the bond market. We'll see.

It is hard to predict how the market will advance but i think we'll see another good year or two before some pain sets in. Like i mentioned, there are still a lot of buyers out there right now so it will be a while before we run out of them :)

i thing the same

i am new hope you upvote me and support me thanks

I know how hard it is when starting out. Here's my upvote. By the way, there are some useful guides for newbies you might want to check out. @hitmeasap has a nice series of guide that are worth checking out: https://steemit.com/writing/@hitmeasap/how-to-increase-your-followers-loyalty-on-social-media

thanks dear

interesting posts I like your posts. because your post can be an insight for me and users steemit .. post interesting .. thanks for you.

Thanks for reading, zainuddin! :)

This post has received gratitude of 1.67 % from @appreciator thanks to: @numpypython.

This post has received a 10.09 % upvote from @upmyvote thanks to: @numpypython. Send at least 1 SBD to @upmyvote with a post link in the memo field to promote a post! Sorry, we can't upvote comments.