24 September 2017

Asia's hump, Asia's cliff

The Asian hump and cliff (before 6am) made its reappearance, while the "recovery" in crypto prices continued.

What does recovery mean in this context? Korean trade was again predominant in a light market. Ethereum saw a hump. Bitcoin and the others described a cliff. How much can this be considered significant when trading is so comparatively thin?

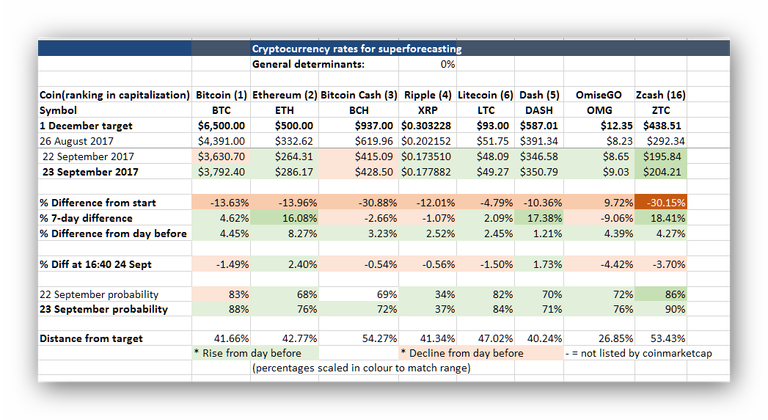

Bitcoin and ethereum are still some 14% below 26 August prices.

Ethereum is 16% up on 7 days ago, while Bitcoin is up 4.62%. Bitcoin Cash is 30% below 26 August, gained 3% on the previous day and remains more than 2.5% down over 7 days.

Bitcoin may be 42% below the $6500 target I set for it, but it is still 88% likely to reach it, on my count, while ethereum, though equally far, is 12% less likely to achieve the goal.

Ethereum mainly a one-source show?

Maybe that has something to do with the report that one source is responsible for more than two thirds of all ether trades.

The strange case of Zcash

Look, too, at Zcash. It is 30% below its 26 August rate. It is 53% from the $438 target, but its probability of reaching it I put at 90%, purely on its recovery from volatility plunges.

The moral seems to be: stay out of trouble and you'll do all right.

Excel version

Click here for an Excel 1997-2003 version of this table with records for every day until now, free for download. There's also an Excel version of the shorter summary screenshot used above.

Superforecasting

Indicators

I've listed my seven indicators and explanations of what I consider important here.

Congratulations @nusefile! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP