10 October 2017

Bitcoin rules

With all the attention on Bitcoin – will it reach $5000? – mainly at the expense of other cryptocurrencies, I thought it might help you to see what the others say they have to offer.

Crypto: A brief what's what

As of mid-September, 866 currencies were listed on coinmarketcap.com. I am tracking only seven for my league tables, since these are the most attractive to tradiers.

Tether, supposedly tied to the US dollar, is a bit of a sport, so I lett it out. NEO (7th largest for market capitalization), focused on Chinese traders, and Qtum, the 6th, (built by "the best team out of China and Asia" as a business applications system), have little purchase on the trading market at the moment.

Even Dash accounts for only 1% and Zcash 0.72%, while OmiseGO is as low as 0.69%. No wonder OmiseGo is nearly 40% off achieving a 50% price rise in three months.

Bitcoin (BTC)

This is the original cryptocurrency. Its website describes bitcoin as "a new kind of money". This is the coin that is up 684% on the year, making some people wonder whether they have missed the boat. Since with ethereum and ripple the rise has been 2385% and 3172%.

Like its rivals, the website is mainly puffery, but it has a page of "things you need to know" about bitcoin:

- You are responsible for securing your wallet

- Bitcoin price is volatile

- Bitcoin payments are irreversible

- Bitcoin is not anonymous

- Unconfirmed transactions aren't secure

- Bitcoin is still experimental

- Most states require you to pay income, sales, payroll, and capital gains taxes on anything that has value, including bitcoins.

That's better than most sites I've seen.

For individuals the website boasts "Bitcoin is the simplest way to exchange money at very low cost.". For businesses it offers accounting transparency as well as irreversible payments and multi-signature facilities.

Note it does not about the speed, except in contrast to banks that make you wait three business days and may charge you for international transfers.

Ethereum (ETH)

This is the rival to bitcoin not as a token to store value independent of traditional currencies but because of its

- ability to do more than hold tokens

- expandibility (bitcoin is limited to 21 billion BTC forever).

As the website says:

Behind it is the Swiss nonprofit Ethereum Foundation in Crypto Valley, between Zurich and Zug.

Notoriously, it allows you to create your own tokens, crowdfunded through Initial Coin Offerings (ICOs), many of which have turned out to be worthless or scams. Could this bring ethereum down? It's not clear. ICOs are often obscure to understand, but this is often the best way to target particular activities, and the smart contracts facility offers unrivalled opportunities for cheap and reliable control systems. The United Nations and major companies are already working on using the ethereum backbone.

Ripple (XRP)

"Built for enterprise use, XRP offers banks and payment providers a reliable, on-demand option to source liquidity for cross-border payments."

It says its payments settle in 4 seconds, compared to 2+ min for ethereum and 1+ hours for bitcoin. Traditional banking takes 3-5 days.

It can handle 1500 transactions per second, 100 times more than ETH, while bitcoin chokes on more than 3-6.

It's moved recently into Singapore and South Korean and now Mumbai. But has it pinned its colours too closely to the banking mast? It has spectacular ups and downs, though its 90-day performance is 40% up, more than Zcash though well behind bitcoin or ethereum. It's 10 October rate was 8% down on the day, mainly a result of Bithumb Korean trading (51%).

Bitcoin Cash (BCH)

The baby on the block. I haven't dealt with this in detail because it is a split-off from BTC and requires the bitcoin community to use it if BCH is to be accepted. Previous owners of BTC before the split -- designed to speed up transaction rates and enable bitcoin to scale up -- get the BCH equivalent of the BTC. But it is 40% down on its price 30 days ago. Acceptance is slow, perhaps because BCH minting is less lucrative and more difficult (requiring much more computer power and electrcity) than BTC.

Litecoin (LTC/XLT)

Litecoin advertises itself as ideal for small-size purchases.because of the speed of its transaction confirmations and lists featured merchants who accept litecoin for "clothing and apparel, food and drink or even a flight abroad".

Several of those prominently featured are out of business or not responsive, which may account for its poor 30-day performance. Perhaps the appeal of fiat-free ordering of goods is not as great as litecoin's creators think. But for an example site, see this. Even here its latest blogs are from 2016.

Dash (DASH)

This wouldbe Paypal killer's creators say "we want digital currencies to be so easy to use your Grandma would use them".

"Dash Evolution will enable you to signup and access your Dash from any device and transact as easily as you can with PayPal, but in a fully decentralized way," it declares.

Its other notable feature is its peer-to-peer network of miners (coin mintersIand masternode owners who are rewarded for validating, storing and serving the blockchain to users, speeding up transactions.

"With Bitcoin, the miner who solves the problem first gets the entire block. Yet with Dash, the block rewards are apportioned: 45 percent goes to the miner, 45 percent goes toward so-called 'masternodes,' and 10 percent goes to a treasury account," the DASH website explains.

"This consortium of stakeholders has voting rights, can give input on how to modify its blockchain protocol over time and makes suggestions on how to allocate its budget. Bitcoin, by contrast, is more like the Wild West (read: completely decentralized), making it hard for users to agree on any changes."

This division or revenues also gives Dash a slushfund to support initiatives, such as BitCart.io, an Ireland-based company that buys unwanted Amazon gift cards and resells them at a 15-percent discount, collecting a spread and doing all transactions in Dash. The company avoids traditional bank network fees of using dollars or euros, and it can sell the cards to anyone holding Dash currency around the world. "Last January, BitCart worked only with Bitcoin and that cryptocurrency almost sunk the company after transactions fees skyrocketed &ndawh; erasing the discount for the consumer – and settlement times for some orders ballooned," Dash says.

It has just (3 October) announced a partnership with Wirex, the mobile debit card and VISA app, for a contactless card and held a big London conference on 24 September. These hardly seem to have inspired the market. It had a negative (-) 9.5% price over the past 30 days and -6.14 over 7 days.

The newspage reports that most of the live-chat was in Korean and Japanese -- an indication of where to look for action.

If you want a prediction of an upturn see this YouTube comment.

But the pessimists can also be found, and this was not tackled at the conference:

The release of the Antminer D3 is going to kill most of the Dash ASICs we got in our mining farms. Bitmain's new ASICs will raise the mining difficulty to a new level. While ASICs like the Giant A-900 will keep hashing the way they did before, the amount of DASH coins we will get per day from them will probably be reduced 10-15 times.

The basis of this commentary is that miners are selling off their coins as fast as they can mint them.

OmiseGO

This is what OmiseGo says about itself:

Through the OmiseGO network connected to the Ethereum mainnet, anyone will be able to conduct financial transactions such as payments, remittances, payroll deposit, B2B commerce, supply-chain finance, loyalty programs, asset management and trading, and other on-demand services, in a completely decentralized and inexpensive way. Further, millions of mainstream users in the largest growing economies in the world will be enabled to make the transition from using fiat money to using decentralized currencies such as ETH, BTC, and others.

It adds:

Founded in 2013, Omise is a venture-backed payments company operating in Thailand, Japan, Singapore, and Indonesia, with rapid expansion plans to neighboring countries across Asia-Pacific. In November 2016, Omise was featured on Forbes as Fintech Rockstar.

With its Asian focus it has taken a pasting lately: 7.65% up today, but -29% in 30 days and -8.2% over 7 days.

Zcash

Its main appeal is complete privacy of transactions:

Zcash is the first open, permissionless cryptocurrency that can fully protect the privacy of transactions using zero-knowledge cryptography

Shielded transactions hide the sender, recipient, and value on the blockchain

If Bitcoin is like http for money, Zcash is https—a secure transport layer

Not surprisingly, it carries an endorsement from Roger Ver, the libertarian crypto guru, and Eric Vorhees, a proselitizer for ananymous transactions.

Note: it is not just for criminals and drug users. Companies often want as much confidentiality as possible for their work.

It is 32% up on its price 30 days ago and 13.34% on seven days before, on some counts. But I have it down 21% on its 26 August price, and 11% down over 7 days. It all depends from where you start counting.

Previous days' commentaries

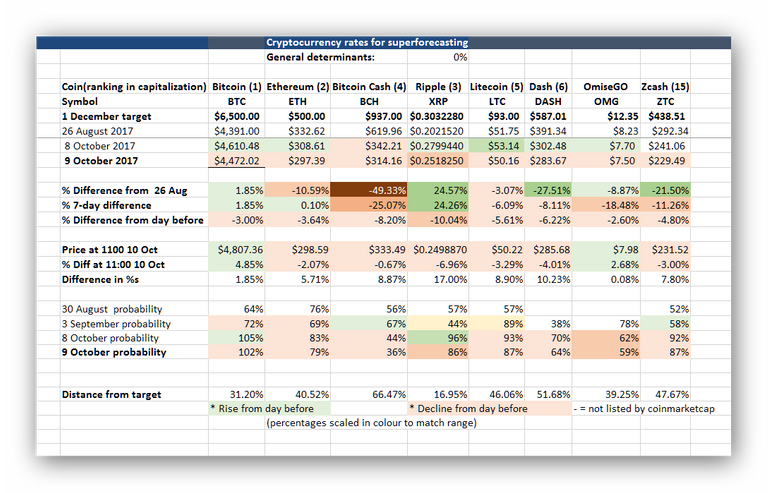

Excel version

Click here for an Excel 1997-2003 version of this table with records key records, free for download.

There's also an Excel version of the shorter summary screenshot used above.

Superforecasting

Indicators

I've listed my seven indicators and explanations of what I consider important here.

You can never solve a problem on the level on which it was created.

- Albert Einstein