Introduction:

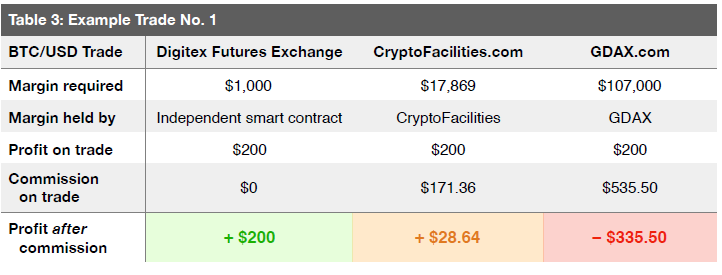

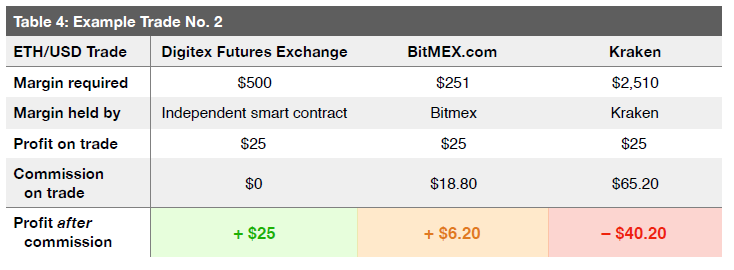

Futures are contracts that specifies the exchange of values at a certain date for a certain price. While the advantages for traders who participate in Futures market, which includes, avoiding high costs and risks of transferring, avoiding costs of storing, etc. are enviable, an underlying problem exist in the Futures market. This problem is transaction/commission fees. These transaction fees can convert profits into losses after commission fees are removed.

Once transaction fees can be removed from the Futures market, then traders can be free to engage seamlessly in the Futures market. This is exactly what the Digitex plans to achieve.

Digitex Futures Exchange:

The Digitex Futures exchange is the very first futures exchanges that is free of transaction/commission fees on the blockchain. Main features of the Digitex Futures Exchange includes:

The DGTX Token:

The DGTX token is the heart of the Digitex platform. To engage in the Digitex Futures Exchange, traders must possess the DGTX tokens.

The DGTX token is an ERC-223 compatible protocol token, and it is based on the Ethereum blockchain, and it is the main currency of the Digitex platform. It denotes the profits, losses, margin requirements and account balances on the Digitex platform.

The creation of new DGTX tokens is the sole reason behind the elimination of transaction/commission fees. When these DGTX tokens are created, it is normal for a slight inflation to occur. However, this slight inflation is counterbalanced by the creation of demand for DGTX tokens by traders, since the traders require DGTX tokens (in the form of “initial margin requirement”) to perform trading in the Digitex platform, a transaction/commission free futures market.

New DGTX tokens won’t be created until 2 years after the launch of the Digitex platform. Hence, the Digitex platform would be operated by the proceeds gotten from the ICO (The DGTX ICO would create an initial supply of 1billion DGTX tokens).

In this 2year duration, trading volumes on the Digitex platform is bound to increase, and this means that incoming traders would have to contend with each other to buy DGTX tokens (limited number). This would in-turn cause the price of the DGTX token would increase, which would result in the reduction of the number of DGTX tokens that must be created to cover imminent costs, and, as you can rightly guess, this would assuage the inflation which is bound to happen when the DGTX tokens are created.

The number of DGTX tokens to be created would be decided by voting, done by traders. 1 DGTX token represents the tick value of every Digitex futures market.

Via the DGTX Peg System, traders can effectively eliminate DGTX price risk from their trades. The DGTX Peg. System is a futures contract that allows traders who own DGTX tokens to lock in a specific sale price at the current market price, against ETH and BTC. For example, if a trader owns 2BTC, and he senses that the BTC price would drop in time coming, he can buy DGTX tokens, then he can use the DGTX Peg System to lock in a sale price, at the current market price. This means that, he can sell his DGTX tokens at that price in the future, even if the price of DGTX token falls. However, if the price of DGTX token rises, he would lose on his peg system trade, since he locked in a lower price.

Vigorous and rigorous efforts are being made to list DGTX tokens on various crypto exchanges. This is to enable the buying and selling of DGTX tokens to be as seamless as possible.

Decentralized Account Balances:

With other exchanges, traders had to trust the exchange with their funds, and this was a scare to every trader. However, traders do not need to trust the Digitex Futures exchange with their hard earned cash, since all funds are held in a decentralized, independent smart contract that is on the Ethereum blockchain. Hence, the exchange does not have a physical grip over trader’s funds.

Automated Market Makers:

Market makers are automated trading bots that possess specialized algorithms. These algorithms are neither programmed to hoard tokens, nor to strip away profits, instead, they are programmed to break even. This their break-even algorithms makes them participate actively in trading, and thus these bots keep the DGTX token(s) in circulation. They are funded by 20% of the tokens currently in circulation.

Bitcoin, Ethereum & Litecoin Futures:

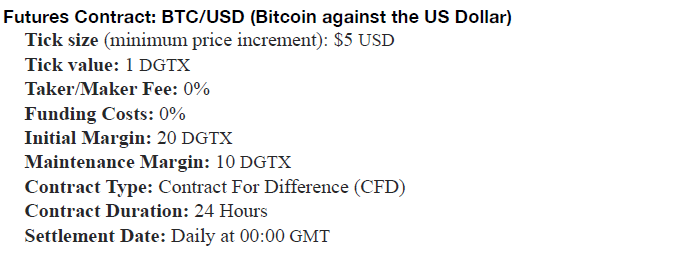

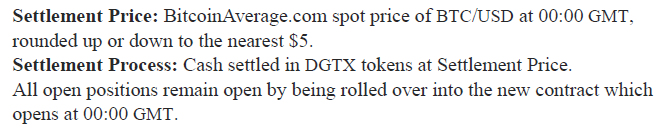

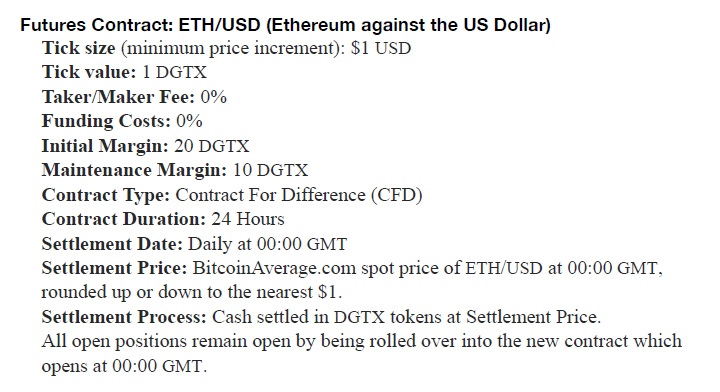

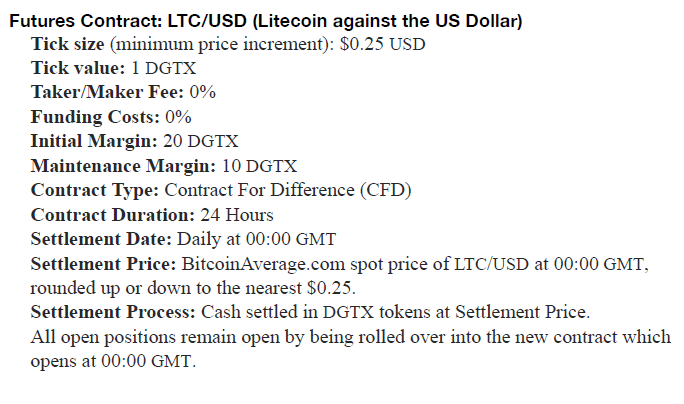

The Digitex futures exchange possess three future markets, viz-a-viz, BTC/USD, ETH/USD & LTC/USD. Each of this future contracts have a large tick size. Check out the specifications of each of the three future contracts.

BTC/USD contract specification

ETH/USD specification

LTC/USD specification

Large Tick size:

A tick is the minimum price increment that a futures contract can move, in the up or down direction. The Digitex Futures exchange possess a large tick size. Infact, the tick size on the BTC/USD futures contract is $5.

User friendly Interface:

The Digitex Futures exchange uses a user friendly interface to enable traders to buy and sell orders with just a single click.

Fast, Private, Reliable and Trustless Futures Trading:

Digitex uses a hybrid model of centralized and decentralized components to ensure trading.

With the decentralized components, traders can make use of the Digitex Futures Exchange without having to trust the exchange with their hard earned cash because the exchange does not have physical possession of the trader’s cash. As anyone can infer, this greatly bolsters security.

With the centralized servers, traders can make use of the Digitex Futures Exchange with the needed speed and reliability in real time, while ensuring the privacy of users.

Decentralized Governance by Blockchain (DGBB):

The blockchain helps Digitex in the generation of its own cryptocurrency, and the issuance of these cryptocurrencies eliminates trading fees, and aids the operation of the futures exchange.

The number of new tokens that are generated is specified by the traders, via an efficient and democratic voting system encoded into smart contracts. Thus, all traders in the Digitex Futures exchanged collectively decide the number of tokens that would be generated to aid operation of the exchange. It should be noted that DGTX token holders can delegate their voting power to a trusted person, if they do not want to play an active role.

Benefits of the Digitex Futures Exchange:

From the features which the Digitex Futures Exchange possess, it is safe to assume that the Digitex Futures Exchange is the future of the Futures market. Some beenefits of the Digitex Futures Exchange includes:

- Absence of transaction fees, hence all profits generated by traders, completely belongs to the traders.

- Traders don’t need to trust the Digitex Futures Exchange with their funds, since the exchange does not hold the funds, instead the funds are held in a smart contract on the Ethereum blockchain, which is independent and decentralized.

- Liquidity is ensured in the futures market with Digitex, since there are no transaction fees. The liquidity of the futures market is further improved via the automated market marker, which is funded by 20% of the tokens currently in circulation are used to trade. This is also to ensure liquidity. This would counterbalance the volatility that is to occur because of dormant accounts.

- Inflation due to the generation of new tokens are counterbalanced by the demand for these tokens since, traders require DGTX tokens (in the form of “initial margin requirement”) to engage in the trustless, commission free futures market.

- Traders can buy and sell, by just clicking

- With Digitex, traders can make enormous percentage gains from a meagre increment in price.

- Digitex makes use of the combination of centralized components and decentralized components to ensure effective and efficient service.

- Via the Decentralized Goverance by Blockchain (DGBB), Traders are in complete control, since they decide the number of DGTX tokens that would be generated to cover the costs of operating the exchange.

- With Digitex, privacy is guaranteed

Use-Case:

Prick the Trader:

Prick is a futures market trader. Trading fees always eats deep into his profit, and this makes life unbearable for him. He hears about Digitex, and he tries it. Check out the following steps:- Prick buys 100 BTC/USD futures contracts at $5,000

- A random trader starts to buy BTC aggressively, and this in-turn causes the price of BTC to increase.

- Prick then sells his 100 contracts at $7,000

- Tick size of BTC/USD futures contract is $5. Therefore, prick makes a profit of 400 ticks on a 100 contract position, which is 800,000 tick profit. Recall, that 1 tick is equal 1 DGTX, so he made a profit of 800,000 DGTX.

- If the current price of 1 DGTX token is $3.0. This means that Prick’s profit is 800,000 * $3.0 = $2,800,000.

- Prick’s initial margin requirement to open his trade was 100 * 20DGTX = 100 * 20 * $3.0 = $6,000. This is what he needed to be able to perform this trade. Recall, that this amount would be held by an independent smart contract, and not by the exchange.

- Commission fees do not exists, hence Prick’s profit remains the $2,800,000.

Conclusion/Summary:

With the launch of the Digital Futures Exchange, a platform that generates its own token to replace transaction fees and ensure operation is birthed. This means that traders can engage in the futures market without the fear of commission fees.

This platform also creates the demand for its own token, by ensuring that traders possess the tokens before they are able to engage in the platform. This would assuage the inflation that is bound to happen with the generation of the DGTX tokens, while also bolstering the platform due to the increase in the price of the DGTX tokens.

With the absence of commission fees, entire profits that traders make belongs to the traders. Check out the images that compare trades done with Digitex against other exchanges.

Simply put, with Digitex Futures Exchange, traders can engage in a trustless, commission free futures market that is liquid, fast and reliable.

For more Resoruces and Information:

Digitex Website

Digitex WhitePaper

Digitex Blog

Digitex Telegram

Digitex Reddit

Digitex Facebook

Digitex Twitter

Digitex YouTube

Digitex Listing:

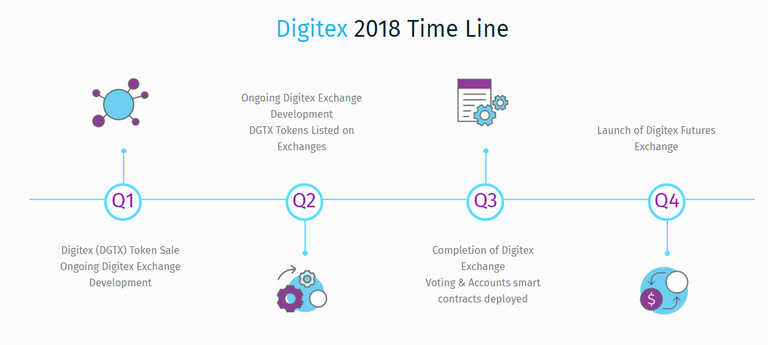

Digitex 2018 Time Line:

Digitex Team:

Digitex Advisor:

Link to Tweet:

This is an @originalworks sponsored contest

digitextwitter

digitex2018 - Traders don’t need to trust the Digitex Futures Exchange with their funds, since the exchange does not hold the funds, instead the funds are held in a smart contract on the Ethereum blockchain, which is independent and decentralized.

This post has been submitted for the OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Hello! I find your post valuable for the wafrica community! Thanks for the great post! We encourage and support quality contents and projects from the West African region.

Do you have a suggestion, concern or want to appear as a guest author on WAfrica, join our discord server and discuss with a member of our curation team.

Don't forget to join us every Sunday by 20:30GMT for our Sunday WAFRO party on our discord channel. Thank you.

Coins mentioned in post: