Preface

Vince Lombardi once said,

“Perfection is not attainable but if we chase perfection, we can catch excellence”

Now, with all the imperfections in the world financial systems, what if I told you about an excellent financial system that it’s currencies have very low volatility yet with high yielding value coupled with high speed transactions? A system where transaction fees are percentage based? A system that enhances money as both a medium of payment and store of value?

Would you hesitate to embrace such system? I guess your answer is as good as mine, NO!.

Why do we even need this system in the first place..?”

The Economist complains,

"FOREIGN-exchange markets are suddenly in turmoil. The Swiss franc jumped by 30% in a matter of minutes last month. Over the past year, the Russian rouble has fallen by 40% against the dollar, while the Canadian and Australian dollar have recently dropped to six-year lows against the greenback. These shifts have proved costly for many in the markets. Alpari, a foreign-exchange broker, went bust, and Everest Capital, a fund manager, had to close its main hedge fund after suffering heavy losses....

Why has currency volatility gotten worse?"

The current market financial system is experiencing severe price fluctuations. Volatility has been one major setback hindering investment in fiat and especially Cryptocurrencies. The cryptosystem is the main victim of this volatility. why?

Because anything that trades in a free market without regulations or in a decentralized network is expected to experience severe volatility.

Now, people prefer to use fiat currencies for day-to-day life transactions but cryptocurrencies for experiments rather than investing solely in it or use it as a store of value because these government issued currencies are based on physical commodities like Gold or silver unlike crypto which is based on fear and faith.

But then, imagine a financial system that uses gold and silver as a store of value to ensure stability of value…but then, gold and silver or any precious metal have no yield attached to them, right?

Yield is mainly seen as the income return on an investment due to holding a particular security or store of money. When interest rates rise on cryptos and fiat it makes Gold less attractive as a store of value. Although there are no value risks attached to holding Gold or precious metal but it even costs more money to keep them safe. The more yields(interest assets like bonds, bank deposits, stocks, shares, etc) in the free market thrives high, gold(including all precious stones) desparately reduces its holding value as it doesn’t produce any yield.

But what about building incentives on gold and silver? What if there a financial system that gives yield to gold and silver by giving incentives on their use and velocity through the attachment of various forms of yields for different levels on participation in the system?

This financial system is then an asset backed digital currency combining the blockchain technology with the most stable forms of value storage but eliminates the slow transaction speed problem bugging the blockchain ecosystem in it own system. A financial system that eliminates the problem of high cost of transaction fees in the blockchain which hinders real life participation by making the fees percentage based?

This is a system that minimizes risks, maximizes incentives and optimizes efficiency. This almost perfect excellent system is Kinesis.

.

Kinesis? Yes, Kinesis.

Kinesis?

Kinesis is a yield bringing cryptocurrency monetary system that uses physical gold and silver backed 1:1 with it’s currencies to ensure stability of value while employing incentives, rewards participation and encourage commerce and economic activities to ensure adoption of it’s system. What makes Kinesis unique is its perpetual incentives, stimulus of money velocity and proportional sharing of the income generated by Kinesis system, appropriated by active/passing participation and capital velocity.

Kinesis Elements

These are the three main components of the Kinesis ecosystem.

Gold/Silver:

Source

Source

Aforesaid, Kinesis currencies are backed 1:1 with allocated physical gold and silver which are the greatest nonvolatile store of value.

‘1:1 allocated’ implies that he value of the currency varies directly in a 1:1 ratio with gold and silver while having a full direct title to the bullion backing the KAU(Gold) and KAG(Silver) coins, which are held by their respective coin owners.

The Gold and Silver are stored in vaults situated in Sydney, Singapore, Hong Kong, Dubai, Zurich, London and New York completely free of charge. The gold or silver can be transferred to other users in the e-Wallet on mobile phones powered by the blockchain technology or easily spent through the Kinesis debit card or Kinesis currencies can be converted back to real gold again and delivered to any user's location.

Yield:

Kinesis unique system attaches a yield to physical gold and silver as incentive for participation in its ecosystem unlike yield that is derived from debt-based interest in fiat currencies. There are several and different levels of yields based on participation, this is the Velocity-Based Yield System.

-Minter's Yield:

Kinesis currencies in the Kinesis primary market. They receive an incentive of 5% share of all the transaction fees on the coins they minted and used thereafter.

-Holder's Yield:

Kinesis currencies in their e-Wallets. They receive incentives of 15% share of all the transaction fees while they hold the coins.

-Depositor's Yield:

Kinesis coins and use them will get an incentive of 5% share of all the transaction fees on their initial deposits.

-Referral's Yield: Lastly, individuals or cooperate users who recruit and refer new users also receive incentives.

Blockchain and Crptocurrency Technology:

This is a proprietary asset-backed and multifaceted finance blockchain yield system.

To avoid asset and market exploitation, Kinesis plans to attract more investors and users in the public and private sectors.

How will Kinesis do this?

Kinesis plans to attract capital from

- Fiat Currency markets that have low and negative yields

- Investment Asset market that have comparatively low yields for stock market and property investments

- Cryptocurrency markets that have no yields currently

- The Precious Metals markets that currently has no yield.

These markets given the low risk, safe and stability feature of the Kinesis Monetary System, will eventually opt for it.

Moreover, in the traditional banking system when a customer deposits fiat currencies, the bank automatically assumes title ownership of the money and usually put these deposits into the market through investments and loans; exposing them to risks. In Kinesis, they wouldn’t do that.. The Kinesis Monetary System(KMS) allocates title ownership directly to the actual owner.

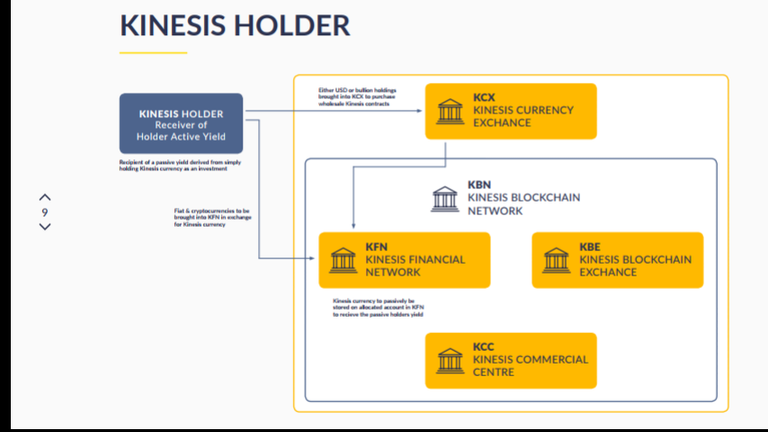

The KMS Components

Kinesis Currency Exchange(KCX):

This is a market where minters create money. This occurs in an institutional centrally cleared exchange with deep liquidity and connectivity into the global wholesale trading organizations via ABX.

Kinesis Blockchain Network (KBN):

KBN is the Blockchain Technology upon which the Kinesis suite is built. Here, Kinesis currencies can be exchanged while still making yields with incentives.

Kinesis Blockchain Exchange (KBE):

This functions as a typical blockchain digital currency exchange where Kinesis and other digital currencies can indulge in trading.

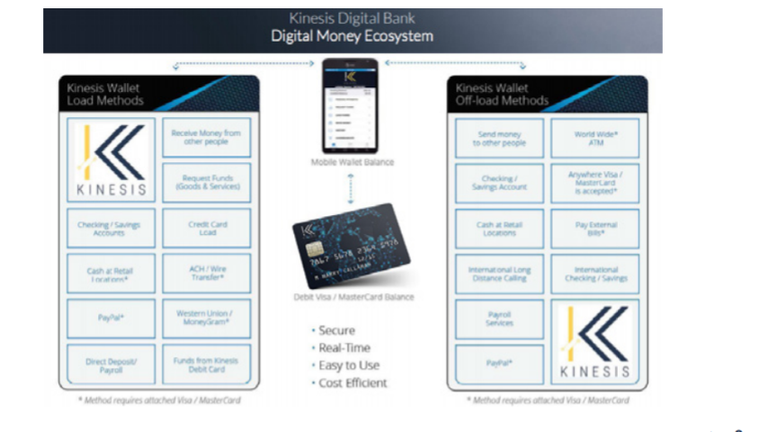

Kinesis Financial Network(KFN):

The KFN serves as a mobile financial system where Kinesis currencies can be user for savings, payments, etc. This also houses the MasterCard and Visa debit card features, thus, enabling the use of Kinesis as a global payment currency.

Kinesis Commercial Centre(KCC):

This is an online aggregator platform that houses all goods and services providers that accepts Kinesis as a medium of payment. This is just like a traditional bank app that shows merchants, POS terminals, shops that accept their cards or sort of ATMs that currently dispenses cash.

Allocated Bullion Exchange(ABX)

Kinesis partners with the public company, ABX to leverage ABX's vast knowledge base and tap into it provided infrastructure. ABX is a world leading electronic institutional exchange base for allocated physical precious metals.

But why ABX? How will ABX help Kinesis plan execution?

ABX will provide infrastructure, aid facilitation of partnerships with external companies through it sector network and vast knowledge base, therefore enhancing the successful execution of Kinesis.

ABX being what it is, will allow Kinesis users to purchase Gold and Silver through it’s exchange platform, MetalDesk.

Kinesis Currency Suite(KCS)

The Kinesis money team has developed a proprietary blockchain system network paired off from the Stellar blockchain for KCS. This fully allocated asset-baser suite will have the following products imbedded in it.

In Reserve and payment Currency:

- Physical Gold and Silver

- Segregated physical Gold and Silver

- Physical banknotes(Euro, Japanese Yen, British Pounds, CHF)

- Digital Currencies (TBA)

In Investment Currencies:

Pair: Physical Silver/Paper Silver.

Since the KCS is paired with stellar, Kinesis leverages the high transaction speed and better security that Stellar offers.

Gold Currency and Silver Currency Descriptions

Gold Currency (KAU)

Description: 1 fine gram gold contract and token, consisting of gold cast bars of minimum fineness of 995, and bearing a serial number and identifying stamp of a refiner as per ABX Quality Assurance Framework, table of Approved Refiner List.

Silver Currency (KAG)

Description: 10 grams silver contract and token, consisting of silver cast bars of a minimum fineness of 999, and bearing an identifying stamp of a refiner as per ABX Quality Assurance Framework, table of Approved Refiner List.

Why Use Gold and Silver?

Gold is used as an hedge against inflation in the Kinesis Monetary System due to it’s non volatility.

Moreover, currencies are backed 1:1 with Gold ensure that it value does not drop. When a coin is backed 1:1 with Gold, it means the value of a gram of gold equals 1 coin if that currency. Interestingly, at the currency's barest price, the coin will always equal the current gold rate and eventually, if the coin becomes popular, it price can actually shoot up irrespective of the value of gold.

Why use Kinesis Over OTC(Over-The-Counter) trading?

OTC transactions in the wholesale bullion market are done through phones, emails or in person. These systems are completely manual, problematic, costly as well as inefficient.

Kinesis offers to change this by introducing its new globally efficient digital system which is actually, highly needed in the market.

Interestingly, Kinesis is designed to solve all the problems of the cryptocurrency market, fiat currency market, asset-backed market and the Bullion market.

Cryptocurrency Market

Problem: Volatility

Kinesis Solution: Introduction of Gold and Silver as store of value

Fiat Currency market

Problem: Inflation and Poor store of value

Kinesis solution: Decentralized through the blockchain and price stability.

Asset-backed market

Problem: No yields, Insecurity and the issue of spending the ‘bad money'(fiat) but hold the ‘good money'(precious metals)

Kinesis solution: Using currencies backed 1:1 with Gold, utilizing the multi-layered third party audit and verification system of ABX's quality assurance framework for security and it using incentives-based features to attract the flow and use of gold and silver.

How does Kinesis open the Bullion Market to regular users?

Producers of precious metals have no direct way of integrating into the wholesale market directly, same goes to the end consumers because the trades routes go through intermediaries, thereby reducing revenue for producers and increasing cost for end consumers. ABX integrates the physical trade cycle, allowing the end consumers to access the exchange directly.

Through the fusion of the trading chain by eliminating intermediaries through ABX, Kinesis makes the Bullion market open to regular users and common merchants. It also breaks the barrier of entry that hindered local merchants from international clients by integrating trading centers, allowing traders to arbitrage the differential.

Average regular users like individuals or organizations that are handicapped in terms of resources are helped by Kinesis to spread and expand their business tentacles to the Bullion market.

Kinesis Velocity Token(KVT) Initial Token Offering (ITO)

.png)

The KVT is an ERC20 compatible utility token. Holders of KVT can earn a percentage of transaction fees from the system. The ITO is currently in pre-sale with the public sale launching on September 10, 2018 through to November 11, 2018.

Kinesis ICO(Initial Coin Offering)

The KAU and KAG coins are on offering for sale of the cryptocurrency backed 1:1 respectively by Gold and Silver bullion. ICO starts on November 12, when the ITO ends.

Use Cases

Peter is a precious metal investor, he invests in Silver. But so far, Peter has only been able to use Silver as a store of value whilst opting to spend his fiat currencies. He doesn’t see a need to invest much in sliver because it brings no yield. Two weeks later, he is introduced to Kinesis by a precious metal merchant. Peter now utilizes the Holder incentive in Kinesis and then begins to gain yields from his silver in his e-Wallet.

Peter now also chooses to become a precious metal merchant. He introduces a lot of his customers to Kinesis and then starts to gain from a stream of reoccurring revenue that in the long run, surpasses the marginal profit margins he had been deriving.

After some years, peter creates a new line of business. He then thought of an excellent revenue system that will boost his financial department. He then recalls Kinesis and happily employs their system into his business. The Kinesis system now help him build an entire new revenue stream, generate more profits, pay employees with and encourage them with incentives, attract more partners and trade creditors.

Synopsis

.jpg)

Source

As we can see, Kinesis does not only profit it’s users or system only. The ideology behind this excellent financial system is open to everybody and can be employed to various financial and monetary disciplines to boost profit and encourage users.

Kinesis promotes money as a efficient medium of exchange and an effective store of value. The Kinesis Monetary System employs Gold and Silver, being the greatest store of monetary value and make it an efficient medium of exchange, thanks to the blockchain and cryptocurrency technology. Concurrently, Kinesis brilliantly enhance money velocity and economic activity in its ecosystem through a multifaceted incentivizing yield system.

Imagine if you had bought even a share of Microsoft some decades back, how much will you be worth now? Think about this…

Won’t you prefer to trade with a system that promises vast returns for holding its currencies, minimizes risks, maximizing returns, enhance fast transactions and the inevitable mass adoption?

Watch my video about Kinesis below

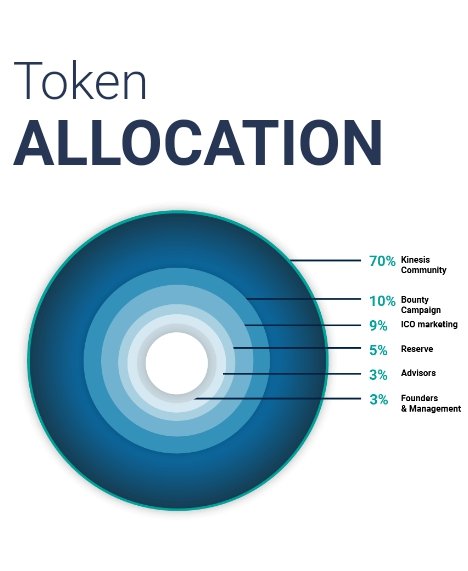

Token Allocation

Roadmap

Watch Kinesis Videos below

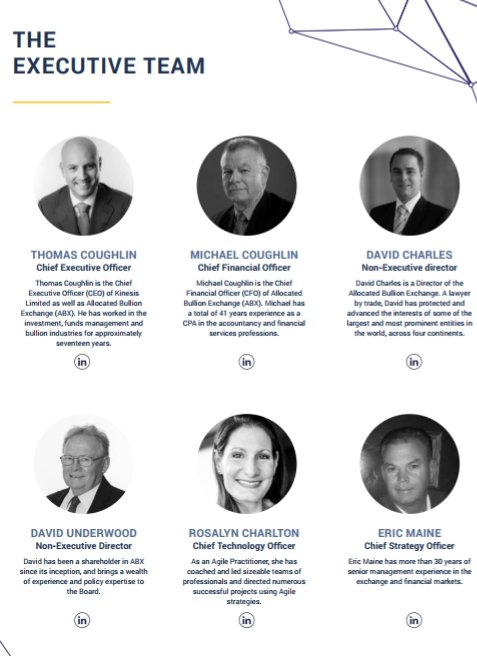

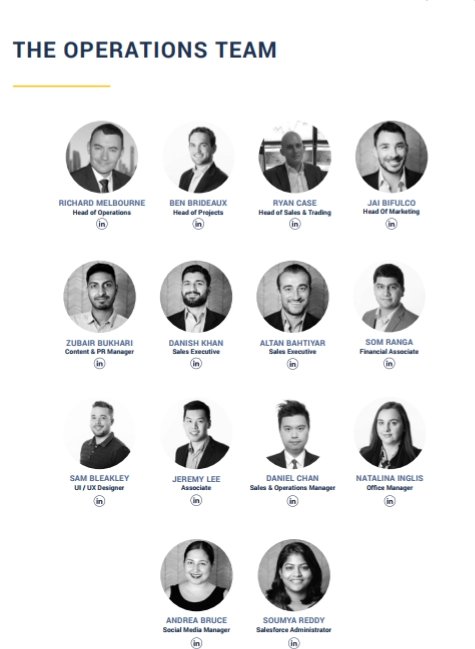

The Teams

For more information or enquiries, visit these sites

Kinesis.Money Whitepaper Summary

Kinesis.Money Whitepaper

Kinesis.Money Medium

Kinesis.Money Steemit

Kinesis.Money Github

Kinesis.Money Youtube

Kinesis.Money Telegram

Kinesis.Money LinkedIn

Kinesis.Money BitcoinTalk

Kinesis.Money Twitter

here to check on the contest.This is a sponsored contest organized by @originalworks. Click

Note: Unless otherwise stated, all pictures and media used in this post are sourced from the sites of Kinesis and are licensed for use in this contest.

kinesistwitter

kinesis2018

.jpg)

Sponsored Writing Contest!

This post has been submitted for the @OriginalWorks You can also follow @contestbot to be notified of future contests!

Your article is well explained and detailed....

Kinesis will be huge..... Welcome back from the break

Thank you bro..

Kinesis will have a huge impact on the blockchain

I agree with the author, @rexdickson!

Yes..!

Kinesis as an almost perfect financial system has so much to offer