Today I will be writing about a topic which I have been introspecting for quite some time but I seriously started thinking about it when I was working on my crypto portfolio for 2024.

I realised that I have been involved with crypto since late 2017 when the incredible bull run of BTC caught everyones attention.

Since then for over 5 years I have been actively reading, researching and writing about the crypto projects I come across. I also try to interact with as many blockchain projects as possible.

This has rewarded me with many big rewards in terms of huge airdrops, sudden gains when an altcoin pumps, big rewards made from the crazy yield DeFI projects, some NFT flips which I was able to catch at right time.

These gains were also paired with many disasters in terms of rug pulls I got scammed by, projects which were abandoned or just died due to fall in demand, games that lost attention of users.

Despite the ups and down I always made more profit than the losses I incurred. However I noticed that whatever profit I made I ended up putting in the next trend or narrative I came across without actually booking any major profits which I could sustain.

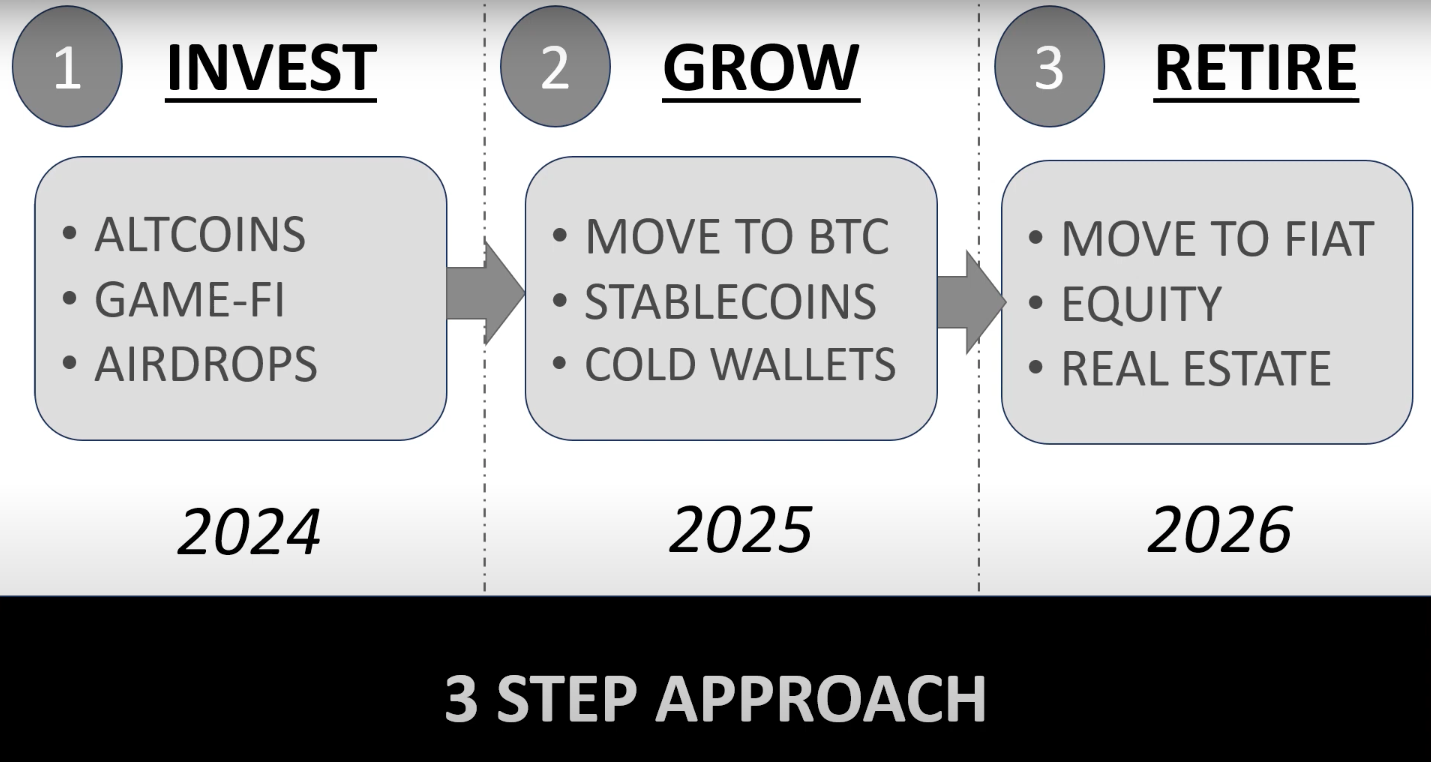

3 Step Structured Approach

To make sure that I don’t repeat the mistakes I made in previous bull run of crypto I will be following a cleared structured 3 Step approach so that I properly book my profits:

-Invest

In the following months of 2024 I will select which are the altcoins, meme-coins, blockchain games, and new narratives like AI, RWA etc that seem most sustainable. Then I will keep accumulating them over the year. I will also keep stocking up on any nice airdrops that I become eligible for.

-Grow

The next phase will be to focus on my BTC and ETH holdings and start moving my altcoin gains into BTC and stable coins. The reason is that once the market starts to crash after the peak is crossed many altcoins drop to zero and I don’t want to left as a bag holder in such pump and dumps.

-Retire

The last phase is to retire happily after converting a major part of crypto gains into fiat and apply into other financial instruments like equity, debt and real estate.

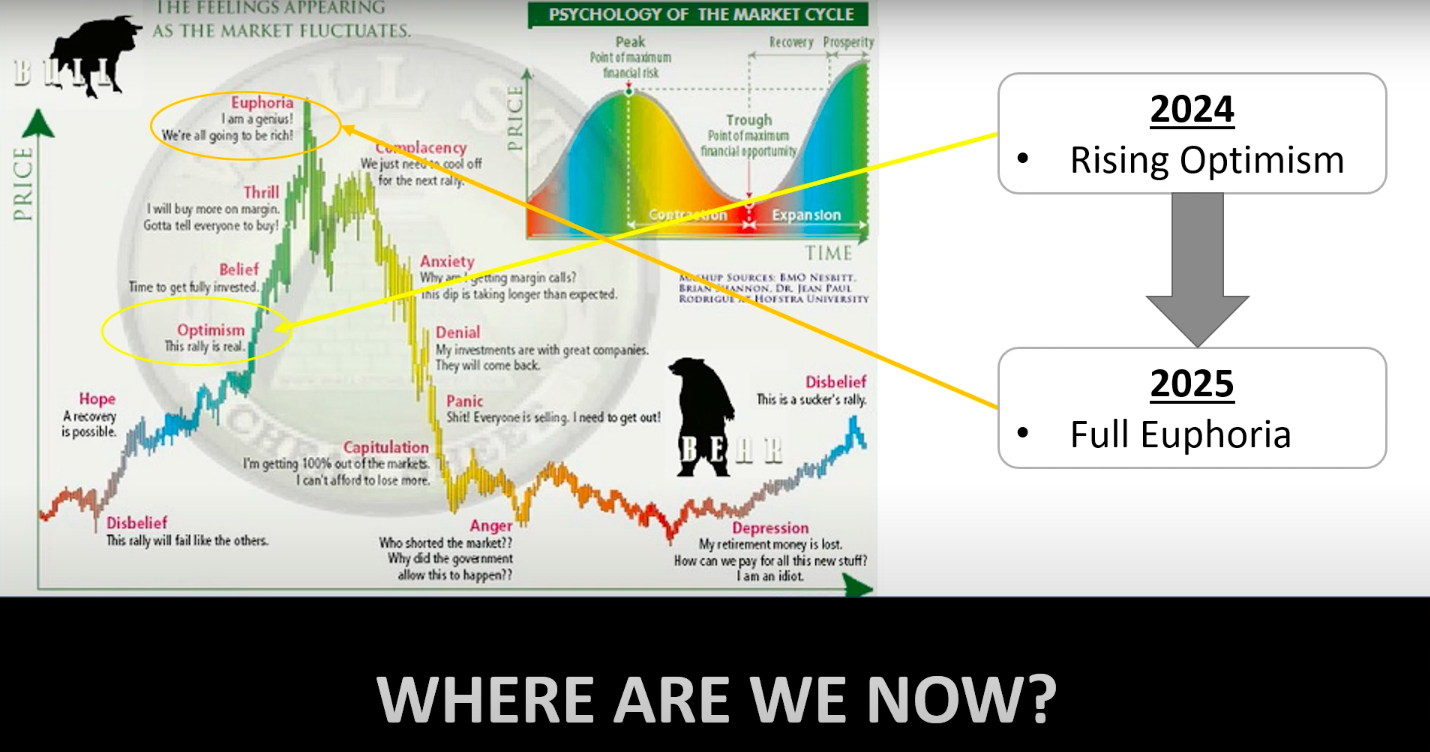

Where are we in the Crypto Market Cycle?

Like all other financial markets, crypto also follows a cyclical repeating pattern. After each crash people start slowly getting hopeful and optimistic about the markets. Once the markets start recovering the excitement level goes up and final phase of Euphoria licks in when even sh*tcoins start to pump like crazy. This inevitably is followed by a crash and the whole cycle repeats all over again and again.

I really thing that we are in early phase of the bull market and will stay there during 2024. The full frenzy of the crazy bull run will happen a bit later in 2025.

Now you will ask me how can I be sure about these timelines when no one can predict the market cycles.

Let’s look at this very valid question in the next section.

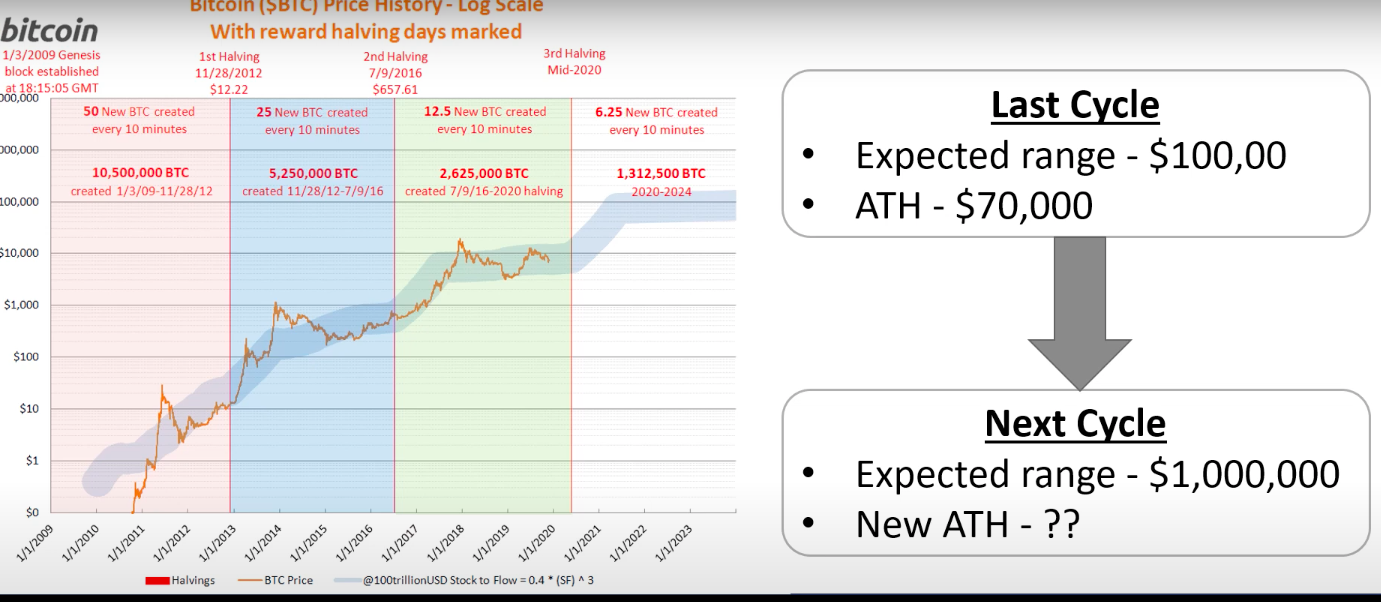

Why I Think BTC will hit it’s ATH in 2025 Year-end?

While it is certainly true than no one can accurately predict market ups and downs there is something very unique and special about the BTC market cycle.

Since its inception it has been following 4 year cycles like clockwork with the new All Time Highs coming 2 years after the BTC halving. If we consider the current halving cycle the new All time high will come around end of year 2025.

We can also get a view about what peak we can expect in next cycle by looking at the logarithmic scale trend. The range expected is around $1,000,000 but of course there might be some deviation depending on the market conditions.

Why am I Sharing my Crazy Plan?

I am publishing this plan as this time I want to follow the crypto cycle in a structured and planned manner. I would be making monthly checks to see how the reality unfolds in comparison to my plan.

You can also decide for yourself if for the next bull run you want to bite the Red pill and make life changing gains or take the Blue pill and go back to your regular life.

If you want to make serious efforts to get max gains from next bull run then watch out this space for more details but keep in mind that I will make my own selections of projects to invest in and you should make your own picks. The only thing I will recommend is to keep your picks diversified as keeping all your eggs in one basket is a recipe for disaster with altcoins.

Cheers,

Sam

The invest part gonna fail. 2013 OG here.

why do you think invest part will not work?

Because everything is going to zero valued in Bitcoin. Real estate, nation currencies, gold, silver, shitcoins included. Starting immediately with step 2 is the only correct decision.

I'm much more conservative in my projections.

I only need about 7% return a year to do well (or be well off).

I don't need anything to "moon".

I invest mostly in knowledge.

I invest in the SP500 index fund.

I use options to hedge against my 401K portfolio.

I do have exposure to BTC/ETH. I have NFT in games like Splinterlands and BigTime.

I like your balanced portfolio.

I also plan to go more into index funds after 2015.

I have not played BigTime, is it Play2Earn like Splinterlands?

Bigtime --> You can play for free.

Their goal is to get you into skins, which will open special dungeons that the F2P user can't get into. So you need to invest in "land", or buy everything on the marketplace.

I'm testing it out and I like the ROI on assets more than I what I get from ROI on my Splinterlands Cards rentals. For example, most cards need to be rented out for 4-7 years to break even. In BigTime, I can expect the ROI to be around 6-8 months for some items like Time Wardens and longer on Land (Spaces).

Bigtime --> You can play for free.

Their goal is to get you into skins, which will open special dungeons that the F2P user can't get into. So you need to invest in "land", or buy everything on the marketplace.

I'm testing it out and I like the ROI on assets more than I what I get from ROI on my Splinterlands Cards rentals. For example, most cards need to be rented out for 4-7 years to break even. In BigTime, I can expect the ROI to be around 6-8 months for some items like Time Wardens and longer on Land (Spaces).