Adoption of cryptocurrencies (especially cryptocurrencies that incorporate blockchain technology) is a key growth area for cryptocurrency companies. However, when they try to scale their business, startups will often find that they need to change their business model if they want to maintain the same level of success.

For this very reason, mass adoption of crypto can provide a boost to a business's business model. Because of this, the adoption of new blockchain technologies can have an impact on how companies look at cryptocurrency by providing more clarity about what they need to do to keep their users in a loyalty program.

One thing to note about crypto-altcoin adoption and adoption by investors is that it has not always been a seamless process. Most of the coins are launched by early adopters and early investors, and only after a few years of growth do they reach market saturation. This makes it difficult to fully understand and validate the coin's value proposition, and even difficult for the early market participants to understand the underlying technology.

So, what does adoption as a community mean? Does it mean that a company, company founder, or any other investor is willing to adopt the coin in the short term? Does it mean the coin is stable and viable? Does it mean that investors can use the coin for investment purposes?

Mass adoption needs to be specified according to the specific use case. Mass adoption as a store of value is different from mass adoption as a payment method, or mass adoption of smart contracts, or NFTs [nonfungible tokens], etc.

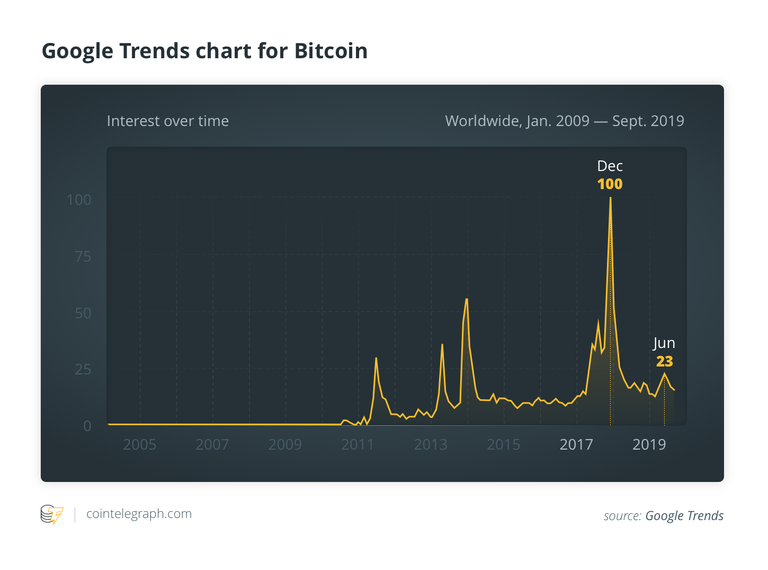

Mass adoption in the crypto community is a measure of how much value is attached to crypto by the general economic population. In the case of bitcoin this would include investors, startups, and businesses in the financial industry, as well as the general public

At present, usage of cryptocurrency on the Internet is mostly driven by speculation and speculation alone. However, this is not such an easy proposition to implement on a global scale. Not just because of the sheer size of the cryptocurrency market, but also because of the various regulatory and legal implications around it. Even those who participate in cryptocurrency trading are mostly not sophisticated enough to navigate complicated legal or regulatory frameworks, just as most ordinary people are not able to read the legal texts on the Bitcoin Foundation website.

The adoption of cryptocurrency would not necessarily mean that it will soon replace the US dollar as the world dominant currency. But once a substantial amount (or majority) of users adopt it, it would become a very strong contender. If this happens, it will lead to what we might expect in the future – a massive, sudden and dramatic change in the way in which we understand money and money systems.

To learn more.This post earned a total payout of 8.287$ and 6.231$ worth of author reward which was liquified using @likwid.