What is a 'Cup and Handle'

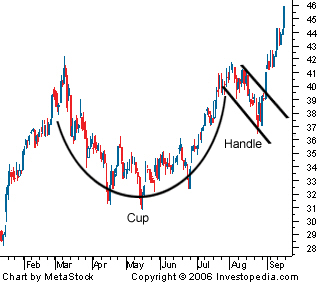

A cup and handle pattern on bar charts resembles its namesake, a cup with a handle. The cup is shaped as a "U" and the handle has a slight downward drift. The right-hand side of the pattern typically has low trading volume, and may be as short as seven weeks or as long as 65 weeks.

Cup and Handle

BREAKING DOWN 'Cup and Handle'

As a stock forming this pattern tests old highs, it is likely to incur selling pressure from investors who previously bought at those levels; selling pressure is likely to make price consolidate with a tendency toward a downtrend trend for a period of four days to four weeks, before advancing higher. A cup and handle is considered a bullish continuation pattern and is used to identify buying opportunities. Below is an example of a cup and handle chart pattern:

Cup and Handle Characteristics

It is worth considering the following when detecting cup and handle patterns: Length - Generally, cups with longer and more "U" shaped bottoms provide a stronger signal. Avoid cups with a sharp "V" bottoms. Depth - Ideally, the cup should not be overly deep. Avoid handles which are overly deep also, as handles should form in the top half of the cup pattern. Volume - Volume should decrease as prices decline and remain lower than average in the base of the bowl; it should then increase when the stock begins to make its move higher, back up to test the previous high. A Retest of previous resistance is not required to touch or come within several ticks of the old high; however, the further the top of the handle is away from the highs, the more significant the breakout needs to be.

Trading the Cup and Handle

Place a stop buy order slightly above the upper trend line of the handle. Order execution only occurs if the price breaks the pattern’s resistance. Traders may experience excess slippage and entering a false breakout using an aggressive entry. Alternatively, wait for the price to close above the upper trend line of the handle, subsequently place a limit order slightly below the pattern’s breakout level, attempting to get an execution if the price retraces. There is a risk of missing the trade if the price continues to advance and does not pullback.

Cup and Handle Stops and Targets

A profit target is determined by measuring the distance between the bottom of the cup and the pattern’s breakout level, and extending that distance upward from the breakout. For example, if the distance between the bottom of the cup and handle breakout level is 20 points, a profit target is placed 20 points above the patterns handle. Stop loss orders may be placed either below the handle or below the cup depending on the trader’s risk tolerance and market volatility.

Remember to upvote and follow and have a great day!

this would be great if you had picture on it,

thanks for the feedback. I will add an example picture right now!

Please vote ether info https://steemit.com/steemit/@mahadi/usd4500-ethereum-price-prediction-tripling-of-price

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.investopedia.com/terms/c/cupandhandle.asp