Crypto Market Cap in 2018:

Jan — $800B

Feb — $330B (-100%)

Mar — $470B (+45%)

Apr — $250B (-40%)

May — $450B (+45%)

With such massive fluctuations in the overall market cap of crypto currencies in 2018, it is very common to wonder that only the connoisseurs of the crypto world could make any profits while the magic word popularised for the rest is “hodl”.

With this article, I hope to change that perception and equip you with strategies and tools to help you make profits even during a complete crypto downturn.

Strategy 1: Short Selling

What does this mean? Buy low. Sell high. But just not in that order.

As a trader in the conventional world, the first strategy that comes to mind is ‘short-selling’ a stock/index if you believe that the price of that security is going to go down. For the uninitiated, short selling is the sale of a security that is borrowed by you. The way it works is that you borrow a security(you believe is going to lower in value) and then sell it immediately on the exchange. Once the value lowers enough, you then buy it back from the exchange and return it back to the lender. The net profit you make is the price drop of the security minus the interest that you incurred due to the borrowing.

So, as long as your prediction is right, it’s all good. But, in case the price of the security ends up rising, then the losses cannot be capped. And this is worse than the long position, where the price can, at max, fall down to 0 and your losses are capped. We have a work-around for this in our tool(more info below).

So, how do we implement this strategy? One way is to find an exchange which allows you to take short positions via the futures market — CME and CBOE have enabled that for bitcoin. But apart from getting access to such exchanges, here is a list of disadvantages of doing that. The other way is for you to borrow securities. While there are a few platforms which provide this facility, they do so in a centralised fashion — that means that your funds are stored at a central location and can be accessed by the owner of the platform at any point. This also makes it highly susceptible to hacks which have led to major losses.

Ideal Tool for this Strategy: NuoLend

NuoLend — a permissionless, global & decentralised p2p lending platform — is the ideal tool for this strategy. This requires no lengthy registrations, no cumbersome form-filling and no delaying KYCs as well. Just install the metamask plugin and you are good to go. And since this is backed by smart contracts, you don’t even need to worry about the security of the funds that you put in to this platform(smart contract).

How does this work? This requires you to borrow Ether by putting in a collateral in the token of your choice. After borrowing the Ether, you can sell it on the exchange of your choice and buy it after the dip to return it back to the lender on the NuoLend platform.

Example:

Price of Ether on May 20, 2018: $500

Your prediction for Price of Ether on May 30, 2018: $400

Action: You borrow 1 Ether worth $500 from NuoLend on May 20, 2018 at a premium of 5%. Sell that borrowed ether on the exchange of your choice. If your prediction does come true, you will be buying it back on May 30, 2018 for $400 and repaying the lender on the NuoLend platform after adding a premium of $25. Your total profit will be $75 during the price fall.

All this is good, but what if your prediction goes wrong and the price actually rises instead of falling? Well, then you have to face the loss, but the good thing about this platform is that your losses are capped at 50% of your initially invested amount. You will have an option to not return the borrowed Ether at all, but your collateral(which was 1.5x the loan amount) will be given to the lender by the smart contract automatically. And, yes, you will be allowed to borrow again from this platform. NuoLend will have nothing against you, even if you default on your loan :)

What’s more? NuoLend is giving $10 worth Ether as crypto-back into your Ethereum wallet as soon as you apply for a loan. Click here to apply for a loan now! Click here if you want to see a step-by-step tutorial on how to create a loan.

Strategy 2: Intraday Trading

Risk Level: Moderately high.

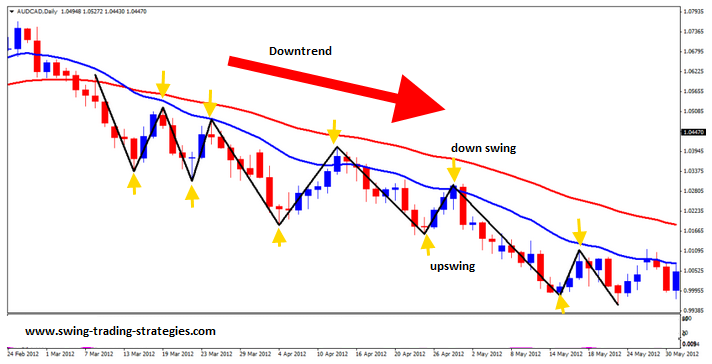

Intraday trading takes advantage of the ultra-short term price fluctuations in the market instead of the general trend of the lowering prices. This graph shows a typical bear market with high volatility. There are various entry points and exit points for an intraday trader to make profits out of this pattern even in an overall downtrend. Intraday trading is usually for experienced traders who are comfortable with recognising patterns via technical analysis. Since this requires extreme precision for buying and selling, algorithmic trading via automated systems are ideal for this purpose. This usually involves dedicated time and effort from your end.

Strategy 3: Passive Income Coins

Risk Level: Low

For a lesser risky(lesser return) proposition, there are a category of coins which give you an ‘interest’ for holding on to them. This category consists primarily of staking and exchange coins.

Staking coins give their holders extra coins for those being used in the governance process in its blockchain. You have to keep a reserve of these coins for the ‘staking’ process which means you will not be allowed to spend them otherwise. You should go for this only if you have a strong belief in the team and believe that this project’s tokens will uphold its value in the long run as well. You can expect returns in the range of 0.1%-20% per annum. Also, watch out for Cardano(ADA) and OmiseGo(OMG) staking programs as they are scheduled to begin in Q3 and Q4 of 2018. Here is a list of coins you can currently go for.

Some exchange coins share the profits generated on their platform with the token holders of their coins. While this is a riskier proposition than Staking coins, you can consider this as a dividend received for the profits that are generated on the platform and given to its token holders. The profits usually depend on the volume that the exchange sees in that month. So, do ensure that you choose an exchange which encounters a relatively higher volume and is safe. You can look at KuCoin, COSS or DECOIN for this.

For an even better solution, you can become a lender at Nuo Lend in which you can earn 5–15% depending on the loan request on the platform.

Strategy 4: Diversify your portfolio

You should invest in uncorrelated securities to improve the efficiency of your investments. Efficiency is defined as return divided by risk. Uncorrelated securities are ones which have no correlation between the prices of any of the securities i.e. if the price of one security goes down, it isn’t necessary for the price of the other security to go down as well. It has been researched that clubbing up of multiple uncorrelated securities increases the efficiency of your investment.

Nuo is coming up with its first ETF fund in which you will be able to do less risky, higher return investments(better efficiency). Do wait for it!

So, don’t just “hodl” and wait for the bull run. Now, you have the tools to make profits in the bear season as well!

✅ @sidsverma, I gave you an upvote on your post! Please give me a follow and I will give you a follow in return and possible future votes!

Thank you in advance!

Congratulations @sidsverma! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard:

Congratulations @sidsverma! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!