In February ,2018 , over 200 crypto-focused hedge funds where formed due to a rapid growth of digital assets space with an average daily exchange trading volume across all cryptocurrencies asset surpassing 18 billion USD equivalent and total estimated market cap for blockchain instruments exceeding 325 billion USD equivalent as if April 2018.

In February ,2018 , over 200 crypto-focused hedge funds where formed due to a rapid growth of digital assets space with an average daily exchange trading volume across all cryptocurrencies asset surpassing 18 billion USD equivalent and total estimated market cap for blockchain instruments exceeding 325 billion USD equivalent as if April 2018.

As a traditional trading experience interest, their exposure to blockchain assets increases but their cryptocurrencies investors lacks the importance tools that are necessary for the space to encounter it’s potentials and this are

• Professional trade execution

• Compliance

• Position and risk management

• Reporting functionality

As it is now , cryptoinvestors are comple to make their choices of exchange while trading in a situation whereby portfolios generating positions on multiple trading platforms with different user interface and functionality, there is difficulty in execution of orders across various exchanges.

Position and risk management sometimes encounter numerous challenges as a result of platform diversity that must be used to trade for a single portfolio due to the fact that it is difficult to harmonize the output of the different platforms, meeting reporting and compliance can also initiate stumbling block to cryptocurrencies investors.

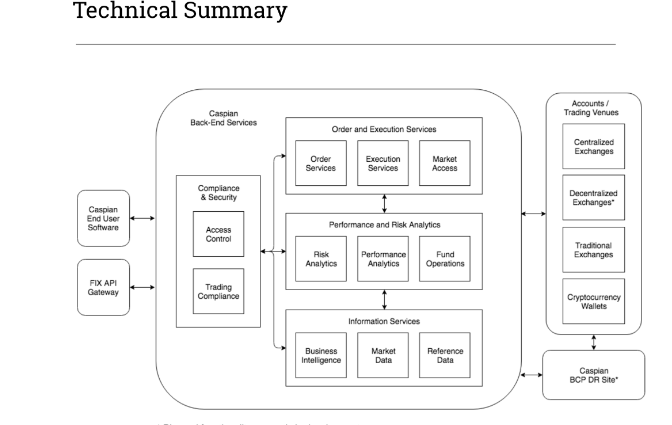

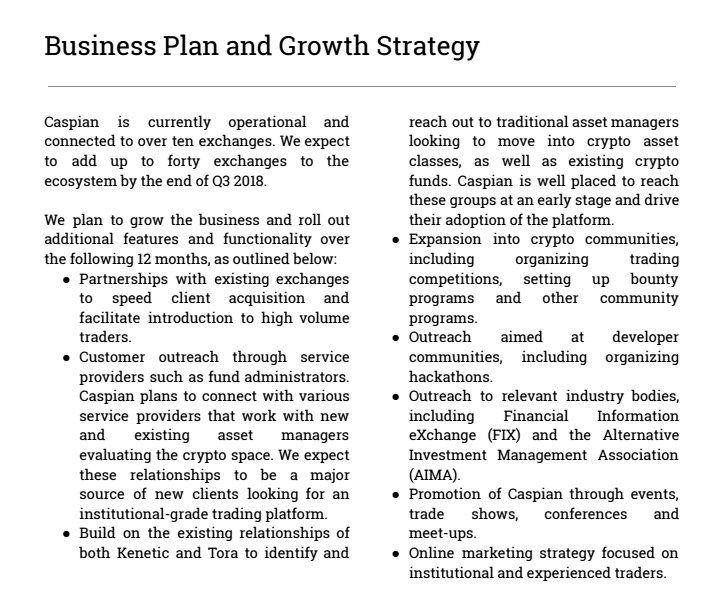

There is an ecosystem design to solve the problems facing crpto investors using a single user interface called CASPIAN.

Caspianaims at driving further growth in digital assets participation on the part of institutional and experience investor. In Caspian investors are equiped with orders execution managements system (ORMS), position management system (PMS) and risk management system (RMS) backed by both experience team and customers support.

Caspianaims at driving further growth in digital assets participation on the part of institutional and experience investor. In Caspian investors are equiped with orders execution managements system (ORMS), position management system (PMS) and risk management system (RMS) backed by both experience team and customers support.

CASPIAN AS A SOLUTION VIZ;

EXECUTION ;

Since Caspian order execution managements system (OEMS ) is based on Tora technology so that it can serves large clients base thereby catering to the specific needs of the cryptocurrencies space through the following;

• By OEMS enabling access to all order types, asset types, and ticket sizes supported by a given exchange

• It’s APIs allows trader to stage and sends orders and slices, obtaining order execution and position information, receiving pricing information, exposing breakdown

• Ability to viewprices bid and depth for exchange to the smallest available tickets sizes.

• Ability to stage orders intentions as parent orders

• Ability review and manage across multiple exchanges

Caspian also consist of module called SMART ORDER ROUTER that enables user to view all exchanges as a single pool of liquidity.

It’s algorithm are built on Tora’s algorithm framework and kinetic trading expertise to make international provisions for institutional grade algorithm from day one. Caspian has user builtstrategies whereby it’s end-user will have the ability to define their strategy to many orders using rule base language

It’s also has an in built mechanism that allows client to configure alerts which appears swoop ups.

POSITION AND RISK MANAGEMENT SYSTEMS (PMS, RMS);

Here Caspian encourages users to monitor their positions, exposure and detailed records maintainance when order are sent from OEMS,PMS AND RMS records and track it’s data in perpetuity. PMS and RMS allows investors to view all positions and historical data in future risk, features from Today platforms will be ported to [Caspian(https://caspian.tech/)

Reconciliation In Caspian is easy as a result of user friendly record keeping.

Rebalancing helps in generating order that contiously brings the fundsack in lines with its objections.

The allocation engine covers wide range of used cases such as:

• Static order allocation

• Dynamic position based allocation

• Enduring a fair price distribution across business units

COMPLIANCE AND REPORTING;

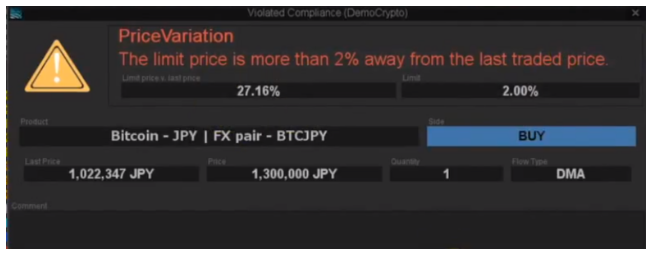

The compliance depends on Tora’s proprietary technology which offers low latency extensively and also robust framework that enables Caspian to implement efficiency and quickly compliance and limit rules.

Compliance engine provides several levels of functionality to address user define limit such as

PRE trade which includes simple limit with complex portfolio and post tradecompliance which includes ; alerts , monitoring and reporting.

REPORTING ENGINE;

Caspian features robust reporting capability from day one simple report such as trade files,snap shots reports, position data, auditreport and compliance report and they are looking on solutions that will incorporate Tora's propritary reporting engineering to allow users to design report template such as graphs, etc.

IMPORTATION OF DATA;

A module in Caspian import data provided by each exchange through its protocol and apis focusing information into a single portal which users are one stop shop.

SECURITY

In order to protects ones data privacy and integrity the following features must be in place;

• Connectivity between the clients appllication and cloud is created by a private leased linecor encrypted connection over the internet

• The client accessed, can be limited to him only, from sets of concrete white listed IPS

• Secure user sign in is enforce through strong passwords complexity requirements and two factor authentication

• Access to the back end is restricted to a limited number of authorize administrative and support users

• Integration with an isolated exchange API signing services

• Connection to exchanges are also encrypted when surpported by exchanges regardless of whether the messaging is handled through fix, rest and other proprietary protocol.

CASPIAN TOKEN(CSP)

It is an ERC-20compliant token given on Ethereum blockchain and it’s model is designed to serve principal objectives and it’s intends to create a rich participatory ecosystem where platform users can become a community member with interest in the platform.

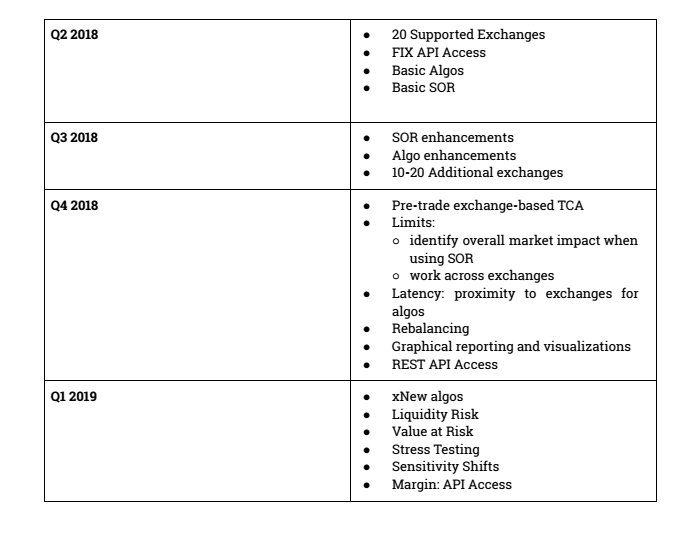

ROADMAP

This roadmap is subject to change due to token base governance, legal consideration, customers feedback and marketing conditions.

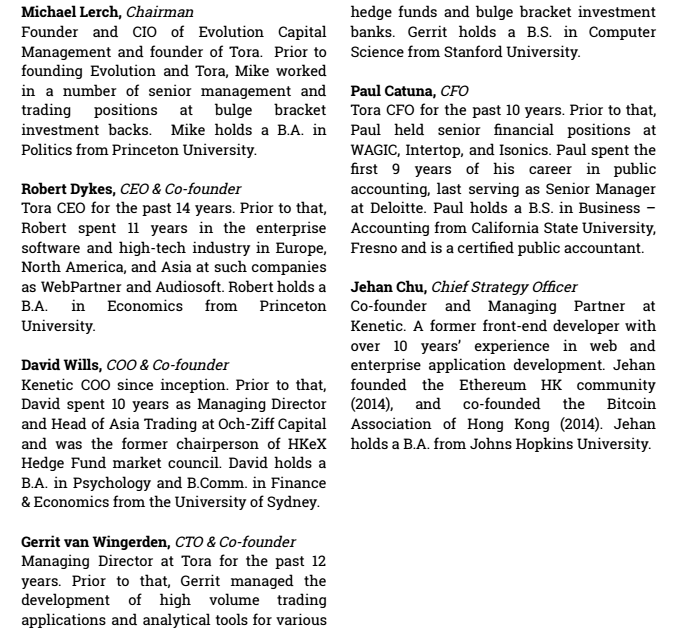

##TEAM OVERVIEW

USED CASES

Samuel is a business man, he has been involved in cryptocurrencies transactions for a year but his friend who is his business partner has been looking for how he can involve himself in cryptocurrencies transactions he pitch his friend how to trade on crypto but he declined due to stressed encounter as a result of resources and tools in order to participate in the cryptocurrencies space. Few months ago Samuel’s friend who stumbles upon Caspian which is a full stack of financial tools that is integrated with major exchanges in order to offer him a single place to interact with the entire cryptospace and because of this new client who are interested in funds management and specializes in cryptocurrencies transactions are attracted.

AN EXAMPLE OF COMPLIANCE ALERT

AN EXAMPLE COMPLIANCE WINDOW

CASPIAN WEB

CASPIAN WHITEPAPER

CASPIAN STEEMIT

CASPIAN YOUTUBE

CASPIAN TELEGRAM

CASPIAN VIDEO

CASPIAN BLOG

CASPIAN NEWS

CASPIAN LINKEDIN

CASPIAN MANAGEMENT

caspiantwitter

HWRE IS MY TWITTER ENTRY;

Caspian2018

Sponsored Writing Contest!

This post has been submitted for the @OriginalWorks You can also follow @contestbot to be notified of future contests!

Hi @slycomaslylene

Caspian is rather complex and complicated tool, but you managed to explain it very clearly. Pleasant read :)

All the best