Feb 23 - Bitcoins/NFT updates with Options / Dividend coverage

Summary of Topics:

- NFT Gaming (BigTime) Rentals is funding Bitcoin purchases.

- Long Bitcoin - We are still EARLY.

- Pokemon Cards - A look back in time

- Week 8 - Options Trading Results

- Week 9 - Dividends payout

NFT Gaming (#BigTime) Rentals is funding Bitcoin purchases.

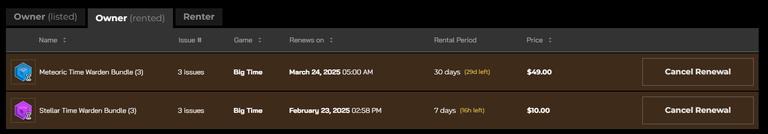

For Feb 2025, my #NFT rental was "bottoming" out and starting to move up now. Here is the screen capture recently:

Here is the transaction history for Feb 2025 with the Feb 22 Transaction listed.

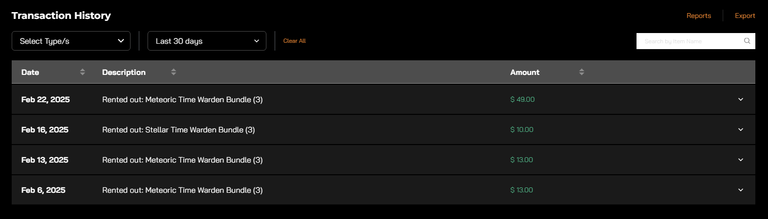

So I transferred the money out of my gaming account using #USDC and moved this into an exchange for me to purchase the #BITCOIN.

Long Bitcoin - We are still EARLY.

In Feb 2025, people wonder if we are too late to buy into BITCOIN. The answer is often found by using the random stranger test. If you ask a room of 10 people who own Bitcoin, you might find 1 or 2 people who own it.

A better question how do you know when you are LATE to Bitcoin? The one way is when FIAT can NOT be used to convert to BITCOIN. That is when you are late because FIAT would have LITTLE or NO value against BITCOIN. This logically makes sense since FIAT can be PRINTED for more and then used to TRADE for someone of MORE value. Today the US Govt or any nation can print Dollars, Pounds, Yen, Francs and trade them for Bitcoin. You are LATE to the game when no one in the RIGHT mind would make that TRADE.

Are you EARLY or LATE? You might not be as EARLY as you want to be, but today many people are trading in their company DEBT, Company Stock, US Dollars, GOLD, and Silver for Bitcoin. With a 2 Trillion dollar market cap, it will take a few more years before you notice Bitcoin is getting close to the market cap of Gold. When that happens, you will see the acceleration of people moving from one asset class into another.

Pokemon Cards - A look back in time:

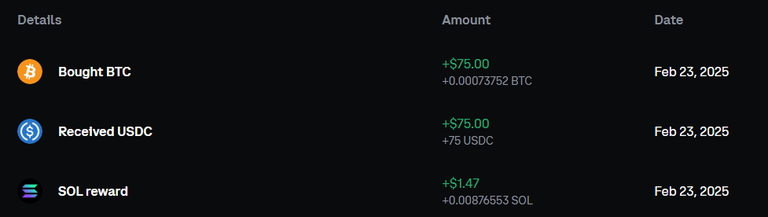

This was at a recent show (Kansas City Collect-a-Con 2024) with The BulbaStore. Here he is selling a single pack of Plasma Storm for $150. This was released in Feb of 2013 (or 12 years ago). My son was 7 years old and we would go to the local library to play #Pokemon with other kids.

This pack was selling for $5 a pack (or even cheaper if you purchase a booster box). There aren't many investments that made 30x in the last 12 years. What does this mean? Collectibles like Baseball cards and Pokemon cards have become a value asset class to hold your money. It's better than CASH. Recently I started talking to my KIDS about buying SEAL Pokemon Products and HOLDING them for 2-3 years to see what happens. While that seems like a long time, some products have doubled within that time frame. This means it is POSSIBLE that Pokemon cards can be twice as good as the STOCK market, which doubles every 7-10 years.

As a test, I purchased a SEAL Shrouded Fable Elite Trainer Box for only $39.99 (full MSRP) at a local RETAIL store (like Walmart/Target or Amazon). Often, these products sell for MSRP for a while before it enter the "end" of the print run. As the boxes age, and 5 or 6 next sets come up, the SET ends up getting AGED out and the prices will move up. Here you can see this has already moved to $49.99 now.

I ordered it several days ago on Amazon and still did not get it. But the PRICE of $39.99 is no longer available and has already moved up to $49.99. People find this strange, but in the world of a limited supply of ITEMS, that is normal RETAIL pricing. The prices move ABOVE MSRP because everyone else is selling it for MORE.

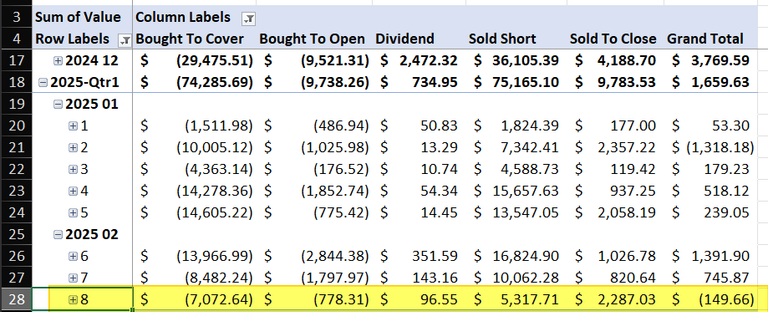

Week #8 - Options Trading Results

Last week was a RED week, especially for anyone with exposure to TECH stock. I held a few stocks that DROPPED 10% or more last week.

I lost money on the #Options trading side because several of my TRADE went bad (like XYZ stock). It is part of the game when you make money for the last 5 weeks. The goal is to try to be consistent in the weeks where we make money and try to reduce the RISK in the weeks where things GO against us.

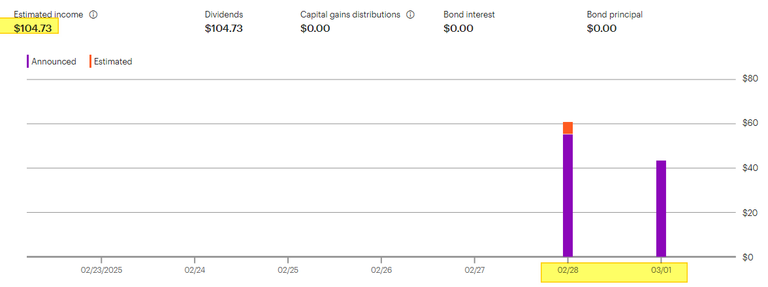

Week 9 - Dividends payout

This week, we are expected to get about $104 in dividends.

Dividends often look sexier in RED or DOWN markets. That is one reason why some investors want to add DIVIDENDS to their portfolio. The dividends mostly get paid out quarterly and most of the time, it at the same expected level as the previous payment.

In 2025, I will continue to sell some of the DIVIDENDS and turn that into CASH/FIAT and use that PROCEED to make some BITCOIN purchases. I believe that BITCOIN will outperform many if not ALL of my Stock Market Portfolio. This works well as I'm still over 15 years from retirement age.

Have a profitable day!

Posted Using INLEO