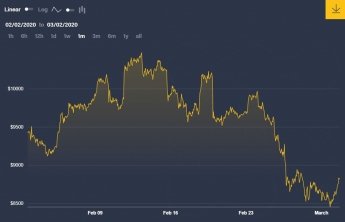

what's up everyone and welcome back to kryptos news here with your host technical make a crypto ready to talk about a subject that I think you're gonna find quite interesting that might let us know why bitcoin might have dropped it's a probable and totally not improbable reason I was just discussing on Twitter with a few folks after reading some news so I figured I'd do a nice short video and pass on the news to you but before we go ahead and do that let me thank the people who are joining us in the live chat Thank You Holly what's up food thank you for joining me with that with your presence as well as Chris Rice crypto life-size box pot heads Oh buff Berlocq I love doing these live streams because I get the opportunity to as soon as I find something out pass that knowledge forward so that we can discuss it together so as we know let's start off with what's going on with the prices today we have Bitcoin dominance around sixty three point nine percent Bitcoin fell you know a little bit about one point zero three percent and you're seeing that kind of across the board here some names holding up better like a theory on point zero eight percent chain-link it's had a nice week five point thirty seven percent that's one of the stronger looking charts will be token ten point eighty six percent but I mean the stock market also was down quite a bit it looked like he was gonna break below a thousand point drop it looked like it was gonna go lower than that it's been absolutely one of the worst sell offs this week it's shaved off I think the most recent period where the stock market has sold off more than this was a 2008 recession as we enter this correction territory and more fears and uncertainty are taking place and you're gonna hear a lot about how crypto is very correlated to the stock market and that is something that we've seen as the stock market has fallen Bitcoin only rallied just one of those six days as far as I can remember so pretty much it has been quite correlated to the stock market it does appear to be that way even today we saw gold get slammed down silver get slammed down bods bond bond yields went down a lot of things went down quite a bit I thought Gregg mannery knows YouTube channel had a good reason for why we could have seen an across-the-board sell-off that is apart from what I'll discuss in just a moment and that really had to do with options so options if you take a call position basically a long position they might have got quite wrecked by going long in their options trades and that's something you're seeing more and more companies financial institutions leveraged way too much right now and as the stock market has pulled back they've had to sell off some of their own assets maybe their own stocks maybe for example they have to sell some of the gold these financial institutions maybe some of the Bitcoin the smaller family office they're holding and that could have led to some of the drop here that we're seeing why everything seems to be going down at the same time people are seeking a flight to safety and they're not doing it in gold and silver today they're actually doing it in bonds by buying up bonds because of fears and I think part of what caused the sell-off you're also going to hear would have been fear about this market going into the weekend it seems like every single day - - what's going on with the beer virusis people are calling it on twitter thanks to the beer virus we like we're finding out that a dog might be able to get it because they found a dog who had it on him although he wasn't showing any symptoms this dog had traces of the beer virus on him so we're trying to find out if this is in fact something that transfers from mammals so for example this is one thing today and it seems like time after time we're not sure how this is gonna affect behavior how people are gonna be going to the movies less how people are going to be going to the gyms less how this could affect travel and the greater economy the prices of oil have been going down quite a bit sign of a recession and so on you have to keep in mind of course that these markets have been very hot and very heavy for a very long time and days like today pays to remember why Bitcoin was created when a trending hashtag on twitter is stock market crash 2020 that's not even though that's outside of crypto trending hashtag people are tagging it everywhere so you might realize that the reason you might have purchased Bitcoin would have been much like mine earlier on which was that you wanted to have access to transact in the event that there was some sort of huge systemic bank run let's say there was a run on the banks which run on a fractional reserve system should absolutely Google fractional reserve system if you're not sure the banks lend out way more money through loans and they actually have when you deposit that bank since most people don't demand that cash but when people are extremely concerned this is something isn't something we're very familiar with in our generation here in the West unless you were around in the nineteen late 1920s you're probably not very familiar with bank runs but they have happened but memory is very very fickle especially through generations but that's primarily why many people bought Bitcoin early on because in the event that the banks closed that you can get your money out of the ATM they do a bail in rather than a bail out and take some of your money just in case you don't want to have that happen to you so instead you buy something that's outside of the banks such as gold or silver on ETF with an account which is why I always recommend buying these physical assets even if it's just digital like Bitcoin it's it's a digital physical Bitcoin is the digital physical if it's a digital physical gold anyway you want to be able to transact if you need to because everyone else has your money locked up and you need to be able to buy certain things and you might not have that cash on hand and if that happens to a great degree the banks could shut down withdrawals and ATMs for a short period of time for a longer indefinite period of time while they try to fix any sort of issues that happen and that's why Bitcoin was created by Satoshi Nakamoto so I think it's important to take this opportunity to maybe discuss that maybe dig a little bit deeper into the systemic problems around which our financial institutions globally are built what kind of really shaky foundations they have but anyway as we talk about that I hope you all are doing well it just pays to hold a little bit of Bitcoin I would say just to be safe just in case right rather than just to get rich yellow it's really protection your family for your family for yourself if you care for those around you and and furthering that discussion anyway we'll see what this what happens this weekend but definitely I do feel like that could have played a role in the stock market who knows what's gonna when news gonna come out tomorrow Sunday how that affects the US and so people don't want to be holding stocks through the weekend they likely sold off I don't know that that's the reason Bitcoin selling off but you might have to have something to do with weakening technicals due to what we're gonna discuss right now and first let me thank you course vehicle for the donation man yeah I'm happy to keep it up man but doing the show as you know Corby got such a loyal supporter for a long time the new news for a long time because it is important and it just reminds me why the work I do is important and just raising awareness about this beyond just a speculative reason so I certainly will try to keep it up man and I feel like it's this channel has more of a raw soul and it's claw reason to beat and then it has in a long time just because of this but anyway what could have caused a Bitcoin crash the primary reason you're here what you read in the title well it's come out you know it's funny because I have a private telegram group for the patreon YouTube sponsors and we were discussing as I mentioned last week what will be the next cause of the Bitcoin flood will it be China I guess the coronavirus could have been that could it be Craig right claiming to be Satoshi again or some other nonsense in the courts I don't know these have been some of the things that have led to decline some have speculated in the past for bitcoins price and one of the reasons that I said we might see a decline might be the reason that we are in fact getting this er correction which has to do with you guessed it bit Phenix and tether I know I know anyway pat yourself on the back of you figured this one out it really has to do with this announcement that came out on bit Fenix's announcements page which reads here dated February 28 2020 BitFenix repays one hundred million dollars of outstanding loan facility to tether and I read BitFenix is pleased to announce that on Friday February 28th 2028 repaid 100 million of the outstanding loan facility to tether Biff Enix made this payment in Fiat wired to heather's bank account this payment is all on accounts of principle interest on all amounts due under the facilitate agreement has been prepaid up to March 2020 so what exactly is going on here if you're not very familiar with everything I won't go too much into the details but in a nutshell BitFenix is and has been quite a popular crypto currency exchange and it is owned by the same parent company the parent companies called I Phenix at the top which owns BitFenix and tether what is tethered if you're not aware of tether also known by its acronym USD T it's ticker symbol USD T is a stable coin which has fractional amounts of fiha and other assets which back a stable coin that is supposed to be pegged to one US dollar which is the most popular stable coin now trading across various block chains and again tether limited is the company owned by AI Phenix which owns bit Phenix and tether at the top thanks Julio played an pink oh cool damping a video say bitcoins going to 0 oh I gotta read that one man Dan Pena is kind of a he's a older you know strict kind of guy he did an interesting interview with Tai Lopez a while back but I'll check that out man I don't know about Xero but thanks for the heads up Julio anyway so BitFenix purportedly because of having money inside of a shady bank in the Caribbean that was the only bank that wanted to work with BitFenix called crypto capital they locked up about 850 million dollars or so could have been more than that with this Bank and suddenly this Bank wasn't able to give BitFenix the exchange this money so Biff Enix dipped into their tether reserves borrowing quite a staggering amount without disclosing to investors people holding USD T people using the exchange that they were doing so this is the court case that is going on from the New York Attorney General whether there was some misappropriation of funds and so on there are a lot more details but again I'll spare you oh it's a joke ok it's a joke Daniel didn't say it's going to zero all right cool I don't want to group him with Warren Buffett in that kind of category anyway so there was a deal that happened whereby BitFenix agreed to repay 100 I'm sorry 700 million dollars back to tether to recoup the money that they had borrowed using a credit line which involved Fiat involved shares of BitFenix and so on if I'm correct and up to 700 million dollars would be paid back over a few years with interest back to tether and so we're seeing that these repayments are taking place the last repayment that took place before today was back in July of 2019 so why do I suspect this might have caused the Bitcoin price to perhaps shatter well let's go ahead and look at coin market cap right I mean if you've been around over the last week you can see obviously that it started to fall kind of lined up with the coin with the coronavirus so it would seem like a an easy scapegoat for what happened here look like we were at a turning point for the crypto markets it could have gone up could have gone down but tell you what check this out right here for every 12 20 20 we were at a nice high and we've just kind of been moving down ever since could this have been the day that BitFenix decided and this is just tinfoil hat theory here again saying it's not improbable it's possible that this could be the reason that we did drop instead of continuing our mass bull run since bitcoin is supposed to be a safe haven asset we didn't and now Forbes is out there saying hahaha you're very far off from gold but could it have been BitFenix that caused this taking advantage of market conditions especially the prices being quite high to sell at a timely point to repay back a hundred million dollars with that loan we can't discredit that or discount that thanks Jerry think we fill CMU gaps at seventy five hundred seventy seven hundred why we dropped eighty five hundred I'm not certain man it's a it could happen we have seen recently the CMU gaps fill a lot but in many cases they haven't filled so it's really anyone's guess teri Hardison I don't strictly go by the CME I don't know that the volume isn't insane there and that's fully affecting things there is a lot of fuckery that goes on with actual spot crypto for example what I'm talking about here with BitFenix these are the whales realize that the whales are the institution's the companies the exchanges the individuals who were very early in bitcoin we're talking about whales I don't know that the Federal Reserve for example if someone thinks they have a lot of Bitcoin is the huge whale here surely they're trying to accrue some here but if they bought too much Bitcoin at any one point you probably be rich because your Bitcoin was skyrocketing value and price and so really I think still it we're at a point where many of these whales are early companies and players in this game who have a lot of Bitcoin and a lot of influence such as BitFenix and tether because of USD T and so on and they're the ones could really affect these markets by selling a lot which over time would put Bitcoin in the hands of more and more people but there's still kind of that boogeyman in the closet there's a reason that name keeps coming up but Phenix and tether and people still care but interestingly they it's it's funny that people still trade on BitFenix to a great degree because it allows them to pay back some of this along with when the market rallies but you don't want to be a sucker here you want to be informed that when the prices climb they're arguing these whales who want to sell and take advantage of that especially if there are debts owed such as in the case of the mount GOx incident which I'm not gonna get into again now since I've discussed at length before and with something like BitFenix so we're looking at a total market cap of really 248 billion dollars today for all kryptos and when you're looking at just Bitcoin I'm not saying that it was just Bitcoin BitFenix old they could have sold a bunch of different assets it's not just Bitcoin you can trade on BitFenix but let let's say just Bitcoin it's a hundred and fifty eight billion dollars that's a drop in the bucket compared to other other markets other other kinds of assets that are traded very very small so when you're looking at a hundred million dollars being sold you're gonna say well that's not very very much right compared to even this number except it is because this is factoring all the Bitcoin in existence this is factoring in Bitcoin that isn't liquid Bitcoin that is held by is held by wallets that have been lost held by Satoshi Nakamoto who has never moved as hasn't moved as a Bitcoin in a very very long time and and many other and and hard core hot lers hard core hot lers like I don't know Adam Meister trace Mayer who really like to stack their Bitcoin and not sell it and there are many of those hot lers of last resort who won't sell Bitcoin anyway my point is that the amount of liquid Bitcoin out there is not as much as you might think so when a hundred million dollar sell order goes into a major exchange it really impacts things because of arbitrage that takes place between the exchanges traders looking at the price here getting slammed down for example on this exchange then they go into that exchange maybe their bot does that buys Bitcoin or crypto at a cheaper price there goes to another exchange sells it and this creates over time minik equilibrium and a balance between these exchanges that brings the prices to a label a level that is stable so realize that some Oracle some services that exists really only look at one or a few exchanges for how they dictate the price on their exchange or their product and so for example many like to use bit mix and so it you can imagine that a bit Phoenix could have taken out quite a short on Bitcoin to recoup even more money than 100 million dollars it could have sold at the top in order to make back some of that money it would have made sense to do something like that with their knowledge and reached rather than sell which you might suspect on an over-the-counter whale trading desk or something like that maybe they did trade spot here and that's why we saw a dip so again when was the last time that we saw this huh well last time that we saw this again was july 2019 as I mentioned before again if you go to bit Phoenix's announcements announcements page you can see here July 2nd 2019 was the last time that they paid a hundred million dollars of those expected 700 million dollars that are owed back to tether it's kind of so kind of to themselves whatever anyway they announced that this was paid in Fiat in both occasions the payment was made in Fiat to tethers bank account meaning that I mean what are you trading on BitFenix I'm pretty sure you're trading crypto for the most part so if you're gonna be getting into fiat you probably have to sell some crypto BitFenix and so it's not on again improbable to think that they sold a hundred million dollars or something around there in order to get that money to tether be a via bank account and just because you're reading that this happened today doesn't mean that the sell-off that they sold a hundred million dollars today I'm saying that they sold this before they posted this so they could have easily sold this a week ago or maybe around February 12th when the market staggered maybe around the highs they are the ones who dictated where Bitcoin would go by doing the sell at that point into fiat eventually finishing the transfer to tether and posting today the announcement on February 28th that they did so we don't know exactly when they sold but looking at the charts they could have played a role here with such a huge amount of selling is what I'm saying and again if we look at July 2nd 2019 same blog posts hundred million dollars let's go over 99 bitcoins calm I love their all-time Bitcoin chart as I've said a billion times in the past cheers so fear Beagle runs a great resource here for the Bitcoin in greater crypto community so you can see here all these things are actually little events that take place but anyway let's go ahead and skip over July 2nd and again like in this case I don't think that they sold on July 2nd which is when they posted the announcement on their announcements page Biff Phenix the price for Bitcoin was ten thousand eight hundred and fifty dollars but about a week before that let's say June 26 the price was twelve thousand nine hundred and seven dollars look like it was moaning and BitFenix may have canceled the bull run so we've waited until now to begin the speculative Bitcoin bull run and it seems that it may have been again canceled by BitFenix to recoup those hundred million dollars yet again so it seems like every time if this proves true the Bitcoin starts to climb again looks like it's reaching some sort of new euphoria in the markets BitFenix takes advantage to sell a portion of the 700 million dollars that is owed over to tether and crashes and dumps and cancels our rally anyway so where do we go from here so I'm not saying that all of this was the the price action we've seen recently is because of BitFenix but I think we could tie it to the BitFenix tether situation the event that you know technical analysis looked like it was at a major pivot point and out of nowhere it looks like that got determined to the downside people are pointing at the coronavirus and so on saying people are trying to look into safer things they're not trying to buy Bitcoin but I think this is an alternative to that viewpoint that I think is very very strong and epiphanic sold they could have made the technical perspectives look a lot worse is what you might see they might have suddenly driven down the the Momentum's pointing us down south so I don't know that it we're completely below all of the moving averages that are gonna take us down to $0 Bitcoin but I think we are at a crucial point and luckily it hasn't been slammed down that hard especially with the havening coming up that I think we can outright say BitFenix cancel this rally unless they sell again when we begin moving up but it seems like we're around that $10,000 level the finnex might be eager to cancel our rallies here that's just my suspicion there but based on the announcement yeah that uh BitFenix both times right before we kind of shattered here sold 100 million dollars and the flood here would be that yeah they still have another five hundred million dollars to sell but at least once that's over we don't have as much to worry with to Phenix in this situation let me know what you guys think personally I am quite excited with the having come I think we could rally substantially more than that leading into that era and I don't know yeah I it's speculation on my end but based on and grounded in foundational truth of what is going on how do we stop it I don't know call the New York Attorney General and your support and say like give some insider information that could bring down and stop this entire Chuck juggling that you see bit Phenix and tether has been doing there's a reason that people talk about them so much they they're quite smart and they have a quite a team of lawyers to keep fighting and doing things on the back end so um yeah I think we might see some sort of relief next week maybe on the bright side we won't see vinick's tell for a while you know it was something like nine months in between there sell orders maybe they were just waiting for the price of pump which would make sense right if you owed that debt you'd wait for the price to go up before doing something like this but it could be a while before we see this I don't think they're gonna sell 100 million dollars tomorrow going into this weekend I think that people we could see a bounce in the stock market on Monday if in fact the stock market is correlated to Bitcoin then you could see that Bitcoin could get a boost later on as well so since it's been behaving as a kind of risk on asset and we'll definitely take it from there see what kind of fundamentals we move into as the next week's news begin to play out I think this weekend could play out quite slow for crypto but you never really really know so let's stay tuned let's stay in touch I hope you enjoyed the talk definitely shared if you think it's something that's interesting or please refute it or find something that I didn't get to discuss related to this that you're aware of in the comments down below so that we can all grow together here yeah take care everyone thank you so much Matthew my pleasure life-size box thank you for joining me yeah boycott BitFenix I guess that's something you could do right stop putting so much Bitcoin in their pockets I think that's something absolutely that could play a role here the more training that goes on there more could go into their pockets uh and yeah no no no complete attack here I know there's still core case going on BitFenix we don't absolutely know that they're the ones manipulating the markets on purpose but it just makes sense from a business standpoint that they would sell at the at a good time to sell like anyone else and so that's let's just say if you were in their position you might have done the same do I have any interesting stories from Burning Man from when I went interesting stories yeah I mean I have a billion but I don't know what kind of things review relic relevant to you blacklist monster but I'll answer that question before I go well it was it was interesting the camp next to ours was a dancing cap super into health and spiritual awareness and body movements they had of one day where they just kind of danced completely naked they were called camp contact that was interesting they were just dancing naked all feeling chilly but for the most part not everyone was naked there were a lot of people riding around in bikes with things out that you know I might not have wanted to see bomb like this is Burning Man I was surprised that the toilets were much cleaner than I would have thought they cleaned them a lot it was that was great the porta-potties I thought that was gonna be a bad experience if you went to the medical center at Burning Man most people were dehydrated or her taking way too many drugs and dehydrated and so that was the primary thing people overdoing it but that's like everything else in life I thought the way that they did meted medical help out there was really great there were a bunch of areas you could have gone for help rescue people who volunteered to help out and I thought the talks were fantastic I was at camp D central so shadow camp D central there were a lot of crypto people there and people from into crypto from other camps are coming by to give talks I gave a talk on censorship that I experienced from Facebook there was a dang I can't remember the book but that I've spoken about a book on flow state and how to get that that a speaker came out and talked about that was a very informative experience and you know like everything else I think there's good and bad I think a lot of people earlier on in the week were into you know no money and giving and cleaning up after yourself and keeping the desert and nature clean and I think the people who came in the weekend were more of the party kind of vibe in atmosphere so my recommendation is if you're thinking of going to Burning Man then save some of your n95 gas masks right so that when the sandstorms come around you're protected take care of your lungs but I think you should try to go earlier than not because it's it's a completely different atmosphere and I would love to go again in the future it was it was uh way more than you might have heard of and it's hard to kind of grasp and explain but it brought out some of the best creativity I've ever seen in people in my life so yeah absolutely consider that if it's kind of expensive takes a lot of time but if you're ever in a position where you can go and you're willing to take the time I think you'll really really enjoy it there were even you know kids and parents families just having a good time together out there it's it's not just all the all the mess that you hear about if you go looking for it you're gonna find it but there's plenty for anyone out there is what I would say anyway thank you everyone for joining me things like a question blockless is a good one and I'll catch you later take care much love and stay cryptic peace

Congratulations @technical01! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!