When I was enrolled in grad school at New York University's School of Professional Studies, I wrote several papers on the topic of Bitcoin and crypto-currencies and even attempted to install a Bitcoin ATM on campus modeled after MIT's Bitcoin ATM experiment. However, NYU rejected the proposal stating that Bitcoin was too volatile and risky to invest at the time back in 2015. Bitcoin and Crypto-currencies have come a long way since its inception and has climbed through everyone's expectations and possibly shooting for the moon. I personally believe Crypto-currencies are the future of money and that regardless of the uphill battle for acceptance by the masses, crypto is killing the markets and out performing everyone's expectations.

I am posting some of my papers I wrote in grad school for my final dissertation back in 2015. Reading this is like looking in the rear view mirror of time and man, have things taken off.

THE CASHLESS SOCIETY

A large percentage of the American population today do not carry cash. The notion, “Cash-is-King” no longer holds true in the 21st century. A survey conducted by Bankrate, a banking journalist company, says that approximately 78% of American carry less than $50 in cash on them on a daily bases. Credit cards and debit cards are used more often than paper currency to purchase goods and services. With e-commerce, the use of credit cards, (a form of digital currency), has become a norm in the American society and much of the world. The online consumer does not have to worry about being physically robbed and losing the money in their wallet. In essence, digital currencies have been around for quite some time, and have helped to change the consumer’s consciousness.

According to Positivemoney.org, 97% of deposited money is digital, leaving only 3% in actual physical cash. In October 2014, Apple introduced Apple pay only for the iPhone 6, which uses near frequency communication technology (NFC). Apple has established plethora of different businesses around the world to accept Apple pay digital payments and is helping pave the way for a cashless society.

Next on the horizon is Bitcoin and Crypto-currencies, which will further enhance the digital currency options for both the consumer and the merchant.

“SUSTAINABILITY” AND THE IMPORTANCE OF AN OPEN SOURCE ECONOMY AS DISCUSSED IN THE HAS MCCOOK’S WHITE PAPER."

According to the article, “The Rise of Digital Currency” by Rob Myers, Bitcoin and or cryptocurrency has encouraged a debate about what money is, the purpose of money, and how money should work; indeed its production, use, and successors have embodied that debate. It has created a sense of possibility and a range of production comparable to the early World Wide Web.

The value of a Bitcoin has gone from as little as $1 per Bitcoin to as high as $1100. As of June 27th, the price stabilized, and has been trading in the more relatively narrow range of $343 to $422 through late September and October 2014.

Hass McCook states it best in his paper entitled, “An Order-of-Magnitude Estimate of the Relative Sustainability of the Bitcoin Network”, when he concludes that the relative impact of the Bitcoin network does not even register on the radar of the fiat and gold-based monetary systems, representing a very conservative relative environmental impact of 0.11%, and a relative economic impact of 0.275%. There are no negative social externalities because of Bitcoin proliferation, and any money laundering and shadow economy dealings that currently happen on the network will reduce drastically in proportion as adoption grows and regulations firm up on the on-and-off ramps into the Bitcoin economy. Rome was not built in a day, and the crypto-currency space will take time to evolve in order to ensure that the issues faced and created by our legacy monetary systems do not continue to plague us for the next century and beyond.

Bitcoin is a sustainable commodity that does not share the same issues and concerns that fiat currency and gold, have. Bitcoin does not require the same energy consumption, labor, or materials that coin or paper production requires. McCook’s paper “An Order of Magnitude Estimate of the Relative Sustainability of the Bitcoin Network” breaks down the sustainability of Bitcoin and compares it with the current monetary system.

Several topics of sustainability are addressed by Hass McCook’s paper

Gold

Gold tends to holds its value because of its inherent properties: Gold properties include, its use in electronics, other commercial uses, is use in medicines, its use as currencies and jewelry.

Gold Issues:

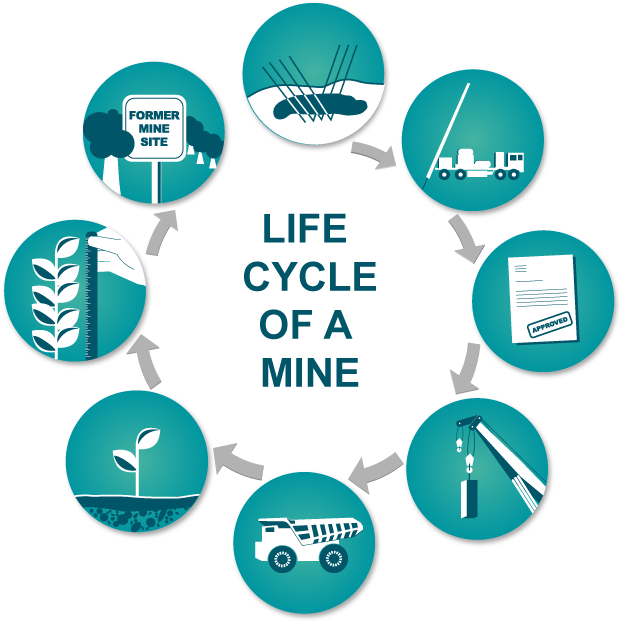

Gold is extracted through mining and as gold becomes even more scarce it becomes harder to source and mine.

The Cost of labor, and the cost for energy affect the cost of gold. The price of gold is also impacted by the rise and fall of the cost of fossil fuels, electricity and machinery. As stated in Hass McCook’s paper “At current production rates, known global gold reserves will be depleted in 20 years’ time, and new production will rely on recycling.”

One third of all gold produced each year is recycled.

Gold mining has economic, environmental and social costs.

The Effects of Cash Printing and Coin Minting:

The Bretton Woods system: of monetary management was developed in the 20th century to govern a nation's monetary policies based on a gold backed currency. In 1971 President Nixon abolished the Bretton Woods system in exchange for a non-gold based economic “Fiat” system. For every dollar printed and coin minted, there is a cost for production.

Banknotes: USD banknotes are made of cotton fiber paper while countries like Canada, Australia, as well as the United Kingdom, (in the near future), use polymer banknotes. Cotton fiber notes are cheaper to produce than polymer notes but have a shorter lifespan. The printing of United States dollars leaves a significant carbon footprint. According to Hass McCook’s research in 2002 on the Federal Reserve:

With the built-in “infinite” inflation of fiat money, more and more physical currency will need to be printed and minted each year.

Security features must be updated to prevent forgeries, and methodologies must be put in place to support product authenticity.

Banknotes that reach the end of their lifespan are incinerated.

The U.S. mint uses 250,000 gallons of water / day = 0.35 billion liters per day in the production of the U.S. currency.

6 million pounds or 2,720 tonnes of wastewater is produced in the process of producing the currency.

It takes 97,850 MWH of electricity to print the currency

Over 7,100 tonnes of cotton and over 2,300 tonnes of linen is required to produce the US dollar bill.

Note: 1 tonne = 1,000 kilogramsCoins: Coins are minted from a mix of copper, nickel and steel and are put into circulation with a 25-year lifespan before they are recycled. International coin minting cost over $1.5 billion every year. There were over 10.7 million USD coins minted in 2013.

The Socioeconomic Impact of Physical Money:

There is a socioeconomic impact that comes with physical money, such as money laundering, counterfeiting, corruption and black markets have helped foster a shadow economy.

Money Laundering:

$1.5 to $2.85 trillion a year, (which equals out 2% to 5% of the world’s GDP), is estimated to be laundered around the world annually. Criminal organizations, who are engaged in: drug trafficking, human trafficking, illegal arms trade and other illegal activity trade primarily in money that either needs to be laundered or money that has been laundered. All of these activities ultimately have an effect on the economy.

Corruption:

The damages of corruption are linked to money laundering and play a significant role in the global economy. The CIA measures global corruption, which is estimated $1.6 trillion in lost funds yearly due to corrupt government officials and politicians around the world.

Black Market:

Black markets generate an annual loss to legitimate businesses of approximately $1.8 trillion a year. It is noted that a majority of money entering the black markets are clean and are obtained by the consumer legally before purchasing illegal goods and services.

It is estimated that $2.8 trillion is generated by money laundering, and the number rises when the spoils of corruption and black market money is added to the pot.

Money Laundering and Bitcoin:

With the entrance of Bitcoin, (a pseudo-anonymous currency that has every transaction posted on a public ledger called the Blockchain), criminal activity becomes harder to hide and detection becomes more feasible. The Bitcoin Blockchain methodology helps, rather than hinders the rule of law and with good investigative work, criminal activity can be reduced. Via Bitcoin, laundered money recovery, would potentially be higher than the current 1%. (Ross Ulbritch, Silk Road open online drug market).

Hass McCook concludes in his paper that crypto currencies like Bitcoin will not solve every problem in the current fiat financial system, but is an alternative. Bitcoin mining reduces the carbon footprint significantly and only requires electricity as a resource to create Bitcoins. Bitcoins have zero risk to individual health and safety when mining compared to precious metal extraction mining like Gold. Energy improvements like solar energy and other alternative energies can make Bitcoin mining more efficient.

Bitcoin mining is finite for there can only be 21 million Bitcoins created through mining. Currently, miners create, every ten minutes, 25 Bitcoins and are entered into circulation through the Blockchain, which equals to the amount of 1,314,900 mined per year. As miners get closer the 21 million Bitcoins, the hash rate “mining” becomes more difficult as for the Bitcoin algorithm becomes more complicated. This will reduce the mining from 25 Bitcoin every ten minute to 10 within the next 5 years. Bitcoin will reach the projected 21 million mining mark in 2045.

Hass McCook states that Bitcoin is still in its infancy and has yet to make an impact on the fiat and gold based monetary market, but can be measured against the current market share of 0.275% of the global economy. Bitcoin’s positive carbon footprint is significant and has not had a negative socioeconomic impact like money laundering and other illicit activity. McCook goes on to suggest that the current monetary system fosters inequality, corruption and has a significant environmental impact.

So, that's a lot of information to absorb. Hopefully you found some of this information interesting and even valuable even for those who know all about crypto-currencies. I have done my best to attach footnotes for your cross reference needs for the format Steemit provides is a little weird compared to Microsoft Word. Thanks.

Footnotes:

1 Caroline Farhat, Bankrate, “Nearly Eight in 10 Americans Carry Less Than $50 in Cash” December 10, 2014” N/A http://investor.bankrate.com/phoenix.zhtml?c=61502&p=irol-newsArticle&id=1929703 (Accessed Decembr 10, 2014)

2 PositiveMoney.org, ”How banks create money” N/A http://www.positivemoney.org/how-money-works/how-banks-create-money/ (accessed 12/10/2014)

3 “Computers and Capital: The Rise of Digital Currency”, Rob Myers, (March 13, 2014), http://www.furtherfield.org/ifeatures/reviews/computers-and-capital-rise-digital-currency (accessed June 21, 2014)

4 Michael Terpin, “Is Bitcoin for You?”, June 27, 2014, http://online.barrons.com/news/articles/SB50001424053111904544004579650261196030186?tesla=y&tesla=y

5 “An Order of Magnitude Estimate of the Relative Sustainability of the Bitcoin Network”, Hass Mccook,( June 5, 2014), https://www.scribd.com/fullscreen/228253109?access_key=key-iZhRvcsFVYpxjPuVQs2e&allow_share=true&escape=false&view_mode=scroll <Accessed October 26, 2014>

6 “An Order of Magnitude Estimate of the Relative Sustainability of the Bitcoin Network”, Hass Mccook,( June 5, 2014),https://www.scribd.com/fullscreen/228253109?access_key=key-iZhRvcsFVYpxjPuVQs2e&allow_share=true&escape=false&view_mode=scroll <Accessed October 26, 2014>

7 Harvard university. (07/15/2015). Bitcoin.Cambridge, Massachusetts: Retrieved from http://ssrn.com/abstract=2495572

8 MIT Technology Review, “The Troubling Holes in MtGox's Account of How It Lost $600 Million in Bitcoins” April 4, 2014 http://www.technologyreview.com/view/526161/the-troubling-holes-in-mtgoxs-account-of-how-it-lost-600-million-in-Bitcoins/ (accessed 12/09/2014)