This is my entry to the sponsored writing contest organized by @monajam. You can find the contest here

The cryptocurrency industry has come a long way, since its birth; but as it is with any industry, new technologies and improvements are to be expected.

One problem that some businesses face, when trying to create security token ICO’s is the technical know-how. For some others, it’s the legalities and regulations involved in the process. This isn’t a journey for the faint-hearted, and as a result of this, many companies get put off, stall and they eventually fail somewhere along the line.

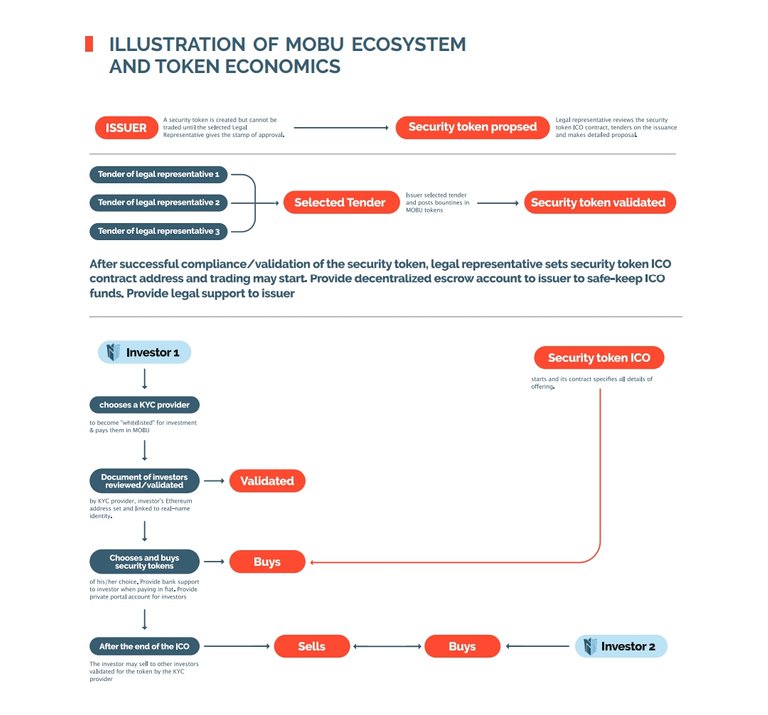

MOBU is an ecosystem that was created to tackle all these issues. It is a decentralised ecosystem that ensures that teams are provided with the resources to be successful. In line with that, MOBU also ensures that businesses are connected with investors, without the need for middle men.

MOBU makes use of some tools, such as smart contracts, which ensures that certain criteria are met, before funds are released.

This is important, because it ensures that companies cannot misuse cash raised during ICO’s and in so doing leave their investors in debt, and without a return on their investment.

As a result of this, MOBU ensures that investors can exit ICO’s pro-rata.

Security tokens are tokens which represent an investment, more or less like a share in a company, which as expected, should bring some returns on investment. The difference between security tokens and utility tokens is ROI. Utility tokens can be used to get some service/value from a company, but not in an investment sense.

An example of a utility token would be users exchanging funds for access to cloud storage. This in itself is a service offered by the company, and users will be able to get a value.

MOBU will have partnerships with banks, to ensure that the conversion of fiat to cryptocurrency is hassle free.

With regards to being complaint with regulations, MOBU provides KYC, AML and ensures that requirements for SEC approval is met.

Security tokens are catching up fast, and as a result of its benefits to investors, it will become the industry standard. MOBU has positioned itself, and will ensure that the dreams of companies and investors alike are fulfilled. In so doing, the sector will thrive, and we will see an increase in the number of successful ICO’s, and by extension, businesses.

Thanks to MOBU, not being technical enough will not be a reason to fail. Issues such as being connected to the right investors and not running foul of government regulations are now a thing of the past. Investors on the other hand, also have more reasons to be positive about getting a return on their investments.

I think it’s only right to feel that a true solution to a real customer pain has been created.

TO FIND OUT MORE INFORMATION ABOUT MOBU:

MOBU Website

MOBU's WhitePaper

MOBU Twitter

MOBU Medium

MOBU LinkedIn

Very good content

Nicely explained

Thanks

Hey. Thank you for this article. Do you think that partnership with banks is important?

I think it is... Seamless process, does away with issues users have with exchanges, etc. I don't just think it's a Level 1 Priority though

Good morning @wakanda

You mind if i ask you some question?

How many people welcome you with words "WAKANDA FOREVER!" ? :)

MOBU seem to be one of very few ICOs that are completly launched as security token. I wonder why. Wouldn't it be better to come up with some utility to their tokens and launch ICO as a utility token?

And also how will they maintan the price? Does MOBU offer Masternodes or POS to attract hodlers? If I cannot use those tokens and on top of that if there is no POS/masternodes introduced into their structure ... then what would make price go up or at least stay on stable level?

Great post. Upvoted already.

Yours

Piotr