Why Do We Need Crypto?

Money is an odd concept. We are told we need it. We work for it. It is the only thing accepted in exchange for goods, services, and taxes (although Ohio just recently announced that Ohioans can pay their taxes in Bitcoin!). In short, we can’t survive without it.

**So why question it? **

Well, if you’re like me, you question things that are forced upon you. You question things when they are presented as the only way. You question if a decision made for you is actually the best way forward-- especially if it is a decision made by your government. Simply enough, shouldn’t the very reason that you were never given a choice in the matter, be reason enough to be curious?

Have you ever thought about how the government has a monopoly on money? It’s OK if you haven't. Most never have, and it is admittedly an abstract and imperfect analogy. But they only allow one currency to be “legal tender”. Perhaps you are thinking, “shouldn’t the government have a ‘monopoly’ on money? Isn’t having a single form of money is like having a single language? It makes coordination, accounting, and price negotiation very sensible! In fact, wouldn’t multiple monies make daily life quite confusing?’

I agree with these points actually! In theory, a singular money system makes daily life and expenses more efficient and forecast able. Money helps us think in terms of one thing, and takes the relative pricing out of the equation. Money makes it so that you don’t need to do mental calculations all day comparing the relative and fluctuating value of one good when comparing it to the value of another. This can go on endlessly! When going to the grocery store we don’t say “this shopping trip is worth 2 pairs of jeans.” When buying ten gallons of gas, we don’t say “it's worth 200 apples.” We use dollars to denominate value, but it is an illusion to think that dollars are the value themselves. The function of a dollar is to be the medium of exchange, and by proxy a short-term store of value (i.e. that dollar I receive today will have the same amount of purchasing power next week as today, but its purchasing power years down the line will slowly be eroded through inflation). Their purpose is to level the playing field when comparing goods and services, which are themselves the value.

We are going to take a closer look at the problem of a government-mandated money, and some areas where the system is not ideal.

But first, a brief primer on monopolies! In general terms, a monopoly implies that a consumer has no option-- no Choice-- in the matter. You use or buy the one thing that is available, and that is all.

Ironically, monopolies are actually illegal in the United States. Antitrust (AKA anti-monopoly) law regulates businesses to promote competition for the benefit of consumers. It is a deeply held notion in capitalism that competition is essential for the growth and well-being of a nation. The key point here is that competition benefits the average consumer, but why then is there no competition within a nation for what currency its citizenry uses?

Government-issued money hasn’t always been a thing. Gold used to be the most widely used form of money for millennia, but gold was Chosen. Gold was free market money, meaning it was a medium of exchange and store of value agreed upon by the people for its inherent qualities. It wasn’t mandated by a centralized party, like our current government-issued fiat currencies.

Among other things, gold was chosen because it has proven to be very durable, uniform (or fungible), and scarce or rare.

This means that one could trust that gold would be immutable and wouldn’t crumble, break, or dissolve and thus lose its value (immutability/durability). One could trust that an ounce of pure gold was equal to any other ounce of pure gold (uniformity/fungibility). And, it was extremely hard to find and produce, so one could trust that the market wouldn’t be flooded with an influx of supply, which would cause the purchasing power of that gold to go down (scarcity/rarity).

It is not a mere coincidence that throughout history, gold was chosen by completely disconnected people all over the world. For example, people in India hoarded, “worshiped”, and used gold just like the Aztecs, the Ethiopians, or the Aleutian Islanders. They never met one another, and they lived during different eras, but they all inherently trusted gold, and for the same reasons. Search far and wide-- history and archaeology show that basically in every inhabited continent in the last 6,000 years, gold was the primary form of money.

Now that we understand why gold was Chosen-- for its inherent value and properties that have been recognized by humanity for millennia-- we begin to see a problem with a piece of paper that has no inherent value. Its value is artificial. Its value is mandated. Its value is propped up by those in charge. Its value is status.

History proves that when competition and capitalism lack-- and government mandates overstep-- then efficiency, progress, and individualism are put in jeopardy. There are long term consequences when government intercedes on behalf of the free market.

In the case of most countries, you have a central bank and government that work in tandem to control an economy on behalf of the people that the government is supposed to be representing. The goal of their monetary policy is to target a certain rate of inflation which should ultimately cause price stability in the markets and act as a counterbalance to a “hot” or “cold” market-- remember that the economy is always vacillating between times of expansion and contraction, and the Federal Reserve has taken it upon themselves to help smooth the transitional times between the two binary phases. Governments and central banks work together to manipulate, or alter, the supply of money (i.e. how much is in circulation), interest rate of money (i.e. how much it costs to borrow. In general, higher interest rates incentivize tighter credit, less spending, and more saving. Lower interest incentivize the opposite.) reserve requirements of a bank (i.e. how much cash from customer deposits a commercial bank needs to have on hand at any given time, a lever that is enabled by the concept of fractional reserve banking), and the interest on reserves (i.e. a lever that was introduced in the financial crisis of2007-2009 to incentivize banks to either have more reserves on hand, or less. For example, if the Federal Reserve wanted to create a greater incentive for banks to lend their excess reserves, it could lower the interest rate it pays commercial banks on their excess reserves. Banks are more likely to lend money rather than hold it in reserve so they can make more money by charging other people interest, which in turn is meant to create expansion in the economy. In turn, if the Federal Reserve wanted to create an incentive for banks to hold more excess reserves and decrease lending, the Federal Reserve could increase the interest rate they are willing to pay to commercial banks for their excess reserves, which is contractionary policy.)

But herein lies the problem. Having a centralized party control the monetary policy AKA the“value” or the “purchasing power” of the money you are saving in is the issue. Overnight, they can single handedly change the rules of the game. They’ve been doing this since 1913. They can devalue your savings through higher inflation, increased money supply, and low or negative interest rates. And prior to Bitcoin, you had no Choice in the matter.

Bitcoin was coded to mimic digital gold, with all those properties I mentioned above, and more. Moreover, Bitcoin has hard coded, unchangeable monetary policy. It takes monetary policy from “meatspace” to “cyberspace”. One is malleable and unpredictable, one is unchangeable and predictable. From Bitcoin’s inception, the rules of the game have, and always will, remain the same. The upward movement in price is a direct reflection of its adoption, and everyday it survives it grows stronger.

In short, we don’t need crypt-- we need Choice. By proxy, Choice introduces Risk, and Risk always introduces Reward.

Follow along closely.

On October 31, 2008, in the heart of the darkest and most devastating financial crisis since the great depression, a group of fed-up activists, scientists, economists, and engineers gave the world Choice. 2008 is not significant because Bitcoin was created. 2008 is only significant because it was the year that Choice’s was born.

Cryptocurrencies are a vehicle of Choice. Nothing more, nothing less.

It has been 11 years since Bitcoin was born. It is nothing short of a modern-day miracle that cryptocurrencies survive and thrive globally. How could the captors and dictators of Choice--banks and governments-- allow the very thing they protect so closely, to escape their grips, mutate, and end up liberating their subjects?! Well, in the same ironic way that legends rise, and empires fall.

Underestimation.

Once in a millennia, an idea so revolutionary arises that it evolves unobstructed. That is, until it is too late. Because the revolution speaks of an unimaginable new world, the idea is written off as unachievable and therefore nonthreatening. Those that the revolution aims to overturn, scoff. “You will overturn us? You have nothing. We have everything. You are a small, scattered group. We are a well-oiled machine. You need to be adopted. We are already ingrained.”

At the outset, you might think it is insignificant to have a Choice in which money you use. I will be the first to tell you that you are wrong.

You think this way because the financial system works well for you, your family, your friends, your community. In fact, you’ve never given a thought about the money you use, much like you don't consciously think about the air every time you breathe. “The money works. I don’t know how it works, and I don’t care how it works. It just is.” Here lies the danger.

The fact is, you don’t need to know how money works until it stops working. When it stops working, you’ll wish you had Choice all along. You may think you are in full control of your financial life, much like the people or Zimbabwe, Venezuela, or Argentina thought they were in control of their financial lives. Ask the families in those countries how it felt when they needed to start over from zero, after their savings were wiped out because of irresponsible and unchecked government spending, poorly managed monetary policy, and eventually hyperinflation. Some families were forced to restart from zero twice in the same generation because two fiat currencies failed. Sure their savings account still said “10,000,” but that same amount of dollars used to be able to buy a car, and now won’t even buy a loaf of bread. That is called hyperinflation. Often overlooked, but very important to understand, the hyperinflation and subsequent failure of the German deutschmark in the 1920s directly contributed to the onset of WWII.

There are a lot of things happening inside inefficient governments and greedy corporations that imply none of us are as in control of our financial lives as we might think, and that is not good.

Some of these things are subtle, like fractional reserve banking. Or, the hidden taxation imposed upon citizens through inflation. Some of these things are flagrant, like the credit card companies openly selling your personal transaction history to brands and advertisers.

I believe that everyone should be aware of these facts, history lessons, and bold ideas that our nation doesn’t dare teach our children in school.

Why should you be aware of these things? Because they are offenses imposed upon everyday people without our explicit consent.

**We are forced into consent everyday. **

If we don’t accept their terms and conditions, we don’t get to participate in the financial system. It’s their way, or the highway.

There is no negotiation. Where there is no negotiation, there is no Choice. Where there is no Choice, there is no power. Where there is no power, there is dehumanization and objectification.

A society brimming with Choice is more vibrant and free.

The question we should all be thinking now, is “How does crypto allow everyday people to take back control of our financial lives that was apparently stolen from us somewhere along the way?

”The answer: by using technologies and systems that give you an alternative where none previously existed. By exercising your individual Choice to save and spend in crypto, you exercise a fundamental, yet very overlooked, component that can save yourself from being objectified by institutions, and a victim of the financial system.

If there is one thing you take away from this manifesto, it is this: Choice is the only thing that can enable a fundamental, societal re balancing of power.

Nothing is more powerful than when the People are given Choice.

Prior to Bitcoin, there was no alternative transaction system for those that want to preserve their medium of exchange and savings from inflation and at-a-whim, arbitrary monetary policy. There was no alternative system for those that wanted to avoid putting their hard-earned money into highly-leveraged, irresponsibly risky banks. There was no alternative system, for those who wanted to preserve the privacy of their family’s purchasing habits.

Once you are informed of the facts-- once you take the time to meditate on what is going on and how you are being taken advantage of-- then you can make your own decision of what to do. Maybe you start up a local activist or discussion group. Maybe you go on to educate your family and friends. Maybe you opt out of certain services. Maybe you just buy Bitcoin and join the Crypto Revolution.

********"Give me control of a nation's money and I care not who makes it's laws"

~Mayer Amschel Bauer Rothschild********

The reasons we need crypto really boil down to the above quote, from the godfather of the largest banking dynasty in the history of the world-- The Rothschilds. Deemed the “father of international finance,” Rothschild understood something that many other contemporaries did not. If you controlled a nation’s money-- its supply and interest rate-- you can control the laws. Laws, as we know, are meant to govern people. But, if you can force people through one money-- one medium of exchange-- you can tell them everything they are allowed and not allowed to do with it.

**Crypto means control over your own savings. **

There is a terrorizing fact that is potentially more damaging than most threats we think about on a daily basis.

Banks and governments don’t have a real plan for how to build a successful economy.

The evidence dates back to the late 1800s, when the two most influential minds in recent economics, Hayek and Keynes, came of age. Both argued for opposite sides on the debate of government influence on open markets. For this guide we’re going to focus on Keynes.

Keynes’ overall sentiment is that ideals and long-term planning be damned, the government has an obligation to take care of its people in every given moment. That thought has driven much of the policy behind money not only in the US, but internationally as well through institutions like the International Monetary Fund and the World Bank. The result of this policy is simply adding bandaid after bandaid on top of an ever-open wound. That wound is debt.

The only way banks make money is through lending. Kind of ironic huh? Every time they get a deposit, they lend out roughly 90% of it! They use your money to help others, and they make interest while doing so.

Currently, there are about $73 trillion of fixed maturity/fixed liability in the U.S. credit system (z.1report), but there are only $1.6 trillion actual dollar bills in the U.S. banking system. This means that there is 40 times the amount of debt than there are dollars in existence to pay off the debt. The reason why dollars have value is because debt is denominated in, and only payable in dollars. You need to have dollars to pay your debt, or you get your assets seized.

If we all had to settle our balance sheets and call in debts, there would be a huge gap in the amount of money actually available, versus what is owed. The debt system is smoke and mirrors, and that smoke has to keep circulating around to keep away the idea of trying to get the debt fully repaid.

The converse is true also. With so many bankruptcies, unpaid debts being canceled after seven years, stolen funds, government takeovers, currencies hyper inflating and collapsing, a ton of value and wealth is evaporated and millions of people who once lived a comfortable life are suddenly starving. When everyone runs to the bank, what happens? The banks are only required to keep a small percentage of reserves. This is called fractional reserve banking. The rest of the money they lend out to make profits by charging borrowers interest on your money! Basically that means about 90% of the money deposited in your bank is actually lent out to someone else and the bank is making money, not you.

What would the bank do in a situation where everyone wanted to withdraw their checking account at once? One possibility is that the Federal Reserve would simply print more money to keep people happy and calm, even though this added supply would make the dollar less valuable.

How can this even happen?

“Bank runs” happen somewhere in the world nearly every few months. Not just third world countries... prominent 1st world countries like Spain and Greece are currently suffering this fate.

But there is a better way... there is an economic system that is ruled by math instead of fear. The rules aren’t decided by a few appointed leaders, but by the entire community that runs it. Anyone can propose a change, anyone can vote for a change. Money isn’t just a boring topicleft to accountants, economists, and lawyers. It’s our very livelihoods at stake and we have to pay attention.

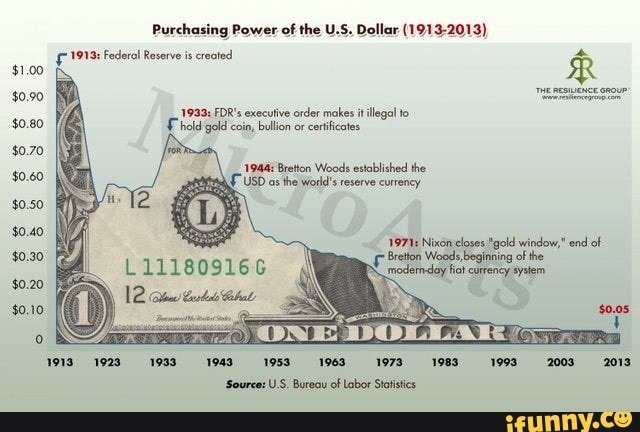

This is a chart of the purchasing power of the U.S. dollar. You can see that over time, due to inflation, the purchasing power of one dollar becomes less and less. The bleeding has slowed down to a drip, but there has been no progress in healing the wound. We haven’t seen the purchasing power of the dollar go up since the 1940s. Not good! How do you save wealth in this kind of environment? Getting out of a debt-based fiat currency and into a diverse basket of assets is your first step. Ultimately, as mentioned before, dollars should be viewed as the denominator OF value, or the expression of value. However, not the value itself. It is a medium of exchange that you get compensated in for doing your job. The money you make is supposed to represent the value that you yourself have created for the economy. You can’t use paper bills as shelter, food, transportation, etc. but you can use it to acquire those things. The house, food,car etc. is what is valuable. Currency is just a way to normalize the expression of value between many assets, and assets are constantly fluctuating in value when compared to other assets due to the laws of supply and demand. I’ll say it again. Currency is a way to normalize the expression of value between many things. It is a unit of economic account. Currency is the tool that makes it so people don’t need to constantly price an asset x in terms of asset y or z. I don't say “my house is worth 16,667 barrels of oil.” I say it’s worth 1 million dollars, even though 1million dollars also equal 16,667 barrels of oil. It also equals 121 Bitcoin, or 575 shares of Amazon stock! Also note that the inverse of the dollar losing purchasing power is actually just asset prices rising.

Diversification is critical for long-term savings. No matter where you put your money, it’s typically not best to put it all in one place or in one investment. Most of us have all of our savings in one bank account, or a 401k at one institution. It’s not safe to keep your entire wealth like that. Don't leave it in one bank account, or retirement account. Don’t leave it in all Apple stocks, or all US Dollars, not even in all Bitcoin. You just never know what can happen in the future, so storing your value in more than one thing is one of the most important things you can do. The term used for a proper distribution of wealth is called a “balanced portfolio”. A balanced portfolio has thoughtfully managed risk. Some wealth is left in liquid cash for expenses, some wealth is in very low risk, low reward investments like government bonds, and then there are higher risk assets like cryptocurrencies, stocks, and private business ventures.

Right now, some governments across the world are issuing bonds with negative yields, in order to incentivize more borrowing and spending, to stimulate their economy. A bond, also known as a loan, typically comes with a positive interest rate. This means that if I borrow $1000 at 1%interest, I will eventually owe that person back $1010. However, negative interest rates flip the script, and degrades the time value of money (i.e. the idea that a dollar today is worth more than a dollar tomorrow due to inflation or its purchasing power). If I lend you $1000 at -1%, you give me back $990. Governments are effectively starting to pay institutions to borrow money. This will have a ripple effect, throughout the financial system, and it calls into question the very nature of money. Negative interest rates at a national or international scale is an experiment that has never been tried before.

An entity issuing a negative yield loan is basically paying a fee to let another entity borrow their money.

Alongside that, don’t keep your wallets and keys all in one place either. Have several crypto wallets and store the private keys in different locations, (i.e. one safe at your house, and the other in private vault storage).

**Crypto means control over your spending **

Crypto transactions aren’t routed through normal credit card networks. Did you know that those institutions sell your purchase history to advertisers so that ads can target you more effectively? We shouldn’t have to see ads for weeks at a time, playing on our recent purchases, social media likes and lusts, enticing us to buy more stuff.

When you hold a deflationary (as opposed to inflationary) money that tends to gain value overtime, you start to think differently about how you spend. Instead of blowing cash on snacks and soda, you begin thinking things like “the $20 I’m spending now could be worth, say, $100 over the next few years... do I really need this?” For many, getting into crypto is what got them to start saving money in the first place. Limiting your spending is a great way to accumulate wealth. By only buying what you need, you can afford to invest more and ideally see that money grow.

On the contrary to the previous example, if you hold your wealth in fiat currencies, in theory it’s better to spend your money today rather than a future date because everyday that money is becoming less valuable through inflation. This harkens back to the saying, “a dollar today is worth more than a dollar tomorrow.”

Using crypto also offers some protection against fraud. Scammers and hackers can hijack bank accounts and credit card information infinitely easier than they hack a crypto wallet private key. However, in the case of credit card companies, they will reimburse you for being defrauded, if you can prove it. In crypto, there is no recourse, meaning that once you’re hacked, it is near impossible to get the crypto back. However, crypto transactions leave a trail in the blockchain that can be traced all the way back to its origins (privacy coins are an exception). If the thief is caught and brought to justice, there is a small chance the authorities force the criminal to return the crypto.

**Crypto is an opportunity to create a legacy **

While crypto is the hot topic amongst world government summits and financial conferences, it is still just in its infancy. Many people thought Bitcoin had hit its peak at $32 and decided it was too late to get in. A few years later, it now fluctuates near $10,000. Aside from the price, the technology has caught the attention of institutional investment firms, retail payment companies, credit card providers, and many more major players in the underlying infrastructure business. Future smart cities will be built with autonomous vehicles and drones that use cryptocurrencies like to pay for their own services like parking, gas, and maintenance. This emerging market is barely getting started.

During the early days of an emerging market, assets go through a phase called Price Discovery, where speculators battle back and forth to drive prices up and down, create and destroy hype and make an absolute killing in both directions, if they know what they’re doing. No matter how good you get at it, never risk more than you can afford to lose. The world of finance, investing, and credit is rigged to favor the wealthy elite. Crypto is a chance to make legacy wealth that most families will never have. In the past, the right assets have grown over 1000x return in just a few years. The wrong assets... 100% loss.

Even if you never actually participate in spot trading, or buy into an ICO, it’s worth it to stick around. The most important thing you will do by getting involved is you will finally learn how money actually works. The stuff our parents and our schools taught us (if at all) is a fraction of the bigger picture. You don’t need to have a degree in Economics to understand that the rich have rigged this game to benefit themselves and give everyone else just enough to keep them busy fighting amongst themselves. Former US President Ronald Reagan revealed a little piece of this international struggle, when he decided to dump the same controls of poverty onto US citizens. He called it “trickle-down economics”.

**Crypto is an opportunity to build something that makes the world better **

Every second of every day, someone in the world is looking at his/her boss and thinking “This idiot...I could do things better if I was in charge!” With crypto, you have a chance to make that happen like never before. If you have an idea to solve a problem, there are startup incubators every where that provide entrepreneurs with grants and education to create a product and raise funds via cryptocurrency. Crypto enables the democratization of access to capital like never before!

Maybe you have more than just a good idea, but a belief. Crypto gives you the tools to create your own movement. People have created mineable coins that don’t just solve random math puzzles, but instead help map the human genome, or donate compute resources to SETI to search for extraterrestrial life. Other projects mine coins that are partially split into a community pool, and everyone involved gets together and votes what to do with it. The different ways to use this technology is growing every day. Whatever you want to do, there are platforms built to help you accomplish it.

The crypto movement itself is a revolution. For the very first time in human history, people around the world are using currencies controlled by no one. This is an invitation to you to be part of something bigger than yourself, bigger than all of us individually. Together, the many have much more power than the few. The few have always been in control because they controlled the money supply. If we, the people of the world, control the money supply, the rich no longer have any power to pay for wars, exploitation, corrupt politicians and judges.

It’s time all humans are free. Join the revolution.