Disclaimer

I'm not responsible for your financial decisions. Please also note that I am NOT a part of Theta team/community. All conclusions are based on what an average user can find available on the internet. Consider this article as the one, a potential investor can write while researching the coin.

Before we start let me give you a brief outline of what we are going to talk about today:

- What is Theta

- Theta Use cases

- Theta Tokenomics

- Theta Founders

- Theta Partnerships

- Fundamental part conclusions

- Theta Technical Analysis

- Final verdict

1) What is THETA?

Theta aims to establish itself as the blockchain-powered video delivery platform featuring decentralized streaming and token-based bandwidth sharing model.

This model enables streamers from countries with expensive or bad internet while incentivizing those who possess high speed and cheap internet.

Blockchain and consensus algorithm overview:

Blockchain: Theta blockchain for TFUEL token

Ethereum blockchain for THETA ERC-20 token

Consensus algorithm: PoS combined with 3 innovations:

- Multi-Level Byzantine Fault Tolerance (BFT)

- Aggregated Signature Gossip Scheme

- Resource-Oriented Micropayment Pool

Overall the problem with CDNs (Content Delivery networks) is real. Blockchain is a "nice try" to solve it. I really enjoy how this is described in Theta wallpaper and other writings - they are not trying to over-complicate things. So first plus is well-deserved.

2) THETA use cases

Today's live video streaming infrastructure is expensive, though available only to top streamers on the platforms. (For example, to stream in high quality on the platform like Twitch.tv you should be Twitch verified partner)

Decentralized video streaming will let users earn Theta fuel, broadcast high-quality video, and reduce the costs of delivering video streams for platforms.

There are many use cases for THETA, including:

Viewers earn tokens from advertisers as engagement rewards, and can in turn gift them to favorite content creators.

Streaming sites can make sales of premium goods and services, and deepen user engagement through TFUEL.

Advertisers fund advertising campaigns with tokens to support influencers, streaming sites, and viewers.

Streaming sites and platforms can offload up to 80% of CDN costs, incentivizing bandwidth relayers.

Even though it may seem a little bit overwhelming at first glance, all use cases are pretty "logical" and easy to catch up with.

Personally, I'm a big fan of blockchain projects which focus gaming industry. Gamers are an inquisitive audience, hence knowledgeable and able to figure out how Theta works. A big plus for adoption.

... and from my side as well.

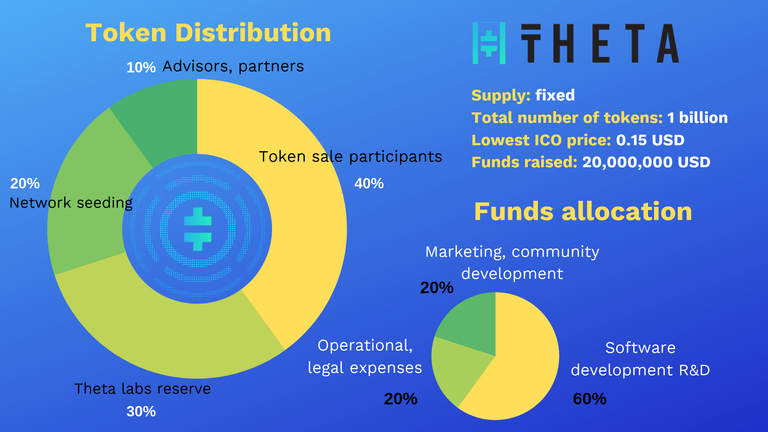

3) THETA tokenomics

It is important to say that there are two tokens in Theta protocol:

Theta Token (THETA) and Theta Fuel (TFUEL)

What's the difference between them?

THETA is a governance token. You can stake it and contribute to block producing. The supply of THETA is fixed at 1 billion and will never increase.

TFUEL is more of a utility nature. Relayers earn TFUEL for every video stream they relay to the network users. After the initial distribution of 5 billion TFUEL (5 for each of the 1 billion THETA), the supply will inflate on an average rate of 5%

From my experience double-token model works the best. Interests of both parties are taken into account. Users and Investors both are happy. And so am I for them. Another plus.

4) THETA founders & advisors

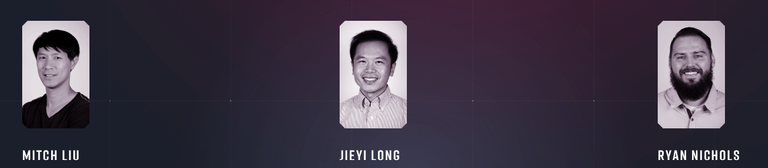

THETA Leadership

Theta's team is inseparable from SLIVER.tv (leading e-sports entertainment platform with patented technology to live stream top e-sports events in fully immersive 360° VR) as SLIVER.tv launched Theta ERC20-compliant tokens in December 2017.

- Mitch Liu (Co-founder / CEO)

Achievements: Co-founder SLIVER.tv, Gameview Studios, Tapjoy

Education: BS in Computer Science & Engineering from MIT; MBA from Stanford Graduate School of Business.

- Jieyi Long (Cofounder / CTO)

Achievements: Co-founder SLIVER.tv

Education: BS in Microelectronics, Peking University; Ph.D. in Computer Engineering, Northwestern University

- Ryan Nichols (Chief Product Officer)

Achievements: Director at Tencent for the Wechat app; Cofounder of a live video streaming app for foodies.

THETA advisors:

Among Theta advisors are such prominent names as

- Steve Chen (Co-founder of YouTube)

- Dennis Fong (Founder Plays.tv)

- Justin Kan (Co-founder of Twitch)

- Kyle Okamoto (Chief Network Officer at Verizon Digital Media)

- Steve Dakh (CTO at SmartWallet)

Theta team and advisory board are another big pluses. Needless to say that these names are widely known in the industry which they are trying to disrupt. They definitely know what they are doing and why.

5) THETA partnerships

Theta has partnered with top Korean companies MBN and CJ Hello (American equivalents to Time Warner and Comcast); Samsung VR (Samsung Next, the VC arm of Samsung is an investor); MBN News (Korean equivalent to CNBC).

- On July 17,2019 SLIVER.tv announced a partnership with BRAVE browser/BAT.

Theta investors

Names speak for themselves. Plus.

6) THETA community

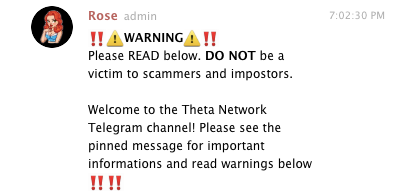

What strikes your eyes first is that Theta has well-structured media, which is a sign that the media team cares for its users and their comfort.

Telegram is subdivided into three groups: for traders (3.2K users), for announcements (2,6K) and Theta network discussion group (13K).

Theta Reddit community has two subreddits (Theta token (4K) and Theta Network (1K). First one was abandoned due to re-branding reasons. All these media communities seem to be fully legit as the rate of active followers more or less matches with the displayed group and threads count.

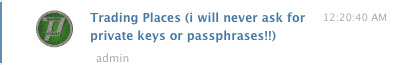

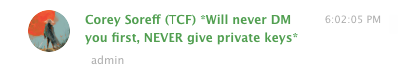

There are a lot of warnings in the Telegram group for the users not to get trapped into a scam. All admin names contain warnings for the users. Good practice!

In "Theta Trader" community is talking about "hodling" long-term. Most users think that Theta is undervalued.

It seems like Theta followers are naturally interested in the development of the project, as people themselves offer solutions to scale the community. Such enthusiasm is a green flag. Contributors and community managers sail in one boat.

Last but not least. There quite a lot of admins in the telegram group (I've noticed at least 5), who seem to be active and have good technical knowledge about the project.

Theta is a good example of time invested in community development can bring 100x returns. Despite people in general, tend to care more about coin's price, community managers have awesome possibility to utilize investors talents for the project's well-being because once you buy-in, you start feeling like an owner, thus interested in project success.

Plus.

7) THETA fundamental analysis resume

Honestly, Theta is the first project from my experience where I'm impressed literally by every part of it. The overall organization feels like it was done by someone with a huge experience within the blockchain industry (which, in fact, is true).

I'm highly bullish on THETA for the long term. Great fundamentals + fixed supply = long term profit (simple, yet working formula)

8) THETA technical analysis

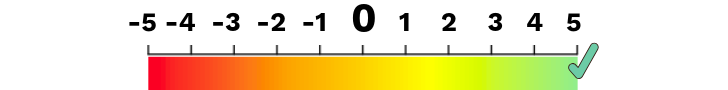

On the contrary to the fundamental analysis, TA looks neutral, making it a perfect fit for swing traders. More details on my Trading View.

9) THETA Verdict

Even though Theta technicals look somehow tricky, don't let the short-term blur your long term-vision.

If the team continue to deliver in such a fast pace - sooner or later Theta will be a top 10 coin for sure. From my point of view, it's highly underrated now. Theta team managed to create a reputation of a top-10 project being a top-100.

So if you are looking to put in your investments for 3-5 years, it really doesn't matter whether you will be able to catch the lowest price.

Current prices are reasonable to go with.

P.S: Always do your research before investing. This article may age but google results won't. Thanks for reading!

Congratulations @y0ujin! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!