There are basically four markets, each with their own characteristics.

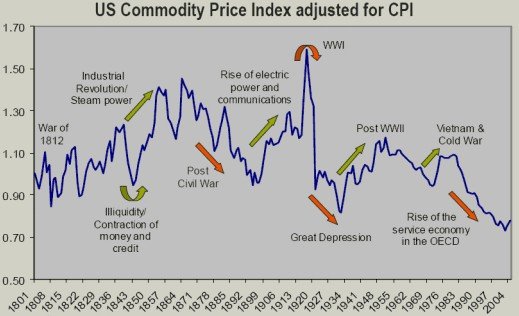

The most important one are the commodities. This is where everything begins. Here, basic materials exchange hands to make the goods we need and the gadgets we want. As production methods improve, prices of commodities continuously decline. Of course there are ups and downs, if only due to the porc cycle, geo-political woes, crazy increases in demand as during the Industrial Revolution, and the price perception is always obfuscated by the inflation of the medium of exchange, but, in real terms, the general direction is sideways to down.

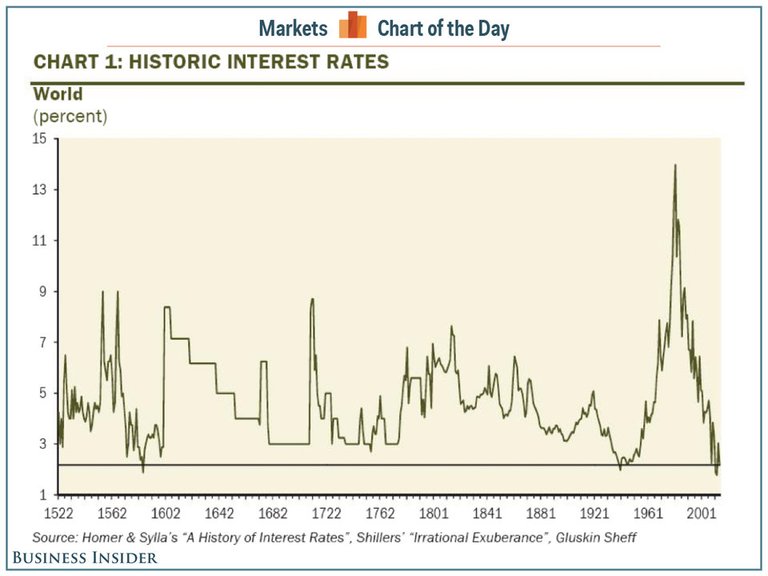

Second are the interest rates, or the bond market. Very important as interest rates are like the traffic lights of an economy; low interest rates are like a green signal: Go! While high interest rates represent a red stop sign. The interest rate market is a neutral market where the interest rates hover around historical averages; which, for the developed world is somewhere around 5%, with the last 200 years fluctuating around 2.5%. Obviously, with de facto negative rates, we are looking at very low numbers right now.

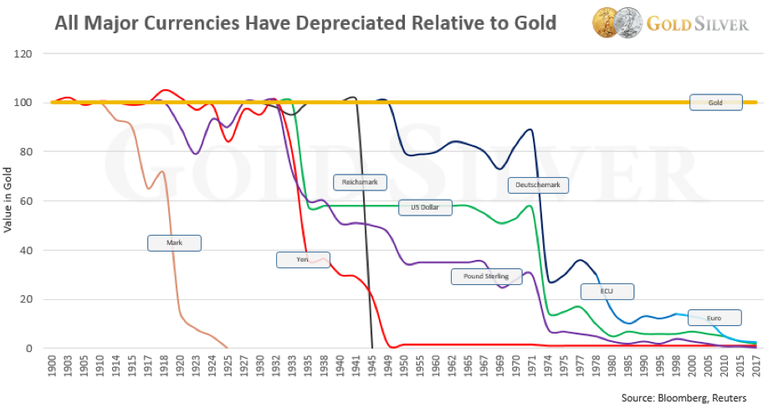

The third market is the largest one: Forex. This is where all currencies are exchanged against each other. All fiat currencies are subject to an inflationary monetary policy, meaning their value diminishes. The game you play here is to guess which currencies will devalue more or less rapidly than other ones, but it remains, for all fiat currencies, a race to the bottom.

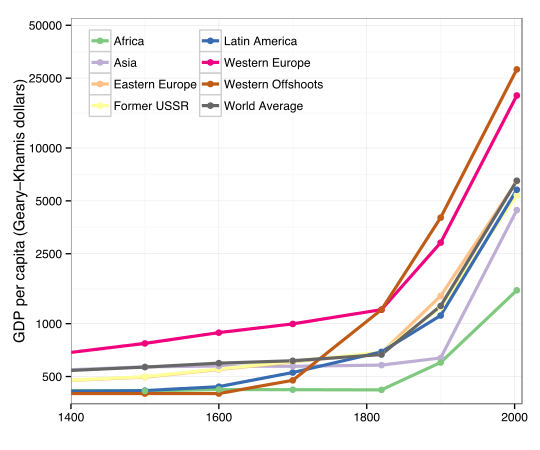

Fourth, and last, are the stock exchanges. This is the market that gets the most media coverage. Most likely because the stock markets are generally seen as growth markets where companies, or at least the major stock indices will become more valuable as the economy grows. And by principle there is no limit to the amount of growth that can be had. Peaks and troughs will occur, of course, but the general direction is up. Currently, with prices and valuations at historic highs, I would think we are at or near a peak.

So, of the four different markets, by design, three move down to sideways and only one goes up.

But now we have the cryptocurrencies. They represent the future: young, wild, unpredictable, techy, ambitious, idealistic, full of promise and plenty of risk. How does crypto fit in? And is it a different, fifth market in itself?

Well, crypto is not going to replace commodities. What possibly may happen is that the markets where these commodities are traded will become decentralized and fueled by crypto technology. It may even be that at some point they will be priced in the favorite crypto du jour. But the goods themselves, I would think, remain unaffected. Not so with the other markets.

As crypto is for everybody, borrowing and lending will no longer be restricted to the happy few. We will all become borrowers and lenders. The sheer increase of market participants should lower the price of money, which is the interest rate. Now, it may be that the quality of both borrowers and lenders drops due to the massive influx of new participants and this will lead to either higher prices for those less qualified or to restrictions from the most prominent lending platforms. All in all I expect the net result to be positive (lower rates) for borrowing money.

The Forex market, on the other hand, will be demolished by crypto. Instead of having a bank account with units of measure that become consistently less valuable, we will all prefer to have a bank account with units of measure that become more valuable. With that simple observation alone, crypto has the potential to replace Forex and become the largest market on the planet. Although we will have to deal with Gresham's law (bad money drives out good money), meaning you will spend the bad money (fiat) while holding on to the good money (crypto). Arguably, at some point, nobody will want to receive the bad money and go through the tedious and costly process of exchanging it for better money.

With respect to the stock exchanges; well, that's difficult to predict. I don't think all companies will disappear because they have become decentralised. At least not anytime soon. Can you still own part of a decentralised company? Probably. What will happen for sure is that all companies are going to adapt blockchain, or better decentralised ledger technologies, in the same sense as all companies are on the Internet. The difference between DLT and the Internet being that the Internet is just a method of communication, which is a prerequisite for crypto, but crypto has much more and much wider possibilities of application.

How this is going to play out nobody can predict, what does seem to be the case however is that crypto is establishing itself as as an independent marketplace with a plethora of exchanges, some of them decentralised, others not. So, next to the 4, above described markets, which are all are very mature, established markets that have been around for centuries, we now have a fifth market in crypto. And rightly so as this is going to be the ultimate growth market, certainly when compared with the other four of which three are sideways to down and the only growth market is topping out.

There’s one thing for sure, there’s another massive financial crash coming for stocks, bonds & will likely effect real estate to some degree as well but not as bad. Crypto will drop as well but afterwards money should start flowing into crypto..