While trading at just under $ 14,000 on January 1, Bitcoin has now reached its lowest level in 2018.

Around noon, at the writing of this article, its price had dropped below the threshold of $ 8,300:

And it was surprising to see a much lower price in the Asian markets - especially on South Korean trading platforms, which typically had prices well above the world average:

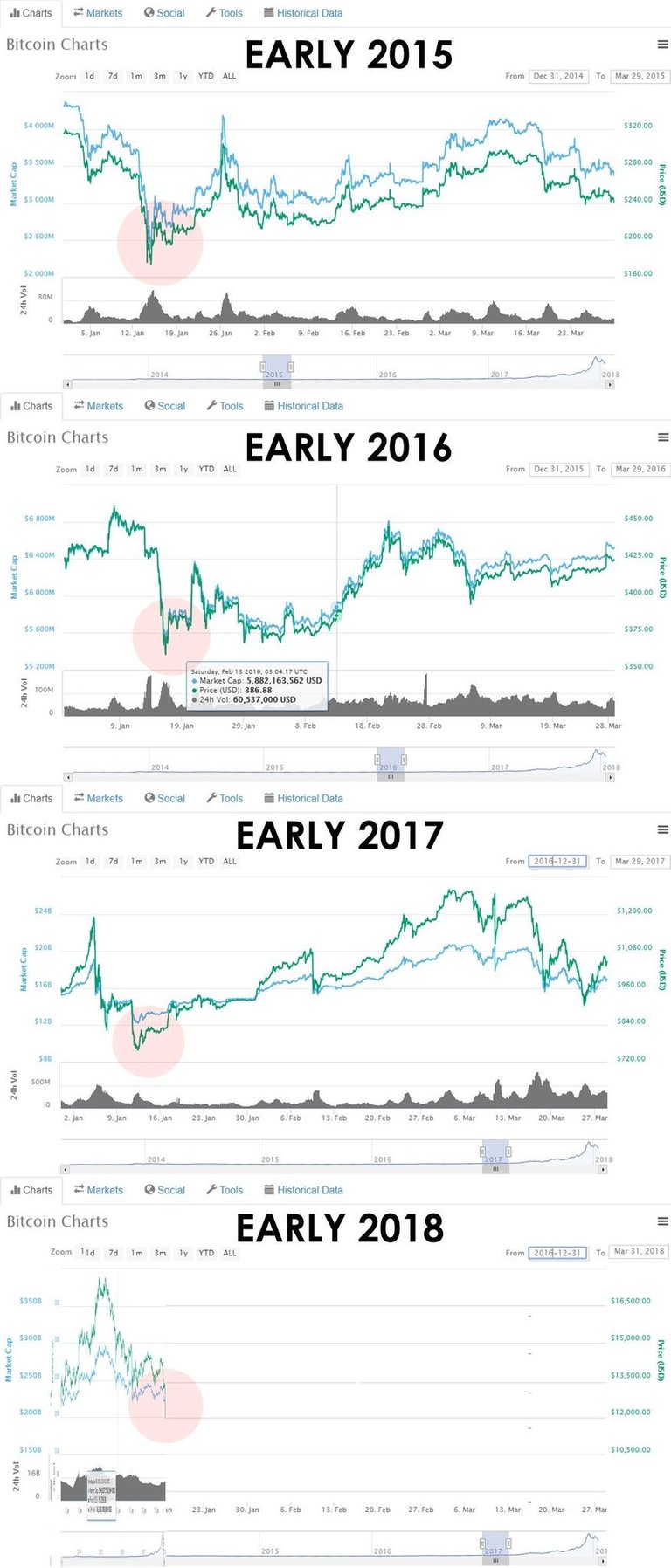

With a decline of about 28%, the month of January 2018 is the worst performance for Bitcoin in a month, since January 2015. The digital currency had then recorded a similar drop in intensity, from 320 to 226 dollars.

What could be the main causes of the fall of Bitcoin?

Falling Bitcoin PricesWhile these may not be the main causes, let's look first at the various government statements that frightened investors - and fed the downward pressure that plunged Bitcoin and vast majority of crypto-markets:

South Korea has stirred this year fears of a closure of cryptocurrency trading platforms, as decided China last September. Yet, even though Seoul has recently set up a working group to develop a regulatory framework around these platforms, it is likely that this activity will not be banned - in any case, this is clear from the statements made there. a few days ago by Finance Minister Kim Dong-yeon.

In the Netherlands, Wopke Hoekstra, the finance minister, said some of the kingdom's ruling parties would like to limit activity around these markets - perhaps even ban them. We should probably know more in the coming weeks.

Yesterday, the bad news came from India, while Arun Jaitley, the finance minister, said in his speech that the government expected to crack down on Bitcoin and cryptocurrency trading. However, several observers remained optimistic, indicating that the authorities would not prohibit the detention and use of this asset:

It should be added, however, that the last two countries mentioned, the Netherlands and India, account for only a negligible part of the exchanges made on the markets. This is not the case in South Korea, where around 20% of global transactions pass.

We can also mention the decision of the German BaFin, which asked that the exchange platform GmbH stops allowing its customers to convert their euros into Bitcoins. However, it seems that this initiative is only related to this site, and that it does not reflect a desire of the authorities to attack this ecosystem.

But the pressure of regulators is probably not the only element to create downward pressure on the price of Bitcoin.

A few days ago, Facebook announced that it banned advertising related to crypto-currencies, ICOs or binary options - a decision that probably did not have a great influence on the markets.

There is also a recent Bloomberg article, which referred to the incentives to appear that were sent in early December to Bitfinex and Tether Limited. Several observers are concerned that, contrary to what the latter indicates, the value of all Tethers in circulation (more than $ 2.2 billion) is not guaranteed by an equivalent number of dollars. They believe that the company could have in recent months, by issuing many Tethers, "boost" artificially the course of Bitcoin.

Others believe that the fall of the digital asset in January could be part of a kind of annual trend. This is indicated by a tweet published on January 16th:

![DTrofxOVMAA4AXD.jpg]

)

)

The reason ? Some mention the superstition of investors from Southeast Asia, while others believe that traders want to "take their profits" before the arrival of the Chinese New Year.

Finally, several observers accuse Wall Street, which would have decided to manipulate the price of the BTC: some fund manager could have relied on the futures of the CBOE and the CME to plunge Bitcoin - and take advantage of this decline.

Many reactions on Twitter

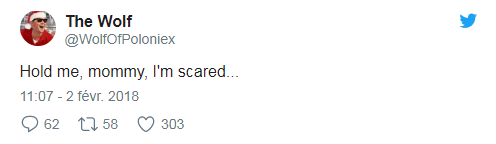

On Twitter, some users were terrified:

But most netizens call to hold on in this storm, and to remain optimistic:

Bitcoin: despite the storm, very encouraging figures

If the markets did not grow enthusiastic, we could now find some comfort by focusing on developments in the Bitcoin network.

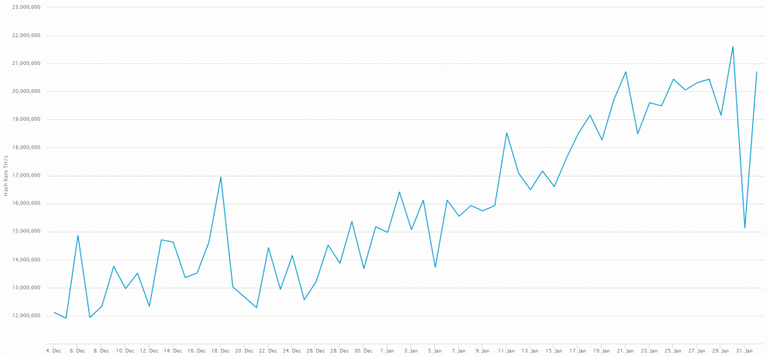

Despite a sharp drop on Wednesday, the hash rate enjoyed by the Bitcoin network (the total computing power provided by the miners) continued to increase.

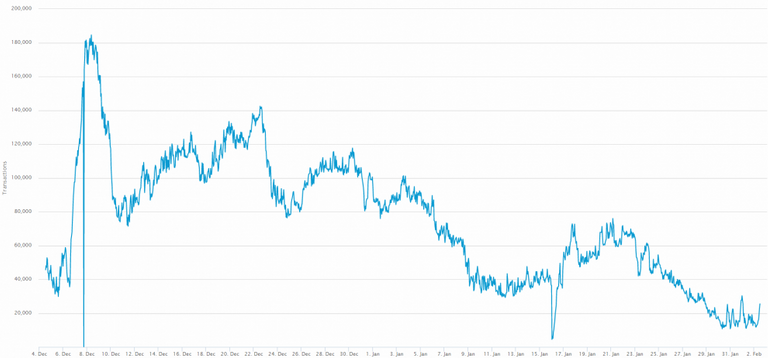

And the size of the "mempool", which hosts transactions waiting to be integrated into a block by the miners, recorded a sharp decline:

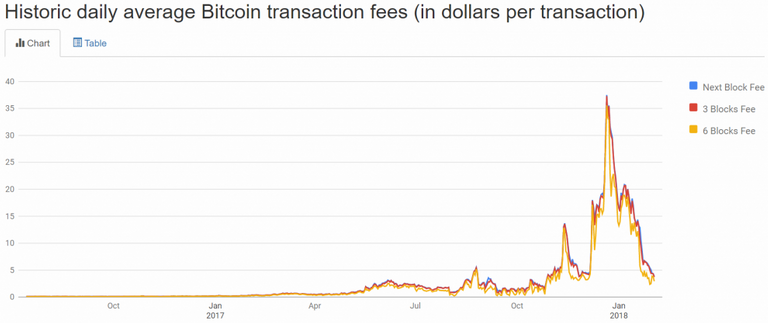

At the same time, the transaction fees that prevailed on the network were down sharply - they ranged between $ 3.50 and $ 4, against more than $ 35 a few weeks ago:

Finally, at the time of writing this article, there were already around 1700 Lightning Network nodes. While this technology could potentially solve Bitcoin's "scalability" problems by offering fast, low-cost payments, it is still an experimental innovation that will have to prove itself over the next few months before disseminate more widely.

Given these elements, we can think that, oddly enough, Bitcoin is in a much better position than it was on December 17, when it was trading at $ 20,000. Let us hope that this improvement will soon be reflected in the price of digital currency.

Following you! +upvote