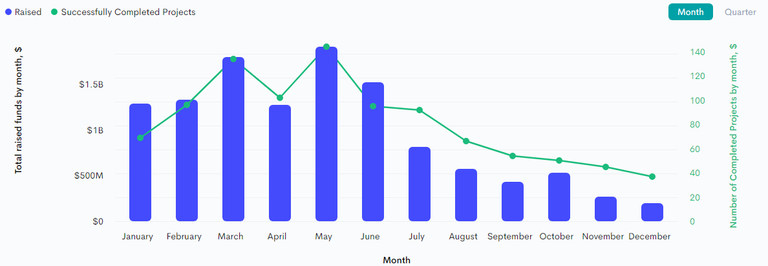

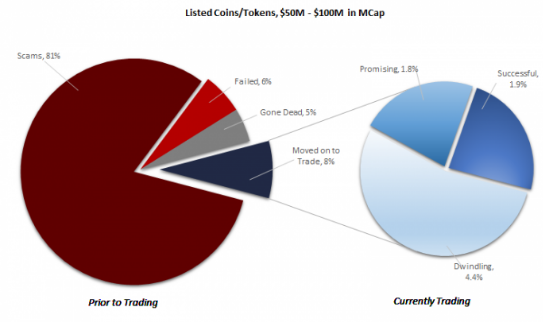

According to Gartner, 2018 for ICO can be called the “precipice of disappointment.” ICO - the primary offer of coins - finally lost investor confidence by the end of 2018, not only because of the collapse of the cryptocurrency market. In the midst of a crypto hype in 2017, attackers kidnapped $ 300 million using the ICO. In the middle of last year, consulting company Satis Group calculated that 80% of 2017 campaigns were fraudulent. During 2018, the organizers of the ICO systematically deduced cryptocurrency, which they collected from unsuspecting investors. Over the past year, the organizers have sold a total of 1.6 million Ethereum - a third of the total ETH, attracted in 2018. From 423,000 coins got rid of in the last month of the year.

The fall in popularity of this method of attracting finance has generated two new trends. The first one is STO - the offer of tokens, which are equated to securities and are officially regulated by the state. The second trend, the stablecoins which are crypto assets backed up by physical assets, traditional currencies, or the most stable cryptocurrencies.

The prerequisites for the transition to STO were the requirements for traditional ICOs, which were formulated by the US Securities and Exchange Commission (SEC) in 2018. SEC offered startups to officially register ICO using Form D. According to the rules, only accredited investors owning assets of more than $ 1 million, persons with annual incomes of more than $ 200,000 and companies with assets worth more than $ 5 million were allowed to participate in ICO. For example, the TON project by the Durovs brothers used the form D.

Startups that conducted ICO without the consent of the SEC, released or promised to release unsecured pseudo-assets. In November 2018, the regulator set a precedent, forcing ICO-startups Paragon and Airfox to register tokens as securities. For the fact that the companies did not do this immediately, the commission obliged each startup to pay a fine of $ 250,000 and return the money to investors.

Participants in the cryptocurrency market view STO as a logical transition to the regulation of tokens-stocks. According to forecasts of the consulting company ICO Alert, the STO market capitalization will reach $ 10 trillion by 2020.

The growing popularity of STO confirms the development of services for the sale of stock tokens. So, tZERO, a subsidiary of the online retail platform Overstock, launched in January 2019 a platform for trading tokens equivalent to securities. Polymath and TrustToken also offer this service. Last fall, NASDAQ announced its intention to launch a service to trade stock tokens.

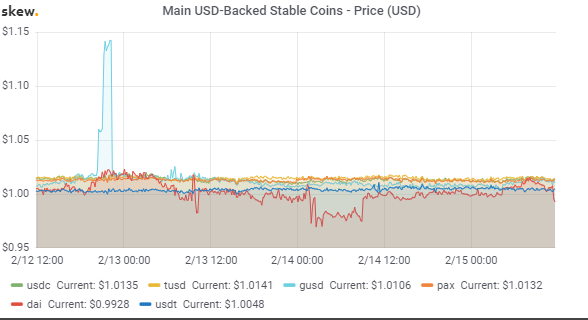

In addition to the lack of transparency with which the SEC is struggling, crypto assets are still subject to another problem - volatility due to a sharp rise in the course, often not supported by anything. Seven-fold reduction in the cryptocurrency market forces its participants to seek a solution to the problem of instability. Providing crypto assets with traditional assets should make the market more predictable. Tether, one of the first stablecoins - USDT, pegged to the US dollar, has already survived the exchange rate accusations. In the absence of transparency of these fiat "connections", crypto activists have found another means of speculation for alternative dollar stablecoins: Paxos, Dai, USD Coin, Gemini Dollar, and TrueUSD. But unlike Tether, the listed cryptocurrencies have not yet discredited themselves, and therefore they are developing the market of stablelcoins. According to analysts by the Skew platform, these coins will surpass Tether’s capitalization in eight months, unless, of course, it turns out that this is just another hoax.

Stablecoins is, in my view, the only reasonable, oractical application of blockchain. You just send money cross-border, but with no fees.

That's true. If only fiar-stablecoin exchange services were mature enough worldwide. At least, here, in France, that's a real problem - with btc/eth easy, but with USDT or EUROcoin - fucking endeavor.

Why not just use Telegram bots? Like @btc_banker

USDT is dead. Long live USDT