Bitcoin and the rest of the cryptocurrencies did not sit well with Google's decision to ban all advertising related to them and the ICOs from next June. After the decision announced yesterday, the value of all the cryptocurrencies has fallen back with force just when they were beginning to recover from the last falls.

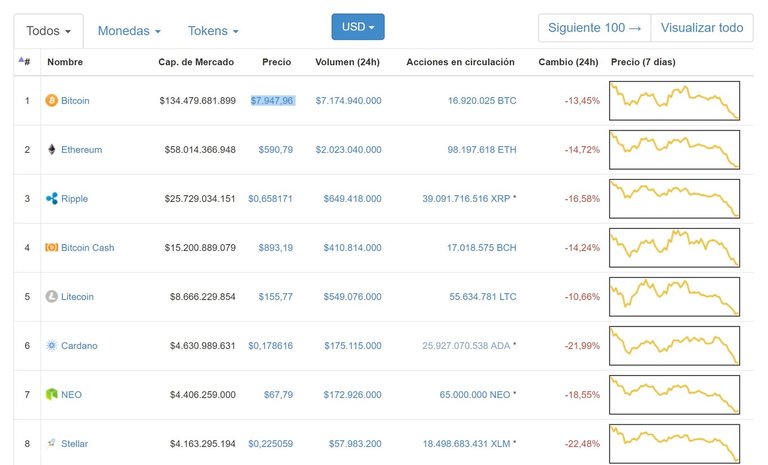

At this time, if we look at indexes such as CoinMarketCap we will see that the value of Bitcoin has fallen by 13.45% with respect to yesterday, and its value already drops below 8,000 dollars. In the rest of the cryptocurrencies most used according to this index, the drop is even more pronounced, with decreases of 14.72%, 16.58% and 14.25% for the Ethereum, Ripple and Bitcoin Cash.

As usually happens, the most logical thing is that in the next few days the value of cryptocurrencies starts to grow again. But what is clear is that, with so many ups and downs, it does not seem easy for them to find a short-term stability that makes them grow back to the levels they had at the beginning of the year. Even so, we will have to wait and see what happens in the medium and long term.

It should also be remembered that Google is not the only one that is charging against this type of technology. At the end of January it had been Facebook who also decided to ban ads related to cryptocurrencies and initial offers of currencies ("initial coin offerings" or ICOs) in all its services. In addition, celebrities such as Bill Gates are also criticizing it strongly, and some governments are threatening to ban them.

The measures taken by Google or Facebook have not stopped causing some controversy among those who support the block chain. The decisions are, according to companies, to protect users, and it is true that there are many deceptions trying to catch clueless with keywords like Bitcoin or Blockchain. But what they are doing is to generalize and punish everyone equally, also to the legitimate advertisements of products that strive to do things right.

Governments like the Spanish swim against the current

While European countries such as Germany, France, or Italy, in addition to others like the United States still do not seem willing to enter to regulate cryptocurrencies, there are still some who decide to swim against the current and place themselves in favor of this technology. This is the case of Spain, where the Treasury is studying its impact, and the government party is drafting a bill to try to favor them.

The idea of Spain is to offer benefits such as possible tax rebates to attract companies that use technologies based on the block chain or opt for initial currency offers (ICO) as a financing tool. With this they could be wanting to position themselves in Europe together with countries like Switzerland as one of the blockchain world capitals.

In any case, the debates around the cryptocurrencies and the chain of blocks have only just begun, and it remains to be seen what ends up happening after it abates, if it does, this storm of instability once the Bitcoin and company normalize the prohibitions and measures against which they are being imposed.