The huge cryptocurrency correction of 2018 is hardly yet over as this article is being writtenBut it is a sizeable correctionBy comparison, the 2014 crash, the largest so far, saw an 80% drop in price from the peak, while the current drop has been about 60% from a high of nearly 20K to a lowest point so far during this crash, of about 6800. However, even though there is no consensus yet on whether the correction is over, we are already able to review the predictions of some of the cryptocurrency analysts here on Steem. Please note that performance during this correction should not to be taken as indicative of how any of the selected analyst will perform in future, nor does it indict any of the analysts. In fact, the selected analysts here are among the three that I have followed and like reading from. Also, it is my experience that some analysts and the techniques they apply, might prove more accurate under different scenarios and market situations, while not so much in other situations. Also, let’s note that all analysis are really probabilities and not a statement of certainties. And this piece should not be read as an endorsement of any trading strategy, trade, investment advice, or analyst.

Why is Trading Analysis Important?

Trading analysis is not important to everyone. If you are into finding assets of fundamental value and holding them, then TA might not be that important to you. However, even in such cases, a good analysis can provide you a good entry point. On the other hand, if you are trying to more aggressively grow a portfolio, maybe a good TA can make some difference. For instance, during the correction going on right now, if you had a good analysis after the first drop of bitcoins from 19k to around 10k and the initial bounce back to 17k, knowing that this was the beginning of a major correction that could see assets as low as 6k could net a more aggressive investor nearly three times their initial holding. So let’s dive into our review. And just like we have analyst ratings and ratings agencies for stocks and fiats, there might also eventually be similar for crypto analysts and this article is intended to inspire thoughts in that direction.

Selected Favorite Analysts

Firstly, let’s commend the selected analysts here on Steem for putting their knowledge and time to provide their insightful analysis. There is a lot that can be learned about markets whether you believe in TA as a tool that relies on measures of past behavior that has been utilized in discerning trends and expected market behavior. The analysts I follow here are Haejin, Salahuddin, and Srezz. Also, note that TA is not an exact science and it events can affect the trajectory of any asset. For instance, if the CFTC and SEC had come down hard on the cryptocurrency space on Tuesday I have little doubt that the shape of any of the charts would have a different look today. So TA is hard and is likely a measure of what is probably than an exact crystal ball. So here are the calls as they progressed through the 2018 crash.

Haejin is a very informative analyst that shares the basis of the procedure behind how he comes about his analysis and conclusions. For those who wish to not simply be consumers of trading analysis, Haejin typically produces videos that describes and educates his followers in trading analysis.

Initially after the first drop around January 17th to 10k, most analysts on Steem and even on twitter, predicted the correction over after the bounce from that low back to 17K. Haejin also saw it the same way. Here in a post around Jan 25th indicating the resumption of a bullish trend.

By around January 31st when the market had then fallen to 10K, Haejin suggested the most probably scenario showing a falling wedge that would take the price to somewhere above 7k and then a recovery.

By February 1st this was refined to about 6,800.

However, following the strong bounce from around 7.5k, the preferred pathway was modified to either a recovery or an ascending triangle.

And then a possible head and shoulders on February 2nd.

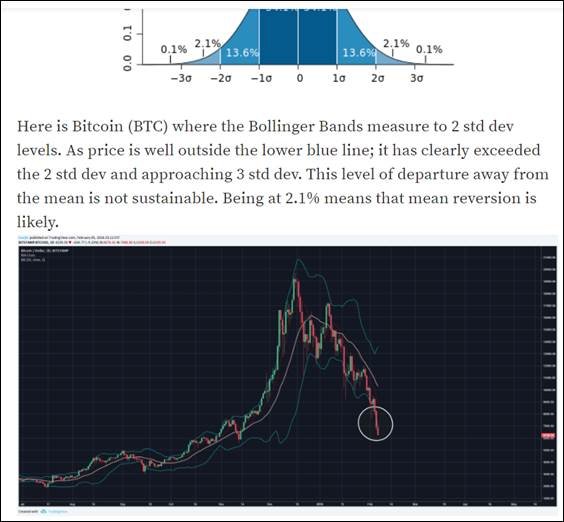

The current preferred prognosis, drawing on the statistical bell curve, is that the correction is currently too stretched to continue much further.

The current call is that the bottom could be in, but there could also be a lower low; unless the recovery is confirmed by the current trend breaking some crucial support that has now turned into a resistance.

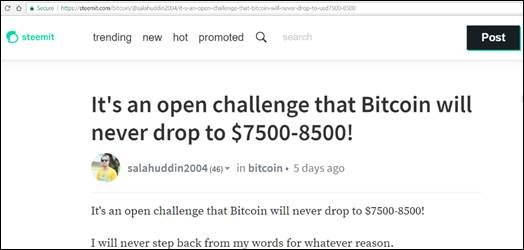

Salahuddin is a former currency trader with notable performance in those markets, and offers very interesting take on several cryptocurrency assets now on Steem. However, at nearly every stage of the current correction, he tended to declare the correction over. Here on February 1st:

And by February 5th:

The current call is that the correction is over.

I first noted Srezz as an analyst on Cryptocompare Ethereum forum back in June 2017 after Ethereum hit ATH of about $420 and then started dropping. To the annoyance of the mostly bullish readers of the forum, the analyst predicted a trajectory that would see Ethereum go lower than most expected and only slowly recover back to that ATH after about 6 months. Eventually, Ethereum did go down significantly and only again reached and exceeded that ATH some time in November. So I kept an eye out for Srezz’s analysis after he joined Steem.

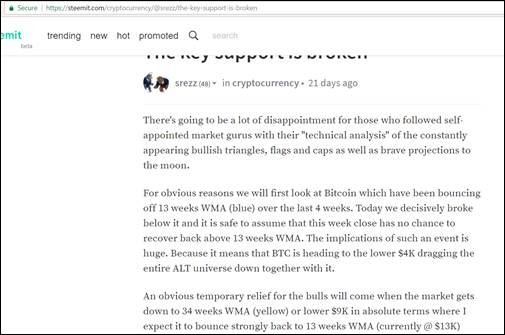

During the current correction, around Jan 15th, Srezz analysis was an expectation of a further initial drop to 9K, a bounce to about 13k, and then further drops that would like take the asset down to around what seemed then to be an implausible 4k.

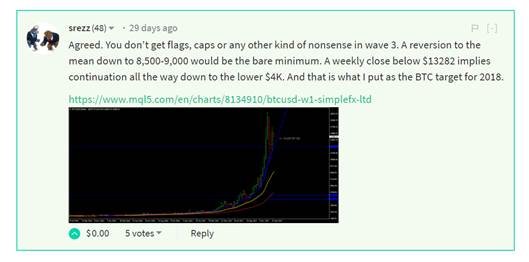

In fact, even before that, in comments on someone else’s blog that I did not see until recently, similar analysis was presented.

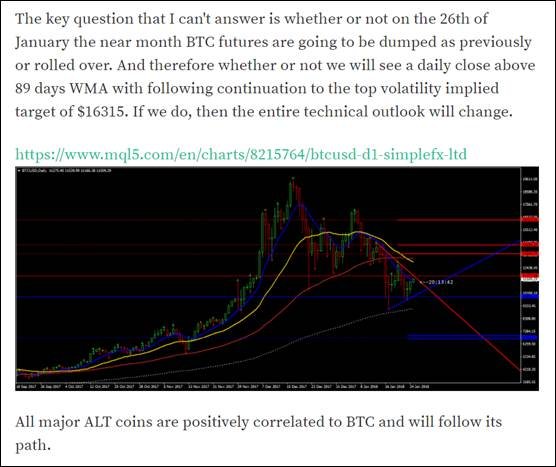

However, the analyst seemed to consider the correction could be over sometime around January 26th depending on if holders of futures contracts decide to buy or sell:

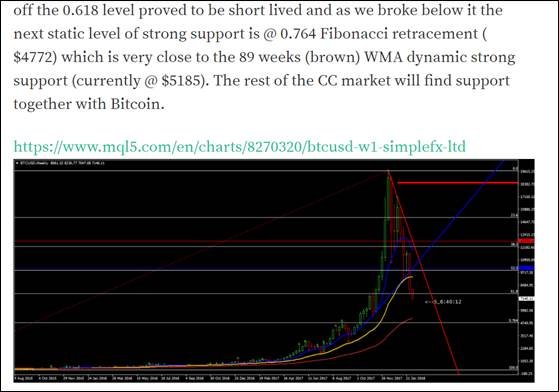

By Feb 5, this was qualified again to a potential low of around 5K.

The current call is that the bottom we saw around 6900K could be the lowest point and recovery needs to be confirmed by current trend overcoming some of the resistance on the way up.

Summary

Trading analysis is not an exact science and can not precisely predict the future. Using several tools including Elliot wave analysis, fundamental analysis, statistics, and sometimes even artificial intelligence, analysts can only provide a probability of the most likely outcome. As a result, it could be informative to follow several analysts and take or leave any analysis depending on your own preferences, analysis, or past performance of each analyst in the market depending on such factors as if it is a bull or bear market. This review is not intended to criticize or invalidate any one’s analysis and should not be taken as such. I intend to continue to follow all the analysts reviewed here and continue to value their viewpoint and see merits in their arguments and presentations at various stages.

And on a lighter note here’s how difficult TA has been the last few weeks.

Courtesy: https://twitter.com/twitter/statuses/960709605000019968

Courtesy: https://twitter.com/twitter/statuses/960709605000019968

If you liked this article resteem it or upvote it and refer it to others. If you do not agree with any aspect of it and need a correction leave a comment. If you wish that I add other analysts to my consumption list also do leave me a note. Thanks.

This info is so valuable and should be read more.

Thank you!!! So help resteem it. I've seen a lot of good stuff also buried on Steem because they were by no writers with no rep.

Disclaimer: I am just a bot trying to be helpful.