a leading financial technology (fintech) research provider, disclosed to CNBC how 124 hedge funds are invested in crypto assets such as bitcoin. With over 2 billion USD under management, it appears, despite some well-documented Wall Street naysayers, the world’s most popular cryptocurrency is convincing money managers the time is right to invest

Crypto Hedge Funds Now at 124 and Counting

Evelyn Cheng of CNBC reports that leading U.K.-based independent fintech research company, Autonomous Next, claims “more than 90 funds focused on digital assets like bitcoin have launched this year, bringing the total number of such ‘crypto-funds’ to 124.”

![piggy-2889046_640.jpg]

Her article details how “the largest share of the funds, 37 percent, used venture capitalist-type strategies and had about $1.1 billion in assets under management,” with digital assets and “statistical arbitrage on digital currencies” rounding out the rest.

( )

)

Autonomous Next’s estimates that in total the “assets under management by crypto-funds now stands at $2.3 billion,” CNBC documents.

This might catch some readers off guard because, as CNBC explains, while “several leading Wall Street banking executives remain [publicly] skeptical about bitcoin, more seasoned money managers are moving into digital assets management.”

Even though crypto-related enthusiasm is relatively high on Wall Street, the “overall number of crypto-funds and their assets under management is also still minuscule compared to the record $3.15 trillion held by the hedge fund industry,” according to CNBC.

Bandwagon is Getting Crowded

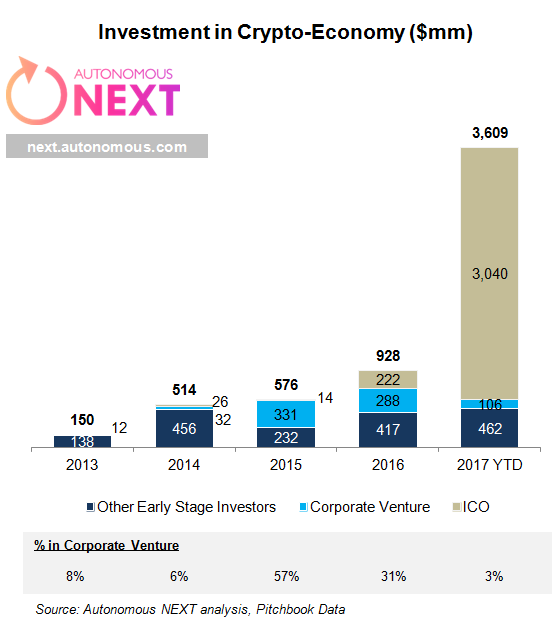

This week, Autonomous Next charted growth of initial coin offerings (ICOs) and related investments. Over 100 Crypto Hedge Funds, Over $3B in ICOs stresses the “crypto economy is moving faster and faster across regulation, assets and new financial ecosystems.”

Since this Summer, the firm tracked ICOs with more than 1 million USD in investment. “Our current [total] figure up to date is $3.04 billion,” they point out. “It is hard not to conclude that the market has shifted considerably from Enterprise blockchain to the public chains in terms of committed resources (even if you assume 50% of 2017 ICOs are scams).”

On purpose, they’re excluding “investment vehicles built by traditional asset managers that package exposure to a single currency, such as the Bitcoin Investment Trust from DGC/Grayscale,” the post lays out.

“While data visibility in this space is quite poor, and not all ‘funds’ are actually funds, we are able to piece together a fairly coherent story about what is happening. Our current view is that 75%+ of these funds were started in 2017, that in total they manage between $2 and $3 billion,” [emphasis added].

Is the increasing hedge fund phenomenon a healthy addition to the bitcoin ecosystem? Tell us in the comments below!

Not indicating that the content you copy/paste is not your original work could be seen as plagiarism.

Some tips to share content and add value:

Repeated plagiarized posts are considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

Creative Commons: If you are posting content under a Creative Commons license, please attribute and link according to the specific license. If you are posting content under CC0 or Public Domain please consider noting that at the end of your post.

If you are actually the original author, please do reply to let us know!

Thank You!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cryptosumer.com/2017/10/29/wall-street-hedge-funds-rush-to-cryptocurrencies-nearly-100-bitcoin-like-this-year-alone/