China is a controversial country, especially regarding crypto currencies. Not only turned the ICO regulations in the past months the market upside down, but also Chinese blockchain projects started to gain attention in the western world. Antshares / NEO is a promising project, that was the first to received wide praise in the crypto community as whole. China also is a special place for me – not only because Waltonchain and Loopring are the first two currencies I reviewed, I also lived in China for some months.

The mission of Metaverse is to create a “decentralized open platform based on public blockchain technology to digitize assets and identities”. They compare themselves not only with the comparatively “small” project BitShares (which is about the same size as ETP right now, regarding market cap.) but with Ethrereum. 1

Bold? Maybe. Let’s see, what is the reason for their confidence.

(As I have read this over and over again: the evaluation of other similar currencies can be one indicator on the true value of a currency. It is just not reliable. For examples on this, just look at Golem (~160 million market cap) and SONM (~40 million market cap). “Neo is at one billion, so ETP is undervalued” as a standalone statement is not a bullish indicator for the value of a coin. It is a bullshit indicator for the person who tells you this.)

Disclaimer:

I have no connection to Metaverse, ViewFin, their partners or employees.

It is my personal view on their project.

I have not received any inside-information or incentives (be them monetary or non-monetary) that somehow influenced the analysis

This analysis does not claim to be complete

For more detailed informations regarding e.g. fund allocation, please read their whitepaper.

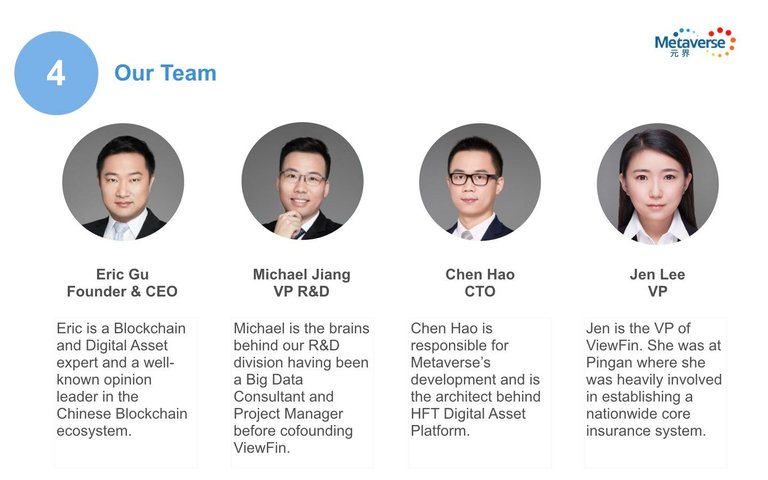

Eric Gu, Founder and CEO 2

Eric Gu is an experienced IT developer and founder of ViewFin (the developing company of Metaverse). He lists 12 years of working experience in the US and Canada as well as 4 years in China and is one of the Co-Founders of Antshares (today called “NEO” and the Chinese blockchain project with the biggest market capitalization of all Chinese projects). 3 Eric Gu is also the one who came up with “Antshares” as the name for the project.5 Basically this means that he seems to know his stuff, when it comes to crypto currencies – he in fact claims be interested in this industry since 2014.

Hao Chen, CTO

He was the star lecturer of 2017 Arch Summit and some of his presentations were transcribed and put on Steemit by Metaverse. 6 7

Janice Shi, Head of Global Development

I could not find major information about her. She however seems to be quite active in relations with e.g. exchanges and also seems to be the one in charge at conferences.

The team of ViewFin is working full time on the project and it is said to have around 50 employees. On the website however, only 9 of them are listed. I also could not find any confirmation on the “50 employees” – statement other than this fact being called out over and over on reddit, twitter and other forums. On LinkedIn, ViewFin is listed as having 51-200 employees. 8

The project itself looks solid from the visible team. The issue regarding the size of the team should be made a bit more public in my opinion, because it gets thrown into everyone’s face by the overly excited people with no proof whatsoever.

Regarding their media coverage, they are quite strange. Because while they received a bit of coverage in some minor crypto currency media news outlets9, they can also claim to be covered by Forbes in July10. These are also not labeled as paid press releases. There were also some informative interviews with the CEO Eric Gu, meaning that they care for public coverage and are aware of not only servicing the Chinese community but the western audience as well (I really can recommend watching the interview Eric Gu conducted with Boxmining)11 12. It is good to see that the CEO makes good use of his knowledge of the western audience from his experience living in Canada.

Other than that, no major news coverage was achieved so far, meaning either the news outlets themselves need to catch up or they deemed Metaverse not relevant enough to cover it so far.

Besides their first ICO in late 2016 (where they raised about 2 million USD), they received seed funding from unknown institutional investors of about 200,000 USD in value in 201713. It is the same case with Ripple in this regard: it has bad implications and good ones. But as we don’t know who these institutional investors are, it is not possible to tell if it is good or bad.

They have two partners so far:

• Zengold, a platform to enable a more flexible trade with gold

• ZenAir, which aims to “build up an online travel ecosystem on the blockchain”

Both are based on Metaverse. And it shows, that Metaverse is indeed serving a market. However, both of their partners are just small start-ups, so there is no extreme benefit to be expected from them soon, if their services do not skyrocket in the next months. And them skyrocketing is not to be expected, because… Gold is never out of fashion, but how often do you trade it? It is – in some circumstances – something you add to a diversified investment portfolio, but speculation on gold is not really fashionable, the market is small. And ZenAir is not operational so far, so they are no major competitor for the established service providers in this field.

Another partner is the Russian crowdfunding blockchain project KICKICO. This partnership is indeed great for the future, as it improves Russian and Chinese blockchain projects. However: both countries pose quite a risk to projects within their countries. And their first goal is the creation of a Russian exchange – but why trying to establish yet another exchange? In Russia? Where ministers are hard to pinpoint on a secure position on the topic of banning or welcoming crypto currencies? And even when we put aside the dangers the Russian market poses, the size of the volume BTC/RUB is not even scratching a quarter of a percent of the whole market. I admit that there might be money to make in this (after all, it is still a market with around 3-4 million USD volume per day), but it is not groundbreaking.

Just recently, they announced a partnership with Draper Dragon, a venture company of Tim Draper. 14 The partnership will handle about 5 million ETP, which is quite strange, considering that they are a venture company. At the one hand, such a partnership is most the time beneficial, due to the network that is made available from it.

However: if we consider the fact that ETP wants to change to a dPoS consensus method in the future, this leaves quite a bad taste. Also, Draper was / is invested into Tezos, which I personally consider a very shady “ICO”, where most of the small investors will lose money in, while Draper gets money out of this “ICO” without any danger. This will not influence the grade – I just want to point out that Metaverse in this case might work with a partner, who has no real interest in the project in the long run. It would be amazing for them to disclose the conditions on this partnership, to dissolve similar worries.

Publicity: 7/10 (7 – the team is transparent, the CEO known and they offer a wide variety of communication channels of which most are active; -0.5 because the activity seems to be selective on certain topics; +0.5 for the continuous progress reports)

ETP leaves little to desire in this regard at the first glance. We of course have the usual platforms twitter15, slack16, reddit17 and facebook18 in use. On top, there is also a forum19 , instagram20, youtube21 , a blog22 , Weibo23 and telegram24 .

It is not a bad idea to have many communication channels, but they seem to be a bit spread out on their channels, I guess. Either this or I just had bad luck on the times I was reading them – because none of my questions was answered by the team, neither on Slack nor Telegram. They are on these channels though, on Slack they just seem to be more focused on questions regarding their wallet, as they seem to be quite acute.

But the forum is lacking in activity, Instagram is admittedly not so usual for a blockchain project and stay the hell away from their telegram channel. Within the time frame I tried to use it (about a week), it was spammed with more memes, gifs, pictures and badly drawn TA that a five-year-old would be ashamed of. I don’t hold this against ETP, seeing this behavior on communication channels is quite normal for a currency that gained a wider attention.

The Slack is way more usable and less spammed than the telegram channel. But they seem to only answer wallet related questions, at least in the past two weeks. Either they are short on staff in this regard (meaning that only tech-staff is answering on Slack) or avoid answering these questions on purpose. I tend to believe the first assumption, as these matters were more pressing during the time I asked them.

ETP is listed on three exchanges: Bitfinex, OpenLedger DEX and BTER – trading however takes place only at Bitfinex against BTC, ETH and USD. However, if you are a US citizen, trading ETP will terminate by the 9th of November 2017.25

Of course, they also have a Whitepaper26 , however the topic regarding their roadmap is mixed in with their “progress report”, which they started to release three months ago.27 According to the second most recent report, they should start with the beta testing of digital identities this month.

Activity - grade: 6.5/10 (7 – many channels and good established communication with the community; -0.5 for the heavy focus on the support for the wallet & not answering other questions on these channels; -0.5 for the scattered roadmap (this is something to include in the whitepaper); +0.5 for the Idea of a regular monthly progress reports)

Metaverse is often compared to Ethereum and rightfully so – it also is a platform for providing smart contracts, but with a different approach. Metaverse advertises a significant difference: Ethereum is about smart contracts, Metaverse is about smart assets. Assets need first to be registered on the blockchain, to be then able to be used by something like smart assets. The token used by Metaverse is called “Entropy” (ETP).

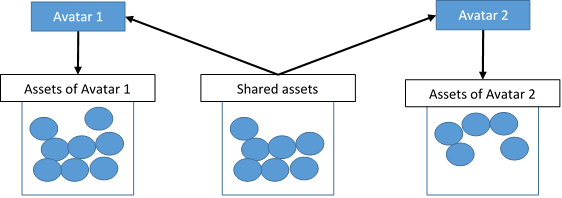

After this registration, these assets will be allocated to the avatar, the representation of an entity on the system. Anyone can (as a person / company / IoT-device etc.) have an unlimited number of avatars and any avatar can have an unlimited number of assets allocated to them. Also, assets can be held by several avatars at the same time, hence the n:m or many-to-many-relationship (which some might recognize from databases).

So, the Avatar can be the digitalized “you”, which is associated with digital assets that you own, all secured on the blockchain of Metaverse. So far, so easy.

But Metaverse aims to include another unique step e.g. when you want to enter a bit more detailed and verified information on your avatar. Because if you like to add your place of birth to the information of your avatar, there is in theory nobody able to prove or disprove your statement. You can write Asunción (Paraguay), even though you are born in London or vice versa. If there is no proof, believing this information is totally up to the reader of the information. And no computing power in the world can officially give objective proof or disproof of this information.

This is where Metaverse wants to include “Oracles”. Oracles can be represented by official government departments and provide objective proof of said information. So, the information of your birthplace being Asunción becomes way more reliable, as it is approved by the Oracle, that is operated by the government of Paraguay.

Another example would be a bank – a bank could store your ingot of gold, provide proof of you having this ingot in your property, register the ingot as a smart asset on the blockchain and therefore make a real, tangible asset usable on the digital blockchain.

Basically, Metaverse tries to expand the Blockchain to the real world. And while I like their approach very much, I always end up with two major issues in this regard:

a) “middle man”

While I personally have not many concerns on this aspect, many others dealing with crypto currencies have a general problem with third parties. After all, one of the major points of Bitcoins creation was a banking crisis and falling trust into large financial institutions, as they did not do their job properly. The need of said official third parties on Metaverse therefore might be a big daunting factor for the crypto community itself – not because it is not working, but because they do not trust these institutions.

b) lack of incentive for many essential oracles & legal issues

Especially when we look at governments, we look at horrifically slow processes and legal issues, so them adapting Metaverse as an Oracle is either highly unlikely or far away in the future. So, the oracles need to be e.g. credible companies (like auditing companies), which in turn might run into legal issues, if they are e.g. not allowed to officially legitimize a birth certificate in the specific country the user is from. So, adaption of big trustworthy Oracles is – at best – very slow.

Moving on to the phases in technology, they want to apply a regular PoW-system first, which will work with GPUs. But they want to stay away from “[…] the SHA256 and scrypt algorithms to avoid facing the possibility of a 51% attack.”.(Withepaper,pg.30) The ETP allocated to the PoW-mining are capped at 30 million ETP with the following stats: (Withepaper,pg.9)

- block reward of 3 ETP

- block time of 24 seconds

- difficulty adjustment after each block

After this, Metaverse is aiming to transit to a modified dPoS consensus method.

(Withepaper,pg.21)

So, we have basically two phases, where different features will be implemented:

Phase 1 (PoW):

- digital identities

- digital asset registration & transfer

- data feed & credit evaluation

- support of additional blockchains operating on Metaverse

Phase 2 (dPoS):

- smart contracts

- implementation of Oracle services

However, I guess either I did got this wrong or the Whitepaper is not explicit enough on this, as I cannot imagine, that they want to attach the implementation of smart contracts and oracles purely to the amount of ETP mined.

In their whitepaper, they also point out some problems on the dPoS-consensus method (which was invented by BitShares and is also used by e.g. ARK and Lisk). I will just quote myself, as I did explain what dPoS is already in the analysis on ARK:

DPoS is basically a democratic way of distributing the power of creating new blocks & confirming new transactions to a restricted amount of people, who are voted by everyone who owns the currency. These delegates can be voted for and of course also voted out, if they do something against the will of the majority of the holders. So, the major difference between regular PoS and DPoS is, that the system does not select a random holder of the currency to create new units of a currency and process the transactions. Instead, one among the restricted number of delegates (51 in the case of ARK, 101 in the case of Bitshares) that were voted for beforehand will be randomly selected every time, a new block is created (every 8 seconds in case of ARK). With DPoS, it is therefore not needed anymore for everyone to have the computer running online 24/7. Only the delegates need to do this, to ensure that new blocks are created and transactions are processed. The distribution of the newly generated coins afterwards is depending on the delegate – some are sharing a larger share profit of these coins to these who voted for them, some none of it.

There are two problems in this consensus methods according to Metaverse:

a) Financial interference

“[…] by acquiring the majority of tokens, delegates can interfere by supporting or opposing important protocols to manipulate the token price for short-term profit. In the current Bitshares system, it is estimated that only $3 million USD worth of tokens is required to manipulate voting results.” (Withepaper,pg.30)

While I understand what they mean by this (short-term manipulation by whales), I tend to disagree with them for some reasons:

1st: the trading volume is too low and too scattered.

If someone would buy 3 million USD worth of BTS, it would increase the price itself significantly. It would open the manipulating buyer of the BTS to a significant danger of the price dropping afterwards, leaving him only with the voting power. This can be of course circumvented by buying over a very long period – but this in turn would open the question, if this can be really called “short term manipulation” and if using these funds for regular investing would not be less risky.2nd: It will be recognized by the BTS-community when someone tries to pull it off.

This poses the danger of the community straying away from the project, losing the faith in the dPoS-system of BitShares, selling their BTS and make the value drop.3rd: Which in turn raises the need of making BTS more valuable again in the future to exit the position with a surplus again.

For this, at least 3 million USD need to be in buyorders above the entry point, meaning that they need to create insane FOMO and mass-manipulation to get the people buying their stuff. Or they simply act in the best interest of BTS and act like a normal long-term investor.

So, what seems like a flaw of dPoS is not a flaw, as the circumstances for this flaw to become significant are not there in the first place.

ETP wants to solve this by adding “token height” as a factor in voting. Basically, an “old” holder of ETP will receive a higher voting power than someone who just bought his ETP just recently. If we assume the problem of financial interference as significant, it basically just raises the need of ETP for a malicious attack significantly. It is a bit strange, that they do not see the flaw in this argumentation, as they correctly addressed the reason why this in unprofitable in their own whitepaper:

“They [PoW, PoW & dPoW] ensure that cheating is unprofitable by making the cost of cheating much greater than its reward. Establishing an economic game between nodes based on these algorithms hence allows the system to have the tendency of a stable equilibrium.”

b) Voter apathy

“As voters (users) often lack of interest in the state of a system, most transfer their votes to delegates and are unlikely to monitor potentially malicious delegate behavior” (Withepaper,pg.30)

I understand their worries and this is indeed a major point of criticism in dPoS. Voters do not check, what happened with the goals of the delegates they voted e.g. a week, a month or several months ago. dPoS means, that the holder of a coin needs to follow the actions of the community and the delegates closely. If they don’t do this, a former “good” delegate can become a malicious one and still stay a delegate, as long as the majority of his voters do not check, how their delegate behaved recently.

This problem is solved by “heartbeats”, meaning that holders of ETP need to signal the system, if they want to maintain their vote on a delegate or vote for another one.

They themselves admit that this is not a solution to the problem itself. It “incentivizes” voters to take part in the voting. But from my perspective, this does not incentivize but instead force the holders of ETP to participate in voting. It is basically not significantly different from other dPoS methods like ARK in this regard, where you need to watch your delegates from time to time as it otherwise would mean that you do not e.g. get lower or no payouts at all from them.

What is important to stress out is the fact, that for using Ethereum, you need to know solidity (the programming language of Ethereum). Metaverse however tries to cut out the need of a developer by not using a programming language – if you e.g. want to use smart contracts, you just turn to ViewFin and ask them to do the basic coding for you, ensuring security and functionability. This is the one crucial thing I really(!) like in their project, as this would open up blockchain technology to a wider audience. As someone who needed to trash a technical project myself, because of the lack of an able programmer, this is indeed a nice idea.

But it is also a drawback. One needs to trust Metaverse for doing this – it is the same problem with the third-party issue pointed out earlier.

Now, we have many things about what they want to do. But if I want to look into what Metaverse has achieved so far, I see a wallet. And the development of a mobile wallet. It is not like I expect a working product right off the bat – Blockchain projects are rarely even in a beta testing phase, but we need to keep this in mind. Most of what you have read above is still in development.

Technology - Grade: 6.5/10 (7 – on a technical level, they seem to know, what they are doing and aim to provide an innovative and new usage of blockchain technology & how to bring it to their possible customer; -0.5 for not solving the problems they pointed out in regards of dPoS & being too vague on the time frame of their two phases)

ETP seems to have a rough past, when we look into the graph.

The first pump during the 7th - 10th, I could not find any information. It is thinkable that the value raised above this level due to the Chinese market. Also, Antshares / NEO had a major run in this time, making it possible that this is the result of speculations on a positive connection between Antshares / NEO and Metaverse.

A possible explanation for the short significant sellout at the 21th of August is a small pump that ETH had at this day (jumping from ~$295 to $340). It is possible that some more big traders exited their position in ETP, to profit from this by trading back into USD. Another (albeit way less probable) explanation would be “disappointment” from some traders, after an interview of the CEO Eric Gu related to Bitcoin in the Chinese media, as the report was only about Bitcoin and not even mentioning Metaverse more than in a sidenote (Eric Gu was described as the CEO in a few words).28

The cause of the downfall between the 1st to the 6th September was most likely the Chinese ICO ban. Because even though Metaverse had an ICO back in 2016 and was therefore not directly affected – the price of all Chinese coins took a deep dive during this time, as for the worries, which steps China might take on crypto currencies in general. In this case, it shared the same fate as NEO, which lost about half its value for the same reason during the same time.

The 8th and 12th September looked strangely like several successive P&Ds, but… well, take a look yourself.

I have no Idea, what happened here. Always at the same time (0:00 UTC), no volume and big spikes. Maybe just a badly programmed trading bot got excited at the beginning of the new day and messed around a bit on a small exchange…

The 20th September was the day, ETP got listed on Bitfinex. As it is quite normal for a coin to gain value after being listed at a big exchange (Bitfinex is the biggest currency exchange to date with about 350-400 million USD in volume every day), this is nothing to worry about.29

Let’s get to the most recent hype, which started around the 10th of October. Some addressed this spike as the “breakthrough”, where the western audience first got made aware of Metaverse. However: I tend to not believe it to be this way. It may be the case that this initiated a bigger attention in the western audience, but the major “hype” of this came after this date around the 12th of October, when Metaverse announced their participation at the “Money 2020 conference”.30 After this, many messages were titled with “Metaverse will sponsor and attend […]”, which is true and wrong at the same time. They attended this conference – this was true. The “sponsor”-issue however boils down to “attend”, as every company attending this conference was a sponsor, as they of course had to pay for their attendance.

Do not get me wrong here – it is good, that they attended conferences, as they can network with other companies, meet important people and get traction on their project in general by getting the word out about it. But such an event itself does not justify quadrupling the price of a project or a company. Take DASH as an example – they attended the same conference but the price was stable between 4,500,000 satoshi (~$270) and 5,000,000 satoshi (~$300) at the time. DASH also “sponsored and attended” – and not only as a “one-star sponsor”, but a “two-star sponsor”.31 32

Disclaimer: by this, I absolutely do not want to say, that DASH is better. I am not saying, ETP is doing a bad job.

It is in fact quite the opposite: them attending this conference is a very(!) good sign. And Eric Gu seems to have a good and professional network inside the blockchain industry of China and the rest of the world (he claims to be the one to have shown Vitalik Buterin around, when he was first in China).33

But again: it does not justify a price, that is 4 times of its former value, even when this former value was indeed undervalued.

Other than this, the past of Metaverse is quite smooth. I could not find major difficulties in their management so far. One thing that bothers me however is the fact, that Metaverse ETP already had some projects under their wing before the Chinese ICO ban (30 in total, 5-6 held ICOs before the ban).34 Yet, we only heard of ZenGold and ZenAir – where are the others?

During the ICO, Metaverse was valued at 6,000 ETP per BTC, putting its ICO-value at 1/6000 BTC or 0.00016666. It is currently traded way above this value. Also nice to know: their ICO price tiers were named after the major cities of the Warcraft-universe (Stormwind, Undercity, Thinderbluff & Ironforge).35

History - grade: 6.5/10 (7 – no major "bad" event in the past; -0.5 for the lack of clarity on their past projects within China)

ETP will get listed on HitBTC in November but at the same time gets delisted on Bitfinex for US citizens at the 9th of November.36

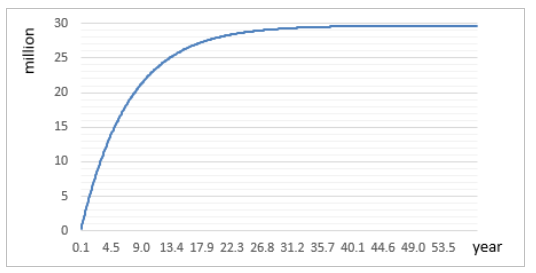

As ETP can be mined and is currently sitting at 22,600,000 ETP circulating, we can calculate a basic inflation ratio based on the facts we have:

3 ETP per ~30 seconds (they aim for a block time of ~24 seconds, but there seem to be issues with this)

6 ETP / minute

360 ETP per hour

8.640 ETP per day

60.480 ETP per week

3.084.480 ETP per year

Even if we take the regular halving of the mining reward into account, we will end up with the following distribution per year of around 3 million ETP per year: (Whitepaper, pg. 10)

Also, there is the option to lock the ETP bought for a certain amount of time. This is however not dependent on the time, but the block height – so if Block X is reached, frozen coins will be released in addition to an additional amount of ETP. (Whitepaper, pg. 11)

| H+block height | 26295 | 112696 | 345600 | 683687 | 1371130 |

|---|---|---|---|---|---|

| Reward rate | 0.10% | 0.66% | 3.23% | 7.98% | 20.00% |

| Time | 7 days | 30 days | 92 days | 182 days | 365 days |

So, it is indeed tempting to freeze the coins for a year, as the annual inflation is about 10% and the reward for this year is 20%. It however also comes with the risk of holding ETP for a whole year. It however also is kind of a daunting ”do or die” – decision for anyone buying ETP for speculation on a higher price in the future.

Their aim to factor in the inflation of ETP in the future by “dynamically adjusting” these coinlock rewards, which is not written out in detail in the whitepaper on how they aim to achieve this.

According to their Roadmap, they aim to integrate digital identities in the wallet and start with betatesting matching orders on their “Metaverse Improvement Proposals” (?) in November and “basic digital identity functions” as well as some development regarding their consensus mechanism upgrade (I guess this is about the change from PoW to dPoS…?) in December.

One major point (integrating Oracles) is aimed to be implemented around February 2018.

Future - grade: 4.0/10 (5 – I see quite a daunting factor in regard of the inflation rate; -1 for being vague on their roadmap as well as on how they want to “dynamically adjust” the coinlock rewards, while already putting numbers on the specific rewards - if I would need to lock my coins for a whole year, I do not want someone to "dynamically adjust" it, I want security on what I receive after this)

ETP is a project with a good idea, a good team, well-thought technical fundamentals, an experienced CEO and established connections in the blockchain industry. But at the same time, there are still some question marks in regard on some major details left.

The hype after the 8th of October seems to be mostly fueled by their participation of the Money 2020 conference. For now, they are of course doing a great job – the word is out, the western audience as well as the Chinese community knows about Metaverse. The project is far(!) away from being a scam. It is just the case that the current evaluation of ETP is not matching with what the project is providing for now or in the next months.

In the introduction, I referred to the argument “Antshares/NEO is at 1 billion, so ETP is undervalued!”, which you can read on many occasions, be it twitter, reddit or even 4chan. And while looking at similar projects can give insights or hints on the true value of a currency (after all, I did the same two weeks ago with SONM and Golem), just comparing the evaluation of two currencies with similar use cases is not feasible. It would be the same as looking at a Porsche and a Ferrari and then say: “Both drive the same way, both are sports cars and both are equally fast – therefore, they both must cost the same.”. You can be right, but the difference in value can also be tremendous. In the case of ETP and NEO, we are right now indeed look at two good looking cars. One has proved already that it can drive and many want to buy it (NEO), one (ETP) still needs a motor and an established marketing to approach the same value as the other.

If you trust Eric Gu and his team to become successful in the future, then consider adding a small position of ETP to your portfolio, as soon as the hype has cooled down (yes, I consider ETP still a bit overvalued). For me personally, there are many issues and important questions left to answer and too many information to confirm for now. This might be because of the language barrier or because of more pressing issues with the wallet right now – but they need to be solved sooner or later. Otherwise, it will also hurt the evaluation as well as the adaption of ETP.

PDF with footnotes and sources

Feel free to visit my blog, where you can find even more analysis on altcoins

If you like my analysis & want to give something back – vote here on steemit or treat me a beer with BTC, ETH or LTC.

After all, I am a German penguin.

BTC: 12dTyxchdGhYjGBi1QFVPWbagQrRSJssWT

ETH: 0x3D8e6B27F7ab389888791ABEe6FA62F4718A1164

LTC: LT6qfsrxPhVxcYPbNgT267W1aVRd6n5AFq

Hello Randallmaller, this analysis is quite impressive. Thanks for your huge interests into Metaverse project. We would like to have a communication with you regarding to the questions you mentioned. Please contact us via our official email address: [email protected] or find us via Slack Metaverse official account. :)

Thank you for reaching out :)

Activity on Slack is a bit hard right now, so I just sent you an email with some details on the issues I see as relevant.

Great analysis, thanks :) Could you share what you learned after getting in touch with Metaverse? I invested in ETP but I have been hearing issues with their wallet.

Could I request an analysis of Request Network?

Love your analysis, I would love to hear what they had to say regarding your questions. Hope you'll share this.